- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Baddies Falling Off-Old Positive Closed Accounts?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Baddies Falling Off-Old Positive Closed Accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Baddies Falling Off-Old Positive Closed Accounts?

Hi, I'm new to the board. I have a question. I have old baddies that are falling off. I currently have 2 collections that I am disputing. After those fall off, I will only have 4 closed accounts in good standing.

Those accounts are Chase $300 Student CC Opened 8./2004 Last Reported: 2/2005- I asked them to close it since it was such a low limit

Sallie Mae Stafford $2000 Opened 8/2004 Closed 10/2004 Status: Paid

Sallie Mae Stafford 1300 Opened 8/2004 Closed 10/2004 Status: Paid

Credit Union Car Laon $9000 Opened 8/2004 Paid 10/2004

I have no other open accounts right now. My question is, since only one was opened for six months (Chase credit card) and the rest of the tradelines were closed within two months, will I have a credit score from any of the agencies after my last two collection accounts fall off? If so, will the score be decent? Also, what secured cc or installment accounts should I start with to rebuild my credit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

you could probably rapidly increase your score by opening a current tradeline such as a secured card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

Also, since these accounts were open for a short time, how does this affect my AAoA after all of the baddies fall off? Will the average age be 8 years or just six months (from the time the Chase account was opened and close)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

you will still have the positive accounts after your ca's fall off. and AAoA is from date opened on those accounts until now. So your AAoA will be longer for a while still. But your credit score will still be low without current accounts. Try getting a secured card with the bank that you currently bank with.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

@DaveSignal wrote:you will still have the positive accounts after your ca's fall off. and AAoA is from date opened on those accounts until now. So your AAoA will be longer for a while still. But your credit score will still be low without current accounts. Try getting a secured card with the bank that you currently bank with.

I don't think that's correct.

AAoA is the average time of accounts being open. When a tradeline is closed, that date is set from an AAoA perspective regardless of how much time has passed between now and then. There's a different metric of when you first obtained credit, but whether that's used at all in FICO I don't know.

This is why opening and closing accounts in such a short timeframe is detrimental to one's FICO score for an extended period of time.

So unless I'm badly mistaken in this (which I really don't think so), the OP's AAoA is going to kinda suck for a while until those old accounts closed in 10/04 fall off (in 10/2014 roughly).

Regardless to the OP I'd suggest the following:

- Go open 2-3 credit cards secured or otherwise, credit limit doesn't matter for now, you just want payment history. Whatever banks/credit unions you do business with already is the correct place to start. Beyond that, if you're military go get an account with Navy FCU, and Capital One isn't a bad plan either for a secured card. BOFA is another suggestion of a bank with a very good secured product but they're a little more picky on approvals.

- Open 1-2 installment loans, secured or otherwise, and try to pick a date out in the future at least 12 or even 36 months if possible for the term length. I personally recommend USAA for this one, but it's a minimum $2500 buy-in on that (though you get it right back 2 weeks later). Some credit unions offer a $1000 one, and in some cases don't have an up-front CD purchase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

I've been researching old posts, and it seems like my old closed accounts count the same as old open positive accounts. Here is what a FICO moderator posted in another thread

masdeocho wrote: OK, tell me if I've got this right: Say I have a five-year old card. I close it today. Two years from today, does it count towards my history as a seven-year old card? It's not frozen in time today when I close it as a five-year old?

Tuscani wrote: Yes, it counts towards your history as a seven year old card. And the 10 yr clock for its removal begins on the date you closed it, not when it was opened.

So...this means I would have an average age of 8 years after all of my baddies are off and I could have a pretty good score, at least 700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

@lnacen wrote:I've been researching old posts, and it seems like my old closed accounts count the same as old open positive accounts. Here is what a FICO moderator posted in another thread

masdeocho wrote: OK, tell me if I've got this right: Say I have a five-year old card. I close it today. Two years from today, does it count towards my history as a seven-year old card? It's not frozen in time today when I close it as a five-year old?

Tuscani wrote: Yes, it counts towards your history as a seven year old card. And the 10 yr clock for its removal begins on the date you closed it, not when it was opened.

So...this means I would have an average age of 8 years after all of my baddies are off and I could have a pretty good score, at least 700

Hrm, I think that's suspect. I do know it's absolutely wrong for an internal model, and I've been told it's incorrect for another as well. RobertEQ had a post about this recently too confirming my suspicions for FICO.

If you want to know for certain, pull your report, but I'd be stunned if you have an AAoA of 7 years at this point. It just doesn't make any sense from a risk analysis perspective: you haven't been using the tradeline during that time and therefore haven't proven anything by it. I've been wrong before and will be again, but there are people much smarter than I am who developed the model, and allowing a 2 month tradeline to look like a 7 year tradeline in any portion of their model is pretty flawed to the point of monkies-with-typewriters randomness from my perspective. I can't see how any lender would want to interpret things that way, and they are the customers, not us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

@Revelate wrote:

@DaveSignal wrote:you will still have the positive accounts after your ca's fall off. and AAoA is from date opened on those accounts until now. So your AAoA will be longer for a while still. But your credit score will still be low without current accounts. Try getting a secured card with the bank that you currently bank with.

I don't think that's correct.

It is absolutely correct. You can calculate it yourself. First look at what the AAoA myFICO or your CMS gives you. Then calculate each account you have, in months, from the date it was opened until today. Then divide by 12 so you have a number in years. Then divide by the number of accounts that you have. You will get the same AAoA that your CMS gives you.

AAoA is not the time you had your accounts open. It is the average age of the accounts that are on your credit report, calculated from the current date.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

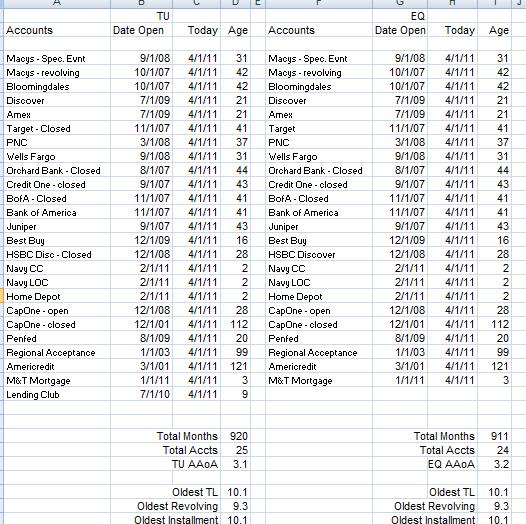

I cheat via Excel. Below is an older screenshot:

DaveSignal wrote:

....First look at what the AAoA myFICO or your CMS gives you.

Be careful on some CMSs. Some, like CreditKarma, only calculate AAoA off open accounts only. FICO factors in all OC accounts, whether they are opened or closed, good or bad.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Baddies Falling Off-Old Positive Closed Accounts?

Weird. Why not, besides how laughably goofy it'd look from an underwriting perpective, simply open up several unnecessary accounts and close them immediately for future AAoA goodness then for people starting from scratch? Tradeline seasoning penalty? Recent payment history non-existent as in the OP's case? I still don't understand it as rational from a lender's perpsective.

Anyway, learn something new every day I suppose though apparently I can't check myself for years as everything currently gets rounded down to the minimum year in my case with the reports I've pulled in the last few months regardless of how the calculation is done. Thanks Dave and illecs.