- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Buffering and Deduplication of Credit Card Inq...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Buffering and Deduplication of Credit Card Inquiries Research Project

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

There is a tendency to extrapolate data and apply it wholesale across all scorecards. I would caution against such an application of results as extrapolation lacks robustness by definition. I remain of the opinion that binning of inquiries into QTY groupings is likely. I also suspect score buffers may not be exclusive to a 850 Classic Fico 08/09 score.

1) Existence on inquiry binning for CCs does not preclude the possibility of de-dupe nor does the reverse hold.

2) Data does show score buffers exist for Fico 08. This is most obvious to see for profiles having scores of 850 but, that does not mean score buffering can't exist at other scores. Really, something similar is seen for some dirty scorecard profiles which have hit a ceiling. This is further supported by those having a last major derog removed and Fico 08 score jumping to 850. Almost certainly some buffering was already in play.

I contend that the presence of "category buffers" exists within multiple scorecards. Quite a few posters, that I suspect are on the same scorecard, have reported different results in their response scores relative to "a common change" in an input factor. Thus, the hypothesis of category buffers.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@JLK93 wrote:

@Revelate wrote:

the grace period... namely I don't think it exists on either of the other bureaus

Why would you not believe it exits on Equifax? My data is so clear, and TT has reported that he believes he had a buffered Penfed HP.

Even if you can prove that HPs are not buffered on EQ for everyone, how would that contradict TT's or my data.

What would the odds be that my EQ data is incorrect? The odds of it being incorrect would have to be incredibly small. My scores were stable at 815 for months. I took 4 HPs. The score dropped to 812 after the grace period. It then remained stable for several months afterward. What are the odds of that one score drop, over a period of many months, coinciding with the end of the grace period?

I also posted the example of the buffered Capital One HP on Equifax. How else can you realistically explain the results of that example? The grace period explains both the score increase and decrease. Nothing else offers a realistic explanation. Once again, it that example, the scores were stable for months before and months after the grace period data.

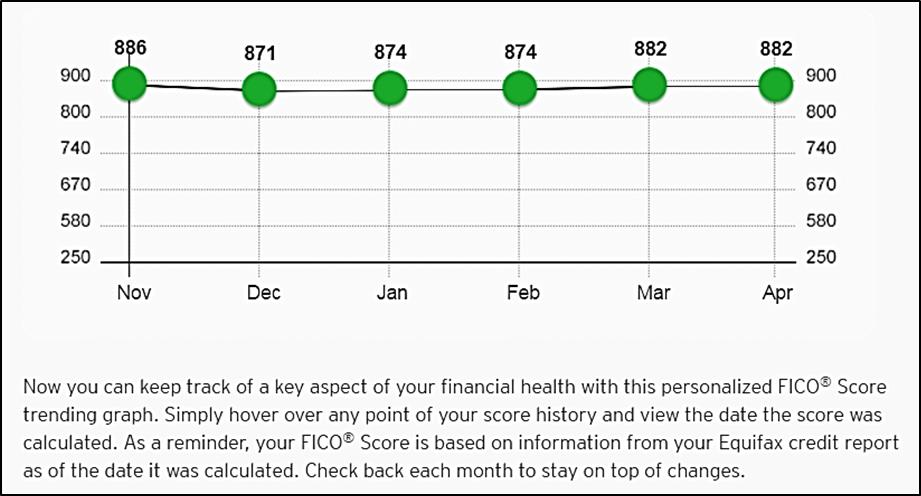

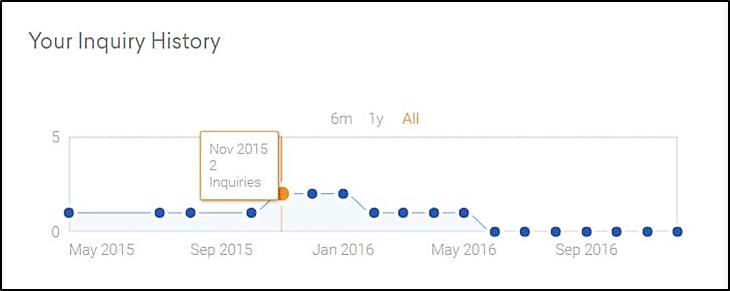

Yes, my PenFed EQ inquiry - which was not authorized and which originally did show as a HP on 11/20/15 - did not count against my EQ Fico 08 Bankcard score on my 12/3/15 3B report [886]. I had that same score [886] on a 7/25/15 3B report. I do believe the 30 day buffer was in play with this inquiry.

I saw an immediate score impact of the 11/20 PF inquiry on my EQ VS3 score per CK. On a 2/14/2016 MyFICO 3B report I noted a substantial drop on my EQ Fico 08 Bankcard [874] ... however, I also had all cards reporting balances in February. EQ changed the HP to a SP late February. My EQ Fico 08 Bankcard score rebounded in March. On a 3/25/2016 report [882] which was post "removal" of the HP ... Note: I am comparing Bankcard scores because I have a Classic Fico 08 buffer and those scores are "fixed".

Note: My monthly EQ Fico 08 Bankcard scores, as reported through my AT&T Universal card account, update between the 22st and 27th of the month - so the Nov 2015 update in the graph below is after the 11/20 PenFed HP posted and the Dec 2015 update is past what would be a 30 day buffer.

Interestingly, a few other posters have mentioned not seeing an impact on score associated with HPs from credit unions. I wonder if they may have experienced a delayed impact following a buffer period?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

FYI - interesting comment on credit card buffering - for what it's worth

http://ncfhaexpert.com/credit/inquiries-and-credit-scores/

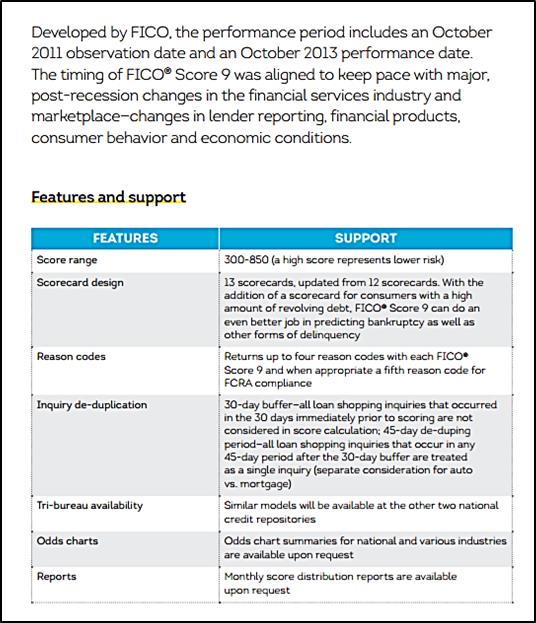

Here is something from TU on Fico 09. This only speaks to "loan shopping" but, does not specifically exclude CC inquiries as being buffered.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@JLK93 wrote:It is a little known fact that most credit card inquiries, taken in a short period of time, will be counted as 1 for FICO scoring purposes.

Most credit card inquiries are scored the same as mortgage inquiries by FICO. The inquiries are not be scored by FICO for 31 days. Then, any inquiries taken within a short period of time will be scored as one by FICO. Therefore, it is possible to take a large number of inquiries and only lose as few as 3 points. Theoretically, this will apply to any inquiries taken within 45 days for FICO 8. However, my research has only focused on inquiries taken within a period of 1 week.

Inquiries from BofA, Barclays, Synchrony, Capital One, virtually all Credit Unions, probably Amex and others will be combined for scoring purposes.

This means that by strategically planning your app sprees, it is possible to lose only a few points. For example, an app spree consisting of BofA, Barclays, Synchrony and several Transunion pulling Credit Unions could only cost you 3 points.

There is no need for the shopping card trick. You can get better cards with little point loss.

The delayed scoring of inquiries is referred to as buffering by FICO.

The scoring of multiple inquiries as one is referred to as deduplication by FICO. The commonly used term is deduped.

Chase, Citi and FNBO pull Bankcard Enhanced inquiries. It is unlikely that those inquiries will be combined.

I recently took 4 CLI hard pulls and on credit card app hard pull. There was no change in my scores for 31 days. At that time the hard pulls were scored as 1. The table below shows the results:

11/2/2016 11/16/2065 11/17/2016 11/18/2016 11/18/2016 11/19/2016 12/16/2016 12/17/2016 Before Spree Barclays CLI Barclays CLI BofA CLI Barclays CLI Synchrony App After Spree Deduped HPs Hard Pulls 2 3 4 5 6 7 7 7 TU 04 802 * * * * * 802 792 TU FICO 8 850 * * * * * 850 085 Bankcard 8 895 * * * * * 895 890

The following shows the deduplication (combined scoring) of 4 Credit Union inquiries:

2/17/2016 2/18/2016 2/19/2016 2/26/2016 3/21/2015 Penfed AAFCU CLI JFCU JFCU CC App Deduped HPs EQ FICO 8 815 815 815 815 812

The next table shows the combined scoring (deduplication) of 2 Hard Pulls from 2014:

11/25/2014 12/1/2014 12/1/2014 12/28/2014 1/6/2014 Before BofA CLI Barclays App After Deduped HPs TU FICO 8 809 809 809 809 806

The next table shows the delayed scoring (buffering) of a Capital One Application:

6/11/2015 6/24/2015 7/8/2015 7/15/2015 CapOne App Loan <10% Buffered HP EQ FICO 8 813 813 850 846

The next table shows the buffering (delayed scoring) of a Penfed CLI:

10/29/2015 11/27/2015 12/2/2015 Penfed CLI Buffered HP EQ FICO 8 846 846 839

The last table shows the delayed scoring (buffering) of a BofA CLI:

10/23/2015 11/22/2015 11/25/2015 BofA CLI Buffered HP TU FICO 8 849 849 846

Feel free to add your comments, data or research.

First off, unfiltered kudos to OP for presenting the data. It's interesting stuff to be sure.

Maybe I'm a little late to the party, but I guess I'm not seeing the combining of HP here. First off, the qualifications about which lenders will combine, yeah, that's not Most, since it excludes two of the very largest issuers, Chase and Citi. No mention of US Bank which is notorious for manual review.

I guess the first main concern I have about your data is that nearly all these HP are related to CLI only. No new account will result. A HP for a new account is not just a HP, it's the new account reporting 30 - 45 days later that would require follow on comparisons. When HP are grouped for Mortgage or Auto loans, one typically only gets one new Mortgage or Auto loan, not a fleet of 10 new accounts, as a CC spree can create.

In the case of the CLI request, I suppose it's possible that the CC HP are combined for that purpose. A comparative situation may be that running a failed spree, where the applicant made 10 CC apps, but only got 1 card and 9 denials, that might be a limited score effect, but wow, the impact on one's self confidence, not so good ![]()

The Capital One score, is that from the Reasons letter? If so, that's not a standardized FICO score, right?

The other influence is that, with starting scores in the high 800's on FICO 8, that indicates your file is rather strong, low utilization, probably a large number of accounts already, with a long-dated AAoA, so a few INQ, and even a new account now and then, is unlikely to have a huge impact on score. Once one builds up a list of INQ, as with all things FICO, that long list of the same thing tends to have limited impact, as more of the same thing (either lates, HP, whatever) is added, the impact becomes less with each additional thing.

In my own experience over the last two years, as my number of INQ grew, there was impact in early 2015 with each INQ being about 7 points on EX (the gathering place it seems) but the INQ after mid 2015, and there were 5 more on EX, had zero impact on my score on EX. The New Accounts reporting, those also had no effect on EX after mid-2015, but they were having negative impact (as new accounts without any HP) on EQ. With my last INQ in March 2016, also on EX, my score actually went up 7 points, most likely because the year-earlier list was shedding INQ at a rapid pace. EQ reported the new account with a -1 point drop.

Even setting up a testing scenario seems difficult here. In any sort of a busy file, there are lots of possibilities in the last year which might influence the outcome. Since the accumulation of HP over a time period starts to have limited effect, I would propose the learning here is that if you want limited impact from HP, then just keep making HP. The more HP you do, the sooner you get to the point where FICO stops counting ![]()

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@Thomas_Thumb wrote:Interestingly, a few other posters have mentioned not seeing an impact on score associated with HPs from credit unions. I wonder if they may have experienced a delayed impact following a buffer period?

I don't know that anyone's really done stringent inquiry testing for different types but that wouldn't be hard as it's just a second test once we have some inquiry data for those we're certain count, though my file will change non-trivially in the next year when my tax lien drops and changes my scorecard. Also there's a non-trivial problem with those of us that spree which is most of the data and does de-dupe or binning exist which is I guess up for debate at this point and what I was suggesting we try to sort out. On the plus side does appear that my and JLK's spree data both agree which is seriously helpful when talking different scorecards.

Not a great datapoint as we're mixing bureaus but I was -2 for Chase inquiry immediately at the 740 I've been sitting at for a few months to 738, and 0 change for the followup First Tech one on EX... I don't know how else to get a -2 on my EX FICO 8, that's the smaller than the usual suspects so I'm inclined to think it counted straight up, but are we talking grace period on the First Tech, or something else especially since at least one monitoring service said it was "Installment Loan" (boggle). Inquiry testing is hard if we don't have a known point to work from I'd suggest.

You stated it well regarding binning / dedupe not precluding each other certainly way more effectively than I did: my stupid inquiry every 32 days test was on the assumption that dedupe for CC's if it exists, is on the same 30 day period as everything else; therefore, if we can sort binning by a strategic pattern over call it 6 months and 12 days, then we can take the spree data and start counting inquiries. I don't mind trying to do this one on TU as I'm pretty confident I'm not house shopping within 2 years and nobody I care about worries what my TU report looks like outside of a mortgage app (and even then I'll be fully clean on EQ/EX so trimerge TU whatever). Do you see a problem with this idea / do you or anyone else have a better suggestion?

This was just the most ruthlessly efficient method I could come up with for trying to isolate it. Might not take six months, I'm at one inquiry now and we know somewhere in there I take a drop but I can't get the 0->1 inquiry which would be handy as my mortgage refinance from 5/16 leaves me stuck on that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

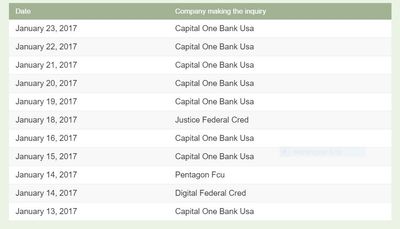

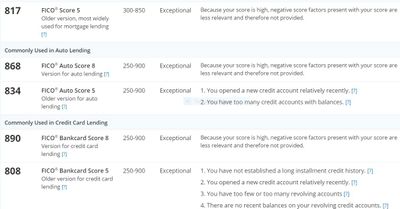

I generated 11 inquiries on Equifax between January 13 and January 23. Three were for CLI requests and 8 were for new credit apps. I had 0 inquiries on Equifax prior to the test. There was no score drop on any Equifax scoring model. My EQ 04 score is holding fast at 817. This is 1 point below the maximum possible score. My EQ 08 is holding at 850.

I expect to see a small score drop on approximately February 14 due to the deduped inquiries.

There will be a significantly larger score drop, prior to that, when my new Navy Federal Visa reports. This score drop will be due to crossing the 1 year youngest account threshold on FICO 8 and the 6 month youngest account threshold on FICO 4.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@JLK93 wrote:I generated 11 inquiries on Equifax between January 13 and January 23. Three were for CLI requests and 8 were for new credit apps. I had 0 inquiries on Equifax prior to the test. .....

Wow, you really took one for the team. I'm impressed ![]() Thank you.

Thank you.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@JLK93 wrote:I generated 11 inquiries on Equifax between January 13 and January 23. Three were for CLI requests and 8 were for new credit apps. I had 0 inquiries on Equifax prior to the test. There was no score drop on any Equifax scoring model. My EQ 04 score is holding fast at 817. This is 1 point below the maximum possible score. My EQ 08 is holding at 850.

I expect to see a small score drop on approximately February 14 due to the deduped inquiries.

There will be a significantly larger score drop, prior to that, when my new Navy Federal Visa reports. This score drop will be due to crossing the 1 year youngest account threshold on FICO 8 and the 6 month youngest account threshold on FICO 4.

It will be interesting to see what happens after the 30 day buffer period (14 days for Fico 98?). Hopefully you can/will report EQ and EX scores - particularly if EX received no inquiries.

Regarding EQ Fico 04 score - I assume the 817 was based off one card only reporting a balance. It would have been interesting to see how score responded to additional cards reporting balances. Unfortunately, the forthcoming expiration of a buffer may have an impact which eliminates the potential for comparison testing on # cards reporting..

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@Thomas_Thumb wrote:

@JLK93 wrote:I generated 11 inquiries on Equifax between January 13 and January 23. Three were for CLI requests and 8 were for new credit apps. I had 0 inquiries on Equifax prior to the test. There was no score drop on any Equifax scoring model. My EQ 04 score is holding fast at 817. This is 1 point below the maximum possible score. My EQ 08 is holding at 850.

I expect to see a small score drop on approximately February 14 due to the deduped inquiries.

There will be a significantly larger score drop, prior to that, when my new Navy Federal Visa reports. This score drop will be due to crossing the 1 year youngest account threshold on FICO 8 and the 6 month youngest account threshold on FICO 4.

It will be interesting to see what happens after the 30 day buffer period (14 days for Fico 98?). Hopefully you can/will report EQ and EX scores - particularly if EX received no inquiries.

Regarding EQ Fico 04 score - I assume the 817 was based off one card only reporting a balance. It would have been interesting to see how score responded to additional cards reporting balances. Unfortunately, the forthcoming expiration of a buffer may have an impact which eliminates the potential for comparison testing on # cards reporting..

I don't have access to EQ98 lol. I think it is a 14 day dedupe, not a 14 day buffer under FICO 98. I could be mistaken.

EQ FICO 04 has been extremely stable since I passed the 6 month youngest account threshold. The 817 holds with 3 cards reporting a balance. There have probably been more than 3 cards reporting a balance since I passed that threshold 10 months ago, but I haven't kept track.

It has always been this way. When I am under the 6 month youngest account threshold, EQ04 is very unstable. Each card reporting a balance causes a further decreased in score. I have lost 40 points or so due to a few cards reporting balances and a slightly elevated utilization.

Once I pass the 6 month youngest account threshold EQ 04 becomes very stable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Buffering and Deduplication of Credit Card Inquiries Research Project

@JLK93 wrote:I generated 11 inquiries on Equifax between January 13 and January 23. Three were for CLI requests and 8 were for new credit apps. I had 0 inquiries on Equifax prior to the test.

There was no score drop on any Equifax scoring model.

The 30 day buffer period for the inquiries passed on February 13th.

On February 13th, 31 days after the first of the 11 inquiries, my EQ FICO 8 industry enhanced scores dropped 3 points. My EQ FICO 8 score remained at 850.

I lost a total of 3 points for 11 inquiries, including 8 Capital One HPs.

As of today, I have an EQ FICO 8 score of 850 with 11 inquiries in the last 2 months.

Conclusion: The inquiries were clearly deduped.