- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Average age of accounts: 4 years, 12 months

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Average age of accounts: 4 years, 12 months

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

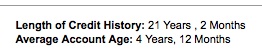

Average age of accounts: 4 years, 12 months

...from my Equifax Credit Watch Gold report.

D'oh!!! What does a girl have to do to get a 5-year AAoA??? ![]()

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

Lol. No respect.

Feel comforted in the fact that it doesn't say 1 year and 48 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

Must still be using that "new" math.

TU 842 12/8/18

EX 840 12/29/18

EQ 842 12/8/18

(NASA 30K) ( Amex 44k ) ( Freedom 10.6K ) ( US Bank Cash+ 20k, LOC 15k ) Winners never quit, and quitters never win

last app 2/15

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

Well, not with 4 years, 12 months! ![]()

In fact, I pulled the report in hopes of provoking a new Scorewatch alert. I'm not convinced that that happens (probably not), but what the heck, it was free, or at any rate paid for via EQ Credit Watch Gold.

And I won't get a definitive answer, either, because a couple of extra cards had posted balances last month, and they'll be back to $0 about now. So I won't be able to separate any score change resulting from lowered balances/ fewer accounts with balances from a change from a higher AAoA.

And since my longest history is 21+ years, I don't think I would be rebucketed. I think that I might be a bit less penalized for having my AAoA way shorter than the overall, but I don't even know if that will happen. It hasn't shown as a negative for a long time now.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

I had this exact same issue happen to me on CreditKarma this past month. I know Creditkarma calculates AAoA differently, but it is odd that we both had the same issue. FOr me it was stuck at 5y12m. I first noticed this ~July 25th or so. I figured it would change with the new month, but on July 29th it updated to 6y.

Not sure our issues are related, but you might see a change in a couple of days.

Maybe we stumbled onto the reason Fico rounds down to the nearest whole year--it cannot handle the remainder :-P

Helpful Threads

Frequently Requested Threads

Understanding your Fico Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

@cobaltnv wrote:

I had this exact same issue happen to me on CreditKarma this past month. I know Creditkarma calculates AAoA differently, but it is odd that we both had the same issue. FOr me it was stuck at 5y12m. I first noticed this ~July 25th or so. I figured it would change with the new month, but on July 29th it updated to 6y.

Not sure our issues are related, but you might see a change in a couple of days.

+1 to that for CK. Last month my AAoA with them was 1 yr. 11 months (it's over 3 in FICO-speak). On 8/1 I was expecting AAoA to bump over to 2 yrs. Nope! 1 year, 12 months. It converted after a day or so to 2 yrs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Average age of accounts: 4 years, 12 months

Well, go figure. I just got a Scorewatch alert that my score had gone back up 9 points. (It had dropped due to too many accounts with balances.)

The only change from the last one is the 4y 12m thing. I did pull another full report from EQ, and they're still showing that jargon, but the myFICO version says 5 years.

I seriously doubt that going from 4y AAoA/ 21y overall to 5y AAoA/ 21 y overall is good for 9 points, but I haven't yet found what else it might be.

***Oh, I take that back: my PenFed AmEx went from 3 months to 4 months. I wouldn't think that that would be a big factor, but maybe that's part of it. And I was too cheap to pull a SW report back when my score dropped, so I can't see what's different on my negative list between then and now.

Oh, well, good incentive to keep from apping! ![]()

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007