- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Credit Card Utilization

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Card Utilization

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

@Revelate wrote:Think I may have missed something but Amex is among the lenders who explicitly do not report payments to the bureaus.

That said I agree lenders are sophisticated enough they can typically tell there's activity on one's report; the fact that there are semi-consistent balances with pretty OK's is a pretty good indication that more than the minimum is being paid even with the bare minimum of reported information... whereas BOFA and others do report the payments in a given month which gives an incredibly good expenditure profile as you suggest.

It would be nice if all lenders reported payments, and then FICO took that into account for tradeline activity, but meh. Oh well

.

Do you have a carried balance, interest paying AMEX portion of your credit report you can share?

And the perception I am trying to protest is anyone thinking that [Showing a balance on your CC statement] = [Irresponsible credit card holder who is a risk]. That's just not the case.

The opposite argument reads: [Pay before statement] = [Responsible usage]

I don't think ANYTHING shows on the report in this pay before statement case, except for the OK, merely indicating the account is not in default, not that there was any usage at all. I'm open to seeing anyone willing to post images like this from their Pay Before Statement CR to argue against me, but I have not seen anyone post such evidence yet.

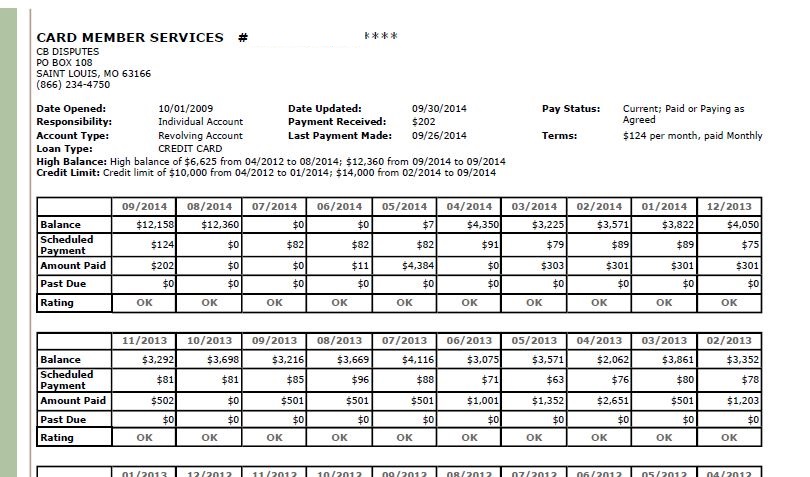

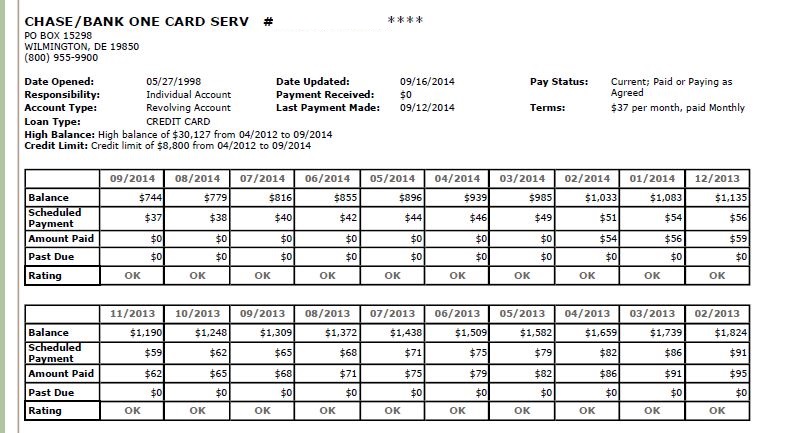

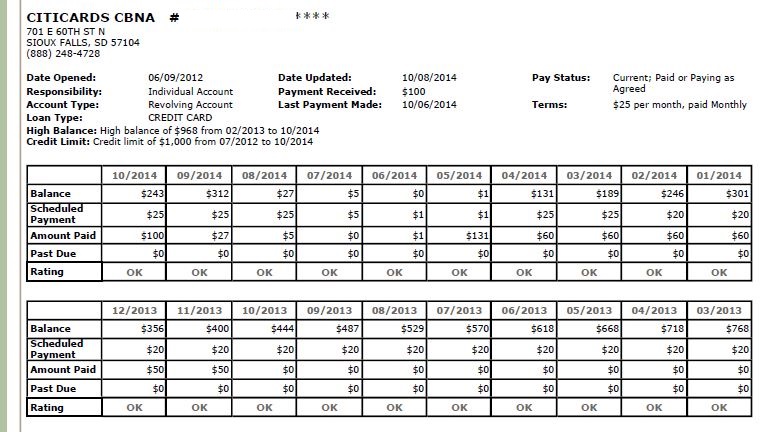

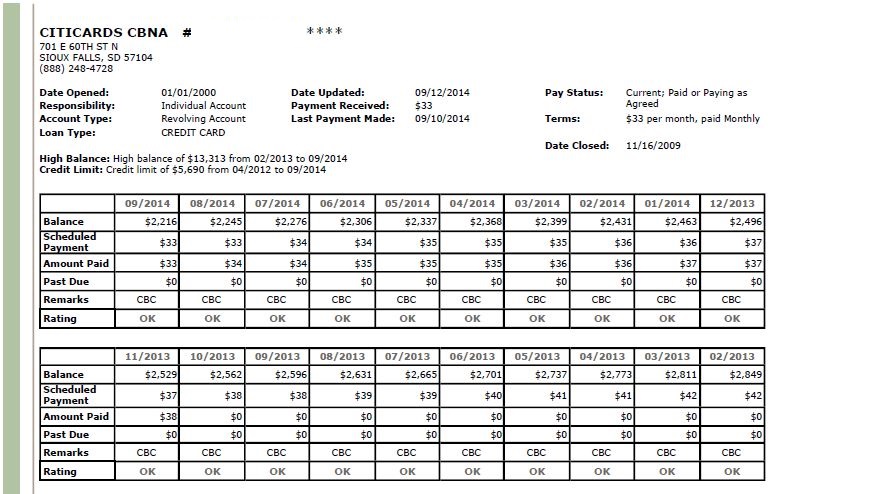

Here are several other of my cards. The payments don't always show every month, but the tendency is to reflect the balance, minimum, and what the payment was the following month. Note also on the second Citi card, this has an additional CBC Closed By Customer note in each month as I pay down the remaining balance.

US Bank Carrying a Balance:

Chase Carry a Balance:

Citi Carry a Balance on a non-closed card:

Citibank Paying Down a Closed card:

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

NRB525, so if I'm understanding you correctly, it is not advisable to pay my card down every month to the point where there's a $0 balance on the statement (this was my current understanding, hence my statement reaching > 30% of my total credit).

Would you recommend I get myself to at least below 30% for the statement date in order to maximize credit rating, e.g. somewhere between $100 - $1,500 on my statement, or just let it run up to whatever point it reaches, and then just making sure I'm paying off before due dates?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

@Anonymous wrote:NRB525, so if I'm understanding you correctly, it is not advisable to pay my card down every month to the point where there's a $0 balance on the statement (this was my current understanding, hence my statement reaching > 30% of my total credit).

Would you recommend I get myself to at least below 30% for the statement date in order to maximize credit rating, e.g. somewhere between $100 - $1,500 on my statement, or just let it run up to whatever point it reaches, and then just making sure I'm paying off before due dates?

I am waiting for someone who does the "pay before statement cut" to show us how such a credit report looks, but yes, I think it is advisable to let a statement balance report.

In general, yes, the card balance should be below 30% to help the score. Having said that, I frequently will take advantage of 0% APR balance transfers and load up a substantial CL cards with 60% - 97% balance to take advantage of the low or no interest cost for a year or more. Discover, BofA x2, US Bank, have each seen large BT like this in the last year. In those cases, and due to my overall large balances that are still around $30k today, I take a hit on my FICO scores because my utilization is high. However, it's not that many points, and I'd prefer to save the cash expense by lowering interest cost. My FICO will recover just fine over time as my balances come down, because I've got no lates in my past, and so it's only utilization keeping my scores down now.

I also ran my AMEX Delta card up to within about $50 of the then $2,000 limit in 2014, then PIF, pushing the credit line to get a CLI, and got an auto $1k increase to $3k right after that. Each individual card company would like you to use their card and pay it off. What they don't like is running up their card then not paying them, or giving indications the card might not be paid. The point being, high utilization has a place and purpose, and often with lower limit cards, is highly advisable.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

@NRB525 wrote:

@Revelate wrote:Think I may have missed something but Amex is among the lenders who explicitly do not report payments to the bureaus.

That said I agree lenders are sophisticated enough they can typically tell there's activity on one's report; the fact that there are semi-consistent balances with pretty OK's is a pretty good indication that more than the minimum is being paid even with the bare minimum of reported information... whereas BOFA and others do report the payments in a given month which gives an incredibly good expenditure profile as you suggest.

It would be nice if all lenders reported payments, and then FICO took that into account for tradeline activity, but meh. Oh well

.

Do you have a carried balance, interest paying AMEX portion of your credit report you can share?

And the perception I am trying to protest is anyone thinking that [Showing a balance on your CC statement] = [Irresponsible credit card holder who is a risk]. That's just not the case.

The opposite argument reads: [Pay before statement] = [Responsible usage]

I don't think ANYTHING shows on the report in this pay before statement case, except for the OK, merely indicating the account is not in default, not that there was any usage at all. I'm open to seeing anyone willing to post images like this from their Pay Before Statement CR to argue against me, but I have not seen anyone post such evidence yet.

Here are several other of my cards. The payments don't always show every month, but the tendency is to reflect the balance, minimum, and what the payment was the following month. Note also on the second Citi card, this has an additional CBC Closed By Customer note in each month as I pay down the remaining balance.

Nobody who has an Amex who's looked at their credit reports in the past few years has ever had anything but $0 in the payment reported section. Not one single person... I don't balance carry (did once for one darned month, got burned on BOFA graduation and never have since).

Amex is simply known not to report that data at all; not every lender does, it's a fairly recent iteration in the credit reporting space (within the last 4 years, EX was first, EQ/TU joined sometime later). Whether you carry a balance or not (I don't) certain lenders will report it every single month... I'm actually the poster-child for that with only the one carried balance early in my journey, but the full payment data is there for some lenders and it's zilch for others. I'd bet a non-trivial amount that my lenders that don't, don't for anyone. Certainly those people who have stated they don't on their reports match my own experience 1:1.

That said, I agree from a UW perspective it's a pattern of balances that matters, not individual point in time. I've never had anyone say boo when I suddenly let a 9 or 11K balance report, but I paid them off the next month. That said FICO in their data analysis apparently has found that the more non-zero balances a consumer has the greater their risk of default. It's somewhat silly as it doesn't seem to really count the amount of the balances in that individual calculation, but it's what we have.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

Ok, it sounds like virtually all your accounts have regular activity and report zero balances virtually every month? Disregarding AMEX.

What I'm trying to locate is an image from a CR (Appreciate the opinion, value the fact) of a CC that is being managed with charges during the month, is paid before statement cut, and thus despite being used for more than $1 during a month, that card is not allowed to report a balance on the statement because it is always paid before statement cut. I know dozens of active MyFICOers have such accounts on recent (or even a year old) CR, because they continue to recommend it as a modus operandi.

I am not optimistic I will get a response, so I have decided my new SDFCU $500 Secured CC will be my Paid Before Statement Cut project card. It has just reported a $3 balance, which I will boast that I have already PIF that princely sum. I had to budget, but managed to pay it off. From now until October, however, that card gets paid within a week of any charges posting. No more statement balances allowed.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

To make a simple suggestion: make a post in the CC forums asking which Credit card lenders report payments to the bureaus - gentleman's bet with you, that you'll see an 100% congruence with responders (except maybe some trollish responses of which the incidence rate should be slow) as to what lenders report payments and which ones don't. It has nothing to do in anyone's experience that I'm aware of as to whether you are carrying a balance or not.

If you look at your EX report it's a little more obvious: EX lists it as No Data instead of $0, the standard for "We didn't receive information for this"

There's not enough traffic on this particular board to really have the poll, and it's close enough to CC related that it should pass the sniff test, or at least it would've when I was a moderator.

Reponses would be similar in format:

Alliant: Yes

Amex: No

Barclays: Yes

BOFA / FIA: Yes

Chase: did till 3/2014, no data since then

DCU: Yes

Synchrony: used to looks like pre-aquisition, nothing since 7/2014, prior to that on statement generation

USAA: Yes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

Alright, well I guess I'll work a few more of my cards into my experiment, Chase Freedom, CapOne along with SDFCU, each to be paid before statement cuts for a few months.

If reporting of payments is so inconsistent, and can be ended by a CCC, that makes me think the only consistent method of showing usage is letting the balance show, then PIF after the statement prints. Which was my original point.

Regarding EX, my 2009 and 2010 reports show only balance month by month, then recent (latest month) payment information and summary high balance items.

And just to be clear, my objective with this is not to say people should carry balances paying interest, or use their cards more than natural, but rather to communicate out their usage through the balance reporting on the CR. Why not get that history into the CR so it is available for all lenders to see? If a lender misinterprets this as the cardholder carrying a balance and paying interest (when the cardholder is actually PIF), and wants to issue a CC thinking the CCC will earn interest? If a CCC sees a cardholder with fairly substantial "balances" over a long period of months, with no problems with making payments, all months are OK, where's the harm? The CCC sees the possibility of swipe fees and/or interest, and wants to get their card in the cardholder's hot little hands to get in on that funds flow. It's not a requirement, cards get issued all the time to those with higher scores and long histories, but I will bet those histories include some reference to balances being shown, some indication of payment ability.

Cheers!

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

@NRB525 wrote:Alright, well I guess I'll work a few more of my cards into my experiment, Chase Freedom, CapOne along with SDFCU, each to be paid before statement cuts for a few months.

If reporting of payments is so inconsistent, and can be ended by a CCC, that makes me think the only consistent method of showing usage is letting the balance show, then PIF after the statement prints. Which was my original point.

Regarding EX, my 2009 and 2010 reports show only balance month by month, then recent (latest month) payment information and summary high balance items.

And just to be clear, my objective with this is not to say people should carry balances paying interest, or use their cards more than natural, but rather to communicate out their usage through the balance reporting on the CR. Why not get that history into the CR so it is available for all lenders to see? If a lender misinterprets this as the cardholder carrying a balance and paying interest (when the cardholder is actually PIF), and wants to issue a CC thinking the CCC will earn interest? If a CCC sees a cardholder with fairly substantial "balances" over a long period of months, with no problems with making payments, all months are OK, where's the harm? The CCC sees the possibility of swipe fees and/or interest, and wants to get their card in the cardholder's hot little hands to get in on that funds flow. It's not a requirement, cards get issued all the time to those with higher scores and long histories, but I will bet those histories include some reference to balances being shown, some indication of payment ability.

Cheers!

The collection of this data was only added in call it 4 years ago. That's not a long time in the credit space ![]() .

.

You're spot on regarding what EX shows, and I'm absolutely a proponent of setting that high balance to demonstrate you can use the limits responsibily; but to be perfectly honest, the lenders can and do make use of more data on the credit report than FICO does. FICO score is only one UW hurdle, and usually it's not the hardest for most people... to be sure, too low of a FICO can outright exclude you from certain product classes, but if you meet the minimum standard, then it's the strength of everything else which comes into play.

I personally let balances report but I just don't spend much compared to either my income or even my aggregate CL (which is lower than most established credit files on this forum, I was somewhat surprised by that but I can understand it I guess, I'm an outlier here apparently) and I have zero problem with lenders knowing this. Fact is the more the lenders know about me, the less questions there will be on an application... though admittedly I only try to report what will support my position, but just looking at a credit report and stated income (assuming this is correct) even I can read most of someone's financial hand and lenders are undoubtedly better and certainly more experienced at that than I am. You give me bank statements or tax returns, and I'm pretty certain I could process FR's for Amex if I were so inclined to chase that as a second career.

FICO isn't the end all and be all, and it's the lenders which drive the bureaus rather than FICO, and FICO lags behind as a result in their analysis. Certainly I'd like payments to be reported by every lender as I think it would bring more resolution and therefore better stability to the market, and I'd even like that to be used in the FICO algorithm (10 maybe)... eventually we'll get there, we're just not now. Amex is a notable outlier in this on this forum but there are others.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

I agree that the FICO score is cute and interesting and one wants to keep it healthy, but the response of lenders to the CR is what matters, it's the whole point of the FICO exercise; to get lending at some point near or far in the future. It's why I also want to put as much positive in my file as possible.

I would guess AMEX's take on reporting amounts of payment is from historical charge cards: "You pay it 100% every month, what's the issue?" no legacy of allowing carrying balances; takes a while to turn the supertanker to a new methodology.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Card Utilization

@NRB525 wrote:I agree that the FICO score is cute and interesting and one wants to keep it healthy, but the response of lenders to the CR is what matters, it's the whole point of the FICO exercise; to get lending at some point near or far in the future. It's why I also want to put as much positive in my file as possible.

I would guess AMEX's take on reporting amounts of payment is from historical charge cards: "You pay it 100% every month, what's the issue?" no legacy of allowing carrying balances; takes a while to turn the supertanker to a new methodology.

I don't know if it needs to be more complicated than they have their systems working and didn't see any reason to update... like an additional discount on their Experian pulls for their reporting that data. Reporting more data does (technically) cost more in terms of infrastructure processing: it's absolutely minor individual, but at Amex scale, that does add up to something measurable in compute power.

Though compute power is so absurdly cheap these days /shrug. One would think it's just an Experian / TU/EQ provided set of libaries anyway which is the major change.