- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AAOA Question Again

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AAOA Question Again

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AAOA Question Again

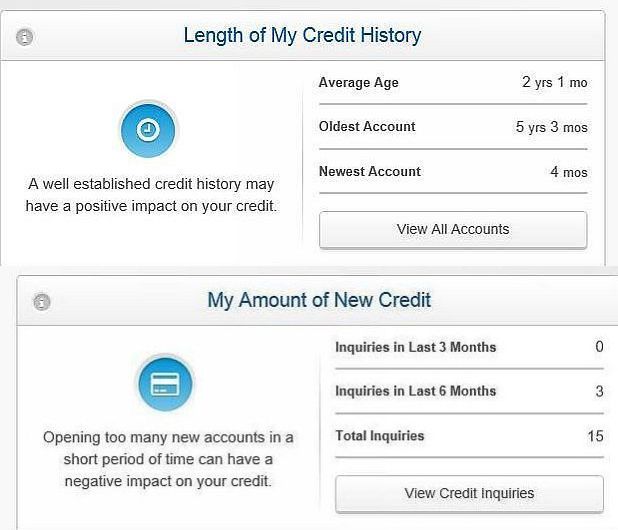

Long gone by now I guess is a post I made some months ago when I was concerned about closing in for the first time finally on 2 years. The original plan was to wait it out until 2017 but opportunities as usual cropped up that led to opening a few new accounts. While I was almost certain that those new cards reporting would set back that time schedule by many months, I recently have discovered it's not the case at all.

In fact current FICO data indicates that the AAOA is just shy by (2) months of actually eclipsing a 2 year threshold which of course is long been one of the more important goals I have been wanting and needing to meet.

My question is a simple one. Whenever that new milestone finally does show as reported data of 24 months AAOA, can anyone offer up a reasonably possible estimate of what FICO Score Points might be realized at this particular point from a NET GAIN?

Would it be, 2 points, 4 points?

And are there any other potential delaying factors short of adding anymore accounts, (which I do not expect at all this time) to prohibit just letting time/days/weeks/months run their course to this new (2) year mark.

And then there is this.

Once the (2) year AAOA line is crossed, what is a doable length of months AFTER CROSSING before you can safely app anew without sliding back under <2?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

My comments in blue below.

@CreditMagic7 wrote:Long gone by now I guess is a post I made some months ago when I was concerned about closing in for the first time finally on 2 years. The original plan was to wait it out until 2017 but opportunities as usual cropped up that led to opening a few new accounts. While I was almost certain that those new cards reporting would set back that time schedule by many months, I recently have discovered it's not the case at all.

In fact current FICO data indicates that the AAOA is just shy by (2) months of actually eclipsing a 2 year threshold which of course is long been one of the more important goals I have been wanting and needing to meet.

My question is a simple one. Whenever that new milestone finally does show as reported data of 24 months AAOA, can anyone offer up a reasonably possible estimate of what FICO Score Points might be realized at this particular point from a NET GAIN?

Would it be, 2 points, 4 points?

More than that, but it would depend what score card you were in I expect.

And are there any other potential delaying factors short of adding anymore accounts, (which I do not expect at all this time) to prohibit just letting time/days/weeks/months run their course to this new (2) year mark.

Sure. Adding new accounts would cause your AAoA to go back down, but so would losing older accounts. For example, if an older tradeline fell off your profile, or if a creditor deleted it.

And then there is this.

Once the (2) year AAOA line is crossed, what is a doable length of months AFTER CROSSING before you can safely app anew without sliding back under <2?

A simple answer is "about 2-3 months" but it depends on how many accounts total (closed and open) you have at the time. Let's assume just as an example that you had 12 accounts total when you crossed the 2.0 mark. An AAoA of 2.0 = 24 months. Suppose you wait two more months -- that's 26 months. Now you add one more account. That makes a total of 13 accounts. Do the math and calculate your new AAoA.

That's 12 accounts at 26 months each, all divided by 13, or (12 x 26) / 13. That equals 24 months. So a person who had 12 accounts when he crossed 2.0 would need to wait two months. If he had more than 12 accounts, he could wait a tiny bit less. If he had fewer than 12, he'd have to wait three months or even more. For example, if he had exactly one account when his AAoA turned 2.0, then he'd need to wait two more years.

An important question to ask yourself is why you want to app more if you have a low AAoA (2.0 will still be low) and already have eight credit cards, many of them very nice ones. That's just important to reflect on. Best wishes!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

Nice info CreditGuyInDixie.

My DW is close to 2 years (AAoA), she is very close to 800, I think she will be over 800 once the AAoA is at 2 years.

I told her to wait a few months so she would have an AAoA of over 2 years and 1-2 cards will not put her back into < 2 AAoA. I'll have to do the math just to make sure, or just go for 1 card then the other few months later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

@newhis wrote:Nice info CreditGuyInDixie.

My DW is close to 2 years (AAoA), she is very close to 800, I think she will be over 800 once the AAoA is at 2 years.

I told her to wait a few months so she would have an AAoA of over 2 years and 1-2 cards will not put her back into < 2 AAoA. I'll have to do the math just to make sure, or just go for 1 card then the other few months later.

+1

CGID laying it all out in true form.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

Glad that helped. Hope everyone has a good week!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

@Anonymous wrote:Glad that helped. Hope everyone has a good week!

Yes it adds some food for thought definitely.

Guess i'm in this thing for the long haul since all the card accounts goals are now mostly achieved.

The next duration of months etc. MUST be to let this years, (and one's before) card/loan accounts age up gracefully without any further deliberate interruption.

Just positioning yourself for a decent long term card(s) from a lender that works with you (SP/HP CLI's, APR Reductions etc.) can be quite the task when you are just starting to build from scratch and your scores borderline for months on end.

The seemingly piling on part is the most challenging of all. In an effort to try to weed out what works best for you, as opposed to accounts that prove or suggest that they may only serve to turn your attention another way, is been a critical stage but one that is come full circle and complete.

The AAOA is my primary goal and focus finally.

In fact it was initially a primary goal this past summer, however, I seen it best to bring in some additional card/loan accounts and forestall the AAOA aging process to prevent myself from continually interrupting that process. Only TIME and WAITING IT OUT can make progress with the AAOA in this case and not dipping back into another "new" account and repeating the backward progression.

The best part that seems the biggest advantage about all of this now is that since ALL (3) reports are once again Crystal Clean, the recent elevation of my FICO Scores serve to enhance this whole matter and i'm quite content to let things ride.

In fact it's a must.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

i was recently playing around a bit and was hoping to max my credit score before renting a new place then get a new car when things settled down. i was just rotating some low card balances around and think i would have hit 800 when a couple balances went to 0 any day now. after that i was going to for fun dabble with my 2 installment loans to see how high i could get my score.

yesterday my score went down 25 points from 797 from carecredit closing my old account with 0 balance and reporting a new account with a small balance for the new mastercard rewards card. i never read the fine print of course ![]()

i see no soft or hard pull and otherwise haven't applied for credit for a year and a half.

so now i need a couple cards to report 0 balance so i am left with one, but i think that will only get me a few points.

so a big hit which is kind of a bummer to me. my aaoa is 38 months on the report i got that includes this new carecredit account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

Yeah this AAOA element of FICO scoring seems to have a dual role in that sometimes applicants can become approved somewhat easily even with a low measure <1 <2 years provided history on other cards and factors/score number is OK, but also can prove an impediment if not allowed to age enough.

But just what exactly constitutes "enough" is the question.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

@damac I wouldn't be bummed. Technically isn't any score over 760 pretty much top tier approval/rate wise?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAOA Question Again

So it seems my EX AAOA has indeed crossed that (2) year threshold i been so patiently waiting to see.

However i refuse to consider as an accurate account the data gleened from CK's AAOA details but suspect that TU is also either at or has already crossed the 24 month bar too.

At the turn of another new year is when i intend to pull a new 3 bureau report to confirm and compare results among those.

I assume a new score change is also forthcoming?