- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Closed account questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closed account questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closed account questions

My first question is how do you know if your reports will say if an account was closed by issuer or by you? Would 3rd party sites like Ck and creditscore.com provide this information or would you actually have to order your reports?

How would a mortgage lender view this closed account?

I'm not sure how lost/ stolen status is viewed as by mortgage lenders.

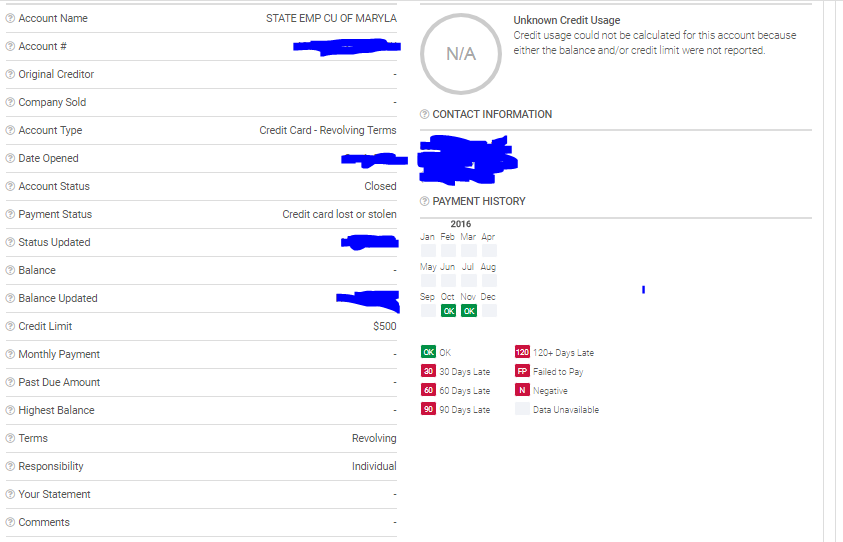

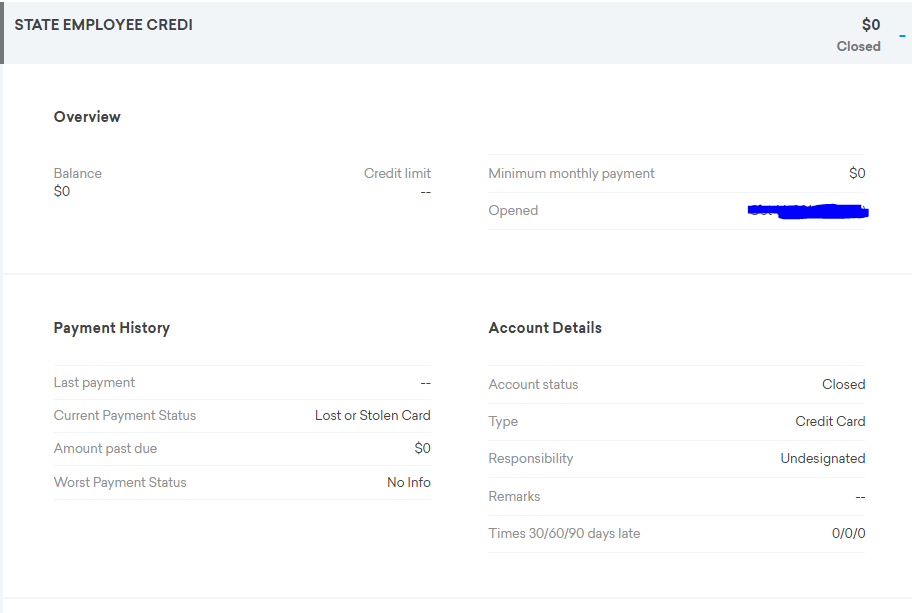

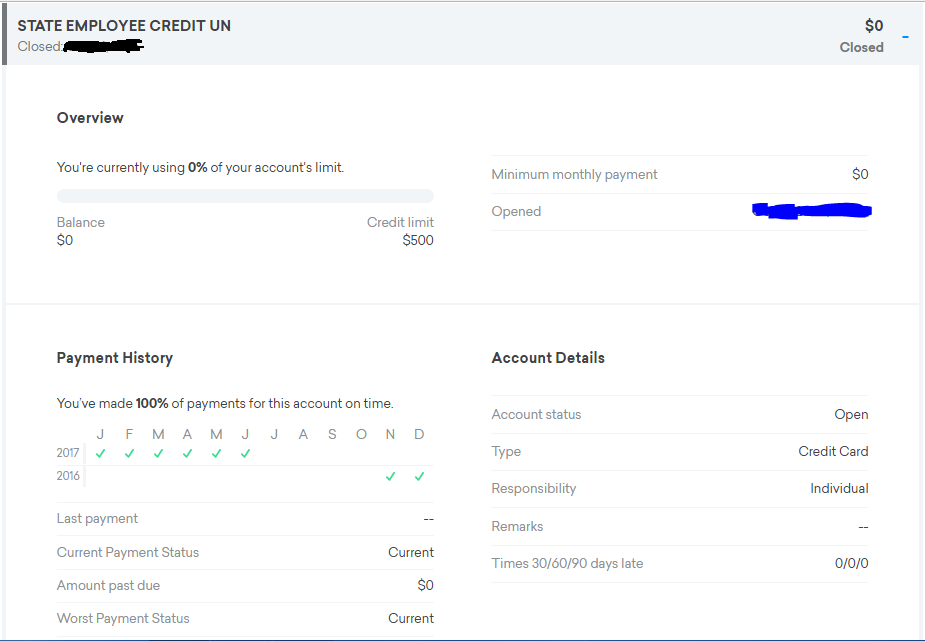

Here are my eq and tu reports from CK respectively

I'm not sure how 'undesginated' is viewed.

For some reason, tu says it's closed on the top part but account status said open.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed account questions

I personally don't think the reasons for closed accounts matter much. Certainly no where near as much as the information contained on the accounts that goes into making your score.

Card "lost or stolen" is an intentionally vague statement IMO, as one suggests the cardholder was at fault where the other suggests they weren't at fault. If it really mattered, I would think that statement would be broken into two sub-statements that indicated which of the two events really happened. IMO, it doesn't matter.

Some feel that during a manual review it's a better look to have accounts closed by the account holder rather than the credit grantor, but this is arguable. As long as it's a positive account, the wording on here isn't a big deal in my view. Accounts can be closed by a credit grantor for a million different reasons as well and they don't have to be negative ones. For example, a mortgage being sold to another lender. Or, perhaps a CCC suspects fraudulent activity and closes an account. At most the terminology could cause a potential lender to ask a question or two, but I don't see the wording ever being something that would matter all that much.