- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Do new accounts themselves actually drop scores?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Do new accounts themselves actually drop scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Do new accounts themselves actually drop scores?

I understand that when you open new accounts a few things happen. Immediately the inquiries can drop ones score and once the account(s) report naturally there will be an AAoA drop which may or may not impact score depending on which AAoA bucket you fall into.

Aside from these 2 factors, do the actual new accounts themselves drop score at all? As in the number of new accounts you have?

Here's an example to illustrate what I'm asking. Say someone opens 3 new accounts at the same time... He's got a thick/aged file so his AAoA remains unchanged as it was 8.9 years (8 years) before the 3 new accounts and is 8.1 (8 years) after the 3 new accounts report. Just for purposes of this illustration let's say that the 3 inquiries for the 3 new accounts all landed on one bureau, TU... so EX and EQ did not receive any inquiries.

So, with no reduction of AAoA and no change in inquiries (on EX and EQ) would this individuals FICO 08 scores on EX and EQ stay exactly the same, OR, would they still drop to some degree simply due to the introduction of "new accounts" to his credit reports? Hopefully this makes sense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

My experience has been that new accounts do not affect FICO scores unless some sort of threshold is crossed. I've had a lot of new accounts in the last few years, and I've never seen a new account affect a FICO 08 score. I have 3B monitoring so I am always aware of any changes to my scores.

If a person has not had any new accounts in the past 6 months, a new account can drop FICO 04 scores by twenty something points. Of course, this drop is profile dependent. I've never seen the same affect FICO 08 scores.

If a person has not had any new accounts for a year or two it could be possible that a new account would affect FICO 08 scores even without crossing an AAoA threshold. I don't know if this point drop would actually occur since I don't have any experience with this situation. I've never gone over a year without a new account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

I've always wondered the same. I opened all of my cards in the past 2 years, but my AAoA is 7 years still. I am doing the SLOW CRAWL at this point....waiting for a few lates and one CO to expire.... I wonder had I not opened so many if I would be at a higher point than I am now.... perhaps not!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

It seems with the addition of multiple new accounts my scores may have dropped. I have not run my 3B scores on CCT yet as I'm still waiting on 1 of my new revolvers (Amex) to report where my other 2 already reported. All 3 accounts were approved at the same time on the same day in mid-June.

My AAoA has not changed with 2 of the 3 new accounts reported, nor will it when the 3rd reports.

Inquiry wise, I had 1 on each bureau prior that was 15 months old prior to apping, and the 3 new accounts added 1 inquiry to each bureau (each only pulled 1 bureau, all different) which brought my total inquiries to 2 across all 3B... but with the first inquiry being 15 (now 16) months old, that should have zero impact at this point.

I just got my updated TU FICO 08 though my mortgage company and it shows a 22 point drop from where it was last month prior to me apping. I'm waiting on my Amex EX FICO 08 to update (it's been over a month so hopefully soon) to see if there's a similar drop there. It's been about a month since my Discover score updated, so when that is available in the next few days I can compare that TU FICO 08 to the one I got from my mortgage company.

Once my Amex account reports, hopefully in the next week or so I will pull all 3B reports from CCT and check all scores/data.

I just sort of figured that new accounts in and of themselves may actually drop scores initially for whatever reason, as the AAoA/inquiry data IMO really doesn't warrant a 22 point drop on a thick/aged file.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@Anonymous wrote:It seems with the addition of multiple new accounts my scores may have dropped. I have not run my 3B scores on CCT yet as I'm still waiting on 1 of my new revolvers (Amex) to report where my other 2 already reported. All 3 accounts were approved at the same time on the same day in mid-June.

My AAoA has not changed with 2 of the 3 new accounts reported, nor will it when the 3rd reports.

Inquiry wise, I had 1 on each bureau prior that was 15 months old prior to apping, and the 3 new accounts added 1 inquiry to each bureau (each only pulled 1 bureau, all different) which brought my total inquiries to 2 across all 3B... but with the first inquiry being 15 (now 16) months old, that should have zero impact at this point.

I just got my updated TU FICO 08 though my mortgage company and it shows a 22 point drop from where it was last month prior to me apping. I'm waiting on my Amex EX FICO 08 to update (it's been over a month so hopefully soon) to see if there's a similar drop there. It's been about a month since my Discover score updated, so when that is available in the next few days I can compare that TU FICO 08 to the one I got from my mortgage company.

Once my Amex account reports, hopefully in the next week or so I will pull all 3B reports from CCT and check all scores/data.

I just sort of figured that new accounts in and of themselves may actually drop scores initially for whatever reason, as the AAoA/inquiry data IMO really doesn't warrant a 22 point drop on a thick/aged file.

You receive a TU 08 score through your mortgage company?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

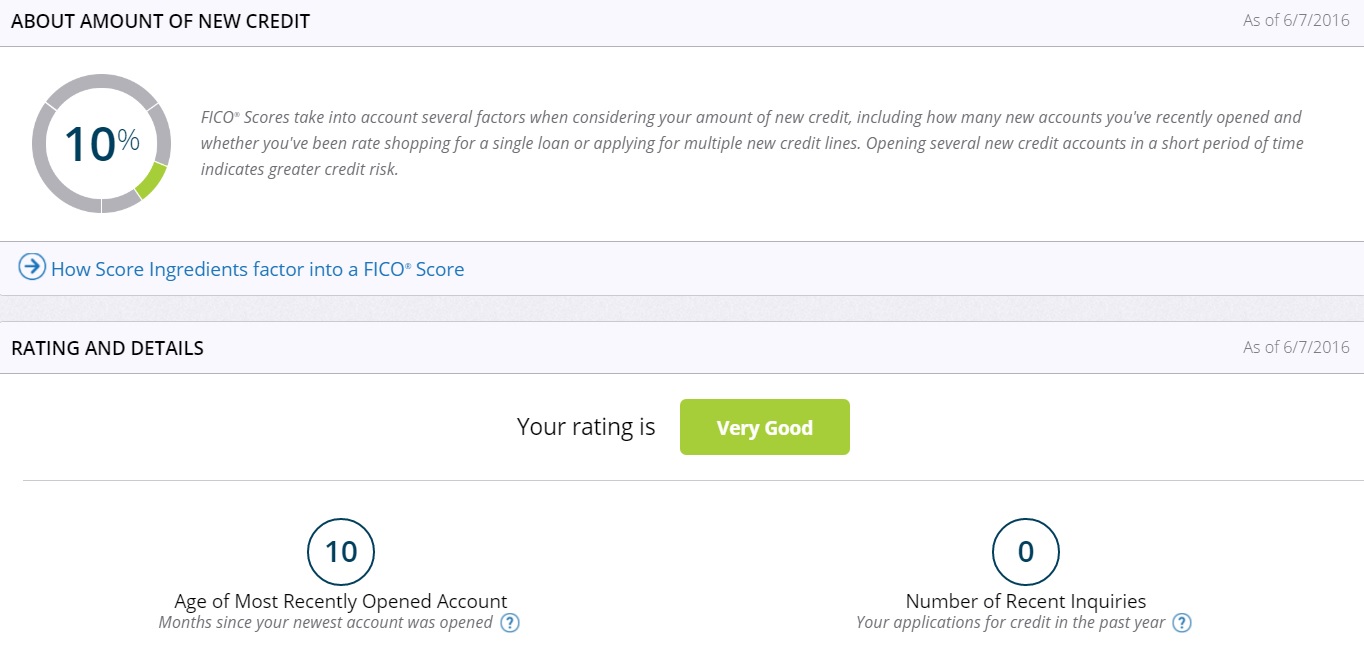

According to MyFICO, "Amount of New Credit" accounts for 10% of your score. Specifically, they say:

FICO® Scores take into account several factors when considering your amount of new credit, including how many new accounts you've recently opened and whether you've been rate shopping for a single loan or applying for multiple new credit lines. Opening several new credit accounts in a short period of time indicates greater credit risk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@Anonymous wrote:

I just got my updated TU FICO 08 though my mortgage company and it shows a 22 point drop from where it was last month prior to me apping.

Are you sure it wasn't TU FICO 04. That is exactly the kind of drop I would have expected from 04 if there had been no new accounts in the previous 6 months.

Could you supply a little more information? Such as:

AAoA

How long since new accounts before the recent ones

How old is your mortgage

Any changes in utilization

How many credit cards you have

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@oilcan12 wrote:You receive a TU 08 score through your mortgage company?

Yup. Nationstar Mortgage. They started giving TU FICO 08's about 6 months ago. A few times I've compared it to my TU 08 through CCT and it's always been dead on or off by a point or two at most if the score generated by CCT was a few days more recent than the score through Nationstar.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@JagerBombs89 wrote:According to MyFICO, "Amount of New Credit" accounts for 10% of your score. Specifically, they say:

FICO® Scores take into account several factors when considering your amount of new credit, including how many new accounts you've recently opened and whether you've been rate shopping for a single loan or applying for multiple new credit lines. Opening several new credit accounts in a short period of time indicates greater credit risk.

Good call here JagerBombs. That would make sense and I could see how if opening 3 new accounts could impact 10% of my score that I could see a 22 point drop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Do new accounts themselves actually drop scores?

@oilcan12 wrote:

@Anonymous wrote:

I just got my updated TU FICO 08 though my mortgage company and it shows a 22 point drop from where it was last month prior to me apping.

Are you sure it wasn't TU FICO 04. That is exactly the kind of drop I would have expected from 04 if there had been no new accounts in the previous 6 months.

Could you supply a little more information? Such as:

AAoA

How long since new accounts before the recent ones

How old is your mortgage

Any changes in utilization

How many credit cards you have

Positive it's FICO 08. Direct from their site: "The FICO® Score provided to you is the FICO® Score 8 based on TransUnion Data, and is the same score that Nationstar uses, along with other information, to manage your account."

The information you requested:

AAoA = 7 years (unchanged from when I added the 3 accounts)

No accounts added in the 15 months prior to the 3 I just added last month. 3 accounts added 15 months ago, 2 accounts added 3 years prior to that, 1 account added 2 years before that. So broken down into accounts added by year: 2010 = 1, 2011 = 0, 2012 = 2, 2013 = 0, 2014 = 0, 2015 = 3, 2016 = 3.

Mortgage is 7 years old

Utilization has been 1-6% overall for the last 2 months. I took it down from around 35% to mid-single digits and made sure all accounts reported as such prior to my app "spree" for the 3 new accounts I obtained.

Total credit cards are 5. I had 2 prior to 3 I added. I will be closing one of the original 2 in the next month or so as it's a Care Credit account that was only used for one purchase ever, some dental work, and it's about to be paid off - I'll be down to 4 active revolvers at that time.

I've got 21 total accounts on my credit reports currently, and 5 of them are almost 16 years old.