- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Are some types of credit negative?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Are some types of credit negative?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

If they receive multiple complaints on this topic, it could become a priority. (Complaints could request deletion or re-coding of the tradeline in question....)

Potentially, regulators could perceive the CFA designation as an issue of 1) fraud, because derogatory credit information is being reported arbitrarily and because creditors are doing so without informed consent on the part of the borrowers; and 2) discrimination, because otherwise creditworthy borrowers are being systematically denied credit or paying higher rates for it without a firm basis.

In particular, if regulators perceive this coding as a way of marking and excluding "underserved" borrowers, my guess is that it could become a high priority.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Revelate wrote:

@DeeBee78 wrote:

@Anonymous wrote:I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

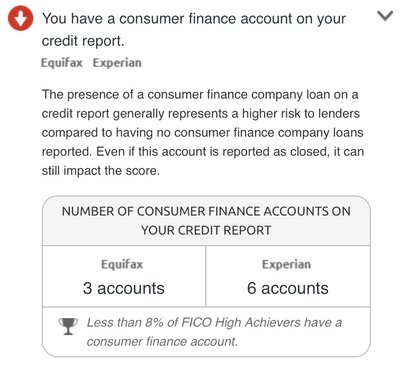

MyFICO states that a consumer finance loan can impact your score. What that impact can be is only known to them.

Hey DB, would you mind listing the open and closed tradelines on those two bureaus? Would be interesting to try to tease out some more CFA's.

I've read about LC/Prosper, I know I have one CFA on my account which I think is the Cashcall loan I foolishly took to cover a short term cash flow issue financing secured cards (even if I used it "well" comparitively) thinking it would help my credit... but I suppose it could be my singleton store card.

Anyway CU's shouldn't be reporting as such, no full bank should other than the possible retail card scenario. CFA's were basically "lenders of last resort" back in the day, not sure this is quite applicable now but it's something my Equifax report complains on at least in the reason codes... and anything in the reason codes is never a positive. Nothing I can do about it other than wait for it to fall off in another 5 years or whatever, it's almost assuredly a minor ding comparitively anyway.

MyFICO doesn't tell me which accounts are considered Consumer Finance accounts, but I'm guessing it's Avant (and their two refi's). Long since paid off and closed.

I'm not sure why Experian is reporting 6, I only have three, ever.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@DeeBee78 wrote:

@Revelate wrote:

@DeeBee78 wrote:

@Anonymous wrote:I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

MyFICO states that a consumer finance loan can impact your score. What that impact can be is only known to them.

Hey DB, would you mind listing the open and closed tradelines on those two bureaus? Would be interesting to try to tease out some more CFA's.

I've read about LC/Prosper, I know I have one CFA on my account which I think is the Cashcall loan I foolishly took to cover a short term cash flow issue financing secured cards (even if I used it "well" comparitively) thinking it would help my credit... but I suppose it could be my singleton store card.

Anyway CU's shouldn't be reporting as such, no full bank should other than the possible retail card scenario. CFA's were basically "lenders of last resort" back in the day, not sure this is quite applicable now but it's something my Equifax report complains on at least in the reason codes... and anything in the reason codes is never a positive. Nothing I can do about it other than wait for it to fall off in another 5 years or whatever, it's almost assuredly a minor ding comparitively anyway.

MyFICO doesn't tell me which accounts are considered Consumer Finance accounts, but I'm guessing it's Avant (and their two refi's). Long since paid off and closed.

I'm not sure why Experian is reporting 6, I only have three, ever.

Yeah, that's why I was asking for a full listing heh. Maybe if you and others do so we can start sorting out precisely which are CFA's and which aren't, but I don't think this particular board on this forum has enough people reading it to get a fantastic dataset unfortunately.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

As for my tradelines open and closed on installment loan accounts are listed as other or unknown for LOAN TYPE, with exception of KIA MOTORS (closed), shows as Vehicle Loan. The open and closed "other", "unknown" are strictly Finance Companies. No payday loans, no student loans. So I guess the coding for other or unknown, when it's a straight ie 12 mos @ 56.88 does not constitute a difference. I can give more information if needed.

ETA: Unlike the OP, I am only getting the red down arrow, it is not telling me exactly how many consumer finance reports I have on each bureau, so I do not know if they are factoring in KIA MOTORS or not. I do know the negative factors are showing on my mortgage scores and auto lending scores.

Which in my siggy shows Score 8's, EQ 671, TU 686, EX 716, my mortgage scores are EQ 5 628, TU 4 688, EX 2 640 granted some other factors are AAoA, oldest being 12 yrs on 1 bureau, 10 years on 2 bureaus, with an AAoA of 4.5 years (lowest), with a "short credit history", newest account being 5 months ago on 1 bureau, 6 months on 2 others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

I have an active, low interest prosper loan and an 837 fico score (833 and 817) credit score, and Citibank denied credit limit increase because of that account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Anonymous wrote:I was reading a post today. There was a question about raising credit. Several people suggested a Shared Secure Loan for an installment loan. A poster said that an Alliant SSL was a consumer finance loan and they were getting dinged for it. They also said that it was hurting their credit like a subprime credit card. Is this true? I guess my question is are some types of credit considered negative to have on your report? I always thought that if you pay and pay on time any credit was good. Am I wrong?

Not true. Alliant credit union share secured loans are reported as installment loans. Credit unions are not consumer finance agencies and are not reported as such by the credit bureaus. They are fully equivalent to banks.

..... wait. Why am I responding to a 10-month-old thread???

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are some types of credit negative?

@Leonardc2 wrote:I have an active, low interest prosper loan and an 837 fico score (833 and 817) credit score, and Citibank denied credit limit increase because of that account.

Interesting! Are you basing that on a denial letter? If so, can you quote for us the exact language used?