- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- 1. You have a short credit history. ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

1. You have a short credit history. ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

@Anonymouswrote:I think the red hits are related to something else. Is it possible that FICO always has to have something negative listed? Is it like the kid that gets a 100% on the final exam? The professor is required by the Department Chair to give some positive feedback to the students to “improve” their performance. So I write, “you could have made your fours more legible in problem #2.” Maybe the worst thing FICO can find on your CR is that you opened an account just under a half decade ago?

If someone has a steadily clean negative column maybe they could chime in and provide some feedback. In the grand scheme of things, for me, if I could keep all my scores consistently above 800, it really doesn’t matter.

I've heard it said that once you hit 810 they stop giving you negative remarks. So at that point I think they go "we know we are just nitpicking at this point. Not even worth it.

I've got 12y and 5y for my AoOA and AAoA, I think its the average thats getting the alert. Probably 8 year cutoff, as thats reported at the average age needed for 850s. Sorry to hear about your Mortgage dissapearing, I've got an old account droping off every year for the next 4 years. Fortunately my oldest won't be, but my AAoA will stagnate until 2022.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

@KreeI've heard it said that once you hit 810 they stop giving you negative remarks. So at that point I think they go "we know we are just nitpicking at this point. Not even worth it.

I believe negative reason codes go away at a score of 800 on FICO 8 Classic that caps out at 850. This may be true of most models that cap out at 850, but not all. For example, on FICO 4 with a score of 803 I still get negative reason codes. For scoring models that go higher, like Bankcard 8 that goes to 900, I still receive negative reason codes with a score of 851.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

If there's a pattern, I can't see one. From last month's scores…

No reason codes:

- EQ FICO 5: 813 of 818

- EQ FICO 9: 803 of 850

- EX FICO 3: 801 of 850

- EX FICO 9: 804 of 850

- EX FICO Auto 9: 813 of 900

Scores above 800 that have reason codes:

- EQ FICO Auto 5: 831 of 900

- EQ FICO Bankcard 8: 815 of 900

- EQ FICO Bankcard 5: 822 of 900

- EQ FICO Auto 9: 813 of 900

- EQ FICO Bankcard 9: 814 of 900

- TU FICO Bankcard 8: 805 of 900

- TU FICO Bankcard 4: 819 of 900

- TU FICO Auto 9: 802 of 900

- TU FICO Bankcard 9: 809 of 900

- EX FICO Bankcard 2: 802 of 900

- EX FICO Auto 9: 813 of 900

- EX FICO Bankcard 9: 816 of 900

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

@HeavenOhiowrote:If there's a pattern, I can't see one. From last month's scores…

No reason codes:

- EQ FICO 5: 813 of 818

- EQ FICO 9: 803 of 850

- EX FICO 3: 801 of 850

- EX FICO 9: 804 of 850

- EX FICO Auto 9: 813 of 900

Scores above 800 that have reason codes:

- EQ FICO Auto 5: 831 of 900

- EQ FICO Bankcard 8: 815 of 900

- EQ FICO Bankcard 5: 822 of 900

- EQ FICO Auto 9: 813 of 900

- EQ FICO Bankcard 9: 814 of 900

- TU FICO Bankcard 8: 805 of 900

- TU FICO Bankcard 4: 819 of 900

- TU FICO Auto 9: 802 of 900

- TU FICO Bankcard 9: 809 of 900

- EX FICO Bankcard 2: 802 of 900

- EX FICO Auto 9: 813 of 900

- EX FICO Bankcard 9: 816 of 900

Reason codes are only provided by Fico if credit score is more than 50 points below the published upper limit. In other words 799 or less for Classic Fico with 850 upper limit and 849 or less for industry enhanced versions with a 900 upper limit.

Side note: real world upper limits may be less than the published limit - particularly for older Fico models.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

Excellent TT. After you said that I looked at my last report and sure enough (as usual) you are right. It's not on my EX.

Great info

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

@Anonymouswrote:

@KreeI've heard it said that once you hit 810 they stop giving you negative remarks. So at that point I think they go "we know we are just nitpicking at this point. Not even worth it.

I believe negative reason codes go away at a score of 800 on FICO 8 Classic that caps out at 850. This may be true of most models that cap out at 850, but not all. For example, on FICO 4 with a score of 803 I still get negative reason codes. For scoring models that go higher, like Bankcard 8 that goes to 900, I still receive negative reason codes with a score of 851.

It depends on the 3rd party summary report. Fico generates negative reason codes/statements for credit scores up to and including 2 points from the upper limit. However, some 3rd party summaries, such as My Fico stop listing them (even though they are generated) at within 50 points of upper limit - true for all Fico models listed on a 3B report.

I did still receive two negative reason statements for my EQ Bankcard Fico 8 from Citi at an 892 score - nothing on MyFico 3B at 850 or above. I also received a couple reason statements from Discover when my Classic TU Fico 8 score dropped to 848. Interesting to note that Discover listed no negative reason statements when my TU Classic Fico 8 score was 849 two months straight.

My recent TU inquiry has taken away some buffer - IMO. Appears like I may no longer be able to report balances on 100% of cards and maintain 850 on TU. ![]() Not an issue with EQ or EX.

Not an issue with EQ or EX. ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

Whoa, whoa, whoa Kemosahbee. TT I know (from reading all your very detailed bucket information and references) that you do not state unsubstantiated data, but am I reading this correctly? You said, “[it] appears like I may no longer be able to report balances on 100% of cards and maintain 850 on TU.” Are you saying that you maintain (or did at some time) balances on all your cards and still get an 850 FICO 8? It doesn’t matter if each was at 1% utilization and your combined (total) utilization was under 2, 3, 4, or even 5%. Are you implying AZEO is a myth for maximization (because it would if this is possible)? Or are you stating that AZEO is a starting point, but not truly necessary when all the ducks are in a row? Sorry Sensei if Grasshopper (me) misread your statement.

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

TT, good to know that negative reason statements are still present, just "hidden" I suppose depending on the CMS/score provider.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

Number (or %) of cards reporting a balance is a Fico scoring factor - just not a real strong one for Fico 8. Thus, ability to be at 850 with all cards reporting balances - even sizeable balances on some cards as long as AG UT is below 9%. Same can hold true (maintaining 850) with a recent inquiry due to the generous buffer that can be realized with other factors "optimized".

I have six cards and occassionally put charges on all cards in a given month. I allow charges to report on statements and then pay the statement balance a few days before due date - never before cut date. Since I started monitoring Fico 8 beginning February 2014 I've had all cards report balances 4 or 5 times. Classic Fico 8 scores hass held at 850 regardless of 2, 3, 4, 5 or 6 cards reporting. It's due to the buffer on Fico 8.

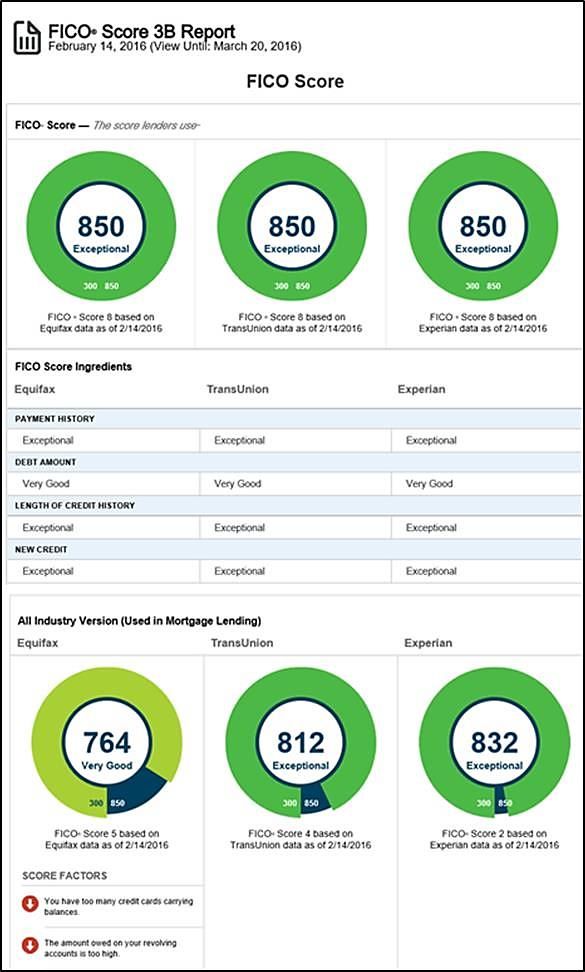

Contrastingly, the Fico mortgage models, particularly EQ Fico 04 (score 5), penalize my score significantly. An example with 6 cards reporting is pasted below. [The next month, 3/25/16, when 3 of 6 cards reported, mortgage Fico scores increased to EQ 809, TU 823, EX 837]. Side note - One INQ on EQ during in Feb 2016, none on TU or EX. The INQ may influence sensitivity of mortgage score to EQ to # cards reporting - different Fico 04 scorecard for EQ? Back to zero INQ on EQ in March 2016.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 1. You have a short credit history. ?

TT, have you ever been able to quantify your points lost through 100% of cards reporting balances? The only real way for that to be accomplished on your profile would have been before you hit 850, as it would take the buffer out of the equation.

The reason I ask is because back when I had only 4 CCs, it didn't matter (scoring wise) if I had 1, 2, 3 or 4 of them reporting small balances, my scores always remained the same. I did see a 16-22 point drop if all reported 0, though. This was back in 2016. I now have twice as many cards, 8 and do see a small penalty when allowing larger percentages of cards to report balances, but it always seems to be in the 4-10 point range.