- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does it hurt your credit to sock drawer a card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does it hurt your credit to sock drawer a card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does it hurt your credit to sock drawer a card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

Your credit takes a temporary hit if your utilization is 0% across all of your cards, but if you have something else that you use and reports a small balance you're fine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

The only time a SD card can "hurt" your credit score is if it's cancelled and removing that credit limit from your overall credit limits results in your aggregate utilization then rising above a threshold. First, chance of it getting cancelled as long as you are using it for a quarter per year are slim, but second unless it has a very high CL and makes up a large percentage of your overall CL it shouldn't impact your utilization significantly even if it were to get closed.

Just to be safe, I might suggest taking it out of the SD for a single purchase at some point mid-year between the date you start using it one quarter and stop. For example, if you use it from Jan through March every year and SD it on April 1st, I'd suggest throwing at least a small purchase on it sometime around August 1st just to show a piece of usage during the 9 month span where you otherwise wouldn't plan to use it at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

Some posters have reported experiencing a temporary score drop when an inactive account 1st reports as active again. From what I have read, accounts can be taged as inactive after 3 months. However, an inactive account (according to the poster) only affects score when re-activated if the period of inactivity exceeds 6 months. Even then, the negative impact associated with re-activation lasts only one cycle. (see below paste referring to a score drop when an inactive card was reused)

http://ficoforums.myfico.com/t5/Credit-Cards/Score-Drop-due-to-Account-activity/m-p/3923793#M1096662

For no annual fee backcards it is best to use the card at least once every 6 months. More than a few have posted bankcards being canceled with a period of inactivity between 8 months and 12 months. It is important to use bankcards you want to keep periodically.

Store cards have much lower risk of closure due to inactivity but, it still will happen. My Kohls card was closed after 52 months of inactivity.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

@Thomas_Thumb wrote:Some posters have reported experiencing a temporary score drop when an inactive account 1st reports as active again. From what I have read, accounts can be taged as inactive after 3 months. However, an inactive account (according to the poster) only affects score when re-activated if the period of inactivity exceeds 6 months. Even then, the negative impact associated with re-activation lasts only one cycle.

For no annual fee backcards it is best to use the card at least once every 6 months. More than a few have posted bankcards being canceled with a period of inactivity between 8 months and 12 months. It is important to use bankcards you want to keep periodically.

Store cards have much lower risk of closure due to inactivity but, it still will happen. My Kohls card was closed after 52 months of inactivity.

I think that my score dropped this month because 2 cards not used for several months reported a balance. I just wanted them to report my new limit and if they don't report then the new limit is not reported.

@Thomas_Thumb, I will no longer ask for CLI on those 2 cards. Just to keep them active can I charge something and pay it before the statement close? I don't need to let a SD card report a balance to keep it active, right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

@Thomas_Thumb wrote:

For no annual fee backcards it is best to use the card at least once every 6 months. More than a few have posted bankcards being canceled with a period of inactivity between 8 months and 12 months. It is important to use bankcards you want to keep periodically.

Store cards have much lower risk of closure due to inactivity but, it still will happen. My Kohls card was closed after 52 months of inactivity.

Hi TT! The last time I asked the broader community for case studies of cancellatons due to inactivity, I think I was unable to find anyone who reported a closure for which both were true:

(a) inactive < 12 months

(b) the card had been used at least once

I did find a couple case of cancellations < 12 months but they were cases of a person who had never used the card at all. Our OP has used his card a lot thus far and the maximum period of inactivity moving forward will never be more than 9 months.

Let me know if you can find any cases of anything different. I have been wanting to reactivitae this thread lately anyway and ask.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

You don't need to let a SD card report a balance to be seen as active. Any activity is activity. Making a minimum payment is activity, too. Someone can have a card with a high balance that doesn't have a single transaction placed on it for 5+ years, but since the card holder is making payments on it (activity) the account can't be closed due to inactivity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does it hurt your credit to sock drawer a card?

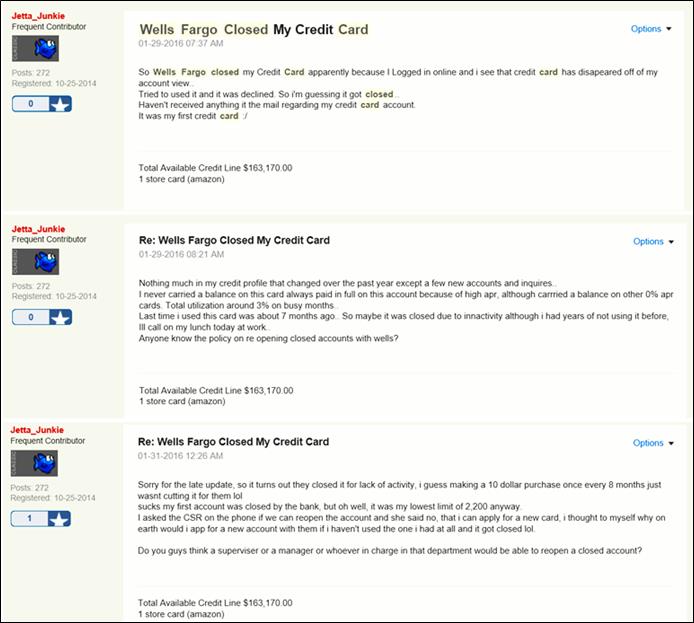

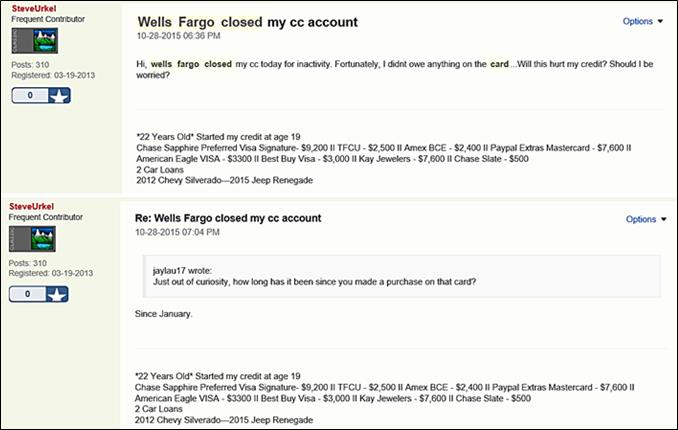

I've come across 5 to 6 threads where bank cards were reported as closed due to inactivity. The majority were for Wells Fargo cards. Example pasted below.

http://ficoforums.myfico.com/t5/Credit-Cards/Wells-Fargo-Closed-My-Credit-Card/m-p/4435638#M1274808

http://ficoforums.myfico.com/t5/Credit-Cards/Wells-Fargo-closed-my-cc-account/m-p/4300972#M1226864

I'll paste a few other links as well.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950