- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Best Allocation of Funds

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best Allocation of Funds

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Best Allocation of Funds

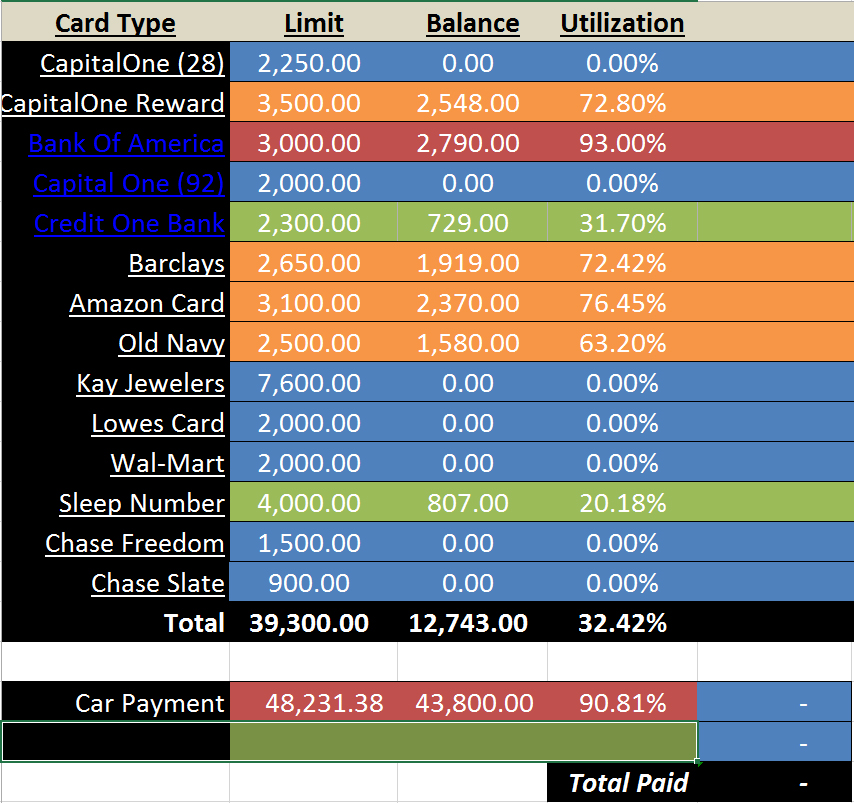

We have been pre-approved for a mortgage, but it is just a little less than we were wanting. The lender suggested paying off a credit card, which will let us qualify for the amount we want. He also said that anything we do to improve our scores would help. My thought is to pay off the Credit One, and Old Navy cards.

Here is my question. Would it be better for my scores to pay off those two, or to pa off one, and put the other money towards paying down the utilization on the rest?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

Need more information as unfortunately this is a multi-variable problem and not necessarily an easy one from what you posted.

First, how much money do you have to play FICO games?

Second, and this is critically important: is the limitation on your loan amount because of your FICO and the corresponding rate sheet, or is it a DTI calculation? Paying down credit cards can optimize FICO but it does little for DTI (take a look at your credit reports and see what the reported payment is on them, and even at $0 balances I have reported payments so they don't help me with my own DTI calc).

On the flipside, zeroing out an installment loan goes straight to the DTI calc but does virtually nothing positive or negative to one's scores when we're talking mortgage trifecta. Is that Sleepnumber tradeline revolving or installment?

What are your mortgage trifecta scores currently and what's the rate sheet for your lender? If it's conventional can make the swag off Fannie's published adjustment sheets, if it's jumbo all bets are off other than what your lender states.

ETA: I really like the colors on your spreadsheet, very easy to read at a quick glance as to what's what on your revolving utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

Rev nailed it.

How much did your LO tell you to pay off (in monthly payments) to get to the loan amount you desire?

Reducing the maxed out cards will help with scoring, but your issue is DTI if you are looking to boost your loan amount

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

@StartingOver10 wrote:Rev nailed it.

How much did your LO tell you to pay off (in monthly payments) to get to the loan amount you desire?

Reducing the maxed out cards will help with scoring, but your issue is DTI if you are looking to boost your loan amount

Question for you S10 as you know way better than on on this one; however, doesn't the DTI calc take into account what the interest rate of the loan is in the sense that the expected loan et al. payment has to fit under the DTI caps? Namely my hitting 720-739 on Fannie's sheet suggests my rate will be .125% lower than if I were in the 700-719 category based on my downpayment.

If it's feasible to eeek out the points on revolving utilization to get to a higher tier, doesn't this directly impact loan amount as a result?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

@Revelate wrote:Need more information as unfortunately this is a multi-variable problem and not necessarily an easy one from what you posted.

First, how much money do you have to play FICO games?

We have 2,000K without dipping into our 6 month emergency fund.

Second, and this is critically important: is the limitation on your loan amount because of your FICO and the corresponding rate sheet, or is it a DTI calculation? Paying down credit cards can optimize FICO but it does little for DTI (take a look at your credit reports and see what the reported payment is on them, and even at $0 balances I have reported payments so they don't help me with my own DTI calc).

Our DTI was the issue. He said that if we lowered our monthly payments by $100 we could qualify for another $20k, which is over what we wanted. On our FICO report, the cards that are paid off, under the "scheduled payment" heading, show either a "-" or $0.

On the flipside, zeroing out an installment loan goes straight to the DTI calc but does virtually nothing positive or negative to one's scores when we're talking mortgage trifecta. Is that Sleepnumber tradeline revolving or installment?

The Sleepnumber is revolving, but I noticed that it has a fixed monthly payment, which doesn't change, probably because of the 0% financing??? Maybe it would make sense to pay this off, just to get rid of the $50/mo, even if I had to close the account.

What are your mortgage trifecta scores currently and what's the rate sheet for your lender? If it's conventional can make the swag off Fannie's published adjustment sheets, if it's jumbo all bets are off other than what your lender states.

Our mortgage scores are: 674-646-634 and 695-653-589. He originally suggested a USDA, but then decided an FHA was a better fit. He said the rate was around 3.75%.

ETA: I really like the colors on your spreadsheet, very easy to read at a quick glance as to what's what on your revolving utilization.

Thanks. It's good at making you feel guilty if they get to yellow, orange or red.

One more thing. My lender has had me send him screenshots of my account balance screens after I pay them off. He says that he can use that to show that I no longer have that monthly payment counting towards my DTI.

We are doing a 3.5% downpayment.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

If it were me and just 2K: I'd pay off CreditOne and Sleepnumber, and then kick the rest to the BOFA account personally from what you described.

If your cards report $0 payment (who knows maybe mine will but every report I can look at has a payment on it even at 8 cards reporting $0 out of my 9 but for me frontend ratio is the issue anyway, backend is trivial so I'm not worried about it) that gets you somewhat probably 2/3-3/4 of the way to the 100/month you were discussing with your LO; the BOFA account while it won't help DTI will likely help your scores somewhat as I know that utilization number has a penalty associated with it from my own data at least.

You can't write a check for the car so that's out; short of trying to refinance the vehicle there's not really anything else you can do to make room in the DTI calc as I understand it; S10 may be able to suggest a better optimization route.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

Thank you very much.

Our car is financed at 1% interest, so can't see getting a better rate.

I noticed that the Credit One card seems to have a much higher minimum payment when compared to other cards with the same interest rate and balance. I am guessing they just want to be paid back quicker. My interest rate with them is 18%, and the minimum payment is $42/mo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

@KeithW wrote:Thank you very much.

Our car is financed at 1% interest, so can't see getting a better rate.

I noticed that the Credit One card seems to have a much higher minimum payment when compared to other cards with the same interest rate and balance. I am guessing they just want to be paid back quicker. My interest rate with them is 18%, and the minimum payment is $42/mo.

Would guess that's because of the monthly fee that I think they still do? Haven't looked at them in a while after writing them off as a vulture card anyway. Yeah car refinancing is out hah.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

I keep telling myself that I am going to cancel my Credit One card, but everytime I pick up the phone, I hesitate, because I have had the card for 8 years, and I hate to loose the $2500, which would raise my overall debt ratios.

They are like a bad relationshipI just can't quit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best Allocation of Funds

@KeithW wrote:I keep telling myself that I am going to cancel my Credit One card, but everytime I pick up the phone, I hesitate, because I have had the card for 8 years, and I hate to loose the $2500, which would raise my overall debt ratios.

They are like a bad girlfriend I just can't quit.

Whack it after you get your mortgage sorted (keys in hand) would be my recommendation.