- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- AG UT at 0.0% with 2 Cards Reporting - Fico Score ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

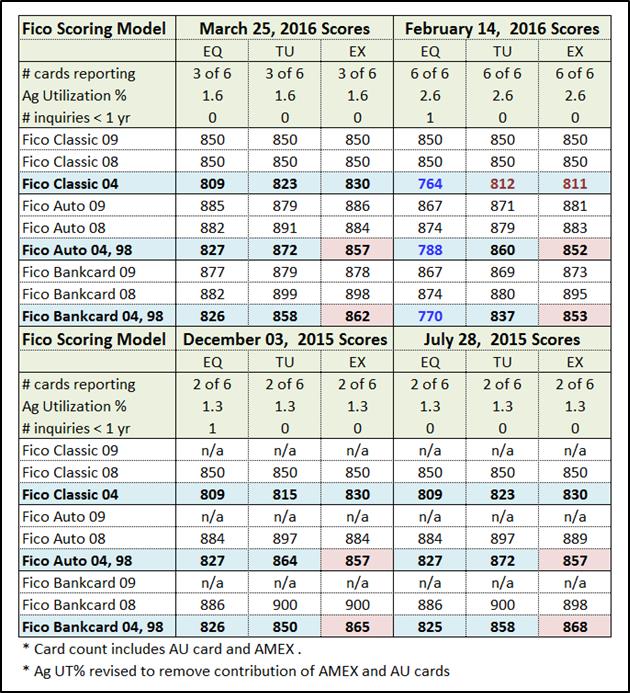

I was checking my accounts on Credit Karma and noticed I was down to 2 cards reporting balances:, an AU credit card and an AMEX charge card. According to Fico's recent algorithms these cards should NOT count toward aggregate revolving credit utilization. So, I pulled another report to see how things were scored.

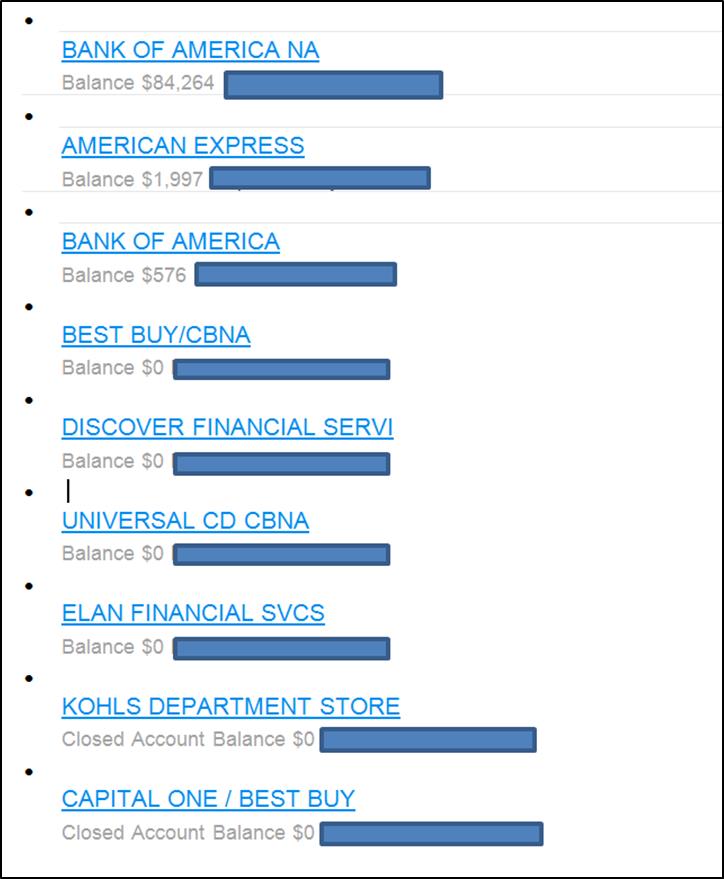

First, here are the accounts used in scoring (blocked out dates for privacy reasons).

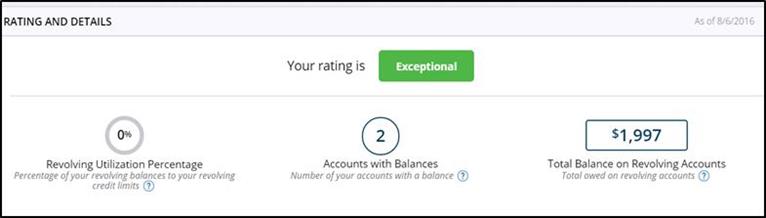

Here's how Fico looked at them in the score tab under amount of debt category.

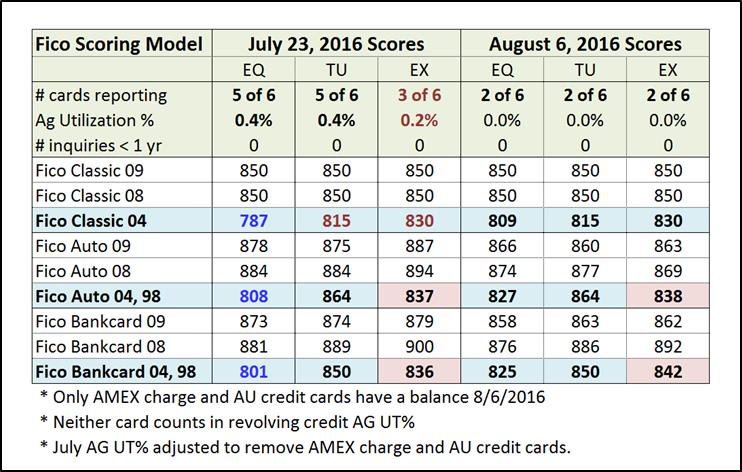

Here's how my profile scored with "0.0% revolving credit utilization [classic Fico 08 and 09 held at 850 but enhanced scores were affected].

Edit add:

Note the beatdown on Enhanced Fico 98 scores in both JUly and August 2016 relative to prior results in the lower table. Why - Fico 98 looks at AMEX B/HB in scoring - B/HB was at 100%. Fico 04 does not look at charge card B/HB but does count AU cards. The Fico 04 scores (Classic and Enhanced) actually stayed the same or went up in August because the AU card balance is included which kept Ag balance above zero.

The more recent Fico 08 and Fico 09 models ignore AU card and the AMEX charge card balances in utilization. Thus, the 0% Ag UT for August 6, 2016 vs 1% Ag UT July 23rd. As seen below Auto, Bankcard Fico 08 and Fico 09 model scores dropped in August relative to July due to the 0%.

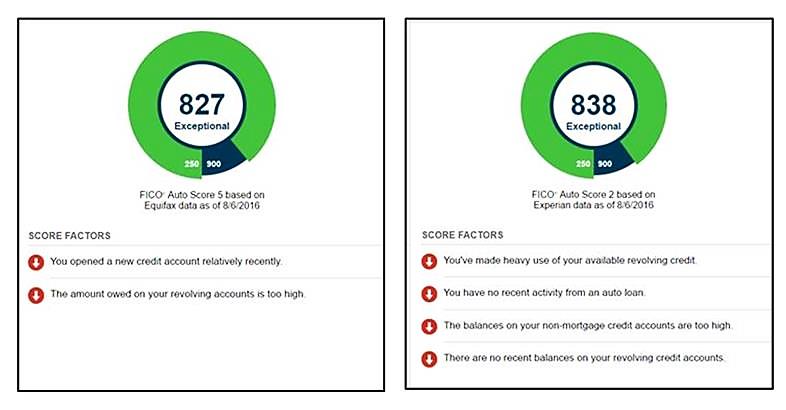

I found the below EQ Fico Auto Enhanced 04 and EX Fico Auto Enhanced 98 comments insightful

Comments and observations:

1) The Fico 08 and Fico 09 models do not factor AU cards nor true AMEX charge cards into Aggregate utilization

2) The Enhanced Fico 08 and Fico 09 scores all dropped 10 to 25 points as a result of a true 0% aggregate utilization.

3) The Classic Fico 08 and Fico 09 scores were unfazed by the 0% utilization.

4) EQ Fico 04 recovered to March level which indicates the primary sensitivity is # cards reporting balances. It sure looks like EQ Fico 04 is hyper sensitive to # cards reporting balances and count does include AMEX.

5a) It is interesting to note that a reason statement for Auto EQ Fico 04 (score 5) says: "amount on revolving accounts is too high" How can this be unless the algorithm is considering the AMEX B/HB of 100% as a factor.

5b) Also interesting is the Auto EX Fico 98 (score 2) statements: "You've made heavy use of your available revolving credit" and "no recent balances on your revolving credit accounts". The 1st statement is clearly referencing the AMEX B/HB of 100% on an individual account basis while the 2nd statement likely is looking at the aggregate calculation which ignores both the AMEX balance and the AU balance.

Edit add (link to background posts) and table of older 3B results revised to remove AU and AMEX from Ag UT calculation:

Comments and interpretations are welcome.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

Very interesting results TT.

Do you think that the FICO 8 and FICO 9 classic scores were unaffected by the 0% UT or that there was enough of a buffer to absorb the score drop?

My own observation of FICO 9 classic suggest that it easily has enough of a buffer to have absorbed the score drop.

These are possibly the first good data points on the treatment of AMEX charge card utilization by FICO 98.

I've only had a chance to briefly look at your results. It analyze it more later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

It seems that your AU card balance must have been included in the overall utilization or individual card utilization for FICO 04.

Unfortuneately, I lost most or all of my data points for FICO 04 with 0% utilization. I wasn't aware, until recently, that Equifax ScoreWatch was only saving 1 years worth of alerts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

@Thomas_Thumb wrote:

5b) Also interesting is the Auto EX Fico 98 (score 2) statements: "You've made heavy use of your available revolving credit" and "no recent balances on your revolving credit accounts". The 1st statement is clearly referencing the AMEX B/HB of 100% on an individual account basis while the 2nd statement likely is looking at the aggregate calculation which ignores both the AMEX balance and the AU balance.

Interesting observation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

@Thomas_Thumb wrote:

5a) It is interesting to note that a reason statement for Auto EQ Fico 04 (score 5) says: "amount on revolving accounts is too high" How can this be unless the algorithm is considering the AMEX B/HB of 100% as a factor.

And, yet your EQ 04 scores increased. If the AMEX B/HB of 100% was being scored, it seems that your scores wouldn't have increased. 04 has always been sensitive to utilization. 100% utilization would certainly have had an effect.

This is an example of why I've never paid too much attention to reason codes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

@Thomas_Thumb wrote:

4) EQ Fico 04 recovered to February levels which indicates the primary sensitivity is # cards reporting balances. It sure looks like EQ Fico 04 is hyper sensitive to # cards reporting balances and count does include AMEX.

Very interesting observation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

@oilcan12 wrote:Very interesting results TT.

Do you think that the FICO 8 and FICO 9 classic scores were unaffected by the 0% UT or that there was enough of a buffer to absorb the score drop?

My own observation of FICO 9 classic suggest that it easily has enough of a buffer to have absorbed the score drop.

These are possibly the first good data points on the treatment of AMEX charge card utilization by FICO 98.

I've only had a chance to briefly look at your results. It analyze it more later.

oilcan12:

Thanks for the response. It's the buffer

Classic Fico 08 and Fico 09 have enough points in their respective algorithms to provide the potential for scores over 850 but, one could say max value is truncated at 850. Thus, depending on scorecard, someone could fail to prefectly execute one or more elements (such as not being above 0% UT) and get the points elsewhere.

Put another way, each of the Fico factor categories is allocated a certain total # of points that sum to 850 which each is fulfilled. Within some categories, depending on scorecard, I believe there is more than one way to reach the category limit. If this is true, there should be cases where someone without an 850 score is able to maintain their score even though an element is not "fully executed".

The # (or%) of cards reporting a balance comes to mind. The impact of allowing "a lot" of cards to show a balance varies greatly. Many can show balances on a high # and/or % of cards without losing points. Why - is it because their are multiple ways to "point out" the category?

Side note: The category totals are scorecard dependent and the sum total [of the categories] is less than 850 for all dirty and some clean scorecards.

Edit add (background post link):

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/m-p/4361047#M102264

Bottom line:

IMO there are "buffers" associated with Fico scoring categories. The amount and/or existance of a given category buffer may be scorecard dependent. The reason why "850 profiles" are often more stable is because they have "pointed out" in more categories.

Many posters with scores in the 700s allude to achieving some milestone and now their scores are much more stable. Perhaps a Fico scoring category reached a saturation point. I see this with my EX Fico 04 score which is hard to move from 830

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

Thank you for posting. It's a big help. I find that no matter what I do that fico always has some comments below my scores too. I did noticed they said my ut on installment loans was excellent now but that will change next yr.

I cannot get the fico 08 and 09 to match up. 1 comes close but the others are way off. One's much higher and one's lower.

Bravo for getting an 850 on both!

So we don't really need to have a 1% balance to achieve an 850 score?

Very good info to follow. ![]()

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

@oilcan12 wrote:It seems that your AU card balance must have been included in the overall utilization or individual card utilization for FICO 04.

Unfortuneately, I lost most or all of my data points for FICO 04 with 0% utilization. I wasn't aware, until recently, that Equifax ScoreWatch was only saving 1 years worth of alerts.

I agree that the AU card must factor into overall utilization for FICO 04. That being said, it appears that FICO 98 does not consider the AU card. It sure looks like a few factors were evaluated differently between FICO 98 and FICO 04 (such as installment loans and AU cards).

The later FICO 08 and FICO 09 models ignore AU cards relative to utilization and do award points for an open installment loan [like FICO 98, unlike FICO 04]

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AG UT at 0.0% with 2 Cards Reporting - Fico Score Implications

Hi TT. In your discussion of buffers, you write:

"... each of the Fico factor categories is allocated a certain total # of points that sum to 850 which each is fulfilled. Within some categories, depending on scorecard, I believe there is more than one way to reach the category limit."

That's one way that buffers might work (assuming they exist, which I believe they do).

But I think there's another way. The five categories don't have to sum to exactly to 850. It's possible that the categories sum to (say) 860 -- and then FICO imposes a final rule which is to render all scores in the range of 851-860 as 850. Is there any particular reason to believe that the developers wouldn't implement the buffer this way?

Curious to hear your thoughts.