- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Credit Mix: Exceptional

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit Mix: Exceptional

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

@Anonymous wrote:Google search and MFF search both returned either 1 result or 2 results, none of which help.

I found a bunch of results when I just searched, but this is the good one I remember from roughly 18 months ago.

As has been reported in that thread and I can confirm, you can reach 850 on all three bureaus with a "very good" credit mix

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

Ah, great find, will peruse it now, thanks!

I'm assuming that "very good" credit mix is enough for 850 but I'm still curious as to what people do to get "exceptional" on it, even if it ignores actual FICO scoring.

Seems to me that promoting these FAKO reason codes on a FICO scoring site or simulator would be antithetical to helping people grow FICO scores, though...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

@Anonymous wrote:I definitely know that mortgage loans are coded different but was unaware of auto loan differences.

I work (rarely!) for a very large well known bank as a consultant and have for many years when they had emergency need for my services and I know a few of the underwriters personally who have basically guaranteed me an auto loan any time I want one (up to 120% LTV at whatever their prime rate is). FICO scores be damned they said. Getting an unsecured credit card from their CC underwriter branch was impossible though, lol.

So if I can find a tax loophole in 'buying my own Uber type vehicle', I will go and get an auto loan, let it report for 3-4 months and then just PIF it down over a few months and close it out, just to see if it helps with that fako reason code, lol. I figure whatever the APR is (0.9%? 3.9%?) the interest on $30,000 can't be that much for 3 months. Maybe a few hundred bucks or so.

I've yet to see anyone provide a mortgage specific reason code. Nor show any concrete data that they're any different than other installment loans, when we see plenty of examples of mortgages playing identically to an SSL in terms of being paid off, or refinanced, or taken out on every modern algorithm (FICO 04 onward, FICO 98 incidently too).

There's only the one reason code I've seen personally or seen documented, and that's the generic installment utilization when it comes to the classic scores.

There's a "no recent activity on an auto loan" in some Auto Enhanced models which I have seen but no idea if that applies to classic scores, and FICO 9 splits credit cards from generic revolving accounts (CC's count as both so let one report FTW apparently) but outside of NextGen that's it AFAIK. Vantage does apparently split out mortgages FWIW.

Your SSL is going to be just fine for your purposes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

There are codes that explicitly mention mortgage in the statement. The exclusion is clearly stated and not ambigious.

I have seen no evidence that an SSL is treated the same as a mortgage relative to B/L ratio in Fico scoring.

1) You have not established a long installment credit history (true if long mortgage history is excluded)

2) The balance on your NON-MORTGAGE credit accounts is too high.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

@Thomas_Thumb wrote:There are codes that explicitly mention mortgage in the statement. The exclusion is clearly stated and not ambigious.

I have seen no evidence that an SSL is treated the same as a mortgage relative to B/L ratio in Fico scoring.

1) You have not established a long installment credit history (true if long mortgage history is excluded)

2) The balance on your NON-MORTGAGE credit accounts is too high.

It is entirely possible that FICO 04 Bankcard doesn't look at mortgages at all and that just looks potentially like a credit mix reason code. We're also talking classic scores in general, as stated some flavors of auto-enhanced break out auto loans, but nobody has ever reported that reason code on a classic score.

To be clear, a negative of a non-absolute statement is not proof under mathematical terms or anywhere else in life my friend ![]() .

.

Look through my original installment thread for the first documented example - see the points I gained for finding installment loan utilization in the first place, and then how many points I dropped for mortgages.

Occam's razor applies, regardless of installment loan type every single report on this forum has demonstrated identical behavior. I cannot understand the constant disbelief in the face of overwhelming anecdotal data by intelligent people; please just find anything disproving this and I will be more than happy to be demonstrated wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

Having a low B/L SSL (under 9%) and adding a mortgage at 100% which then brings aggregate up to 99.5% causes a significant point drop. That is too be expected. Same thing happens if one has a small B/L on an SSL and adds a car loan - nice score drop due to aggregate B/L spike.

In neither case does that bit of information demonstrate whether or not those loans are treated the same as SSL loans.Through SJ's data we have seen that a short duration card loan continues to be sub optimal from a points available perspective on Fico 8 until B/L drops to single digits. Would this still hold if the loan had a multiyear payment history, perhaps not. NRB525 may some some data on that as I recall him mentioning having an open SSL (or similar) above 9% with multiple uears payment history.

If one has an open (aged) mortgage with or without other loans, I see no evidence indicating an ultra low utilization is required to point out on B/L.

I would suspect Fico's score models have a variety of conditional IF/THEN type statements build in. Factors are often interactive (paired if you will) and a robust model whose stated goal is to accurately predict risk would incorporate conditioning. The KISS principle is good for "high level" discussions and developing strategies to improve credit worthiness. However, the model itself is a bit more sophisticated.

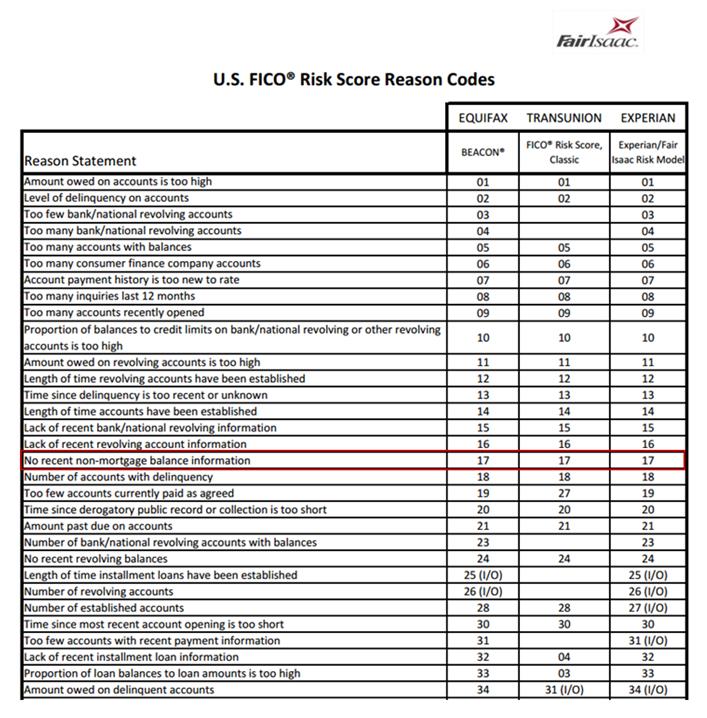

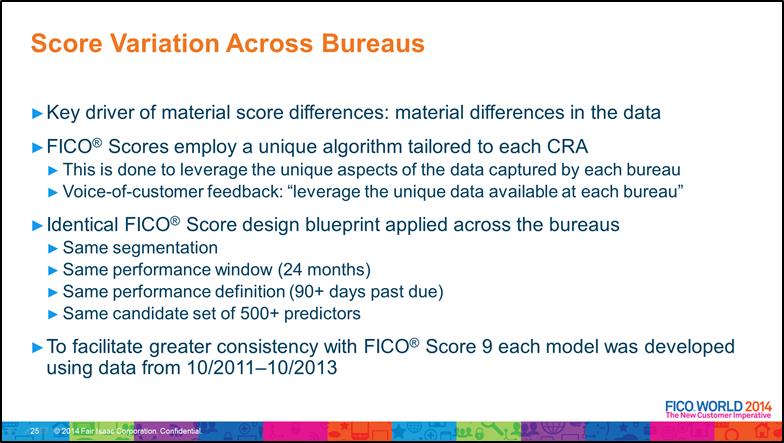

The reason codes/statements were published to use for reference when explaining why adverse action is being/has been taken. They are not a detailed road map which capture all facets of scoring. In fact, Fico has referenced a list of over 500 predictors that are considered in scoring in some presentations.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

@Thomas_Thumb wrote:Having a low B/L SSL (under 9%) and adding a mortgage at 100% which then brings aggregate up to 99.5% causes a significant point drop. That is too be expected. Same thing happens if one has a small B/L on an SSL and adds a car loan - nice score drop due to aggregate B/L spike.

In neither case does that bit of information demonstrate whether or not those loans are treated the same as SSL loans.Through SJ's data we have seen that a short duration card loan continues to be sub optimal from a points available perspective on Fico 8 until B/L drops to single digits. Would this still hold if the loan had a multiyear payment history, perhaps not. NRB525 may some some data on that as I recall him mentioning having an open SSL (or similar) above 9% with multiple uears payment history.

If one has an open (aged) mortgage with or without other loans, I see no evidence indicating an ultra low utilization is required to point out on B/L.

I would suspect Fico's score models have a variety of conditional IF/THEN type statements build in. Factors are often interactive (paired if you will) and a robust model whose stated goal is to accurately predict risk would incorporate conditioning. The KISS principle is good for "high level" discussions and developing strategies to improve credit worthiness. However, the model itself is a bit more sophisticated.

The reason codes/statements were published to use for reference when explaining why adverse action is being/has been taken. They are not a detailed road map which capture all facets of scoring. In fact, Fico has referenced a list of over 500 predictors that are considered in scoring in some presentations.

Pink has been shown over and over again, originally at least twice in the initial discovery. In my case my loan was a year and small change old at the time, doubt that counts as aged in terms of mortgages.

Blue: There's also been zero evidence that they aren't treated the same though, what are you basing this assertion on? Sure, the model is complex, but you can't simply presume that because it's complex, that it has to be treating something some way.

That's just not how scientific inquiry works, and ranks of belief. Seriously, we have tons of people on this forum, we

1) Should be able to find and confirm the upper installment loan breakpoint; it's been shown to exist, just needs rigorous testing... it's not hard, someone just has to stop fiddling with their files constantly; if I didn't have a mortgage lording over my report, I'd go do it again.

2) Find someone who is watching their scores who has a mortgage somewhere around that point, walk it across, same caveat as above. Or even across the lower breakpoint though we don't get many people on this forum that are near the 10% line on the mortgage, or at least not in UFS anyway.

I agree the reason codes are not a full road map, but we have to find something, and vanillabean's hitting 850 without having a hugely paid down mortgage is the only thing I've seen you reference that might be indicative, but we have haven't proven that an 850 is not achievable with any installment loan at ugly B/L ratio. It's just not proof... and when everything else suggests that mortgages are treated identically I simply can't understand it.

We can agree to disagree I guess, but stating that mortgages are absolutely different is sloppy at best, maybe we both need to communicate in more disclaimers; however, I'd really not like to repeat the sins of the past where things went on too much feel and not enough data on these forums. To be fair I've been guilty of that more than once, but when we can get data, we really should.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

It would make sense to me to score installment loan categories as slightly different mostly because of the reality that people will default on an unsecured personal loan before they get their car repossessed and people will let their car be picked up before they lose the roof over their heads. But would FICO add that complexity to scoring models? I guess it depends on what their QRAs and PQRAs are discovering in aggregate data -- and I would greatly believe that anything older than FICO08 probably wouldn't have done the processing needed to look for these assumed risk category differences, whereas I wouldn't be surprised if FICO09 actually did the grunt work since processing power today is orders of magnitudes better than it was way back when.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

It's not really a problem achieving 850 scores with aggregate B/L in the 60% to 70% range. I was above 60% B/L in 1/2014 and 850 on TU Fico 8 through Discover card. Inverse was there early last year with aggregate B/L above 65% - 2 open mortgages and 2 open car loans as I recall. As I recall, MY-OWN FICO reported 850 with a B/L above either 80% or 90% on a HEL or mortgage. Can't recall specifics.

People who only have an SSL and pay it down from above 10% to 20% to under 9% have reported a Fico 8 score bump over 20 points. Ain't going to happen with an aged mortgage either by itself or in aggregate with other installments. The available points for loan will already have been realized in part or in full.

BTW - As has been reported before, Ubuntu had an 850 Fico 8 with no open installment loans of any type. This is another example of how some conditioning of predictors comes into play.

I feel lumping scoring of mortgage B/L in with an SSL loan is misleading. It suggests someone's score will be harmed by the mortgage until near end of loan term when B/L drops below 9%. There is no such evidence.

Defaulting on trivial SSLs should correlate most strongly with B/L ratio whereas credit worthiness (& default) likelihood based on mortgages undoubtedly correlates strongly with payment history and to a degree a very high B/L which could translate to underwater mortgages if home prices are in decline. Thus, the abnormally high default rate in 2009 - 2011. Of course, the tell tale to default would be payment history much more so than B/L. Loan to value (L/V) would be a better predictor than B/L. However, CRA reports do not capture value (appraised or market).

Revelate, I must continue to disagree with your conclusions on mortgage treatment. I'll leave it at that. There is no value in pushing my view to the point that it creates undue animosity. ![]()

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit Mix: Exceptional

For example, someone with 70% utilization on their mortgage pays it off and replaces it with a SSL @ < 9% and sees little to no score increase, where someone else pays off their only installment loan that's sat an auto loan that was at 70% and replaces it with the same single digit utilization SSL but they see 10-15 points gained.