- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO 5 EQ vs FICO 8 EQ

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO 5 EQ vs FICO 8 EQ

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 5 EQ vs FICO 8 EQ

@SouthJamaica wrote:

@Revelate wrote:Anecdotally FICO 8 focuses on weights recent data more heavily when it comes to derogatories.

Tax lien added with an old lien already on report:

FICO 5: -5 points

FICO 8 -52 points.

Probably coincidental but they landed within 3 points of each other; by the six month mark my score had recovered on FICO 8. Similar behavior is seen with other types of derogatories; does not apply to clean files of course.

Also FICO 8 effectively mandates having both credit cards and installment loans open, and at pretty utilization metrics for both for optimal scoring. FICO 5 didn't particularly care: we saw that when we made the transition to FICO 8 on Scorewatch and 2 people each dropped from 680-690 to 636-640 from not having any open credit cards and just having installment history.

Also FICO 5 doesn't care about installment utilization, loan counts for credit mix and that's it.

Look in the reason codes for your particular differences TBH.

Followed your excellent advice to compare the negative reason codes!

The following reason codes appeared for FICO 5 which did not appear for FICO 8, thus giving me a clear path to improving the FICO 5 score:

new recent acct

recently looking for credit

too many cards carrying balance

Well that answers that, for my situation

Gotta remember that trick for future instances of wonderment at why a partcular score is lagging.

Bueno, out of curiosity for comparison purposes what were the reason codes for FICO 8?

Presumably with enough data around this from a number of people we could start trying to figure out some of the weighting differences, maybe. Big project and probably not enough contributors and it's purely an intellectual exercise compared to optimization strategies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 5 EQ vs FICO 8 EQ

@Revelate wrote:

@SouthJamaica wrote:

@Revelate wrote:Anecdotally FICO 8 focuses on weights recent data more heavily when it comes to derogatories.

Tax lien added with an old lien already on report:

FICO 5: -5 points

FICO 8 -52 points.

Probably coincidental but they landed within 3 points of each other; by the six month mark my score had recovered on FICO 8. Similar behavior is seen with other types of derogatories; does not apply to clean files of course.

Also FICO 8 effectively mandates having both credit cards and installment loans open, and at pretty utilization metrics for both for optimal scoring. FICO 5 didn't particularly care: we saw that when we made the transition to FICO 8 on Scorewatch and 2 people each dropped from 680-690 to 636-640 from not having any open credit cards and just having installment history.

Also FICO 5 doesn't care about installment utilization, loan counts for credit mix and that's it.

Look in the reason codes for your particular differences TBH.

Followed your excellent advice to compare the negative reason codes!

The following reason codes appeared for FICO 5 which did not appear for FICO 8, thus giving me a clear path to improving the FICO 5 score:

new recent acct

recently looking for credit

too many cards carrying balance

Well that answers that, for my situation

Gotta remember that trick for future instances of wonderment at why a partcular score is lagging.

Bueno, out of curiosity for comparison purposes what were the reason codes for FICO 8?

Short credit history; that one appeared on both. That was the only negative reason code on FICO 8.

Presumably with enough data around this from a number of people we could start trying to figure out some of the weighting differences, maybe. Big project and probably not enough contributors and it's purely an intellectual exercise compared to optimization strategies.

Well in my case I can say this: those 3 reasons appear to have accounted for a 65 point difference between FICO 8 and FICO 5 from the exact same data [I misspoke earlier when I said it was a 73 point difference]. The scores were 720 for FICO 5 and 785 for FICO 8. That's an awful big spread, in my opinion, considering how minor these things were.

But one could also conclude that the score difference supports basically all of the factors mentioned by you and JLK93:

-open installment loan utilization percentage: i have that highly manicured and perfected for FICO 8, but FICO 5 doesn't seem impressed

-open installment loans: here again I have the SSL open, with a $37 balance, for no reason other than to appease FICO 8, but FICO 5, again, is indifferent

-youngest account: it's as new as it could be, but apparently FICO 5 is more interested than FICO 8, since the FICO 8 monster was silent on the subject

-number of cards reporting a balance: for crying out loud, it's only 5 out of 24 accounts, which FICO 8 could care less about but FICO 5 does not like, it appears

-revolving utilization: it's around 1.7%; FICO 8 wouldn't find that problematic in the least, but apparently FICO 5 does have a preference for my more usual .5%

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 5 EQ vs FICO 8 EQ

Well FICO 8 plays out of 850 for all CRA's, top end EQ FICO 5 is 818 and that's 32 points off the top.

i.e. it's not a full 65 points difference once you get into the higher scoring buckets, but it is absolutely interesting to note how many complaints you have (clean scorecard wise) on FICO 5 vs not on FICO 8.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 5 EQ vs FICO 8 EQ

@Revelate wrote:Well FICO 8 plays out of 850 for all CRA's, top end EQ FICO 5 is 818 and that's 32 points off the top.

i.e. it's not a full 65 points difference once you get into the higher scoring buckets, but it is absolutely interesting to note how many complaints you have (clean scorecard wise) on FICO 5 vs not on FICO 8.

Yes, 4 versus 1.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO 5 EQ vs FICO 8 EQ

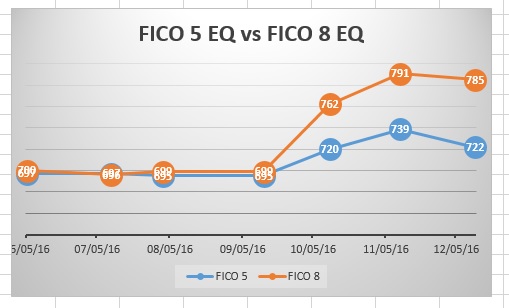

Actually maybe this chart conveys a different story. When I got rebucketed due to my only negative aging off, my FICO 8 soared; my FICO 5 less so.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687