- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Equifax

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Equifax

I'm new to this site and apologize in advance if this issue has been addressed....anyway, my wife and I recently sold our home and are renting while we look for a new one. I pulled scores from all three reporting agencies and found that they all dropped because I did not have a mortgage. , Huh???? I don't get it. Also, Equifax has a score that is almost 40 points less than the other two. The only difference I can find is that (even though I have had credit since 1974) Equifax is only showing a 9 !/2 year credit history while the other two show around 19 years. Why the discrepancy? Equifax claims that there is nothing that can be done about it because my older accounts were removed because they were over 10 years old. My Equifax score dropped from around 710 to 668 after we sold the house. The other two dropped from around 730 to the low 700's. What is going on? Any input would be greatly appreciated....Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

All 3? Where did you get the scores from? Seems like you did not get FICO scores if you say you got all 3.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

The three scores came from Equifax....their 3 in 1 deal. I should have clarified...Is this what you all call the FAKO score?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

@Anonymous wrote:The three scores came from Equifax....their 3 in 1 deal. I should have clarified...Is this what you all call the FAKO score?

Hello and welcome.

No one has been able to buy their own Experian FICO score since February of 2009. Creditors can pull Experian and also there is a CU in Pennsylvania that supplies that information to it's members only. You can only buy true FICO scores at a few places. One place is here at myFICO. I suggest you do an internet search for "myfico discount codes" to save a little money. You can also purchase your Transunion score at www.transunioncs.com. At www.equifax.com EQ will still sell you an EQ FICO score but they make it very hard to find.

You probably bought the Equifax Complete product is that correct? None of those scores are FICO based scores unfortunately.

From a BK years ago to:

EX - 9/09 pulled by lender 802, EQ - 10/10-813, TU - 10/10-774

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

Thanks for your help...In short..Yes, I bought the Equifax complete. The scores are all different.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

@Anonymous wrote:Thanks for your help...In short..Yes, I bought the Equifax complete. The scores are all different.

It's not unusual for the scores to be different from each of the CRA's. They all use slightly different scoring formulas and it's very rare that the infomation used to calculate a score is exactly the same. My TU score is 39 points lower than my EQ with pretty much the same data.

But......the reports you got there can be relied on if that's any solace???? ![]()

From a BK years ago to:

EX - 9/09 pulled by lender 802, EQ - 10/10-813, TU - 10/10-774

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

An account that has been closed will stay on your reports for about 10 more years. The oldest account and the average age is based upon accounts that are on your reports. This is why it is a good idea to keep any old accounts open. This usually means revolving accounts since an installment account is automatically paid off and closed when the last payment is made. I have found EQ to drop accounts first, followed by TU, followed by EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

I really appreciate all the help...The thing that I really don't get is that all of the scores actually dropped after I sold the house. The "Equifax Complete" explanantion is that the score dropped because I don't have a mortgage. Kind of a "Catch 22". They just made it a little harder to get that mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

@Anonymous wrote:I really appreciate all the help...The thing that I really don't get is that all of the scores actually dropped after I sold the house. The "Equifax Complete" explanantion is that the score dropped because I don't have a mortgage. Kind of a "Catch 22". They just made it a little harder to get that mortgage.

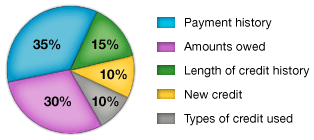

Credit mix is a small (10%) part of scoring but it is still counted. The rationale is that showing responsible use of different kinds of credit i.e. credit cards, installment loans, mortgages makes one a better risk. Here is how scoring is broken down.

From a BK years ago to:

EX - 9/09 pulled by lender 802, EQ - 10/10-813, TU - 10/10-774

"Some people spend an entire lifetime wondering if they've made a difference. The Marines don't have that problem".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Equifax

@Anonymous wrote:I really appreciate all the help...The thing that I really don't get is that all of the scores actually dropped after I sold the house. The "Equifax Complete" explanantion is that the score dropped because I don't have a mortgage. Kind of a "Catch 22". They just made it a little harder to get that mortgage.

The Equifax 3-in-1 scores are FAKO's, and so is their advice. ![]()

Your FICO scores might have gone up, down, or stayed the same. They don't consistently relate to changes in FAKO's.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007