- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Does the "mix" really matter?????

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Does the "mix" really matter?????

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the "mix" really matter?????

I always see people referring to Fico liking the "mix" of credit lines and types.

But does anyone actually have any proof or data points that having any kind of mix will actually increase their score above what would be possible without a mix?

I have always seen little to ZERO purpose in store cards. That's not to say I don't have any....but I just don't see their value in helping to boost your score.

I have installment loans, revolvers, PLOC's and one or two store cards(furniture).

The only thing that ever makes my score jump is when a baddie falls off.

Other than that it just ebb and tides in a rhythm in the same area.

I would like to take a SCT opportunity just don't see the value in scoring....

But it would be nice to have about 3 of those cards just for my personal use.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

Adding an open installment loan if you only have credit cards will increase your fico score, especially once you pay down most of the balance.

We know that a mix of the major types of credit (installment, morgage, car loans, credit cards) can make a small but significant difference. What isn't known is how much, if any, improvement might be seen by having a mixture within those types. Ie, having multiple types of credit cards (bank, charge card, retail, gas company). We do know that finance company credit is seen as a negative, as it is a creditor of last resort. But will having a credit card that is issued by a gasoline company improve your mix? Will it improve your car insurance fico score? who knows?

The mix matters. But we don't know how much in most circumstances, or even if improving the mix is a positive or negative in some circumstances. You place your bets, and you take your chances. Or, not.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

@Cmikul wrote:I always see people referring to Fico liking the "mix" of credit lines and types.

But does anyone actually have any proof or data points that having any kind of mix will actually increase their score above what would be possible without a mix?

I have always seen little to ZERO purpose in store cards. That's not to say I don't have any....but I just don't see their value in helping to boost your score.

I have installment loans, revolvers, PLOC's and one or two store cards(furniture).

The only thing that ever makes my score jump is when a baddie falls off.

Other than that it just ebb and tides in a rhythm in the same area.

I would like to take a SCT opportunity just don't see the value in scoring....

But it would be nice to have about 3 of those cards just for my personal use.

I can speak to certain types of credit/debt. When my home improvement loan dropped off, Equifax lowered my score by 37 points. When I added my new car loan, it became a plus on the side of types of accounts and added a small number of points to all three bureaus. I have a couple of store cards that I really like and use - Amazon, Home Depot and Care Credit, which I believe is counted as a charge card. Others have good reason for the store cards and will respond to your post, I am sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

Once you are past 720, 740 score you just need a dig in and reward chase. As mentioned above you still have things falling off and what not your past isnt squeaky clean yet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

@Cmikul wrote:I always see people referring to Fico liking the "mix" of credit lines and types.

But does anyone actually have any proof or data points that having any kind of mix will actually increase their score above what would be possible without a mix?

I have always seen little to ZERO purpose in store cards. That's not to say I don't have any....but I just don't see their value in helping to boost your score.

I have installment loans, revolvers, PLOC's and one or two store cards(furniture).

The only thing that ever makes my score jump is when a baddie falls off.

Other than that it just ebb and tides in a rhythm in the same area.

I would like to take a SCT opportunity just don't see the value in scoring....

But it would be nice to have about 3 of those cards just for my personal use.

How many baddies? Those will be the biggest drag on your score, quite simply.

Getting a store card is not adding to your credit "mix". It's just another revolving credit account, and you've already got more than three regular CC, the likely sweet spot for number of revolving accounts. Said another way, FICO does not recognize and reward you for getting the SCT completed ![]()

Clarification to others: OP already has an installment loan.

Back to the metrics: What are your scores, OP? That by itself is an important place to start.

Yes, everyone is in a certain narrow range based on where their file is at a point in time. Only radical changes such as dropping baddies, paying down utilization, are the things that make a quick difference. The other factor is time, lots and lots of on time payments.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

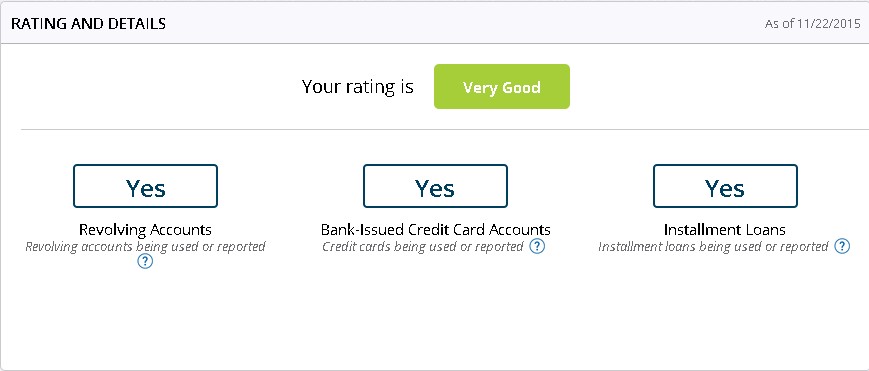

I've asked a couple times for someone with an "excellent" mix to post a screen shot, but no one ever has.

A little bit of research that indicates a store card will not boost your mix.

Here is a great recent thread

http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Having-Store-Cards-Necessary/m-p/4277683

Here is a decent old thread

There is some literature that indicates a true charge card will add to mix quoting FICO spokesman Anthony Sprauve

http://creditcardforum.com/blog/fico-score-credit-mix/

Revelate disputes this in his posts

Here's my screen shot. Maybe next year I will get a charge card and see what it does for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

my mix registers as "very good"

As does my payment history(1 late 11months ago) amount of debt (sub 9%)

the late pymt is my one baddie....and it's recent.

my mortgage's have always been on time and time on those accts is over 15yrs. .....but my new home is only 3yrs old and I'm working on getting that equity built up.

I suspect it will just take time now that I have a lot of new cards and need my mortgage to age as well.

as of today EQ 701, TU 718, EX 696

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

@Anonymous wrote:

Here's my screen shot. Maybe next year I will get a charge card and see what it does for me.

Where is the "credit mix" image from?

And point of clarification, a Store Card is different from a Charge Card aka AMEX Green, PRG, or Platinum card.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Does the "mix" really matter?????

@Cmikul wrote:my mix registers as "very good"

As does my payment history(1 late 11months ago) amount of debt (sub 9%)

the late pymt is my one baddie....and it's recent.

my mortgage's have always been on time and time on those accts is over 15yrs. .....but my new home is only 3yrs old and I'm working on getting that equity built up.

I suspect it will just take time now that I have a lot of new cards and need my mortgage to age as well.

as of today EQ 701, TU 718, EX 696

I don't know the specifics around this, but anything you can do to get that one baddie off your report, that's where your biggest boost to FICO score will come from.

Maybe ask in the Rebuilding forum, see what methods may be available to pay for deletion or something, otherwise it's going to be hanging on there for many years to come, keeping your score down.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765