- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- December 2017 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

December 2017 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@ohjoy wrote:Ok December. Let's get started.

So, I admit that I went a little crazy last month. I needed and leased a new car. Technically, I should've paid cash for an older model and been done with it but no. I had to go for a new Lexus. Ah well. Can't beat myself over that now. But, immediately afterwards, I went on an app spree and am now trying to manage SUB requirements. So far, so good tho. I have a total of $5k spend requirement in 90 days and figure I'll just run my bills through them. Buuuuuut, the cards with the SUB are Amex cards and not all of my bills can be paid via Amex. So, I've decided to run a few of my business expenses through and just do an expense report for reimbursement. That takes care of that.

My scores, now that the dust has settled are:

EQ: 748

TU: 755

EX: 727

I hoped to be 760 across the board by the end of 2017 but, I don't see that in the cards. I'd be thrilled if I could get 2 out of 3 so. that's where I'll set my goal for this month. FICO simulator says that I'll be 769, 755, 741 if I just pay my credt card bance down by $159 (I'm at 2% Ut right now. How accurate do you think that is? I could settle for that. And of course, there will be holiday spending so, I guess I need to factor that in somehow. Also, I don't think my car is showing up yet so, yikes. Oh, and I need to replace the hood on my car. Don't even ask. I'm not happy about it. So, that's an additional expense along with insurance on the vehicle.

On a good note, I'm excited to have gotten my $300 in airline gift certificates from the Amex airline credits benefit. Next month, I'll grab the other $300, having platinum and gold this first year at no AF. Figuring that out was definitely on my to-do list.

I'm sure I'll have stuff to add to my goals list for this month. I'll come back later.

ohjoy, I wouldnt heavily rely on the simulator - it has a one track mind, but it's good to play around with. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

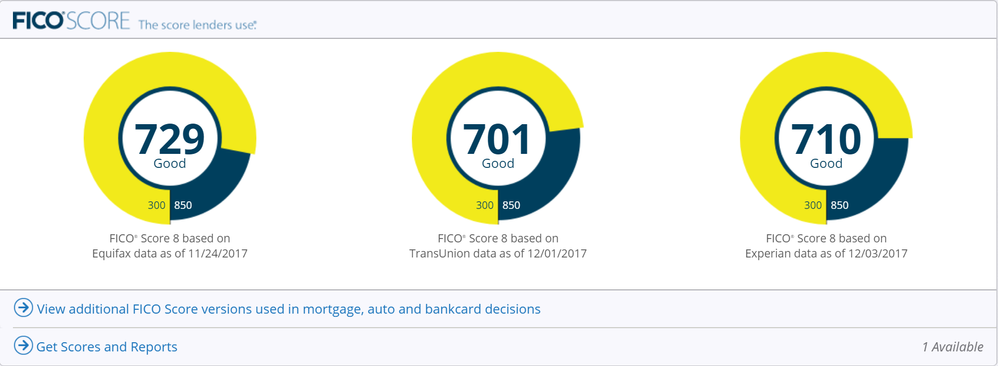

@Anonymous wrote:Super excited to join the 700 club finally! No idea why TU jumped from 695 to 701 but assuming either it's some inquiries from May finally losing some punch, or maybe my installment loan is finally old enough to recover a bit of FICO ding.

Won't do a 3B pull until December 20th when everything reports again, but still pretty excited to see 700s even though it doesn't mean anything versus that 695 that was lurking.

Really weird to me that EX is 710 with no derogatories whatsoever, but TU is 701 with an unpaid tax lien reporting. I have to go over things with a fine toothed comb to figure out what's keeping EX back so much. FICO simulator (which we can't trust) shows me at 795 for EX and 789 for EQ in 24 months, but only 720 for TU with that stupid lien still reporting. Disputes have been no-go so CFPB is next to see what can happen. I live in a state where EVERYONE pulls TU every time, so of course it's frustrating that TU is the one still showing that lien.

My December goals have nothing to do with credit -- I just paid off a $10,000 unreported tax situation in full to avoid a new lien (lots of court dates and arguments and me using really improper terms for the tax folks in front of the tax judge who laughed often and seemed to agree with me).

This entire month I am basically in the Caribbean except for 5 days I'll be at home winterizing and making sure it stays winterized, so I don't have a lot of "real life" to deal with, but my to-do list for December 2017 is:

- FICO related: Send off CFPB dispute on the tax lien and see what they can do if anything. Not really all that hopeful!

- Not FICO related: I have my biggest CD maturing on the 15th ($8000!) so I am splitting it into two CDs and putting half into a 24 month CD and half into a 12 month CD. I am moving all of my 12 month CDs into 24 month ones along with half sized 12 month ones over the next 12 months, and then in another year I'll move everything into 24 month ones that mature every 2 months. Future goal for 36 month CDs that mature every 2 months so I'll have 3 years of more than my bimonthly income maturing bimonthly. This is huge for me since my expected accruing interest may be up to $6000 a year of "free" money that is safe and available fast enough to cover a total loss of income.

- Kinda FICO related: I am closing down my Comenity Williams Sonoma card in January but hopeful for a Christmas clearance to get one of my wish list items and earn enough to get a $25 gift card (I have a $21.80 gift balance or something). Once that's out, Comenity is on my blacklist for life. 7 months having the card, $400 toy limit. I believe this card counts towards 5/24 but maybe not, but either way it doesn't matter or affect my 5/24 in either way.

- FICO related-ish: I have no problem keeping and maintaining AZEO method. I just did an audit of 2017 spend and looks like I left somewhere in the range of $2300-$3300 on the table in possible credit card rewards because I couldn't qualify for rewards cards, and even today I still can't qualify for Chase Sapphire Reserve. Amex Platinum is on my wish list as it'll boost my annual rewards by around $600 even with the residual annual fee -- but I wrote a Chase 5/24 calculator in Google Sheets and if I get Amex I won't be at 4/24 until 10/2019! Holy moly. Might make more sense to just get CSP if I am preapproved and after a year try to PC. Still, my 2017 audit really kicked me in the gut because I figured I was doing well with credit card management on spending and earning as much as possible. $3300 of possible money left behind means $3300 that isn't sitting in my rolling CD portfolio earning me more money free. Ugh.

- Not FICO related: I drastically cut spending even more than ever in November -- chopped out 4 lingering useless subscriptions and only have 1 subscription left (Spotify) which goes away when Capital One stops giving me $5 back monthly. All those fees I was paying now goes into my rolling CD portfolio.

- Not FICO related: This month I am also considering selling off a bunch of real estate because the market has gone to insane levels -- one of my favorite rentals only earns about $1200 a month before expenses and costs, but I can sell it for $180,000 or so which is the equivalent to someone buying a future foreclosure on themselves. 3 properties are on my list of consideration because they've gone to insane prices (comps) and cashing out of real estate might earn me more than collecting rent and dealing with maintenance/landlord stuff. For those thinking of investing, now is a horrible time to buy in 71 markets I monitor in the US.

- FICO related: I bought a small bought in May from a broker I have gotten close to. He needed one more loan closed that month and offered me a fantastic deal: if I got a loan through him, he would cover 100% of my interest for the first year in-kind (free maintenance, boat washes, inspections, oil changes, etc, versus every dollar I spent in interest). So that boat loan lets me get some data points for free. Unfortunately, I tried to pay it down below 90% to see what effect it would have on my score, but the bank reports 2-3 months behind schedule. So right now it shows 96% utilization even though I am well under 90%. In January I am paying it to below 40%, and in March I'll pay below 8%, then pay it off in April. It's very annoying to see how long it takes to update, and the data points have been uesless since my FICO scores have gone up an average of 20 points a month, every month. Still, maybe I'll glean something out of loan utilization. I do have an Alliant SSL sitting at $40 balance/$500 original, and that will stay that way for the full 5 years with little $1-2 pushed payments every 3 months.

- FICO related: Amex 3X CLI comes up January 2, 2018 so hoping to get to $6000. I like the BCP, a lot. My local grocer is offering $10 gift cards on $100 gift card purchase for their grocery store only, and they do code as 6% on BCP, so I may be able to max out my $6000 this year in supermarket spend if I have time back home to do it. Sadly, $2000 limit right now makes it very difficult and I have no idea how Amex would look at me if I spend $5200 on supermarkets in December, lol. Probably not worth poking the bear over just $300 or so...

- FICO related: Was really hoping to see new "Your Offers" in Chase around November 30th which was the 6 month mark since I accepted the previous offer of Chase Freedom Unlimited. Some rare data points said people lost offers for 6 months. December 1st or 2nd I finally got a green check mark on the Chase login menu, clicked it excitedly and the only green checkmark was for a credit card terminal. I laughed for 5 minutes at the stupidity of that offer since it was showing with a checkmark for 6 months. Oh well. Was hoping to see CSP so I would run to a branch and ask for a CSR offer, but so far, no-go. Booo, hiss.

- FICO related: Amazon CLI request on 12/16 -- went from $400->$5000 (chat)->$6000 (luv button) all in 5 months, and now am into 6 months and 12/16 is 90 days since I got the $6000 bump. I don't use Amazon at all for shopping so it's a weird useless card but I am eyeballing a very expensive cinema camera and one of the 3rd parties said they'd put it on Amazon for me at a $1000 discount there, but my CL at $6000 means I can't afford it ($6500 with the discount). So getting $10,000 would be awesome, would put $300 more in my pocket, and I already rent 2 cinema cameras out locally for bundles of cash and this one would probably pay itself back before wedding season is over in 2018. Last one I bought paid for itself in just 9 weekends during wedding season!

Nothing else on my to-do list. Pretty boring actually. 2018 is going to be just as boring -- just want more CLIs so I an get over $10,000 so I can hope to get CSR at some point. Amex Plat, CSR in 2018 if I can, and then try for some awesome 3% card for 2019, and I'd say I was done with my rebuild.

Wow. Somebody's been busy. ![]() Crossing over to 700 is a big deal - atleast it was to me as I was so weary of seeing ORANGE! Congratulations on getting YELLOW across the board! I started getting some good Fico 8 score jumps once I was in the 700's.

Crossing over to 700 is a big deal - atleast it was to me as I was so weary of seeing ORANGE! Congratulations on getting YELLOW across the board! I started getting some good Fico 8 score jumps once I was in the 700's.

I definitely encourage you to try your luck with the CFPB. TU deleted the state lien on my CR with them fairly quickly when I filed a complaint against them with the CFPB, so I hope you try out the CFPB atleast once.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@Anonymous wrote:I'm new here. so why not make my first post the december check in.

i'm currently trying to grow my score.

working_on_me, welcome myfico.com!

If you want some good tips and how to's in growing your score, you may want to visit the Rebuilder's forum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@ohjoy wrote:Also, in other threads, I talked about my Navcheck being lower interest thatn my NF CC. And wanting to rack up my required spend for points quickly and also plan for Christmas spending. Someone recommended that I open a PenFed and grab a zero percent card. So, I opened a PenFed account and applied and was declined. Too many recently active accounts, whatever that means. I'm going to call for a recon and explain that I'm looking for a 0% specifically and all my accounts remain PIF. No lates, no baddies and my score for them was 755. Yes, I did just do an app spree but, I mostly got credit cards. AND, I have 23 inq on my EQ but, that's from buying a car and leasing a car. C'mon! Anyway, when I first rec'd the decline, I had pangs of my lower score days in my gut. But, in reality, I'm reconning with some pretty decent scores. Meh. Let's see what happens. It's worth a try. Wish me luck!

But seriously, what's up with EX. They dropped me down to 727 and don't appear to be interested in moving. That's a long way to 760 with a reluctant CRA. Ah well. I'm still hoping for a Christmas miracle. I think I'll do some researching and see what makes EX happy.

Welp! That's all I have for now. Wishing everyone a successful month!

Good luck! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@ohjoy wrote:

@ohjoy wrote:

@ohjoy wrote:Ok December. Let's get started.

So, I admit that I went a little crazy last month. I needed and leased a new car. Technically, I should've paid cash for an older model and been done with it but no. I had to go for a new Lexus. Ah well. Can't beat myself over that now. But, immediately afterwards, I went on an app spree and am now trying to manage SUB requirements. So far, so good tho. I have a total of $5k spend requirement in 90 days and figure I'll just run my bills through them. Buuuuuut, the cards with the SUB are Amex cards and not all of my bills can be paid via Amex. So, I've decided to run a few of my business expenses through and just do an expense report for reimbursement. That takes care of that.

My scores, now that the dust has settled are:

EQ: 748

TU: 755

EX: 727

I hoped to be 760 across the board by the end of 2017 but, I don't see that in the cards. I'd be thrilled if I could get 2 out of 3 so. that's where I'll set my goal for this month. FICO simulator says that I'll be 769, 755, 741 if I just pay my credt card bance down by $159 (I'm at 2% Ut right now. How accurate do you think that is? I could settle for that. And of course, there will be holiday spending so, I guess I need to factor that in somehow. Also, I don't think my car is showing up yet so, yikes. Oh, and I need to replace the hood on my car. Don't even ask. I'm not happy about it. So, that's an additional expense along with insurance on the vehicle.

On a good note, I'm excited to have gotten my $300 in airline gift certificates from the Amex airline credits benefit. Next month, I'll grab the other $300, having platinum and gold this first year at no AF. Figuring that out was definitely on my to-do list.

I'm sure I'll have stuff to add to my goals list for this month. I'll come back later.

Ok. Moving into week 2, my TU score is now 760. Now to get the rest of them up. I usually pay off all of my balances but had still been carrying a balance on my NF Cash Rewards card, basically forgetting that my brother's card, for which I'm an AU usually carries a balance. AND, now spreading my spend across 3 new cards that require it for points, I've made sure that I've paid everything down to zero so that my brother's card will be the only one with a balance. It's sitting at 8%, barely making it for what I'd like but, hey. I can't require him to make any moves so, I'm hoping this will be good enough to grab me more points for years end. So, I'm looking forward to all of my accounts reporting for this month.

Also, in other threads, I talked about my Navcheck being lower interest thatn my NF CC. And wanting to rack up my required spend for points quickly and also plan for Christmas spending. Someone recommended that I open a PenFed and grab a zero percent card. So, I opened a PenFed account and applied and was declined. Too many recently active accounts, whatever that means. I'm going to call for a recon and explain that I'm looking for a 0% specifically and all my accounts remain PIF. No lates, no baddies and my score for them was 755. Yes, I did just do an app spree but, I mostly got credit cards. AND, I have 23 inq on my EQ but, that's from buying a car and leasing a car. C'mon! Anyway, when I first rec'd the decline, I had pangs of my lower score days in my gut. But, in reality, I'm reconning with some pretty decent scores. Meh. Let's see what happens. It's worth a try. Wish me luck!

But seriously, what's up with EX. They dropped me down to 727 and don't appear to be interested in moving. That's a long way to 760 with a reluctant CRA. Ah well. I'm still hoping for a Christmas miracle. I think I'll do some researching and see what makes EX happy.

Welp! That's all I have for now. Wishing everyone a successful month!

Welp! TU giveth and TU taketh away (and EQ too, btw). The 5 pts from TU went poof, along with 5 pts from EQ. This is because my Navy Amex was added ($15K SL with $302 balance). I wasn't sure when it would report and CSR estimated due date at the end of the month. So, the balance reported slipped past me. No biggie. After doing some reading, I found that in using the AZEO method, the account carrying the balance should not be the AU account (as planned in my last post). So, this $302 will serve as my one reporting balance. I've paid it off since.

As for the PenFed recon, the CSR didn't help much and was rushing me. I asked that she transfer me to sr loan officer or have him call me back. To date, no return call. But, I did get the survey over the weekend and expressed my displeasure there. So, maybe someone will call me back after that. But really, I'm over it. I really don't need a new account added. I plan to just try for a cli on my Discover and use that 0% promo. After that, I'm going to pick up a shovel and head over to the garden. Oh, I've said that before and it's hard to sit down but, I think 6 months should do me well and allow me to grow what I have.

LOL! I hate when that happens. ![]() But like you said...it's a brief change and should bounce back once the CRs are updated. Hang in there!

But like you said...it's a brief change and should bounce back once the CRs are updated. Hang in there!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@Anonymous wrote:I am trying to build my score and pay down my UT. Due to lots of travel, and buying a new home and needing appliances, etc, I am at 90% UT!!! $%^$%!!! Not good. I just paid off my Delta Amex which was $3000. That should bring me down to 60% UT. I need to pay off my Barclays which I used to buy a Macbook Pro for work ($3000). My husband is not very financially savvy or a good saver so its like talking to a wall trying to explain how this works. He pays bills and will begrudgingly save but its not a priority for him so thats a bit frustrating.

Goal: Pay off my cards in 2018 and enjoy this trip to Rome I'm going to in May (booked with points!)

Great job in getting your UT % down to 60%! That will really help boost your scores. You're off to a great start. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@Revelate wrote:Late reply (again); still holding steady with the credit plans since everything is up in the air right now. Basically taking a month off before I start looking for work again, about halfway through it and starting to finally feel clean again after the swamp that was my last gig.

Most of the major changes to my credit happened already, this was a really good year for me (knew it was coming but it was a long road); doesn't look like I'm going to quite make my FICO 8 target but I coming so close anyway I can't rationally complain.

At this point I'm just getting squeaky clean as these are the last things I can deal with in the near future before things like a new mortgage might be needed.

Dec 2017:

Two inquiries off Experian - 1 left

Jan 2017:

One inquiry off Experian - 0 left

Feb 2018:

I hit AAOA of 4 years

1 inquiry off Equifax - 0 left, 0/0/0 for scorable inquiries, just a truly dumb 30D late on TU as my only blip, well that and short credit history and installment utilization haha, can't come up all aces even in the credit world I guess for a while longer.

Hope everyone's doing most excellently!

Revelate, you've made great strides this year! Keep on keepin' on. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

@IQn2D wrote:This has been an epic journey thus far this year with the world of credit. As I close out the month of December things had been gong really well.

Here are a few of my accomplishments.

1. Total credit lines were increased totaling 42.2K with 33.1K available. That roundout to about a UT of 21%. My UT was at 69% in April when my credit lines totaled 18K.

2. The debt at the moment are

Credit Card: $9073.93 ($500 extra on top of monthly payments. Will most likely reduce when assuming mortgage)

Car Note: $10125.00($300)

Signature Loan: $3,103($225)

3. Applied and received a pre-qualification for a home loan mortgage for 270K. This was done in the month of July when my mid-score was 621. I signed my contract and placed a deposit for pre-sale with a builder. On 15 December official applied for home loan with a mid-score of 653. Got the automatic approval and lock in my rate for 60 days for a 3.75% 30yr VA Loan. Submitted required paperwork and $600 appraisal fee. Received my Loan Disclosure. (Loan $267,989) unofficial pending taxes, appraisal etc. Awaiting the decision from the underwriters….Pray for me. Closing should be on Jan 12, 2018. I will keep everyone updated.

My score today are:

EQ: 687

TU: 705

EX: 692

The 700 club is on the horizon.

Lastly, once I close on the house. The only major purchase will be furniture for the house. My spousal unit wants all new furniture. So I plan on selling what we have now to offset the cost. Still not decided if I’m going to spend cash or apply for an account with a furniture store.

Awesome job in getting the CC debt down and may the closing on your new home go as smooth as possible!

Regarding the furniture store account, I read somewhere in one of the forums on myfico.com that they are not one of best types of accounts to open. Perhaps consider a 0% first year CC and charge it. You can budget to pay it off in a year - and pay zero interest! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

Hello, MyFico Challengers!

Well, it was getting down to the wire, so I made a hail-Mary passes into the end zone and hoped something good would come out of it. December was the best month yet, scoring wise thanks to EQ removing the state tax lien from my CR. Something nudged me to make a call into them, and the stars must have all been aligned - as the CSR was very willing to review the documents sent from the CFPB and the BBB and took steps towards getting the lien removed. Two days after that call, walla! Lien gone! and my EQ Fico 8 score jumped to 850!

I did request EE of the two 30-day lates from TU and EX. EX removed them from the CR and my EX Fico 8 score jumped to 850 as well! TU seemed more difficult and said they would put in a dispute about the items' age. Not what I wanted, but not all that critical since they are due to fall off in 2-3 months anyway. But who knows, maybe they will still get deleted before the year is out and let me meet that 800 across the board goal!

Fico 8 scores:

EQ: 775 -> 850 (last 30-day late aged off CR and state tax lien deleted from CR - whoo hoo!!)

TU: 790 -> 791 (two inquiries aged over 1yr)

EX: 810 -> 850 (two 30-day lates aged off CR)

Mortgage scores:

EQ: 739 -> 817

TU: 774 -> 783

EX: 810 -> 811

2017 goals:

Reach Fico 8 700+ score across the board. DONE!Get Fico 8 740 or more across the board. DONE!Get Fico 8 760 across the board. DONE!Reach my first EVER Fico 8 800 score! DONE!Get middle mortgage score to atleast 740. DONE!Try to get the PIF State Tax lien removed from EQ/TU reports. DONE!- Try to get the three 30-day lates off of my CRs via GW letter.

- I was able to get EX to remove the lates via EE. Requested EE from TU - still waiting results.

- Save atleast 5% down for mortgage.

- No change since last reporting 4% (of lowest) or 2% (of highest) saved. Holidays, man!

- No change since last reporting 4% (of lowest) or 2% (of highest) saved. Holidays, man!

- Get Fico 8 800 across the board.

- Not quite yet...TU is holding out.

Got two 850's instead...I'll take it!

Got two 850's instead...I'll take it!

- Not quite yet...TU is holding out.

- STAY in the garden until close on mortgage.

- The CC I 'accidentally' closed in Nov. still shows on my CRs and the new replacement CC has yet to appear on any CR. No new inquires have appeared either. So far, so good - but fingers and toes are crossed.

Although I still want that 800 across the board, I am very happy with my goal results. 2018 should be quite an interesting year!

Life happens...Adjust accordingly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: December 2017 Check-In Thread

Thanks. I will be sure to research some cards at 0% for a year.

Current Score: EQ720, TU728, EX705 02-18-18

Goal Score: 750

Take the myFICO Fitness Challenge