- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: AAoA Question - I need help!!!!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AAoA Question - I need help!!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AAoA Question - I need help!!!!

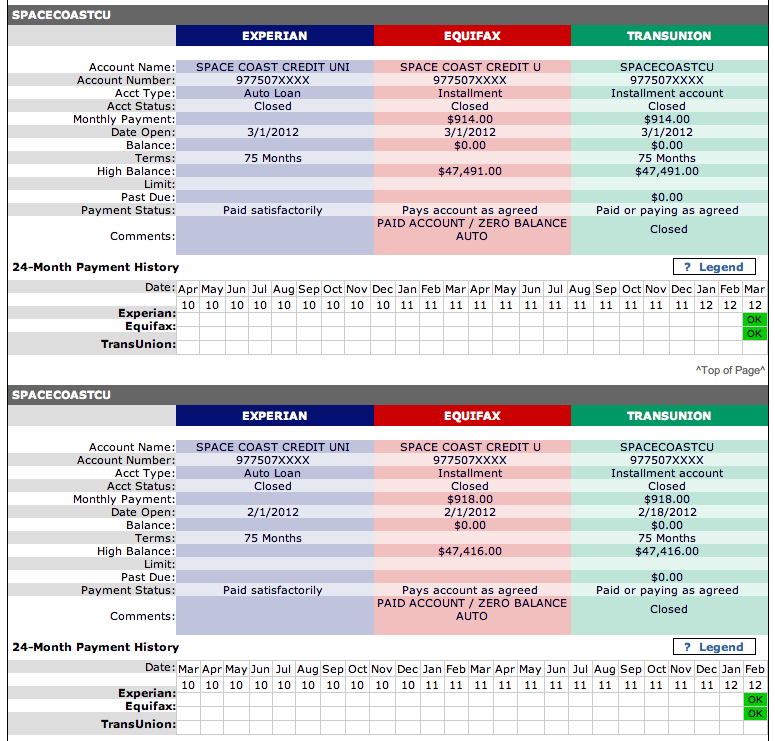

Last year 02/2012 I applied for a loan with my local credit union to buy a car & was approved for $47k. Unfortunately, the 2 cars I tried to seal the deal with had issues I couldn't look away at (NO WARRANTY). At the end of the month I ended up with NO car & 1 inquiry....... BUT most importantly 2 CLOSED/PAID tradelines reporting as:

My very important question is would it hurt to have them removed? My oldest accounts are 2 backdated Amex: Zync 12/1996 & BCE 04/1996. AAoA right now is showing as 2yrs 1mth. MOST IMPORTANTLY - Would it actually help my AAoA to remove them? My DH says yes...... I need the experts to chime in!!

Starting Scores: EQ 447 (01/02/2017), TU 476 (01/02/2017), EX 456 (01/02/2017)

Starting Scores: EQ 447 (01/02/2017), TU 476 (01/02/2017), EX 456 (01/02/2017)Current Scores: FICO 08's as of 12/12/2019: EQ 584, TU 702, EX 631

Goal Scores: ABOVE 800 ALL 3

Current Cards: CapOne QS1 $500, Walmart SC $500, Discover It $750, Amazon Prime SC $900, CareCredit $2,000, NFCU CashRewards $10,000 and NOT APPING until 04/2020....

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question - I need help!!!!

Make sure to calculate AAoA correctly. FICO reads it as a whole number only (vs. 2 yrs 1 mo.). Many CMSs out there show an incorrect AAoA. If indeed it is 2 yrs 1 mo, then you have a 2-yr AAoA. What would be the AAoA when you remove the accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question - I need help!!!!

Between my 29 open & closed accounts combined I have 747 months aging which = 25.76 months AAoA. If I remove these 2 accounts giving me 14 months each of aging it would bring me down to 27 accounts with 719 months aging combined which would now = 26.63 month in AAoA.

If I did my math right this just means I would "rebucket" to a higher AAoA without the 2 accounts reporting a month sooner. Am I wrong?

Starting Scores: EQ 447 (01/02/2017), TU 476 (01/02/2017), EX 456 (01/02/2017)

Starting Scores: EQ 447 (01/02/2017), TU 476 (01/02/2017), EX 456 (01/02/2017)Current Scores: FICO 08's as of 12/12/2019: EQ 584, TU 702, EX 631

Goal Scores: ABOVE 800 ALL 3

Current Cards: CapOne QS1 $500, Walmart SC $500, Discover It $750, Amazon Prime SC $900, CareCredit $2,000, NFCU CashRewards $10,000 and NOT APPING until 04/2020....

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AAoA Question - I need help!!!!

AAoA wouldn't change based on your figures. Your AAoA is at 2 years and after they are are moved, it remains at 2 years. FICO rounds down to the nearest whole number per AAoA.

Even if AAoA increased, let's say to 3 or 4 years, it still doesn't mean you would be rebucketed. Assuming you have a perfectly clean report, you can change AAoA without being rebucketed.