- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Debt by account type

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Debt by account type

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Debt by account type

So how much does debt ratio matter in FICO scoring and what is best way to manage this area. I'm aware Lexis Nexis scoring uses proportion of revolving to installment loans.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

That chart is talking about utilization. Revolving utilization (which is the ratio of revolving debt to credit limits) and installment utilization (which is the ratio of amount owed to the original amount of the loan). Both kinds ignore closed accounts.

In the second half of your sentence ("I'm aware Lexis Nexis....") you are asking about something very different. Namely whether there is some kind of ideal proportion between number of revolving accounts to number of installment accounts. To just make up an example, that could be three revolving to one installment.

Which of those two things are you asking about?

As far as the best percentages for utilization ("best way to manage this area") you have been around on these forums for a while now and may know the answer already. Let us know if you do not and we'll tell you.

As far as how much debt ratio matters, it is the main thing in Amounts Owed category. This is 30% of your score. The category also contains some other factors, like the number of open accounts reporting a positive balance.

http://www.myfico.com/credit-education/whats-in-your-credit-score/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

@Anonymous wrote:That chart is talking about utilization. Revolving utilization (which is the ratio of revolving debt to credit limits) and installment utilization (which is the ratio of amount owed to the original amount of the loan). Both kinds ignore closed accounts.

In the second half of your sentence ("I'm aware Lexis Nexis....") you are asking about something very different. Namely whether there is some kind of ideal proportion between number of revolving accounts to number of installment accounts. To just make up an example, that could be three revolving to one installment.

Which of those two things are you asking about?

As far as the best percentages for utilization ("best way to manage this area") you have been around on these forums for a while now and may know the answer already. Let us know if you do not and we'll tell you.

As far as how much debt ratio matters, it is the main thing in Amounts Owed category. This is 30% of your score. The category also contains some other factors, like the number of open accounts reporting a positive balance.

http://www.myfico.com/credit-education/whats-in-your-credit-score/

I meant like should proportion of installment loan debt be higher than revolvoing debt or vice versa. Like is it better to have $1000 installment debt and $500 revolving debt or other way around. I'm not talking about number of accounts, I'm talking about ideal proportion of balances themselves.

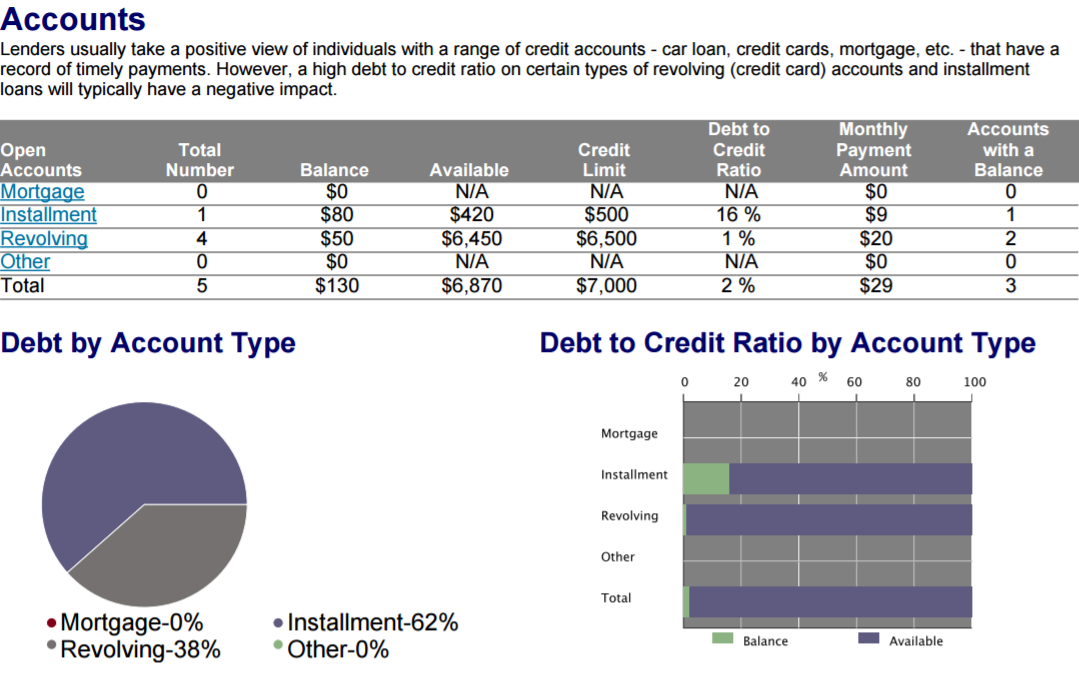

Like with my bar graph, 62% of my balances are from installment while 38% are from revolving. If the bar graph was like 10% was from installment but 90% was from revolving then how would my score change. This is assuming all else equal.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

The word proportion always means dividing two numbers. (Same for ratio) For example the "golden rectangle" of the Greeks has certain proportions, specifically one side turns out to be approx 1.618 the length of the other.

So when you ask about the proportion of installment debt and revolving debt, are you dividing one by the other? E.g.if one's installment debt was $3000 and one's revolving debt was $500, then the proportion of installment debt to revolving would be 6 to 1.

So are you asking if there is (in FICO scoring) an ideal ratio of those two numbers?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

@Subexistence wrote:

Like with my bar graph, 62% of my balances are from installment while 38% are from revolving. If the bar graph was like 10% was from installment but 90% was from revolving then how would my score change. This is assuming all else equal.

I didn't see this paragraph when I wrote my response. Possibly you edited your response and added it? Or maybe I just missed it.

It's now clearer what you are talking about. You are basically dividing (a) dollar value of installment debt by total dollar amount of debt and (b) dollar value of revolving debt by total dollar amount of debt. That boils down to looking at the proportion of installment to revolving, though it handles the corner case of $0 revolving as well.

OK, now that we know what you are actually asking.... the answer is no. FICO does not divide those two two dollar amounts in that way. That is not a scoring factor at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

PS. Very slight caveat. FICO does like you to have at least one tiny balance on an open loan and also on an open credit card. That's a very well known, well discussed fact on these forums that I can't imagine is news to you. That aside, FICO doesn't care about the proportions you mention.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

Proportion was fine. I just didn't know what two things were being divided. The proportions you had in mind were

Total Installment Debt (in dollars)

-------------------------------------------

Total debt (in dollars)

and

Total Revolving Debt (in dollars)

-------------------------------------------

Total debt (in dollars)

Those are certainly proportions. In practice your question can be phrased by looking at a single proportion (which is Intallment / Revolving.) and asking if FICO cares about that. It doesn't. It cares a lot about revolving and installment utilization, but that is of course very different.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Debt by account type

I guess proportion is used most often to mean the ration of a part to a whole. Like the proportion of students of Anders High School who are black.

So the two things you gave are proportions. Ratio is a more general term that can be used for any two numbers divided by each other. E.g. the ratio of white to asian students. If 40% were black, 55% were white, and 5% were Asian, then that last ratio would be 11.

Regardless it seemed gradually clearer that you were thinking about numbers being divided by each other. I was just trying to figure what those numbers were.