- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Buckets?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Buckets?

I keep hearing about different buckets and the effect on your score.

Here is my situation. My last collections account droped off from all three CR. The Credit One card that was charged off and resulted in the collection that just dropped is still showing on TU and EX, but is gone from EQ. Since the collection dropped off the credit card should also so I have disputed with TU and EX. After the Credit One account is removed I will have 1 car loan from a sub prime finance company still on my report with 1 30 day late, and 3 120 day lates. The 120 days will drop off by September 18. (no love on my goodwill effort)

I currently have the following Positives.

1 Capital One Auto Loan - closed - zero balance - never late.

1 State Farm Auto Loan - open - never late

Capital One Platinum Secured (CL 500) - PIF every month, shows zero blance at statement cut - never late

Capital One Quicksilverone (CL 300) - PIF every month - keep 14.95 balance at statement cut - never late

Lowes Card (CL 8400) - AU - zero balance - if used zero balance at statement cut - never late.

EX and TU show two old closed CC accounts that should have already dropped but havent. Both closed by customer - never late

Will having zero collections accounts result in my being rebucketed, or will the 120 day lates keep me in the same bucket? If I am rebucketed what effect will it have on my FICO scores?

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

The scorecards (or "buckets") different from each FICO score flavor. FICO 8 has one number of scorecards but FICO 9 has another.

The major scorecards are split into two: derogatory and non-derogatory. Non-derogatory scorecards are generally set by the age of your oldest account (I believe) so aging old accounts helps you get a higher score.

The derogatory buckets I have no idea yet. I believe the two main derogatory scorecards are 1 derogatory and 2+ derogatories. So far from what I've analyzed, collections and chargeoffs and public recorders all are derogatory. 90D and 120D lates MIGHT be, but I haven't seen enough data point evidence.

Generally speaking, going from a derogatory to a non-derogatory scorecard SHOULD raise your FICO score, but in very very rare cases, getting rid of an old derogatory may take your oldest account age from 7 years to 0 years, which could mean a small FICO ding until your profile ages.

I've been analyzing the scorecards a lot this year, and from what I can tell, there is about a 10 point boost as you go from a younger scorecard to the next order scorecard, with about 70 FICO points of range between the youngest scorecard and the oldest one. So the oldest one(s) can get you to 850, but the youngest one may "cap" at 780.

This also fits with the derogatories, as people with derogatory accounts rarely have posted data points showing a possibility of more than 770-780 on FICO scoring. So if the scorecards are 850->780 for positive scorecards, and 770 for 1 derogatory and maybe 760 (?) for two+ derogatories, it fits the data points I've analyzed.

My own FICO scores in my signature are interesting based on this data:

- EX is clean, on the "5 year" oldest scorecard

- EQ is clean, on the "7 year" oldest scorecard

- TU is derogatory, on the 1 derogatory scorecard

Everything else is identical other than inquiries. My analysis tells me that EX will likely go up 10 points next year from the <6 year scorecard to the <8 year scorecard (or whatever the age breaks are). TU is capped at about 720 no matter how much age I throw at it, but may go to 760 when all my inquiries fall off and my new account penalty is gone. It won't go over 760.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

Thomas Thumb knows quite a bit about FICO scorecards, so he may be able to comment. Actually, you may find TT's comments in this fairly recent thread illuminating. His comments is the fifth and last comment in the discussion:

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Buckets-Scorecards/td-p/5069914

You'll see that there are four dirty scorecards for FICO 8. Other models have different numbers of scorecards, as ABCD mentions.

Scorecard assignment for clean scorecards is based on three factors:

Age of Oldest Account

Age of Youngest Account

Total Number of Accounts (a profile being "thin" vs. "thick")

I am personally skeptical that having old collections drop off your report could have any effect on your scorecard, given that you have severe lates (Day 120). TT conjectures (see the other thread) that the presence or absence of public records could matter, as well as the presence or absence of recent severe delinquencies. But none of that appears to apply to you. Your derogs are all old, you have severe derogs, and you have had no public records drop off.

But the truth is that this is all wildly conjectural and it does not assist you in making decisions . You should want all your derogs to go, regardless of what that does to your scorecards. If you want to find out what happens to your scores when derogs fall off, pull your scores for a dollar at Credit Check Total. That is far better then relying on guesswork by us.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

Thanks for the responses guys. I thought I had read somewhere here that your score could have a drop if you are rebucketed, but it dosen't sound like that should be a major concern.

I did see a 5 point increase in my EX Ficor 8 with the collections dropping off. I am continuing my goodwill campaign and hope I get some success but at worst I will have my 120 day lates gone by September leaving me only a 30 day late that will be gone a year after that. No matter what the end is in sight and in about 1 year 8 months I will have a clean CR.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

Going from a dirty scorecard to a clean one CAN cause your score to drop, but you have to have one of the rarest profiles for it to happen. It doesn't happen very often.

The #1 reason why someone's credit score drops when they go from a dirty to a clean card has nothing to do with scorecards, it's because some rebuilders go from no credit with baddies to now having credit with no baddies and maxed out utilization. The scorecard change didn't affect them, but rampant overspending.

On Facebook last month someone went from 8 collections being removed in 3 months to having 3 brand new credit cards all at 90% utilization and they were freaking out that their score dropped so much "because collections were removed". It wasn't that at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

@MakingProgress wrote:I keep hearing about different buckets and the effect on your score.

Here is my situation. My last collections account droped off from all three CR. The Credit One card that was charged off and resulted in the collection that just dropped is still showing on TU and EX, but is gone from EQ. Since the collection dropped off the credit card should also so I have disputed with TU and EX. After the Credit One account is removed I will have 1 car loan from a sub prime finance company still on my report with 1 30 day late, and 3 120 day lates. The 120 days will drop off by September 18. (no love on my goodwill effort)

I currently have the following Positives.

1 Capital One Auto Loan - closed - zero balance - never late.

1 State Farm Auto Loan - open - never late

Capital One Platinum Secured (CL 500) - PIF every month, shows zero blance at statement cut - never late

Capital One Quicksilverone (CL 300) - PIF every month - keep 14.95 balance at statement cut - never late

Lowes Card (CL 8400) - AU - zero balance - if used zero balance at statement cut - never late.

EX and TU show two old closed CC accounts that should have already dropped but havent. Both closed by customer - never late

Will having zero collections accounts result in my being rebucketed, or will the 120 day lates keep me in the same bucket? If I am rebucketed what effect will it have on my FICO scores?

Fico doesnot have buckets but, the models do have scorecards as follows:

1) Fico 98 and Fico 04 Classic versions: 2 dirty scorecards and 8 clean scorecards.

2) Fico 8 Classic version: 4 dirty scorecards and 8 clean scorecards

3) Fico 9 Clasic version 4 dirty scorecards, 8 clean scorecards and 1 High revolving utilization scorecard.

The industry enhanced (Auto & bankcard) scorecards add additional segmentation criteria for profile differentiation.

The 120 day lates may land you on the same scorecard as collections. However, even if collections are a different scorecard from "long lates" it is doubtful removal of the collection will improve your score much given the lates are still there. Removals are always good - so congratulations on that.

P.S. foreclosures, short sales and bankruptcy are almost certainly a different scorecard than collections and tax liens.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

I agree with TT. I don't think you'd be rebucketed (to a "better" bucket) in dropping a collection when you have multiple 120 day lates still present. You may see a 3-7 point gain or so, but the 120 day lates will continue to be the constraint to significant score improvement.

Once the 120s are gone, you'd definitely be rebucketed and see a nice score improvement since you'd only then have a 30 day late left.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

Not convinced that a 120D late is scored similarly to a PR/collection from a bucketing perspective, I think at least with FICO 8 there's a PR vs. non-PR bucket, and then there's a sorting by age of PR or similar... my analysis anyway from my scores while in a dirty bucket but I don't have much more than anecdotal evidence on that one. I can state though that multiple collections / tax liens appear to shift you around inside a given scorecard rather than changing it... and that there's a lot of anecdotal evidence on most notably because I don't think anyone has ever gone down with the removal of any derogatory that wasn't their final.

I've never seen nor heard of anyone above a 756 I think it was with a PR, whereas 90D lates at least which meet the standard definition of serious deliquency as I understand it have hit markedly higher than that.

Scores going down on scorecard reassignment isn't that uncommon when moving between dirty to clean scorecards: I actually had it happen to me on some FICO models (tax lien and 30D late, when the tax lien went away I dropped... 30D late appears to be on a non-derogatory scorecard) and over time we've had numerous accounts on this forum. May not be common, but if a limited file with not very much history gets moved from one of the derog scorecards to a clean one (albeit probably not the highest scoring one like in my case), because the scorecard ranges overlap you can take a drop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

@Revelate wrote:Not convinced that a 120D late is scored similarly to a PR/collection from a bucketing perspective, I think at least with FICO 8 there's a PR vs. non-PR bucket, and then there's a sorting by age of PR or similar... my analysis anyway from my scores while in a dirty bucket but I don't have much more than anecdotal evidence on that one. I can state though that multiple collections / tax liens appear to shift you around inside a given scorecard rather than changing it... and that there's a lot of anecdotal evidence on most notably because I don't think anyone has ever gone down with the removal of any derogatory that wasn't their final.

I've never seen nor heard of anyone above a 756 I think it was with a PR, whereas 90D lates at least which meet the standard definition of serious deliquency as I understand it have hit markedly higher than that.

Scores going down on scorecard reassignment isn't that uncommon when moving between dirty to clean scorecards: I actually had it happen to me on some FICO models (tax lien and 30D late, when the tax lien went away I dropped... 30D late appears to be on a non-derogatory scorecard) and over time we've had numerous accounts on this forum. May not be common, but if a limited file with not very much history gets moved from one of the derog scorecards to a clean one (albeit probably not the highest scoring one like in my case), because the scorecard ranges overlap you can take a drop.

Scorecards do overlap trenemdously - certainly by 200 points or more. You can score 760 on a dirty scorecard with a tax lien or 590 on a clean scorecard (thin, young with maxed out new credit cards). That 760 can jump to 850 when the tax lien is removed (Inverse data point). Others have reported similar results with score jumping to 850 after a collection was removed. However, my recollection was the score (with collection was a bit higher - around 790).

Given long lates are on a different scorecard than collections, data posted including the OPs suggests very little score movement if one is removed while the other still is on file.

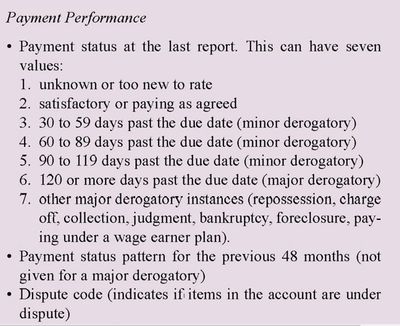

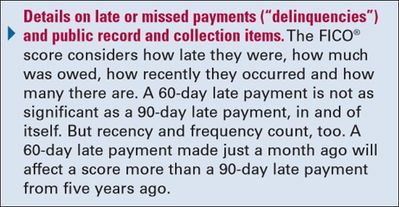

Revelate, Fico does say public records are a segmentation criteria on dirty scorecards. What you are saying is correct. Not sure where the differentiation is for minor vs major for PRs. For lates and Fico segmentation, I always thought 30 and 60 day lates are grouped together with 90, 120 and 150 day lates being the other group with age being a wild card. I pasted the below excerpt a couple years ago as food for thought.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buckets?

So my distutes to TU and EX resulted in the charged off credit card account being removed from both. My EX FICO 8 was 675 before either the orginal charged off credit card or the collections account were removed. When the collections account was removed I went to a 680 and when the charge off account which included multiple 120 day lates was removed I went to 698. Really couldn't the FICO gods have given me two more points.

Now I can see 700 in my sights, I am continuing my goodwill campagin on a paid off car loan with 3 120 day lates and 1 30 day late. If I have no goodwill success I will have a clean report in Aug 19, the 120 day lates will be gone by Sep 18. I can see that clean report out there in the fog.

Current Scores

Garden Goal is All Reports Clean – Achieved 11/26/20