- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Credit score drop, then increase.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit score drop, then increase.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

@Anonymous wrote:Awhile back I posted about an unexplained 60+ point drop in my 800+TransUnion credit score. I have no mortgage, no unpaid bills, and had not used my credit card for over a year. ( As I explained, I don't need credit, so I don't bother with it, and certainly won't pay an annual fee for it.) The drop took place in 2015, and lasted for over a year.

Recently I decided to fly out west to visit an old friend, and about the only way to buy a plane ticket is with a credit card. Lo and behold, the use of my credit card bumped my credit score right back up to exactly where it had been before.

I speculated on and seem to have been correct that my credit score was not actually a relfection of my creditworthiness, but of my credit utilization. In other words, my FICO score isn't really a credit score, but a credit utilization score. It would be interesting to hear if others have had similar experiences.

My belief is credit scoring models evaluate credit worthiness based on credit use data. If you don't use credit, you are an unknown and therefore models can't put you in a top tier classification nor will they put you in a low tier. If your file is clean with no lates a "default" score in the 720 to 760 range would seem logical to me.

Active file => enough data for model to evaluate profile with a good degree of granularity and score accordingly.

Inactive file => Still scorable if open accounts are still reporting. However, no recent data so limited granularity which may "force" a score reduction.

As mentioned above, no recent activity on revolving accounts is a negative factor in Fico scoring (nominally a 20 point penalty for clean files with no buffer). OPs 60 point drop/increase went beyond what would be expected so, I speculate inactivity may have played a role. How, I don't know.

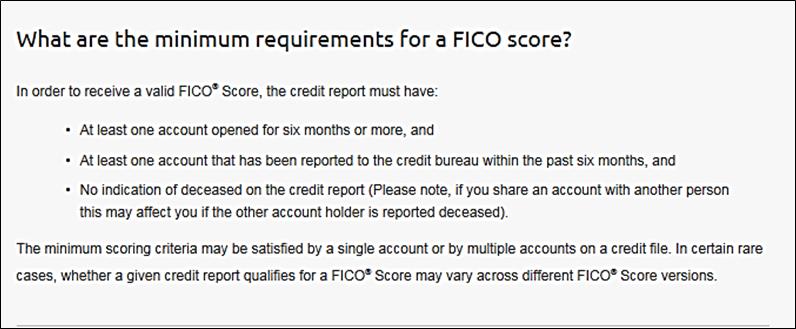

Side note: If a file has open accounts being reported as "pays as agreed", an extended period of inactivity [over 6 months] doesnot necessarily mean a file becomes unscorable. All that is required is that an account has been reported to the CRAs. The OP's data certainly supports this.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

Yup, that's what I was alluding to when I said that "I had a theory" as to what was going on, but wanted the OP to answer some more questions. Until he does we won't know how viable this theory of mine and TT is. Namely that when an open tradeline stops having activity on it for a long time it eventually gets flagged as inactive and stops "counting" in terms of traditional scoring factors.

In our OP's case he was in a rare place to test it because he had exactly one open revolving account for a very long time. Assuming our theory is right, this one account was flagged as inactive (curiously at exactly one year of inactivity) and then that caused his profile to look (from a scoring perspective) as if he had no open revolving accounts at all, which would be a big plunge in his FICO 8 score.

In our OP's previous thread, I think we discovered that he did not have a credit report from the month before and the month after the big drop, so we'll never be able to see the "status" of the account -- was it formally given a status of "inactive" by the CC issuer? (Reflected in the report.)

Or is it FICO's algorithm itself that decides that the account is "inactive" -- in which FICO is probably using the DOLA (Date of Last Activity) that comes with the report data (but consumers often don't see it).

Again all of this is very hard to test, because people who like "testing" FICO scoring algorithms tend to hang out on sites like this, and people who hang out on sites like this would never have exactly one credit card and if they did would never leave it dormant for a full 13 months in a row.

Our OP's case does have some practical value nonetheless. It suggests that perhaps FICO might ignore tradelines that have had no activity for a long time. And so as a practical matter, if you are preparing for a really important loan application (like a home loan) and you have a bunch of revolving accounts that have not been used for over a year, you might consider putting a little activity on them (and then paying it off) as part of preparing for the loan -- if you want to be sure that they'll be counting fully in the way you expect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

Hi Credit Guy, you are correct. I have just one credit card. I had problems with my Citi cards not wanting to acknowledge an incorrect charge, and then wanting to charge an annual fee (I'm not saying those two things were related), but I don't see any reason to pay for a card, so I've still got my Discover. Its the one that gives me my TransUnion Credit score. Still have no debts, homes are paid off, cars too, (I'll buy with cash again if need be), so in some ways for them to give me a credit score over 800 is generous, but also accurate.

I have no idea if that's a FICO 8 score or not.

You're also correct that I don't know if my Experian and Equifax scores also took a dive, I don't really care to pay for a score. And I've had problems with Equifax refusing to even give me a copy of my credit report, so I don't even bother with them any more. Thanks for the important questions.

One more thing for people to think about. I have an extended fraud alert on my credit reports, which I suspect has saved me a great deal of trouble over the years. But it also gives me control over which credit reporting agency any financial institution can use. After problems with TransUnion (they were a big pain in the b*tt over the ID theft issue), I no longer let any financial instituion look at my TransUnion report. Its one small thing I do to encourage the credit reporting agencies to act responsibly.

DeVeras

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

Captain, just a touch more background. I actually put a charge on my card at Christmas, and then paid it off immediately, before the statement was generated. I did not get a statement for that charge. I did the same with the plane ticket (paid it before the statement generated) but this time I got a statement and a score. What I did not get this time is a graph showing my score over time, which in the past showed a flatline at over 800, then a sudden drop to under 740, and flatline there until the statement date. I hope that helps.

DeVeras

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

Hello again Credit Guy, I appreciate your questions.

I bought the ticket in May of this year, just after my May statement date. Then I paid off the card before the June statement date, so the statement I received showed a zero balance due. I should mention that I also did the same thing at Christmas, but since I wasn't sent a statement, I don't know if it generated a change in my score then or now. In a sense it doesn't matter, since the actions were the same. I have not used the card since then, nor do I expect to receive a statement.

I'd love to hear your theory.

DeVeras

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

I've never had a problem with my cards due to a lack of activity. That may be something new that I'm glad to be aware of. I'll have to ask my cardholder.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score drop, then increase.

Nice theory guys, and I'm happy to test it. That's part of why I posted here. IMO, just because someone (in this case me) doesn't need to use their credit cards certainly doesn't indicate a credit risk, and as such that person (in this case me) also doesn't deserve such a radical drop in their credit score. Which leads me to suggest that FICO scoring models do not accurately reflect a person's creditworthiness, and may in fact be designed to reflect how much a person can be expected to use their card (i.e., how much can a credit card company expect to make from a person's credit card use). I suspect I'll be using my card several more times in the coming year, so I'm not sure I can test it again, but I appreciate the insights.

DeVeras