- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Comparing EX, EQ, and TU

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comparing EX, EQ, and TU

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Comparing EX, EQ, and TU

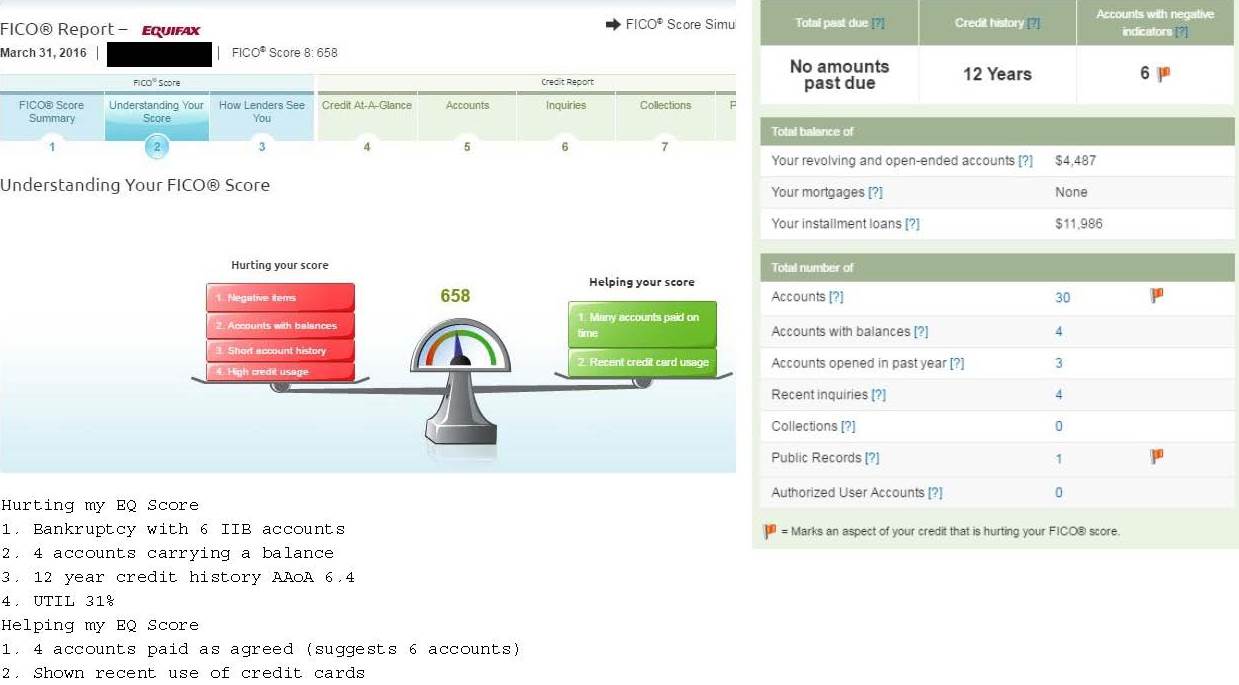

Hey fellow members. I see lots of posts that wonder why one bureau is lower than another. My TU is lower by ~20 points when compared to EQ and EX. We are always told to look closely at the reports and compare the differences. Which I've done, plenty of times. Even if the reports are almost identical (with the exception of 1 extra account on my EX) the bureaus/FICO still weigh things differently.

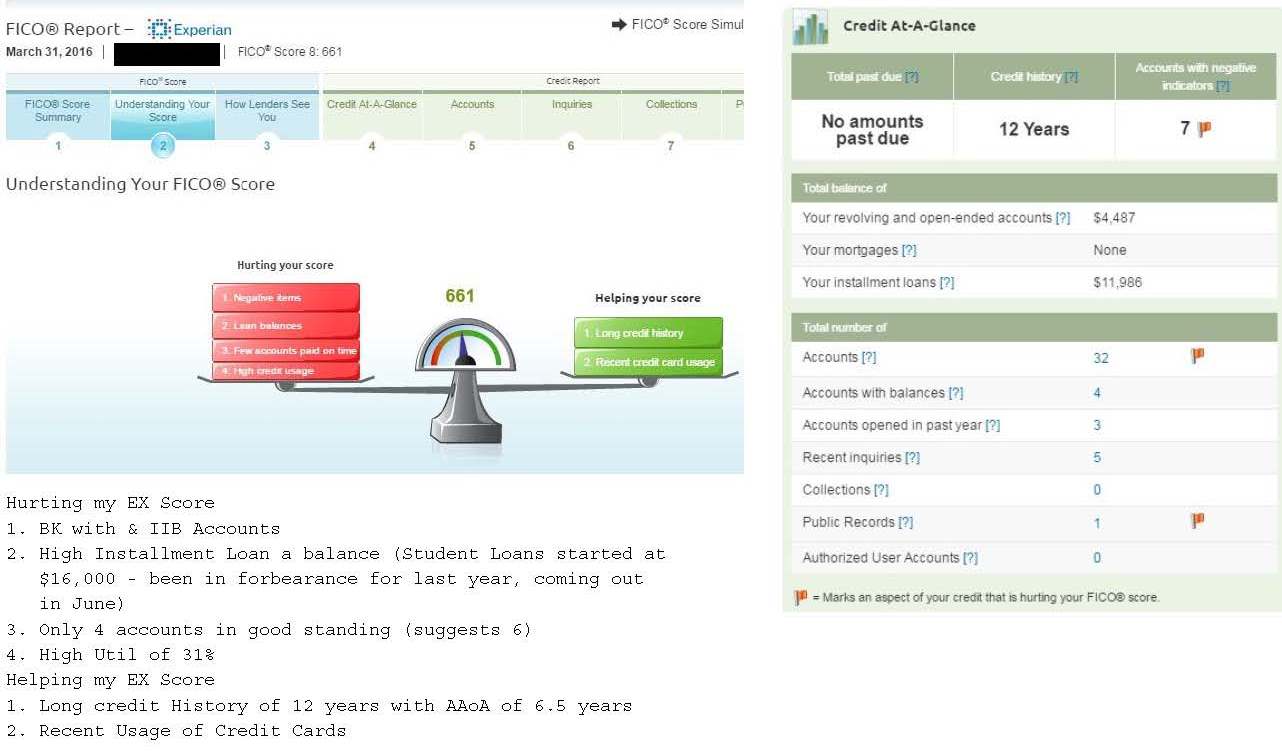

For example, my EX, which is curretly my highest score, has one extra IIB account that is not reporting on TU or EQ. My UTIL is the same across all 3 (31%). My history is 12 years across all 3. AAoA ranges from 6.4 to 6.7 so still in the 6 year range for AA0A.

Post BK I have 4 credit card accounts reporting in good standing (2 Cap 1 cards, 1 Discover IT card, and a Milstar card). I also have a student loan (in good standing). So in total, I have 5 open, good standing accounts post BK. The "hurting my score" factors for TU and EX all say I only have 4 accounts in good standing (shoud be 5 so I am a little confused by this one) and suggests I should have 6 accounts. ON my EQ, the 4 open and good standing accounts help my score, but still suggests 6 accounts.

My 12 year history and 6.4 AAoA is hurting my score on EQ. But the 12 history and 6.5 AAoA and 6.7 AAoa on TU and EX help my score.

My 31% UTIL hurts my score on EQ and EX but helps my score on TU.

EX and EQ like my recent use of credit cards where TU is silent on the issue of recent use. TU doesn't like me carrying balances on 4 of my accounts. EQ is dinging me for this too. EX says nothing.

EX doens't like the balance on my only installment loan.

The point of this is to just show, each bureau looks at your profile differently so don't panic if the scores between them differ, even when the information is almost identical. What's good for one, may not be good for the other. What's important is that the information is accurate. Just keep UTIL low, don't open uncessesary accounts, pay on time, and pay down installments and eventually scores will reflect that work.

My UTIL will drop to less than 10% when everything updates so it will be interesting to see where that takes my scores. My student loan comes out of forbearance in two months so that will start getting paid down again. I'm a little worried as my oldest tradeline of 12 years falls off in Aug, next oldest tradeline will still be 12 years but this will mess with my AAoA. It'll drop close to low 6 high 5 years if my Excel spreadsheet is accurate. Two steps forward and 3 steps back, right?

Keep up all the hard work myFicoer's.

CH 7 Filed 7/27/15 Discharged 11/16/15

Starting Score: EQ 620 TU 568 EX 593

Current Score (07/13/16): EQ 674 TU 649 EX 674 (FICO's 08)

Cap1 QS ($5350) (Combined QS and QS1) Discover It ($4100) MilStar ($8,600) Fingerhut ($800)

Off to the garden 05/01/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comparing EX, EQ, and TU

The point of this is to just show, each bureau looks at your profile differently so don't panic if the scores between them differ, even when the information is almost identical.

You are absolutely correct. At the time of this snapshot, my profiles weren't just "almost" identical, they were an exact match in every single metric.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comparing EX, EQ, and TU

I have done all of my auto purchases over the years through my local credit union. Have also had a few signature loans through them. When I first started with them, they only reported to TU. A few years later, they started reporting to EQ as well. They still don't report to EX. My account mix as well as my AAoA suffers on EX as a result.

Next auto loan I get, I will use someone who reports to all three just to boost my EX somewhat. Just as its good to know what bureau someone pulls, it's also good to know what bureau(s) they report to.