- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Equifax is reporting a recent consumer finance acc...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Equifax is reporting a recent consumer finance account being added but....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

Great reply, Sarek.

You are absolutely right that people do get into trouble with 0% credit card offers and HELOCs and so forth. You are right to emphasize the way that people are targeted for these, that lenders are not trying to "help" them but rather trying to exploit weaknesses. Their hope is that they have found a person who will run up debt will end up paying huge amounts of interest.

But FICO has a way to track the riskiness of such people: namely CC utilization.

The riskiness of a person who uses CFAs instead of credit cards is not revealed via his CC utilization, so FICO has resorted to other ways to identifying that risk (namely the presence of accounts tagged as CFAs).

But for the record, let me say that I disapprove of how CFAs are handled by FICO and why. (Otherwise you guys might see me as a defender of all this.)

My biggest concerns are (1) transparency and (2) the way that CFA-detection in scoring models violate (in my opinion) the spirit of the Fair Credit Reporting Act.

Transparency

First, it can be a hugely difficult task to figure out what accounts on one's reports are being tagged as a CFA. That shouldn't be the case. If CFAs are indeed a marker of risk, then a person should be able to see (at least after the fact) what accounts are harming his score. This is a problem with one's reports -- a CRA problem.

Second, this is an area where FICO does a terrible job of disclosing risky behavior to consumers. FICO doesn't need to disclose HOW exactly a CFA hurts your score, but they should do a better job at disclosing THAT a CFA can hurt your score. FICO does an admirable job at explaining the big picture of how to have a good score: pay bills on time, keep CC utilization low, have a mix of installment and revolving, etc. Nowhere do they mention that broadening your mix to certain kinds of well-paid accounts will harm you. Check the LEARN ABOUT SCORES section here and you'll see they are silent about this.

I feel if FICO did a better job at being transparent in this second sense, we wouldn't need a detailed list of every possible account and lender that is tagged as a CFA. In general, it's not hard to predict when you are opening an account that might well be a CFA (it's when you are opening an account with a merchant to buy something specific).. The problem is that so many of us don't know what a CFA is and that it hurts our scores until it is too late. And then (#1) even then it's still hard to figure out which account is the culprit.

Violating the spirit of the FCRA

When FICO (or Vantage) penalize a person for a closed well-paid CFA, that harm continues to accrue to his score for TEN years (until the account falls off). In my opinion, the people who drafted the FCRA clearly intended for "negative" items to lose all ability to affect your score after 7 years. FICO is not doing anything illegal (note that I said "spirit") but it still feel really wrong. I'd have less of a problem here if FICO would agree to ignore the scoring harm once a well-paid CFA had been closed for 7 years.

I also think that if they are truly treating a CFA like a late, then like a late all reports should clearly identify CFAs in the "Negative" section (getting back to the issue of Transparency).

What To Do In The Meantime

Moving forward, people should assume that if anything feels like it might be a CFA, don't open that account. Use a rewards credit card to buy it and then pay in full. Second best is to use a major credit card that has a 0% promotion. I call that second best because it doesn't address the underlying issue of why am I buying something that I can't afford? There are smart reasons to do that occasionally, but they are rare. Better in most cases is to buckle down and live frugally. Once upon a time people actually did that -- I think it is in the history books somewhere.

If a person has a CFA reason code from something in the past, what I would do is to everything I can to identify what account it is. Calling each CRA might work. Their databases by definition almost certainly have a metadata tag that is stating that an account is a CFA. Somebody at one of the three CRAs may be able to help. Then I would call the creditor (or write Goodwill letters) and cry and wail and see if you can get them to delete it outright. Attempt to evoke pity.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

Ok so im soo irratated with Equifax.

I spoke with myfico on the phone, it took quite awhile but the customer support supervisor found what he thinks is causing the consumer finance account derrogatory.

I have a chase mortgage from back in 2011 that was closed. with TU and EX the payments are recorded and the its being reported as closed.

With EQ there are no payments being reported in the payment history and instead of being reported as closed its showing as unknown

So he thinks this is the only one that could maybe be causing the problem. So he suggested contacting EQ... thats where I blew my stack.

I must have called 10 different occassions... could barely understand the person on the other end and EVERY time I called all they wanted to do was make me purchase another report even when I told them I had my free report from a month ago they always insisted that I needed to pay for a new one in order for them to help me.

TOTAL SCAM IMHO

im soo irratated.

just had to vent

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

@Anonymous wrote:OK Sarek. I'll reproduce LowKey's question below and then do my best to give some thoughts.

@Anonymous wrote:I'm just confused as to why financing wood flooring would be considered a negative. What if it was 0% interest? Why are people being penalized for being extended that type of credit?

The first thing to bear in mind is that when we use the word "penalized" we have to remind ourselves that this is different from a Teacher punishing us, singling one person out for something he wrote on his term paper and taking 10 points off with a big red pen.

FICO is not criticizing us as individuals, not judging us, not even claiming that this particular individual is likely to default on debts. Instead, it only means that FICO's statisticians have found a "marker", an indicator common to a big group of people. It's a claim about this big group, not about the individual creditworthiness of any individual in the group. Nor (and this is crucial) is FICO claiming that all people in the group in question are ALL more likely to default on debts. It's just one marker that can help predict something to some extent.

Many examples exist in the life and medical sciences. If a 50 year old man has an elevated "PSA" test, that does not mean he has prostate cancer. Nor does it mean that if he has a perfect PSA test that he doesn't have prostate cancer. It's just that the PSA is one marker that has been somewhat helpful in diagnosing cancer across a large body of people -- but it is only one marker.

Let me give you one more example in the credit world. That's CC utilization. A person could say: hey, I always pay my credit card bills in full. Why do I get penalized for using 12% of my credit card -- is FICO really saying that using 1/8 of my credit card makes me risky? I just don't get it. Maybe it was a really smart thing to buy, maybe it actually showed smart financial managment.

Well, that person would be right in a way. But all FICO has to go on is these big statistical markers. And until very recently, it could not see if you paid your bills in full. So it had to use the best statsitical markers it had. And its statisticians found that the class of people with a utilization of 1-9% defaulted less often than those who had 11-14% (other things being equal). So any individual with a 12% util might be much more financially smart and responsible and much less risky than someone with a 7% utilization. But the algorithm can't assess individuals in quite that way (though in the future it will be better at doing that). It can only see what groups you belong to.

OK, so that's some broad conceptual stuff to bear in mind before we dive into the specific question about CFAs. That preface was was important, however, because otherwise we'll have a tendency to slip into the model of a Teacher "penalizing" an individual, which is not how FICO thinks. FICO thinks about statistical groups.

Given all that, the question becomes this. Why might FICO's statisticians have found that, other things being equal, and considered only as a large statistical class, people who have consumer finance accounts tend to be riskier than those who do not?

Here involves speculation on my part, but it seems fairly plausible. Consumer finance accounts are in most cases a sign of people who want to buy things that they do not have the money to pay for. They are for people who live hand to mouth, paycheck to paycheck. Their sales appeal is "Get this awesome dining room set at no money down and no payments due until ____." That's a huge appeal to such people. It gives them something for nothing -- it's the rabbit out of the magician's hat.

Now it is true that such people sometimes do NOT use CFAs, but rather run this sort of debt up on credit cards. But then FICO has a way of tracking and measuring the riskiness of such people: namely via their CC utilization.

It is sometimes said that CFA use is a marker of sound financial management, since the person may be getting a 0% rate and can then make the cash he has in the bank "work" for him. But this is rarely true. If you crunch the numbers, the amount of money you make by having your money earning interest in a high-yeild savings account is almost nothing. The "0%" is a hook to induce you to spend -- the CFA almost always still costs you money (money in lost rewards cash back that you could have made with a Citidouble cash card, for example, to say nothing of the fact that you may be spending more money than you would if you paid cash).

So, back to this statistical group of the people who get CFAs: their typical demographic is a person who can be easily seduced into buying stuff he cannot pay for. They are people with low amounts of safety net savings and a high tendency to live paycheck to paycheck. Not everyone in that group is like that (any particular person on this thread is probably a happy exception) but many of them are. People who tend to run up bills with small savings and who live paycheck to paycheck tend to have much higher risk of default -- if unexpected medical expenses occur, if they lose their job, if their engine blows on their car, they may quickly become unable to pay debts.

THis is one reason why FICO might use the presence of CFAs on a person's report as one of many markers to compute his score.

I guess I should have been more clear.

I wasn't thinking of it as you described - teacher punishing a single student, or whatever... rather... there's a lot of people who do not have the income to support large, but necessary purchases.

Single mom living paycheck to paycheck because that's her reality, but squirreling away little bits of extra money who always pays her bills on time versus johnny go-spend-alot who doesn't need to live paycheck to paycheck, but is 'easily seduced into buying stuff he cannot pay for'.

This is a direct penalization to lower income brackets and there are surely much better ways to identity Johnny go-spend-alot versus someone who is utilizing that type of credit because the cost of living versus minimum wage is completely unbalanced.

Given that the majority of consumers have good credit, I find it hard to believe that a CFA is a quality indicator of risk. You can't really identify people spending 'outside of their means' without their income information and what they have in savings reserves. Someone with 100k in available revolving credit could be stretched paycheck to paycheck and have a 'low' utilization.

I remain critical of the risk factor, especially when it's been paid off with no missed payments.

But... this is just my opinion. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

Very thoughtful response, Lowkey!

It's really hard for us to do anything more than speculate (me included) since we lack FICO's data on millions of consumers and we are not professional statisticians. It's very possible that using the presence of CFAs was never predictive of risk -- that FICO simply made an irrational decision from the beginning and it is still there. It's also possible that it was predictive of risk at one time (perhaps as late as 2007 when the FICO 08 model was being developed) but is not anymore -- in which case perhaps it has been dropped in FICO 9. (I'd be curious to hear whether people get this reason code in the FICO 9 model.)

I do want to point out that it seems as though you are doing two things.

(1) You are attaching moral weight to FICO's risk assessment. You are thinking about people whom you sympathize with (single moms who are financially strapped -- it's not their fault that their husband left, etc.) vs people with whom you do not sympathize (grasshopper types that you call Johnny Can Spend). You are trying to evaluate whether you morally approve of why they are living paycheck to paycheck, rather than coldly looking at the fact that they are financially strapped. People who live P2P are, considered as a group, riskier than those who do not.

FICO, however, does not do that. It does not engage in any way in moral assessments of individuals (or in societal conditions, e.g. the state of minimum wage laws). It simply does its best, given the data it has, to coldly predict the risk that a person will become severely delinquent.

(2) You are arguing by individual cases. That is, you can visualize individuals for whom (as you see it) the statistical marker being discussed would not predict risk, and are concluding that therefore the marker is invalid.

But again, that's not how FICO thinks. It never claimed that any of its risk markers applied to all individuals who bear that marker. CC utilization is a classic example (and one of the reasons I gave it). One can imagine many people who always pay their CCs in full and who are basically Joe or Jane Responsible (lots of money in the bank, etc.). And yet their CC utilization is always 40-70%. They just place their monthly spending on their card and pay it off after the statement prints. Unfortunately, because FICO in the past never had access to trended data, it could never tell whether people paid their cards in full. So it used the best markers it could find.

Likewise I gave the example of PSA testing for men being evaluated for prostate cancer. For many individuals, a high PSA result is completely consistent with no P-cancer. And for others, a perfectly normal PSA result can be consistent with the actual presence of cancer. But doctors decided that PSA testing was, with all its limitations, still a fairly helpful marker (only one of many) for assessing the presence of P-cancer.

I remain critical of FICO's use of CFAs for the reasons I gave earlier in the thread. But one of my reasons is not that they are bad predictors of risk. FICO might well have made a sound decision (viewed purely on the basis of the task of coldly predicting risk) -- hard for me to say since I can't see their data. What I was doing is trying to help peoiple imagine why FICO might have done that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

@Anonymous wrote:Ok so im soo irratated with Equifax.

I spoke with myfico on the phone, it took quite awhile but the customer support supervisor found what he thinks is causing the consumer finance account derrogatory.

I have a chase mortgage from back in 2011 that was closed. with TU and EX the payments are recorded and the its being reported as closed.

With EQ there are no payments being reported in the payment history and instead of being reported as closed its showing as unknown

So he thinks this is the only one that could maybe be causing the problem. So he suggested contacting EQ... thats where I blew my stack.

I must have called 10 different occassions... could barely understand the person on the other end and EVERY time I called all they wanted to do was make me purchase another report even when I told them I had my free report from a month ago they always insisted that I needed to pay for a new one in order for them to help me.

TOTAL SCAM IMHO

im soo irratated.

just had to vent

I doubt it.

That said if it's not reporting payment history and is in an unknown state, I'd suggest that qualifies as innacurate reporting and just go and dispute it. After the dispute is fully recognized (and this one will probably go full monty) pull the report that has reason codes again and see if the CFA tag is gone with the dispute in flight though it's not 100% it will get discounted during the dispute unfortunately so this might not be 100% accurate.

The account isn't help you from the looks of it with it's being a broken tradeline, get it updated or get it deleted and then see what the reason codes suggest.

Everything suggests that tradelines in a unknown / broken state aren't counted at all, I'm nearly 100% confident that it's something else but I could be wrong.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

@CGID - I should clarify that I am a software engineer and I work in the finance industry, previously at Cap1 working on CreditWorks, actually. I currently work on algorithms involving finances, credit risk is one of them.

While you are correct that the algorithm itself does not hold any moral weight, us engineers that write them... well... we do.

We intake a collection of data and look for various peaks and valleys, correlate them to various resulting actions, and write equations that spit out a number that attempts to give its best judgement from a predetermined scale. Statistically, we think because we maybe get it right most of the time that our data points are acceptable causation, and we truly do use our collective human reasoning to determine this.

Though we can say, well, a CFA is an indicator of risky behavior, it might not likely be the underlying cause. It is usually a symptom of something else.

People with little or no savings and other assets are nearly always considered a risk in lending - even though it's not a part of a FICO score. Most people who don't have a savings or assets for collateral are low income.

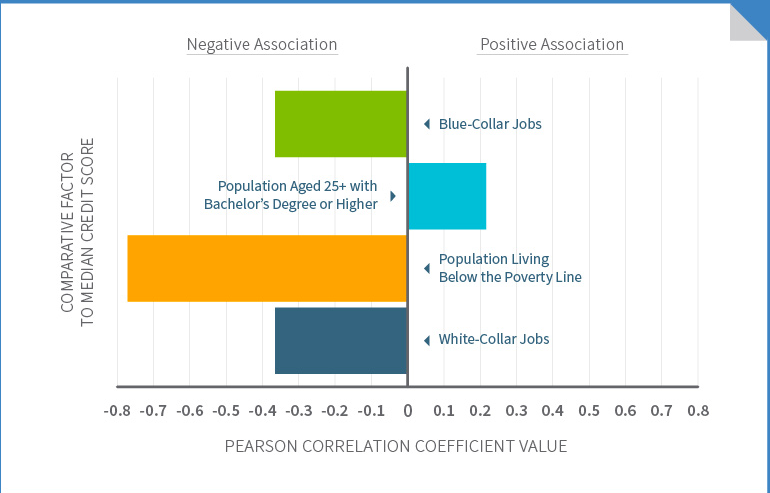

One thing we know for certain is that credit scores near-lineraly increase with median income. Predatory lenders often go after people who have no credit at all, and low income, quite probably moreso than they do people with poor credit in general.

High income individals have a median FICO8 score of nearly 780 - and that's only considering 120%+ MFI. The lowest median credit scores are found in the areas with the lowest median income. At 50% MFI, we go from most people having prime-worthy scores, to most people having sub-prime scores. Once you start moving into below 30%, you're in the average score range of sub-600.

Another direct correlation is education. Again, we see a near-linear rise in credit score medians with average education reached. There will always be outliers (I dropped out of high school, for example, because of personal issues, and have 8 years of college credit with no degree), but for the most part, these all point directly to the socioeconomic reality that it's easier to have good credit with a good education, and subsequent good career. Obviously that doesn't mean it is impossible, but it's pretty clear that something is wrong here.

In ITFin, I don't know A SINGLE PERSON with bad credit - we also are all fairly well educated (pretty much everyone with a CompSci BS degree) and making mid to high six figure incomes. All the people I know with poor to fair credit are struggling to make ends meet with incomes 50% or lower compared to MFI and have little to no college education.

I should emphasize that while this is not the fault of the algorithms, or even those that write them or analyze data points, peaks, or valleys... but perhaps the financial industry as a whole, at least in this country.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

Ohhhhh! OK. I think we were just talking at cross purposes.

I agree 100% that there's all kinds of complex social forces at work that can result in any individual or group of individuals to be the sort of people who'd have a higher risk of getting behind on payments or defaulting altogether. Poverty and education are the two biggest ones.

In other words, if somebody is a trust fund baby and gets sent to MIT or Harvard then yup, he'll be less likely to have financial trouble than somebody raised in rural Appalachia.

And man do I ever think (as a private person) that this should be on the radar of all decent people, regardless of where we fall on the political spectrum. We should certainly be thinking about that as individuals and together in civil society as we try to move forward together as a country.

But as far as I understand it, FICO isn't in the business of proposing solutions to social problems. It sounds terrible, but its stockholders don't want it to do that and its customers (Chase, BOA, Citibank, etc.) aren't paying it to do that. FICO's job is just to do its best to assess risk based on the data provided to it by the big three CRAs. If CFAs are indeed a marker that is associated with risk (why is speculation on my part) then what its customers want is for FICO to build that in so that they get the best assessment FICO can give (again, based on what the CRA gives them).

PS. I am not sure if you are much of a TV or movie guy, but in case you are, and just so you know that your concerns are not falling on deaf ears in my case, three very different titles I love are Winter's Bone, The Wire, and 99 Homes. That's a dramatic work dealing with (respectively) rural Appallacia, inner city Baltimore, and the effect of the post-2008 financial meltdown on a Joe Average working man. So I promise you I am very sympathetic to the issues you raise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax is reporting a recent consumer finance account being added but....

I love a multitude of fine arts. I really appreciate the recs. I will check them out.

I am a member of the upper income, but I grew up in poverty. My mom stole my identity when I was a teenager, and continued to steal money from me, even when I was a single mother, because of our striking similiar appearances using my physical ids. I've experienced a myriad of economic levels, from being homeless, to building my first house with an income that allows me to do so without the support of a secondary income, paying child support, and being essentially the sole provider for my daughter.

Which leads to another factor - inherit intelligence.

I believe that increasing awareness of these parallels, and people who are capable of taking steps to address them are key. I am one of the loudest 'run far, far away from predatory lender' forumists in the rebuilding section for this very purpose. Most people pay their bills on time... and the majority of people with poor credit don't actually default on their responsibilities, rather they are perpetually behind, or in over their head in dead with high interest until they die, with little, to no benefit seen from their ability to manage what they have, with what they've been forced to spend.

Ultimately, I'd like to take my obtained software and math skills into building tools and educational sources for people who only need some guidance and direction to combat the lenders who sell them on the 'you can afford it if you stop drinking coffee, and you need it now' mentality while behind the scenes they are making $20,000 off of a $7,000 loan, and the consumer spends 5-6 years in debt for virtually no benefit.