- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Equifax FICO 08 percentiles

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Equifax FICO 08 percentiles

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Equifax FICO 08 percentiles

Since a lot of us Score Watch subscribers have been switched to FICO 08, let's put our heads together to figure out the percentile chart for this newer scoring model.

I'll go first. Please add your scores in ascending order and percentiles.

744 - 61%

Updated 8/24/14:

575 - 20%

589 - 22%

596 - 24%

617 - 27%

618 - 28%

638 - 32%

648 - 34%

649 - 34%

650 - 34%

651 - 34%

653 - 35%

654 - 35%

661 - 36%

669 - 38%

670 - 38%

672 - 39%

673 - 39%

674 - 39%

675 - 39%

677 - 40%

678 - 40%

680 - 41%

681 - 41%

682 - 41%

683 - 41%

689 - 43%

695 - 45%

699 - 46%

700 - 46%

701 - 47%

702 - 47%

703 - 47%

713 - 50%

717 - 51%

718 - 52%

719 - 52%

720 - 52%

736 - 58%

744 - 61%

747 - 62%

756 - 65%

759 - 66%

760 - 67%

761 - 67%

762 - 67%

767 - 69%

773 - 71%

776 - 73%

779 - 74%

781 - 75%

782 - 75%

790 - 79%

792 - 80%

798 - 82%

801 - 84%

807 - 87%

809 - 89%

812 - 90%

841 - 99%

843 - 100%

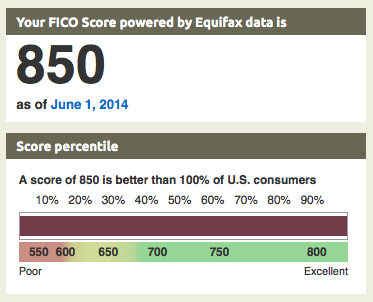

850 - 100%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

i wil be canceling this service, have had it since early 2012. Just did a tri merge report for a home loan yesterday and all 3 scores were 710-745. This new scoring model shows me at a 635, it says short history... only 15 years and 40+ good accounts. 1 negitive account from 5 years ago. this scoring is a joke.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

@Sarabehm wrote:i wil be canceling this service, have had it since early 2012. Just did a tri merge report for a home loan yesterday and all 3 scores were 710-745. This new scoring model shows me at a 635, it says short history... only 15 years and 40+ good accounts. 1 negitive account from 5 years ago. this scoring is a joke.

Just because it says 'short history' does not mean that is the reason your score is lower than you expected. Scorewatch is known to provide strange statements like that. Whether you cancel or not, the scoring will not change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

I understand that, i just called to cancel and the guy that we talked to say "yea this new system isnt right" because yesterdays score watch alert for the inquiry was 748 and now its in the 630s.... I don't think so. This score is no longer relevent to us. the tri-merged scores were very close to the old FICO scores. but now they are 100+ points off and the new truck my husband bought used auto enhanced scores that were in the 760s....

they need to rethink this scoring model thats why transunion's vantage score is taking off with some of the credit unions we use

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

@HiLine wrote:Since a lot of us Score Watch subscribers have been switched to FICO 08, let's put our heads together to figure out the percentile chart for this newer scoring model.

I'll go first. Please add your scores in ascending order and percentiles.

744 - 61%

798 -- 82%

(I just got the update to '08 today, and after all that anticipation and wondering, my score didn't change by a single point. My profile is: long, long history, AAoA 13 years, 6% overall util (but three cards of six reporting right now, darnit!), no mortgage or other installment loans, credit cards only, never a missed payment, no baddies.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

@Sarabehm wrote:i wil be canceling this service, have had it since early 2012. Just did a tri merge report for a home loan yesterday and all 3 scores were 710-745. This new scoring model shows me at a 635, it says short history... only 15 years and 40+ good accounts. 1 negitive account from 5 years ago. this scoring is a joke.

So what is your Score Watch percentile?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

Since a lot of us Score Watch subscribers have been switched to FICO 08, let's put our heads together to figure out the percentile chart for this newer scoring model.

I'll go first. Please add your scores in ascending order and percentiles.

744 - 61%

798 - 82%

809 - 89%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax FICO 08 percentiles

@Anonymous-own-fico wrote:

If I'm not part of the 100%, then what?

That is awesome!!! Can I borrow a few of those points? ![]()

April 2024: EX8: 839; EQ8: 845; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .