- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does FICO consider AU account balance in debt to c...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does FICO consider AU account balance in debt to credit ratio?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does FICO consider AU account balance in debt to credit ratio?

Hi all, I've lurked on these boards for quite a while and very much appreciate all the valuable insight. I apologize if this has been covered but I can't seem to find anything on it. The short of it - my EQ hard copy shows my debt to credit ratio which includes my AU account available credit. However, MyFico EQ score analysis, while reflecting the correct available limit on my AU account, does not seem to calculate my AU available limit when calculating my debt to credit ratio.

Is this a function of FICO 8 scoring? Or should there not be a disconnect? I know Fako scores consider my AU available credit when determining my debt to credit ratio.

Thanks!

Starting Score: 598

Starting Score: 598Current Score: 781

Goal Score: 720

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

Anyone can correct me if i'm wrong, but both should match; CL/debt from you + AU accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

@RecoveryGuy wrote:Hi all, I've lurked on these boards for quite a while and very much appreciate all the valuable insight. I apologize if this has been covered but I can't seem to find anything on it. The short of it - my EQ hard copy shows my debt to credit ratio which includes my AU account available credit. However, MyFico EQ score analysis, while reflecting the correct available limit on my AU account, does not seem to calculate my AU available limit when calculating my debt to credit ratio.

Is this a function of FICO 8 scoring? Or should there not be a disconnect? I know Fako scores consider my AU available credit when determining my debt to credit ratio.

Thanks!

When you refer to "my EQ hard copy" do you mean a printed copy of the report you got from the myFICO Ultimate 3B? If not, what product gave you that?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

Sorry for being unclear - I meant a recent copy of my EQ report I pulled from annualcreditreport. It includes the CL from my Amex AU account in its debt-to-credit ratio. Whereas the myFICO report accurately lists my Amex AU account details on my report but for whatever reason, it excludes it from the debt-to-credit ratio listed.

Starting Score: 598

Starting Score: 598Current Score: 781

Goal Score: 720

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

Having just read through a number of posts on this board concerning FICO 8's algorithm designed to protect against authorized user abuse, I have a sense this is what's going on with my account. I have one secured card of my own with a $1500 CL and my girlfriend listed me as an AU on her Amex, which has a CL of $32k. To me, this would appear to trigger whatever anti-AU piggybacking algorithm FICO 8 uses. We're not married (yet) and our names don't match, nor do our addresses, so I could see why FICO might assume this was an AU I purchased.

Now, the question becomes - is it possible to negotiate with FICO directly to attempt to have an exception made since this is pretty clearly not a case of me purchasing an AU account? I read elsewhere that certain CRA CSR's will redirect consumers to FICO when certain score reason codes seem invalid. I saw a phone number listed by a poster that a CRA CSR had given them: 1-800-777-2066, but it's just an automated service explaining that they have no ability to correct reports, just the CRA's, etc etc.

Starting Score: 598

Starting Score: 598Current Score: 781

Goal Score: 720

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

The free annual report does not provide true FICO scores. If it gives you a score, it is a FAKO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

This got a bit confused. I didn't intend to imply I recieved a score from annual credit report. Just that my AU account balance and debt to ratio was accurately reflected on that version of my EQ report. The only score I was referring to was the FICO 8 EQ I purchased from myFICO. Which is not considering my AU account in my revolving accounts for debt to credit ration purposes, though it is listing it as an account on my report in the accounts section.

Starting Score: 598

Starting Score: 598Current Score: 781

Goal Score: 720

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

@RecoveryGuy wrote:Having just read through a number of posts on this board concerning FICO 8's algorithm designed to protect against authorized user abuse, I have a sense this is what's going on with my account. I have one secured card of my own with a $1500 CL and my girlfriend listed me as an AU on her Amex, which has a CL of $32k. To me, this would appear to trigger whatever anti-AU piggybacking algorithm FICO 8 uses. We're not married (yet) and our names don't match, nor do our addresses, so I could see why FICO might assume this was an AU I purchased.

Now, the question becomes - is it possible to negotiate with FICO directly to attempt to have an exception made since this is pretty clearly not a case of me purchasing an AU account? I read elsewhere that certain CRA CSR's will redirect consumers to FICO when certain score reason codes seem invalid. I saw a phone number listed by a poster that a CRA CSR had given them: 1-800-777-2066, but it's just an automated service explaining that they have no ability to correct reports, just the CRA's, etc etc.

Great that you are doing a lot of your own research and that you have learned about the anti-abuse algorithm of FICO 8 (and presumably FICO 9). I'll get to your thoughts on that in just a minute.

Before I do, however, let me tackle a broader question, which is whether the summary software on a credit report or third-party tools (like the MyFico score analysis module) can be counted on to accurately reflect what an particular FICO model is doing behind the scenes as it calculates and spits out your score.

The answer is: you cannot rely on them. They are often wrong. (That includes simulators.) These all tools that were written by some programmer to try to summarize your report or how that programmer believes the algorithm would work. These people are often mistaken. You'd think that if the tool is a "myFICO" tool then it would be right, but they are often wrong.

If myFICO gives you a score, then that really is your score. But if myFICO tries to talk about why the score is the way it is, that's just some guy's opinion and is not the actual algorithm talking. The only exception is when you see negative reason statements -- these are actually generated by the algorithm itself and although not entirely reliable (they can mislead people) they do have quite a bit of value. All other stuff you see that talks about your score (including positive reason statements, claims about what your total credit limit is, etc.) are just the opinion of some Joe Blow.

Quick example: myFICO will sometimes tell people they have a CC utilization of 0% when they have a small positive balance reporting on one card. This is untrue. The actual algorithm rounds everything up to the nearest integer. So if your utilization is 0.2% ($20 out of a total credit limit of $10,000) the FICO algorithm views that as 1%. This mattters a lot since if your CC utilization is 0% you will get a big scoring penalty.

So to summarize thus far, the fact that your ACR report tells you that your AU card is being counted as part of your total credit limit -- this is just some guy's opinion. FICO 8 or FICO 04 or whatever might be counting it. Or not. Likewise if the myFICO scoring analytic implies that it is not being counted, you can't be sure that is right either.

Fortunately, there is a way for YOU to find out whether it is being counted or not. It has to do with the fact that there is a sharp penalty for having all of your cards reporting $0. Here are the steps:

(1) Get your credit profile as stable as you can. Additionally, have your AU card reporting a small positive balance and exactly one of the cards in your own name reporting a small positive balance. All other cards need to report $0.

(2) Pull your three FICO 8 scores using the $1 trial using Credit Check Total.

(3) Pay the card that is in your name down to $0. Make sure it is reporting as $0 to all three bureaus.

(4) Pull your three FICO 8 scores using the $1 trial using Credit Check Total.

If your score does not change much, or perhaps goes up a bit, then the AU card is being counted toward your utilization. FICO 8 is considering you to have 1% utilization.

If your score takes a prompt dive of about 20 points, then FICO 8 is not counting it. FICO is considering you to have 0.000% utilization. If this happens, it's because FICO 8 somehow doesn't perceive you as a genuine AU -- it's anti-abuse algorithm got triggered.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

@Anonymous wrote:

@RecoveryGuy wrote:Having just read through a number of posts on this board concerning FICO 8's algorithm designed to protect against authorized user abuse, I have a sense this is what's going on with my account. I have one secured card of my own with a $1500 CL and my girlfriend listed me as an AU on her Amex, which has a CL of $32k. To me, this would appear to trigger whatever anti-AU piggybacking algorithm FICO 8 uses. We're not married (yet) and our names don't match, nor do our addresses, so I could see why FICO might assume this was an AU I purchased.

Now, the question becomes - is it possible to negotiate with FICO directly to attempt to have an exception made since this is pretty clearly not a case of me purchasing an AU account? I read elsewhere that certain CRA CSR's will redirect consumers to FICO when certain score reason codes seem invalid. I saw a phone number listed by a poster that a CRA CSR had given them: 1-800-777-2066, but it's just an automated service explaining that they have no ability to correct reports, just the CRA's, etc etc.

Great that you are doing a lot of your own research and that you have learned about the anti-abuse algorithm of FICO 8 (and presumably FICO 9). I'll get to your thoughts on that in just a minute.

Before I do, however, let me tackle a broader question, which is whether the summary software on a credit report or third-party tools (like the MyFico score analysis module) can be counted on to accurately reflect what an particular FICO model is doing behind the scenes as it calculates and spits out your score.

The answer is: you cannot rely on them. They are often wrong. (That includes simulators.) These all tools that were written by some programmer to try to summarize your report or how that programmer believes the algorithm would work. These people are often mistaken. You'd think that if the tool is a "myFICO" tool then it would be right, but they are often wrong.

If myFICO gives you a score, then that really is your score. But if myFICO tries to talk about why the score is the way it is, that's just some guy's opinion and is not the actual algorithm talking. The only exception is when you see negative reason statements -- these are actually generated by the algorithm itself and although not entirely reliable (they can mislead people) they do have quite a bit of value. All other stuff you see that talks about your score (including positive reason statements, claims about what your total credit limit is, etc.) are just the opinion of some Joe Blow.

Quick example: myFICO will sometimes tell people they have a CC utilization of 0% when they have a small positive balance reporting on one card. This is untrue. The actual algorithm rounds everything up to the nearest integer. So if your utilization is 0.2% ($20 out of a total credit limit of $10,000) the FICO algorithm views that as 1%. This mattters a lot since if your CC utilization is 0% you will get a big scoring penalty.

So to summarize thus far, the fact that your ACR report tells you that your AU card is being counted as part of your total credit limit -- this is just some guy's opinion. FICO 8 or FICO 04 or whatever might be counting it. Or not. Likewise if the myFICO scoring analytic implies that it is not being counted, you can't be sure that is right either.

Fortunately, there is a way for YOU to find out whether it is being counted or not. It has to do with the fact that there is a sharp penalty for having all of your cards reporting $0. Here are the steps:

(1) Get your credit profile as stable as you can. Additionally, have your AU card reporting a small positive balance and exactly one of the cards in your own name reporting a small positive balance. All other cards need to report $0.

(2) Pull your three FICO 8 scores using the $1 trial using Credit Check Total.

(3) Pay the card that is in your name down to $0. Make sure it is reporting as $0 to all three bureaus.

(4) Pull your three FICO 8 scores using the $1 trial using Credit Check Total.

If your score does not change much, or perhaps goes up a bit, then the AU card is being counted toward your utilization. FICO 8 is considering you to have 1% utilization.

If your score takes a prompt dive of about 20 points, then FICO 8 is not counting it. FICO is considering you to have 0.000% utilization. If this happens, it's because FICO 8 somehow doesn't perceive you as a genuine AU -- it's anti-abuse algorithm got triggered.

Thanks a bunch for the education, CreditGuy. I did not realize the analysis portion of a lot of these products is mostly conjecture by employees of the products.

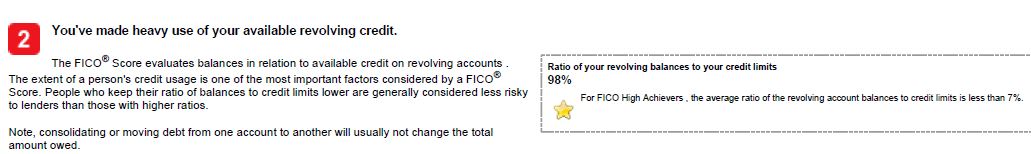

I also intend to try the CCT method of experimentation you suggested. Though, what you said about the negative reason statements being generated by the algorithm would seem to support the fact that FICO 8 is not considering my AU CL in my util. Here's a screen shot from that section of the FICO 8 report:

I should note that I only have one secured CC in my name, and no other CC's. It has a $1500 limit and I was near maxed when I ordered this report (I just pif 2 days ago). My Amex AU CC is the only other CC account I have, and as I mentioned previosuly, the CL is $32k with a near zero balance at the moment.

Does this suggest to you that I've triggered the FICO anti-abuse algorithm? Either way, I'm still happy to try the CCT experiment.

Starting Score: 598

Starting Score: 598Current Score: 781

Goal Score: 720

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does FICO consider AU account balance in debt to credit ratio?

The negative reason statement you show in your screenshot was accurate even if if the AU card was being considered as part of your total credit limit. That's because that particular reason statement can be triggered by one's total utilization or one's individual utilization. You had half of your cards at almost 100% individual utilization. That caused a big penalty.