- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- Re: January 2018 Check-In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

January 2018 Check-In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@Anonymous wrote:I want to keep it simple this year.

Goals:

1a). Continue saving 12% of income, and look to increase that if I'm able to lower my tax withholding.

1b). Look at depositing part of what I've already saved into a higher yield CD, maybe NFCU's Special 15-month at 2.25%

2a). Continue paying that extra $100 per month on my highest student loan balance

2b). Pay off my lowest student loan balance, which is less than $350 now. It's just annoying seeing it there, lol!

3). No credit apps. Looking to get a ruby spade in December 2018

4). Pay down utilization.

That's about it!

Wow, you're just getting financially stronger and stronger! Love it! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@ohjoy wrote:Welp. Following my November app spree I cringe when I get the MyFico score change notifications. I expected my scores to take a dive but, I did get a pretty nice haul out of the deal and should be satisfied. Today, I got a notification and responded with the familiar cringe. But this time was different. +1 TU! Hey! It's not a big deal at all but could signal the beginning of a rebound. I'm optimistic although I probably shouldn't expect very much until my February payments post. But, we'll see. For now, I'll take that +1 happily. I gotta get back in the green and every green "+" helps.

Yep. +anything means headed in the right direction! Here's to all green! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@javonnj wrote:It seems like every year I tell myself that I will get my financial situation in order, and every year I take two steps forward before massively going backwards. I have decided that this year will be different, because I now have some personal and professional goals that I would like to attain. I have also been put into a situation where I will need to start looking for a new place to live at some point this year, and having good credit obviously makes things easier.

For 2018, my financial goals are to be responsible and stop the cycle of living paycheck to paycheck. I have set some challenges for myself this year including not incurring any overdraft fees or late payment fees. I never realized just how much these fees add up over time, and how that money could be better spent elsewhere. I also want to keep my utilization to 15% or lower this year. At one point, as recently as a few weeks ago, I was at over 200% utilization on my cards. I maintained that utilization for months, until I finally decided that I needed to become serious about my financial future and started working towards getting that number down. At the end of next month, my utilization will hopefully be at below 10%.

I am looking forward to reading everyones stories through their journey this year, and wish everyone the best of luck.

^^^ getting rid of those unnecessary fees will have a very real impact on the bottomline for sure!

If you can, try to get it below 9% for maximum benefit. I'm with you on the whole, getting serious about my financial future. Things just got real! Good luck in all of your goals this year! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

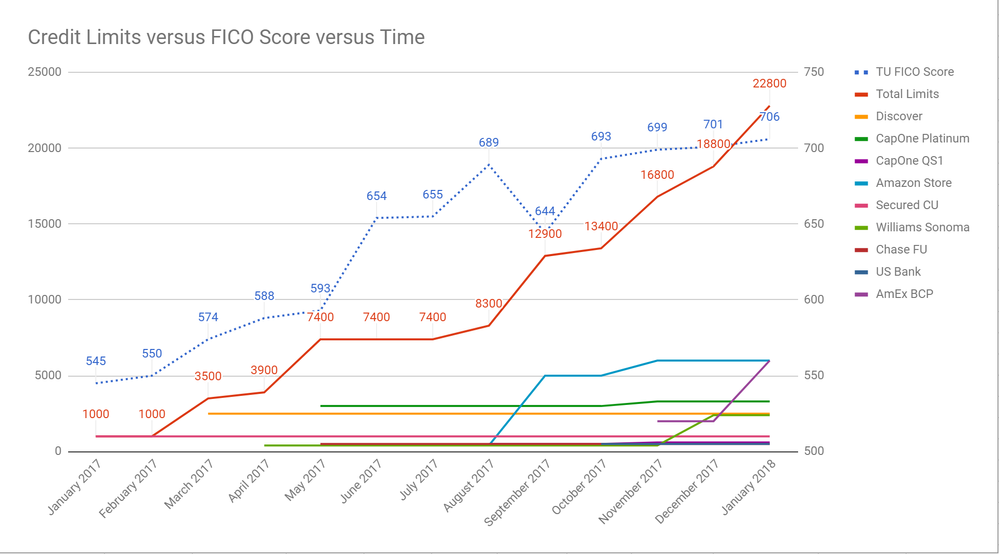

@Anonymous wrote:Happy to update my progress chart based on a few CLIs received since I posted December's chart.

This puts me over $20,000 in total CLs whereas I started 2017 with $0 in usable credit limits. Current utilization is 9.1% aggregate (oops, bad math) but in 2-3 weeks it'll be $50 balance on one card and no higher than that in the future, ever. I accidentally calculated my "estimated" aggregate utilization based on my Amex 3X limit increase but of course that won't report until the next statement cut, derp.

Have a ton of inquiries fading out of score-territority between March and May. Will be down to 1-2 scorable inquiries on most bureaus then.

My goals for 2018 are really simple: gardening 365 days (until 6/1/19 actually), but hoping to get CLIs to get me from $20,000 in $50,000 in total limits. I know this is extremely unlikely but holding out for Amex 3X from $6000 to $18,000 if possible, and maybe getting the unicorn auto CLI on Chase FU, along with my other cards hopefully showing some luv. We'll see.

I just started my 60-month CD Ladder this week with my first roll-over into a 12-month, a 24-month, a 36-month, a 48-month and a 60-month set of CDs. This is exciting to me because if I face no emergencies and can "survive" cutting my expenses as much as I did, I'll actually be able to get a "paycheck" from myself to myself for 5 years. Not a great "paycheck" but more than I spend on essentials.

I think I will scratch 800 by the end of 2018 -- not at 800 FICO8s but in the 785-795 range on at least EX and EQ.

Only "goal" for this year other than gardening and expanding the CD Ladder is to get my unpaid tax lien nuked from TU.

Have you considered, requesting a 4K increase from 6K to 10K first, then when you're eligible for another increase, do the 3x request 10K-30K. Will get you to that 50K. Amex did approve my 3x 10K to 30K request last year, so it's possible. ![]()

I also have the goal of a 60-month CD laddering - love the idea of it too - but I'm about a year or two from implementation.

Lastly, if your profile behaves in anyway that mine did last year, you're see 3-4pts increase each inquiry tier you cross as they start to drop off. ![]()

Good luck in reaching all of your worthy goals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@Anonymous wrote:Have you considered, requesting a 4K increase from 6K to 10K first, then when you're eligible for another increase, do the 3x request 10K-30K. Will get you to that 50K. Amex did approve my 3x 10K to 30K request last year, so it's possible.

Hmm, I was under the impression that after the first 61-day 3X CLI, additional CLI requests would be every 182 days? If so, doesn't it make more sense for me to request $18,000 immediately at 182 days versus requesting $4,000 at 182 days and then $30K at 364 days? Or am I confused here?

For me, since I can only use BCP for groceries and my monthly high usage MIGHT be $600, there's really no purpose in me having more than $600/.089 = $7000 credit limit on the card, so anything over that is just a cherry. But Amex is a nice prybry for Chase/etc so naturally having a higher limit on my grocery card might get me a useful limit on my (future) travel card!

@Anonymous wrote:

Have a ton of inquiries fading out of score-territority between March and May. Will be down to 1-2 scorable inquiries on most bureaus then.

My goals for 2018 are really simple: gardening 365 days (until 6/1/19 actually), but hoping to get CLIs to get me from $20,000 in $50,000 in total limits. I know this is extremely unlikely but holding out for Amex 3X from $6000 to $18,000 if possible, and maybe getting the unicorn auto CLI on Chase FU, along with my other cards hopefully showing some luv. We'll see.

I just started my 60-month CD Ladder this week with my first roll-over into a 12-month, a 24-month, a 36-month, a 48-month and a 60-month set of CDs. This is exciting to me because if I face no emergencies and can "survive" cutting my expenses as much as I did, I'll actually be able to get a "paycheck" from myself to myself for 5 years. Not a great "paycheck" but more than I spend on essentials.

I think I will scratch 800 by the end of 2018 -- not at 800 FICO8s but in the 785-795 range on at least EX and EQ.

Only "goal" for this year other than gardening and expanding the CD Ladder is to get my unpaid tax lien nuked from TU.

I also have the goal of a 60-month CD laddering - love the idea of it too - but I'm about a year or two from implementation.

I lucked out this past quarter because I needed to rebalance my portfolio -- my crypto was way out of whack so I sold a bunch, AND my stocks were also crazy out of balance, so I sold some there, too, leaving me with underfunded bullion and cash savings to put the profits into. So I went from expecting to do just 24-month CD ladders to having the available cash assets to do 60-month CD ladders. I really should sell a rental property right now but I am still doing the math, but the smart money says to sell my cheapest rental property and diversify the proceeds into more bullion + cash.

The BIGGEST issue with 60-month CDs is that interest rates appear to be going up, so locking in a 60-month rate now might mean not getting as much later, but in reality as rates go up, the new 60-month CDs I open will get the better rates.

I expect my FICO scores to go up 30-40 points before May, and another 30-40 points before December, based on my own analysis and the calculator-estimator I wrote. I definitely know 800 is just around the corner though!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@ohjoy wrote:Welp. Following my November app spree I cringe when I get the MyFico score change notifications. I expected my scores to take a dive but, I did get a pretty nice haul out of the deal and should be satisfied. Today, I got a notification and responded with the familiar cringe. But this time was different. +1 TU! Hey! It's not a big deal at all but could signal the beginning of a rebound. I'm optimistic although I probably shouldn't expect very much until my February payments post. But, we'll see. For now, I'll take that +1 happily. I gotta get back in the green and every green "+" helps.

Another +6 from TU. Yep. I'm going to believe that this is the beginning of the rebound that I've been hoping for. Now to get EQ and EX to follow suit.

Current Scores: 752 TU, 717 EQ, 750 EX

Goal Score: 820+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

ABCD!! Nice going! LOVE that chart too! Did you make that up, or did you have a template??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

@BungalowMo wrote:ABCD!! Nice going! LOVE that chart too! Did you make that up, or did you have a template??

It's just a Google Sheets spreadsheet with a web published chart that renders as a PNG file. Seems to auto-update a few times a day, can't figure out what triggers the update. I added two decimal places to the day figures to try to see when it updates so I could figure that part out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

Starting scores as of January 1 were

Experian - 663

Transunion - 667

Equifax - 723

In the garden for the full year. I will only come out for a pre-approved intro rate card like a discover with at least 12 months no interest for consolidation purposes, and only if the limit is significant. No more toy limit cards, my next card will be one of my final five keepers. I have reached that point.

Six accounts (no longer listed in my sig) have either been closed or are being left open with their cards destroyed until the creditor is bored of keeping them open.

This year is all about aging and thickening. I have 18 open accounts all less than a year old as of right now. At the end of 2018 I should have 12-15 accounts all just under 2 years old. Then I will be in a much much better position. This year is the turnaround year and by the end all scores should be about 720.

So my goal score for all three bureaus is 720 (even though EQ is already there, I wont consider my goal met until all three match it)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: January 2018 Check-In Thread

After doing a bit of online & store shopping in December, my balances, and my scores took a bit of a hit. Not going to beat myself up over it, it is what it is.

Just putting the cards away for now, except for the gas & grocery rewards cards. Hoping to get the most bang for the buck & use that cash back for either the balances, or save it & get gift cards for next year.

Going to do my best to get those scores to 800 by July. Last July I had TU-790, EQ-793 & EX-794! I was SO excited!!! (then I did my app/CLI spree!) That dropped things a bit, but by next summer the new cards will hit the year mark.

Just telling myself...behave...behave...behave!!! ![]()