- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: 89 and 91 point gains from tax lien removal

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

89 and 91 point gains from tax lien removal

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

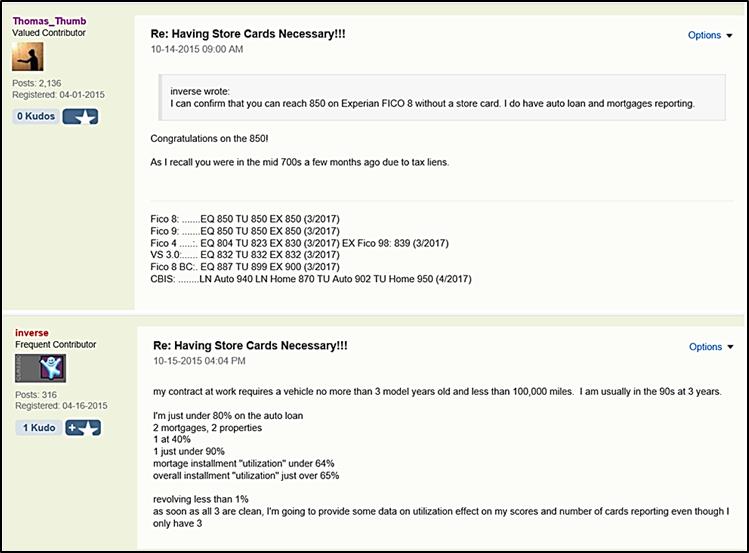

In another thread @IV recently reported 850 scores with aggregate installment loans at 95% (mortgage loan + Auto loan) as I recall.

Links pasted below.

I have never done a refi. Curious does a refi maintain the original loan date (e.g. credit history)?

P.S. The results of the OP's tax lien removal mirror what @Inverse reported on late 2015 when he had a couple Fico 8 scores go to 850 from the 750s when his tax lien was removed

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

It sounds like the OP here definitely had somewhat of a buffer in place (above 850). He just received the inquiries from the CSR app, but also referenced a lease that started 3 months ago which no doubt means an inquiry from that time. That would place his AoYA at 3 months. I'll be curious to hear if your CSR reporting has any impact on your scores in a month or so. AoYA will drop from 3 months to 0 months, which I'm not sure will matter in terms of scoring. The AAoA drop won't matter, as you could drop your AAoA by several years and still be above the best threshold with no problem at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

TT: a refinance on a mortgage is handled the same as refinancing a car or similar loan - new account, new original amount too.

Doesn't keep whatever payment history you had on the last tradeline, nor the original terms from an installment utilization perspective. Fortunately there's no issue with one's mortgage being passed around on the secondary market, that keeps the same info as the original tradeline.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

@Revelate wrote:That's awesome Hale!

Actually if you wouldn't mind, would you post the two auto loans and the mortgage in something akin to the following format?

current balance / original amount

We've had some debate in the last few months on how various installment tradelines were counted and whether it was possible to have an 850 with full monty ugly installment utilization which it sounds like you have.

Here's the information for the Mortgage/installment loans.

Auto Lease opened in July of 2017. Original amount $12,276. Current amount $11,594.

Auto Loan opened February of 2015. Original amount $52,996. Current amount $32,089.

Mortgage Loan opened December of 2015. Original amount 261,250. Current amount $253,804

On January of 2017 I took out a Mortgage on a 2nd house but paid it off in May of 2017. That mortgage is reporting closed, paid as agreed. Not sure if that one has any impact on my score but I listed it because it just closed a few months ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

@Anonymous wrote:It sounds like the OP here definitely had somewhat of a buffer in place (above 850). He just received the inquiries from the CSR app, but also referenced a lease that started 3 months ago which no doubt means an inquiry from that time. That would place his AoYA at 3 months. I'll be curious to hear if your CSR reporting has any impact on your scores in a month or so. AoYA will drop from 3 months to 0 months, which I'm not sure will matter in terms of scoring. The AAoA drop won't matter, as you could drop your AAoA by several years and still be above the best threshold with no problem at all.

I'm curious about the CSR reporting as well. I'll definitely let you know.

Something I noticed while riding in the tax lien bucket, New activity could produce a score drop with TU or EQ while the same event would cause a score rise with EX which had no lien showing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: 89 and 91 point gains from tax lien removal

@Anonymous wrote:

@Revelate wrote:That's awesome Hale!

Actually if you wouldn't mind, would you post the two auto loans and the mortgage in something akin to the following format?

current balance / original amount

We've had some debate in the last few months on how various installment tradelines were counted and whether it was possible to have an 850 with full monty ugly installment utilization which it sounds like you have.

Here's the information for the Mortgage/installment loans.

Auto Lease opened in July of 2017. Original amount $12,276. Current amount $11,594.

Auto Loan opened February of 2015. Original amount $52,996. Current amount $32,089.

Mortgage Loan opened December of 2015. Original amount 261,250. Current amount $253,804

On January of 2017 I took out a Mortgage on a 2nd house but paid it off in May of 2017. That mortgage is reporting closed, paid as agreed. Not sure if that one has any impact on my score but I listed it because it just closed a few months ago.

Looks like your aggregate B/L ratio is 91%. Oldest open installment loan (Auto) is over 2 years old.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950