- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does Closing a Credit Card Help or Hurt Credit Sco...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does Closing a Credit Card Help or Hurt Credit Score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@dapps06 wrote:The guy on the phone actually sounded like he agreed with what I was doing. I've put a pretty good amount of money through my Freedom already and I've only had it a month, I told him I wasn't going to use the Slate because of the low limit they gave me and he agreed it was best to just transfer the limit. He's the one who asked if I wanted to do my Amazon Rewards as well.

I'm not worried about my AAoA, my student loans go back 14 years and my closed Wells Fargo auto loan goes back 9. Those accounts will keep me in the respectable AAoA range for awhile.

Thanks for the extra info that wasn't in the first post. Makes more sense now... the closures and AAoA.

I'd probably have agreed with you... my student loans go back 15 years.

Hard INQs last 12 months: EQ: 5 | TU: 8 | EX: 9

Verizon Visa $8500 Amex Delta Reserve $10,000 Care Credit $18,000

NFCU CashRewards $7500 Apple Card $7000 Best Buy $8000 Amazon $5000

NFCU auto loan (2022 Ford Bronco Sport Badlands - Cactus Gray) 6.95%

NFCU motorcycle loan (2024 Harley Davidson Road Glide - Alpine Green & Chrome) 9.45%

Total CL: $64,000 --- Total CC UTI: 27% --- AAoA: 5.5 years --- Income: $200k

Last app: 4-6-24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

My two cents:

This might not be the right way to look at it, but my Cap1 was my lowest limit (4k) but also my oldest account at 3.5 years. I closed it because it could bar me from getting high starting limits. This isn't the only reason I closed it, but I also found the card useless. Now, it's completely up to you to close it or not. I personally don't get the keeping it open for the history thing either. AAoA and credit score don't really matter unless applying for something. And after 750, it doesnt really matter because you won't get any better interest rates. After 750, it's essentially bragging rights to see who can have the highest score.

I've been on this forum a while, and I've been prone to being scared of HP's. Closing cards is kind of the same way. But in the end, you do what you think is best for your needs and your credit profile. I get that everything you do now affects everything down the line, but if you can't see yourself keeping it open in the long run, then close it. Don't keep it open just because.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@TRC_WA wrote:You aren't helping your AAoA closing 1-3 month old accounts.

I'd love to hear what Chase had to say about you closing the Slate before you even got the card... let us know how your next Chase app goes.

Why? It doesn't impact AAoA at all for about ten years.

Closing cards usually doesn't matter, but there are a few times it will be a red flag on manual review:

1) Multiple "closed by issuer" cards in a short period of time, especially if it involves multiple issuers. Who closed it doesn't matter for score, but on review they may want to know why all this AA was taken! This isn't your case

2) Issuers suspicious that you are churning for rewards. If you keep opening cards, meeting min spend and closing shortly after, some issuers, now including Chase, will object and probably stop issuing you new cards (and possibly close existing ones)

But a few cards closed by you without reward implications is OK. People open cards then find it doesn't work for them

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@Anonymous wrote:Also, if there is no annual fee, it is good to keep it open.

While that's a popular line of thinking here on myFICO it's up to each to determine if that is relevant and the only consideration when it comes to deciding whether or not to close a card. One should consider the information in the Closing Credit Cards thread which is linked in the Helpful Threads stick in this subforum as well as the individuals' specific concerns. Do the utilization calculations before and after closure and use that to help you decide.

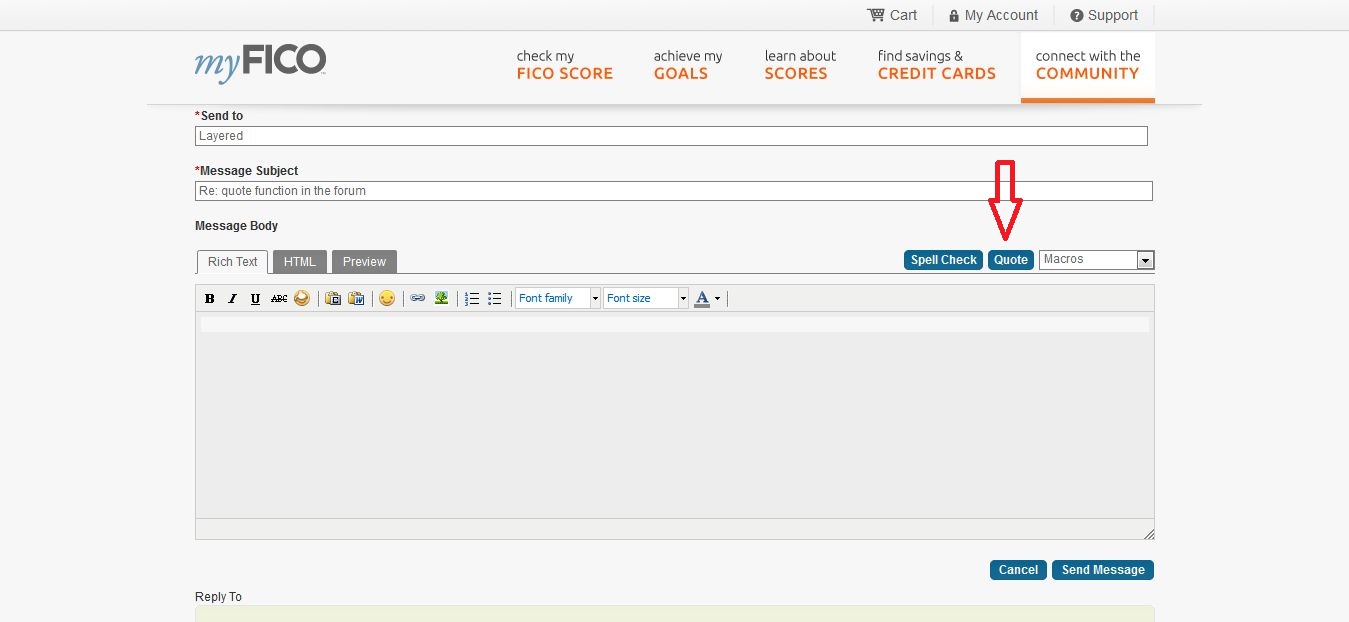

@Anonymous wrote:I haven't figured it out how to use "Quote".

Hit the Reply button under the message you want to Quote. On the Reply to Message screen hit the Quote button. Trim, if needed, and add your reply.

@Anonymous wrote:I thought it was a little strange myself but nothing else was going on at the time so I went with what 3B told me.

You have to be careful when analyzing. "Something" isn't just additions or deletions. Aging can also affect scoring without adding or removing anything from a report.

@dapps06 wrote:One thing I was wondering, does having multiple closed accounts look bad if those accounts are only a few months old or less?

Doesn't matter for scoring purposes. The damage was done when the accounts were opened. However, it can look flakey on manual review.

@dapps06 wrote:I'm not worried about my AAoA, my student loans go back 14 years and my closed Wells Fargo auto loan goes back 9. Those accounts will keep me in the respectable AAoA range for awhile.

Even so, you could benefit from a higher AAoA. If you don't need the cards the time to sort that out is before applying -- not right after. If you find yourself closing multiple new accounts then you probably need to do better with your due diligence.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@09Lexie wrote:

@Anonymous wrote:I haven't figured it out how to use "Quote".

Thanks, everyone!

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the toolbar, next to the MACRO drop down-- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

I did it!

Thanks, 09Lexie.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

@longtimelurker wrote:

@TRC_WA wrote:

You aren't helping your AAoA closing 1-3 month old accounts.

I'd love to hear what Chase had to say about you closing the Slate before you even got the card... let us know how your next Chase app goes.

Why? It doesn't impact AAoA at all for about ten years.

Closing cards usually doesn't matter, but there are a few times it will be a red flag on manual review:

1) Multiple "closed by issuer" cards in a short period of time, especially if it involves multiple issuers. Who closed it doesn't matter for score, but on review they may want to know why all this AA was taken! This isn't your case

2) Issuers suspicious that you are churning for rewards. If you keep opening cards, meeting min spend and closing shortly after, some issuers, now including Chase, will object and probably stop issuing you new cards (and possibly close existing ones)

But a few cards closed by you without reward implications is OK. People open cards then find it doesn't work for them

@Shock wrote:My two cents:

This might not be the right way to look at it, but my Cap1 was my lowest limit (4k) but also my oldest account at 3.5 years. I closed it because it could bar me from getting high starting limits. This isn't the only reason I closed it, but I also found the card useless. Now, it's completely up to you to close it or not. I personally don't get the keeping it open for the history thing either. AAoA and credit score don't really matter unless applying for something. And after 750, it doesnt really matter because you won't get any better interest rates. After 750, it's essentially bragging rights to see who can have the highest score.

I've been on this forum a while, and I've been prone to being scared of HP's. Closing cards is kind of the same way. But in the end, you do what you think is best for your needs and your credit profile. I get that everything you do now affects everything down the line, but if you can't see yourself keeping it open in the long run, then close it. Don't keep it open just because.

That's the same reason I wanted to close my Capital One account. I had the card for 3 years and it's got 2K credit limit.

My AAoA is 3 years. Credit Utilization is 4%.

I thought if I close 2-3 of my low limit credit cards, I may be able to get a better credit limit in the future.

I just wansn't sure how it's gonna affect my credit score.

Thank you all for your input.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does Closing a Credit Card Help or Hurt Credit Score?

I got the Chase Freedom a while back, about a month after getting Walmart and Amazon from Synchrony. The two synchrony cards were for helping credit rebuilding and helping to get a prime card (since I also had CreditOne which we won't talk about). I'll be closing the Walmart card next PIF, and the Amazon card not long after. Probably keeping CareCredit open for medical expenses and such.

No AF is one thing, but if they're store cards that offer very little in the way of benefit, and you've already achieved what you wanted (in my case a prime card like CF) then there's no point in keeping them open.