- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Are some types of credit negative?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Are some types of credit negative?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Dalmus wrote:

For FICO scoring purposes, "sub prime" cards like CreditOne are no different than "prime" cards from Chase. I don't think a "consumer finance loan" has negative on your score, either.

Now, for a manual review by an underwriter, they are probably more of a liability than an assert.

I have also posted previously about the term "subprime". I asked which cards were subprime. Basically, the answer was that it is a matter of opinion (if I understand correctly). Its basically as card you don't want . LOL. I didn't get a straight answer. How can they sing you fort something that is not really defined?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

I thought subprime cards were cards with high APR, little to no rewards structure, high AF and cards that collect a "maintenance fee" not just simply a card you don't want?.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

You are probably correct. I just got answers that didn't clearly define it. It was just emphasized that a person didn't want them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@DeeBee78 wrote:

@Anonymous wrote:I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

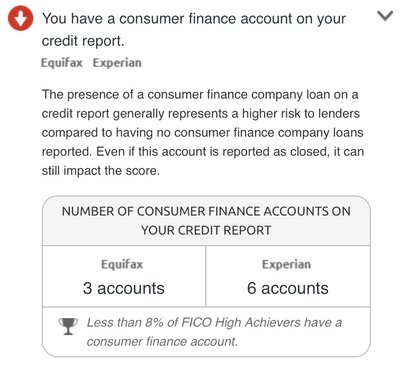

MyFICO states that a consumer finance loan can impact your score. What that impact can be is only known to them.

Hey DB, would you mind listing the open and closed tradelines on those two bureaus? Would be interesting to try to tease out some more CFA's.

I've read about LC/Prosper, I know I have one CFA on my account which I think is the Cashcall loan I foolishly took to cover a short term cash flow issue financing secured cards (even if I used it "well" comparitively) thinking it would help my credit... but I suppose it could be my singleton store card.

Anyway CU's shouldn't be reporting as such, no full bank should other than the possible retail card scenario. CFA's were basically "lenders of last resort" back in the day, not sure this is quite applicable now but it's something my Equifax report complains on at least in the reason codes... and anything in the reason codes is never a positive. Nothing I can do about it other than wait for it to fall off in another 5 years or whatever, it's almost assuredly a minor ding comparitively anyway.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

So because they are viewed as "lenders of last resort" is the reason why FICO scoring penalizes someone for the presence of a consumer finance loan on your credit report? I'm not sure I see the distinction today. Maybe I could understand it slightly if the loan was open, but if it's closed and paid as agreed I think it's a bit ridiculous that it would still adversely impact score, even if it is only a couple of points.

Several years back when I was in a furniture store the salesman pitched me financing it at 0% for 18 months or something. I had the cash to pay for it right then and there, or would have put it on a CC, but he somehow talked me into it saying that it looks good to have paid off loans on your credit report etc. I didn't know anything about credit at the time so I took the bait. I paid it off in about 1/3 of the time that I needed to and thought that was somehow going to look good. I had no idea that this type of loan would stick around on my credit reports and ding my score for a bunch of years after.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

What the OP posted, or I will have to look, was my post. I do NOT have Alliant. I have a XYZ Finance Company loan, and the screenshots provided here are what I see as a negative factor on my FICO scoring. I thought I had interepted it as if you do NOT go Alliant, which I believe is a FDIC institution, that at least go through some type, of Bank or Credit union. Sorry for any confusion. Mine will be paid off later this year, and I will go with Alliant to keep the credit mix in my scores.

ETA and my concern is we are hoping for a mortgage loan in 12-18 months and wondering how this will affect us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Anonymous wrote:So because they are viewed as "lenders of last resort" is the reason why FICO scoring penalizes someone for the presence of a consumer finance loan on your credit report? I'm not sure I see the distinction today. Maybe I could understand it slightly if the loan was open, but if it's closed and paid as agreed I think it's a bit ridiculous that it would still adversely impact score, even if it is only a couple of points.

Several years back when I was in a furniture store the salesman pitched me financing it at 0% for 18 months or something. I had the cash to pay for it right then and there, or would have put it on a CC, but he somehow talked me into it saying that it looks good to have paid off loans on your credit report etc. I didn't know anything about credit at the time so I took the bait. I paid it off in about 1/3 of the time that I needed to and thought that was somehow going to look good. I had no idea that this type of loan would stick around on my credit reports and ding my score for a bunch of years after.

Tax liens when paid still count, so do 60 or 90 day lates for that matter too even if the account is brought current. I'm maybe not smart enough to see a distinction there.

It's just data and risk analytics based off it it: doesn't always make sense to us as consumers. Also not everything which makes good financial sense is good for FICO either, 18 months 0% doesn't suck if your money is invested elsewhere making you money rather than making the store money in this case.

Where I'm not certain it's applicable any more is LC and Prosper aren't "lenders of last resort" by what should be anyone's definition and yet they're CFA tagged for some unknown and likely dumb reason frankly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

I wonder how meaningful an indicator of financial distress this is anymore, with the plethora of non-tradional cash-advance-type products available today.

Certainly this is an area where a bit more regulation would be a good thing: creating a formal definition of "Consumer Finance Accounts", and requiring full disclosure and consent before allowing the "derogatory" account to open.

I imagine that this is the type of issue that the CFPB and/or state attorneys general would enjoy getting their respective teeth into if it were explained to them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Anonymous wrote:I wonder how meaningful an indicator of financial distress this is anymore, with the plethora of non-tradional cash-advance-type products available today.

Certainly this is an area where a bit more regulation would be a good thing: creating a formal definition of "Consumer Finance Accounts", and requiring full disclosure and consent before allowing the "derogatory" account to open.

I imagine that this is the type of issue that the CFPB and/or state attorneys general would enjoy getting their respective teeth into if it were explained to them.

If we even got that I'd be happy. It's one thing to be flagged as a CFA for a PDL (pay day lender) or similar deep subprime (Credit One, Springfield, Loan Me, etc) but I don't understand something like Lending Club when the worst APR they have is like 25% in comparison to the 125-400% some of the other lenders are charging... at vastly different underwriting standards too (LC is well above some of the others I list).

I don't know if we could get to the disclosure part, I'd just like to know who makes the determination and to reiterate, how it's made. I wonder if groups you mention would be interested, it's not likely a major issue in comparison to some others?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

PenFed denied my credit card application for the "too many finance company accounts" reason. During the last 12 years, I would get a loan from a loanshark company and instead of paying it off, I would just pay the interest and renew (similar to payday loans). Supposedly, it helped your credit, but obviously, that was not true. I stopped getting those type of loans 2 years ago, but it still hurts me with PenFed to this day, although they were never late, always paid on time. Just my experience.

Current FICO 9s: Ex 775, Tu ?? Eq 781

Total TLs: $120,000

8 (30-60 day) mortgage lates and 2 (30 day) auto lates remain from Jan., Feb. 2016

Current Mortgage Ex. Fico 2 787