- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

@Revelate wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:

@Revelate wrote:Equifax sells two different sets of products:

The first based on the proprietary / pretty much educational score already mentioned.

The second based on FICO Beacon 5.0 (EQ 04 or FICO 5 as listed in the myFICO interface) which will match the listed mortgage score here for Equifax, and the Equifax score on 99.99% of the mortgages underwritten in the United States. Scorepower is the single pull product, Scorewatch is the monitoring product.

The monitoring scores here at myFICO are FICO 8 for all 3 bureaus these days; however, when you order a report (or you get a report refresh with one of the services) you get the whole suite of scores. FICO 8 is the dominant pull in the market today (by numbers); however, it's not used by everyone and absolutely not in the mortgage space.

So, if someone has a desire to monitor a Fico mortgage score it can be done using Equifax scorewatch.

Revelate, based on your reporting of EQ 04 I would guess you may subscribe to Scorewatch. I purchased the Scorepower report a few times back in 2014 and early 2015 before the 3B became available. I like the EQ report summaries.

Does the Equifax proprietary score offer any clues as to behavior of FICO 5 EQ?

(Reason I ask, it just took a 15-point leap, and the only change I noticed was that the number of cards reporting a balance went from 7/21 to 6/21).

Oh it's not proprietary score, it's just the older version of Scorewatch (FICO 5) that we had on the site a few years back. I would assume reason codes would be there just like they are on the 1B pulls when talking individual scores, on the monitoring side though we didn't get reason codes from Scorewatch (and don't now) only from the individual pulls so I somewhat doubt that.

That may be a nice datapoint, I know for me on FICO 8 I take a drop at 33% (and someone else's data seems to confirm it's between 30-33%, I'm betting 1/3 personally) but my FICO 5 doesn't shift until I'm much worse (pretty sure it's 1/2, I'll test that again before my tax lien comes off) but I'm on a dirty file; I think you're on a different scorecard than I am on EQ (well likely based on our understanding of them) and of course TT has always suggested EQ FICO 5 moves more for him but I suspect his FICO 8 datapoint there is skewed with his godlike score on that model.

@Anonymous sorry I missed this I never used the EQ one, but I have DCU for datapoints and I pull 1B reports maybe more than I should though this past year been focusing more on EX since my lenders care about that one, and EQ hates me anyway

I'm talking about the Equifax proprietary score which appears on Equifax.com

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

@SouthJamaica wrote:

I'm talking about the Equifax proprietary score which appears on Equifax.com

Oh well in that case why would you ever pay for a properitary score? Has no bearing on FICO and doesn't for your balance twiddling as a result.

If you want score analysis you go ScorePower or ScoreWatch for Equifax and avoid the properitary one for the plague, or the 1B report here since I think it's the same price even for non-subscribers. My apologies if I didn't understand.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

There are a few things I like about the Equifax ScorePower report:

1) A superb summary table of open accounts by type which includes:

* Total accounts by type, accounts with a balance by type, total balance by type, available credit by type, total credit limit by type, total debt to credit ratio by type and total monthly payment amount by type. [this is great as I hate doing manual counts/calculations for # open with balances/aggregate balance]

2) A listing of soft inquiries by entity and date.

3) The reports do include a summary of whats helping and whats hurting your score.I actually like the what's helping part. Standard reason codes on MyFico 3B reports only show negatives.

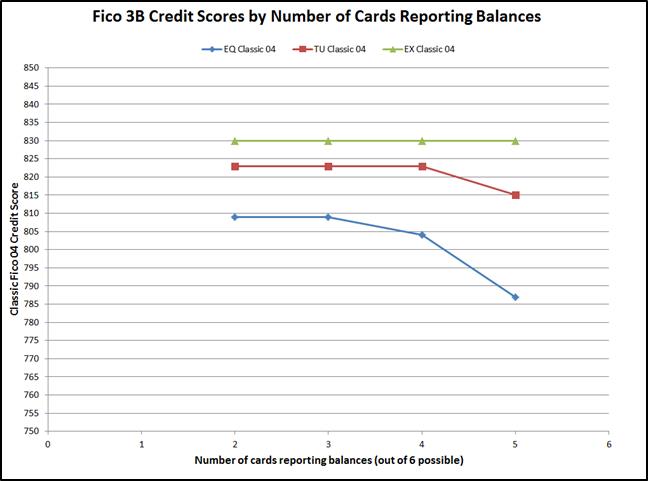

My EQ Fico 04 (score 5) does receive a progressively harsher smack down when I allow more than 3 of 6 to report balances. Here is what I show:

* As mentioned the 11/20/15 inquiry was from PenFed (didnot complete membership application authorizing pull). It was reclassified from HP to SP end of 2/2016. Lack of score drop 12/3/2015 due to 30 day buffer - IMO.

* In all cases my aggregate utilization was less than 7% - and lowest scores were NOT the highest utilization.

* I do not see a score change going from 2 of 6 to 3 of 6 cards reporting balances.

* I do suspect my score would be higher with one of 6 reporting (I'd guestimate 816).

| Report | Cards with | Number | Classic Fico 04 |

| month-year | Balances | Inquiries | EQ Score 5 |

| Jun-14 | 6 of 6 | 1 | 765 |

| Aug-14 | 4 of 6 | 1 | 777 |

| Mar-15 | 3 of 6 | 1 | 796 |

| Jul-15 | 2 of 6 | 0 | 809 |

| Dec-15 | 2 of 6 | 0 | 809 |

| Feb-16 | 6 of 6 | 1 | 764 |

| Mar-16 | 3 of 6 | 0 | 809 |

| Jul-16 | 5 of 6 | 0 | 787 |

| Aug-16 | 2 of 6 | 0 | 809 |

| Oct-16 | 4 of 6 | 0 | 804 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

@SouthJamaica wrote:

@Revelate wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:So, if someone has a desire to monitor a Fico mortgage score it can be done using Equifax scorewatch.

Revelate, based on your reporting of EQ 04 I would guess you may subscribe to Scorewatch. I purchased the ScorePower report a couple times back in 2014 before the 3B became available and once in late 2015 to compare against VS3 and Fico 3B. I do like the EQ report summaries.

Does the Equifax proprietary score offer any clues as to behavior of FICO 5 EQ?

(Reason I ask, it just took a 15-point leap, and the only change I noticed was that the number of cards reporting a balance went from 7/21 to 6/21).

I'm talking about the Equifax proprietary score which appears on Equifax.com

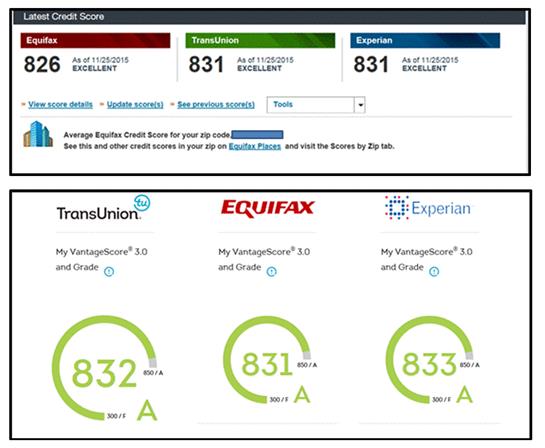

SJ - I did purchase a couple EQ proprietary score + reports along side a EQ ScorePower reports & a 3B report - a couple times in 2014 (only found one of these) and again in late 2015. The information on the reports (other than the scores) is basically the same format.

The EQ proprietary score appear somewhat like my EQ Fico 08 - Not at all like skitish EQ Fico 04 (score 5).

| Date | EQ Proprietary | EQ Fico 04 |

| score obtained | Score | Mortgage score |

| Aug-14 | 825 | 777 |

| * Dec-15 | 826 | 809 |

* Actually 11/25/15 for EQ Proprietary and 12/3/15 for EQ Fico 04 (score 5)

The proprietary EQ score is most similar to VS 3.0 (see below) - VS3 scores from 10/28/15

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

@Thomas_Thumb wrote:

@SouthJamaica wrote:

@Revelate wrote:

@SouthJamaica wrote:

@Thomas_Thumb wrote:So, if someone has a desire to monitor a Fico mortgage score it can be done using Equifax scorewatch.

Revelate, based on your reporting of EQ 04 I would guess you may subscribe to Scorewatch. I purchased the ScorePower report a couple times back in 2014 before the 3B became available and once in late 2015 to compare against VS3 and Fico 3B. I do like the EQ report summaries.

Does the Equifax proprietary score offer any clues as to behavior of FICO 5 EQ?

(Reason I ask, it just took a 15-point leap, and the only change I noticed was that the number of cards reporting a balance went from 7/21 to 6/21).

I'm talking about the Equifax proprietary score which appears on Equifax.com

SJ - I did purchase a couple EQ proprietary score + reports along side a EQ ScorePower reports & a 3B report - a couple times in 2014 (only found one of these) and again in late 2015. The information on the reports (other than the scores) is basically the same format.

The EQ proprietary score appear somewhat like my EQ Fico 08 - Not at all like skitish EQ Fico 04 (score 5).

Date EQ Proprietary EQ Fico 04 score obtained Score Mortgage score Aug-14 825 777 * Dec-15 826 809 * Actually 11/25/15 for EQ Proprietary and 12/3/15 for EQ Fico 04 (score 5)

The proprietary EQ score is most similar to VS 3.0 (see below) - VS3 scores from 10/28/15

I subscribe to Equifax Complete Premier Service which includes the Equifax proprietary score. I don't subscribe to it for the score, I subscribe to it for the reports. It gives me constant real time access to my Equifax report.

But I would like to know whether the score has any utility, especially since it made that sharp move this morning.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

@Revelate wrote:

@SouthJamaica wrote:I'm talking about the Equifax proprietary score which appears on Equifax.com

Oh well in that case why would you ever pay for a properitary score? Has no bearing on FICO and doesn't for your balance twiddling as a result.

If you want score analysis you go ScorePower or ScoreWatch for Equifax and avoid the properitary one for the plague, or the 1B report here since I think it's the same price even for non-subscribers. My apologies if I didn't understand.

Oddly, Equifax won't allow me to subscribe to those products because I already subscribe to their Complete Premier Service; they don't allow you to subscribe to more than 1 product.

I wouldn't give up the Complete Premier Service because it provides me constant access to real time-updated Equifax reports. Whenever I want to, I can find out what's in my Equifax report.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DIFFERENCES IN CREDIT SCORE (EQUIFAX) AND (MYFICO)

Revelate wrote:

SouthJamaica wrote:

Thomas_Thumb wrote:

Revelate wrote:

Equifax sells two different sets of products:

The first based on the proprietary / pretty much educational score already mentioned.

The second based on FICO Beacon 5.0 (EQ 04 or FICO 5 as listed in the myFICO interface) which will match the listed mortgage score here for Equifax, and the Equifax score on 99.99% of the mortgages underwritten in the United States. Scorepower is the single pull product, Scorewatch is the monitoring product.

The monitoring scores here at myFICO are FICO 8 for all 3 bureaus these days; however, when you order a report (or you get a report refresh with one of the services) you get the whole suite of scores. FICO 8 is the dominant pull in the market today (by numbers); however, it's not used by everyone and absolutely not in the mortgage space.

So, if someone has a desire to monitor a Fico mortgage score it can be done using Equifax scorewatch.

Revelate, based on your reporting of EQ 04 I would guess you may subscribe to Scorewatch. I purchased the Scorepower report a few times back in 2014 and early 2015 before the 3B became available. I like the EQ report summaries.

Does the Equifax proprietary score offer any clues as to behavior of FICO 5 EQ?

(Reason I ask, it just took a 15-point leap, and the only change I noticed was that the number of cards reporting a balance went from 7/21 to 6/21).

Oh it's not proprietary score, it's just the older version of Scorewatch (FICO 5) that we had on the site a few years back. I would assume reason codes would be there just like they are on the 1B pulls when talking individual scores, on the monitoring side though we didn't get reason codes from Scorewatch (and don't now) only from the individual pulls so I somewhat doubt that.

That may be a nice datapoint, I know for me on FICO 8 I take a drop at 33% (and someone else's data seems to confirm it's between 30-33%, I'm betting 1/3 personally) but my FICO 5 doesn't shift until I'm much worse (pretty sure it's 1/2, I'll test that again before my tax lien comes off) but I'm on a dirty file; I think you're on a different scorecard than I am on EQ (well likely based on our understanding of them) and of course TT has always suggested EQ FICO 5 moves more for him but I suspect his FICO 8 datapoint there is skewed with his godlike score on that model.

@TT sorry I missed this I never used the EQ one, but I have DCU for datapoints and I pull 1B reports maybe more than I should though this past year been focusing more on EX since my lenders care about that one, and EQ hates me anyway ![]()

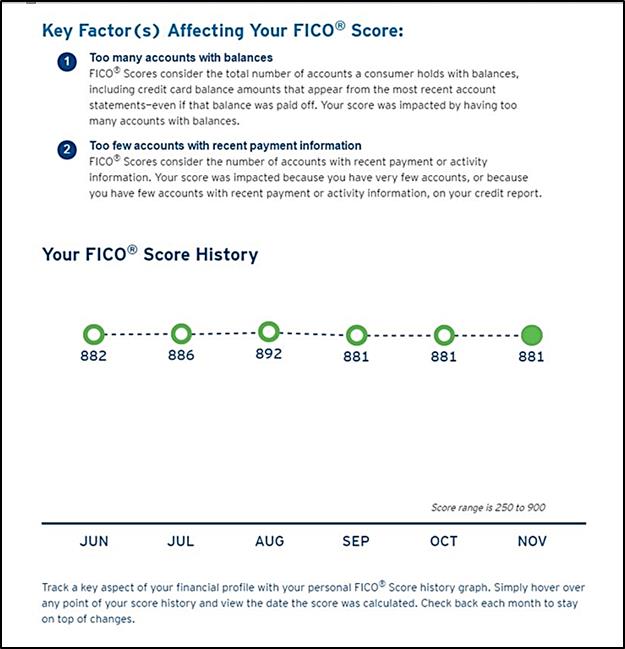

I suspect my file is somewhat unusual even for others on my scorecard because my file is a bit thin (6 open CC accounts including AU & 1 open mortgage), well aged with no new accounts in 5 years and no inquiries. My latest Fico update from EQ says it all with their reason statements. The negative impact of cards reporting is mild on EQ Fico 08 BC but, more pronounced with both the Classic and BC Enhanced Fico 04 models. [Catch 22 use accounts & PIF after balances report =>negative, limit monthly activity to a few accounts => negative]

The negative impact of cards reporting is mild on EQ Fico 08 BC but, much more pronounced with both the Classic and BC Enhanced Fico 04 models (see table below)

| Report | Cards with | Number | Classic Fico 04 | BC Fico 04 | BC Fico 08 |

| month-year | Balances | Inquiries | EQ Score 5 | EQ Score 5 BC | EQ Score 8 BC |

| Jun-14 | 6 of 6 | 1 | 765 | n/a | n/a |

| Aug-14 | 4 of 6 | 1 | 777 | n/a | n/a |

| Mar-15 | 3 of 6 | 1 | 796 | 816 | 877 |

| Jul-15 | 2 of 6 | 0 | 809 | 827 | 886 |

| Dec-15 | 2 of 6 | 0 | 809 | 827 | 886 |

| Feb-16 | 6 of 6 | 1 | 764 | 788 | 874 |

| Mar-16 | 3 of 6 | 0 | 809 | 827 | 882 |

| Jul-16 | 5 of 6 | 0 | 787 | 808 | 881 |

| Aug-16 | 2 of 6 | 0 | 809 | 827 | 876 |

| Oct-16 | 4 of 6 | 0 | 804 | 831 | 881 |

The below table illustrates how each of the three CRAs are treating # cards reported in their "customization" of the Classic Fico 04 algorithm. The data again shows how EQ is putting more weight on # (%) cards reporting than TU or EX.

EQ data having an inquiry was removed so that only results with zero inquieies are compared.

| Report | Cards with | Number | Classic Fico 04 | Number | Classic Fico 04 | Classic Fico 04 |

| month-year | Balances | Inquiries | EQ Score 5 | Inquiries | TU Score 4 | EX Score 3 |

| Jul-15 | 2 of 6 | 0 | 809 | 0 | 823 | 830 |

| Mar-16 | 3 of 6 | 0 | 809 | 0 | 823 | 830 |

| Jul-16 | 5 of 6 | 0 | 787 | 0 | 815 | 830 |

| Oct-16 | 4 of 6 | 0 | 804 | 0 | 823 | 830 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950