- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO Auto Score 8-what's a good score?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Auto Score 8-what's a good score?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Yes, they listed 350 as the lower boundry. I searched, and didn't find any model that would fit that. I know that they pulled something from EX, as I've gotten the alert from CCT, but other than that, I have no way to truly know if what they told me was true at all. The underwriter said the score wasn't the problem anyway, that the accounts were too new.

Even though my other lenders haven't had a problem with it, I'm OK with it if that's their reasoning.

Wasn't trying to badger the guy at all, just asked a few really simple and straightforward questions. This is a billion dollar CU and I expected to get this information without a problem. Now I know better.

I think this little situation has finally pushed me into the credit burnout zone. I've accomplished everthing I set out to do and more from when I started working on my credit last July. I'm headed for the coolness of the garden and going to let time do it's thing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

There are a couple non Fico, non VantageScore models that bottom out at 350.

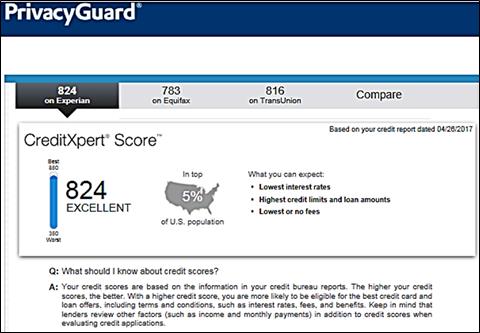

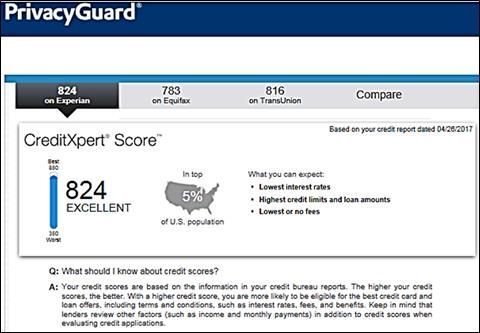

They include CreditXpert and a consumer credit score called CE score from CE Analytics. CreditXpert is currently being used and marketed. Not sure about CE score

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

I looked for any sites that offered free access to those scores, but came up empty. They are both marketed as "educational" scores. Hard to know what where the score they sent me actually came from, but I'm very sceptical it's a FICO8 auto. In looking through the credit pulls data base, there are many instances of people who claim to know their actual FICO8 score being quoted a much lower score from a CU. Perhaps it's a common practice in the industry.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

I know this is an old thread, but I applied for a car loan through Kia Motor Finance. They showed me 9 different auto fico scores ranging from 630 to 720 from the three CRAs. They still gave me 2.99% financing for 72 months with no money down and a $8000 trade, paying off a $17,000 loan. My monthly payments are $591 for a $24,000 car with full 100k warranty coverage, gap and the old loan payoff. A lousy deal but I'm not exactly savvy when it comes to money. I like the car. It's a 2017 Kia Niro hybrid base model. At least I didn't gamble the money away (or maybe I did), though the first car I got was defective. I had to get a replacement. Same model and color. I gave it a long drive today. Ran fine. On Monday I start the long drive from Arizona to Oregon. Good thing the first new car broke down right away before I was far from the dealership. I've had 3 other Kias and never had a problem. Just another thing that went wrong for me in Arizona. Time to pack and go home to the rain.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

@Anonymous wrote:I'm really not sure, but I'm assuming it's the lack of any installment data on my EX file. It's completely clean, but with a very young AAoA (6 m. and about to go down as I recently added two new trade lines).

I received the letter from them yesterday, and it listed only the number (690) and the range (350 to 850) as far as credit score information. My actual FICO8 from CCT is and was at the time of the pull 725. I talked to at least four different people trying to get the actual score model they used, and it was like trying to pull teeth, I explained as clearly as I could what information I was looking for, and was finally told it was FICO auto 8. I asked why it listed the score range as 350 to 850 and could not get an answer. The guy in the loan department seemed annoyed that I was asking these questions. I got the feeling this is a rare occurrence for them.

All in all, there was no real harm done in all this, and I learned some valuable information about FICO scoring for auto loans, and the general lack of competence of this CU. They really came across as uninformed and unprofessional. I'll keep my credit card open with them as a positive trade line, but I doubt I'll do any further business with them.

I think your score is CreditXpert. I do know that score pops up from time to time in the lending industry as a secondary option to Fico. I did find a way to obtain CreditXpert scores - not exactly free but, I was curious so I paid $1 for a 14 day PrivacyGuard trial membership which provides CreditXpert scores as part of their credit monitoring/protection service. [Note the 350 to 850 score range]

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Howdy all -

Since I'm the king of rambling - I'll try to keep this brief as I haven't a clue what these 2 pages are about.

1) Good god I'm confused about that speadsheet on Page 1 .... My TU and EQ "credit scores" (no matter where I pull from) are 778 - I have a medical bill and AoA issue with EXP, PLUS they only show 14 of my 17 accounts?!? One is a gas card and called them - and they said they don't report to EXP - so maybe the other 3 are the same? Either way, without that extra $10K-$15K as usable credit, now my UTIL is all messed up on EXP by 10% too (I'm at 3% on TU/EQ, but 13% on EXP!) - Not sure what my EXP score is? - but when I got my Amex card it said at the bottom it was 723 - but also applied for a CapOne QS card (and got my only denial in 3 yrs) which was like back in 2016 and in their 'rejection letter' it said my EXP CS was like 667 (going from memory) ... So I need to work on my EXP score obviously - just not sure what more I can do....

2) Seems the auto loan FICO8 (9 now?) is even more strigent - FWIW, MBUSA use TU and gave me the 1.99% / 2.99% CPO offer currently running this past weekend... So I'm searching for Auto Loans / Mfg's that only pull TU or EQ? ... Someone mentioned Wells Fargo - Bzzzzz - wrong - they def pull EXP, or at least in Colorado they do - Plus they're super slow with any balance updates - and haven't updated my records now since NOV 2017!!! (They say my account is fresh as of 5 days ago, yet my score is lagging around like 701 (w/BankCard 09, the newest one) - so I have to avoid that now too! till I get this medical bill removed - It's 5 yrs old and long ago written off and hear (read here) it won't affect my score if I pay it off anyways, right? And there's no guarantee after paying it'll get removed from my EXP report either, so may choose to just ride it out for 22 more months? TBD - Funny part is it's not on my TU or EQ reports but the place that filed it (the scummy CA) is literally 5 blocks from my house! - Tempted to go pay them a visit and 'negotiate' with a shot gun :-P (I'M JUST KIDDING!) ![]() Just chaps my arse, as they bought it for .10 cents on the dollar yet keep hiking it up monthly with fees etc...

Just chaps my arse, as they bought it for .10 cents on the dollar yet keep hiking it up monthly with fees etc... ![]()

3) Given my situation - Where does one go for an auto loan that pull only TU or EQ?

Just wanna get the best APR% deal and not step on a landmine should they pull an EXP report...

Cheers-

BB ![]()

PS: OK - after rereading Page 1 and the rest of Page 2 here again... On that chart (which needs updating to reflect BKC09 now) I have 3 Q's still...

1) As the original poster (OP) asked "What IS a good Auto Loan Score"?? Good question that seems to not really be answered clearly ... Anyone? T_T with all the charts and 850 & 900 perfect scores (if that's you?) I'd think would know this answer best... Or, what qualifies as a "well qualified buyer" with these Mfg offers? "800+" ?? ... or will my 778 scores get me anywhere???

2) What does that "10%-90%" represent across the top of your Auto Score chart?? I also see it again on your PDF link that you kindly provided us for FICO8... and shows my 778 is like 77% - what does that mean?? I'm certain it's something simple and basic but at 3:18AM - Yawn - my brain has checked out....

3) In CO (or southwest/Rocky Mtn region) can anyone recommend a decent C.U. that doesn't require jumping thru a million hoops? I had a run in with Chase back in 1999 after a very ugly "D" and got run thru the wringer with them - and they have *very* long memories - Ironically I just got a 'discharged/write-off' notice from them 2 weeks ago in the post mail from 20 years ago? (1999-to-2018) okay, so 19 years ago... So dunno if that clears my record? - But I currently only bank with HSBC, Barclay's, Wells Fargo, ING, BB&T, USAA and have a trading account with eTrade that is also a bank account with debit card attached (if anyone needs a 'No Check' checking account, defo do the e-Trade thing! They just want your $$$ ![]() ) - I did once bank w/TCF and Bank Colorado (or Colorado Bank & Trust?) yeah, the latter... but the closest branch was 92 miles away and they have HORRID customer service as I was travelling Europe once and despite me advising them of my travels, would constantly lock my card up!! Grrrr! So I'd have to wait 9 hours, and phone at $2.99/min from my mobile... Fun bank they are.... Not. Anyway... Am also looking for a place to bank for our Small Business - but with Wells Fargo just changing to BankCard09 which dropped my score about 40 pts (Double Grrrr) and their slow updates, my search continues - I used to love Wells when I lived in SoCal - but now? I guess I need to switch banks - I've never had any issues except with Chase as just mentioned... but they're not a C.U. obviously (none are clearly) - Another idea is that I did work for D.E.C. (aka Compaq/HP) once - so thought about going back to DECUS? - but don't know who they pull from...?

) - I did once bank w/TCF and Bank Colorado (or Colorado Bank & Trust?) yeah, the latter... but the closest branch was 92 miles away and they have HORRID customer service as I was travelling Europe once and despite me advising them of my travels, would constantly lock my card up!! Grrrr! So I'd have to wait 9 hours, and phone at $2.99/min from my mobile... Fun bank they are.... Not. Anyway... Am also looking for a place to bank for our Small Business - but with Wells Fargo just changing to BankCard09 which dropped my score about 40 pts (Double Grrrr) and their slow updates, my search continues - I used to love Wells when I lived in SoCal - but now? I guess I need to switch banks - I've never had any issues except with Chase as just mentioned... but they're not a C.U. obviously (none are clearly) - Another idea is that I did work for D.E.C. (aka Compaq/HP) once - so thought about going back to DECUS? - but don't know who they pull from...?

3B) How do I add my scores and card images etc in my footer? I don't see any options within my account setup on here (low priority obvs!) Thanks!

So much for not rambling ![]() - sorry again!

- sorry again! ![]()

TIA

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

I think your score is CreditXpert. I do know that score pops up from time to time in the lending industry as a secondary option to Fico. I did find a way to obtain CreditXpert scores - not exactly free but, I was curious so I paid $1 for a 14 day PrivacyGuard trial membership which provides CreditXpert scores as part of their credit monitoring/protection service. [Note the 350 to 850 score range]

...

Just for grins (b/c I saw your results and also was curious about my latest EXP report) I went ahead and signed up for the "14 day CreditXpert trial" - WOWZERS! - *ALL* my scores using CreditXpert are 100 points LESS than CCT/Others that I've checked recently - with my EXP one around with CreditXpert at 673! Ouch! ![]()

This is what I don't understand about the 'credit game' ?? - With these scores, while even CreditXpert are kind enough to still label me as "Fair" - everyone else that pulls my 775+ scores bend over backwards for me??!! - This is just not right or fair - and very feel sorry for peeps that pay $19.99/mo. to get this useless info - unless they're truly doing business with a company that uses this service and score - My understanding is FICO 8 and BankCard 8 are the N. American standards (I have a Vantage 1000 score in England of 985 as they go from 400-1000 and never remove anything, ever!) - so am happy for that -

But I digress.

I'll click around and see what's causing the damage w/CreditXpert - My TU is over 710 - so that's actually just a 65 pt difference - but still, ya know? Just doesn't seem right ![]()

Sad BB

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

@Anonymous wrote:Thanks for the info, T_T. I've searched all over for this without success. My auto score is indeed lagging considerably behind my FICO8. Hopefully the savings secured loan bumps it up some. Not much else I can do at this point except wait for my accounts to age, and it will take a good 18 months before I hit the 2 year AAoA, which I understand gives a noticeable score boost.

Comparing the negative reason codes in my most recent FICO 8 and FICO Auto 8 it appears that the Auto score is more sensitive to (a) the dollar amount of balances on the revolving accounts (b) the opening of new accounts and (c) the average age of accounts

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

Do the auto score models like to see the presence of an open auto loan? Do they look at closed auto loans? When I recently closed an auto loan (still had 1 open non-auto loan on file) I saw a 4-5 point drop on my Classic FICO 8 scores. I don't know my auto scores, but I would venture to guess that the drop was greater to those from the closure of an auto loan. Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Auto Score 8-what's a good score?

A long while back I suggested that this intuitively plausible common sense idea was likely to be the case. I.e. that the Auto flavors of FICO were likely to weigh Auto accounts more heavily than a Classic or Bankcard flavor. The exact details of that I was unsure but it just seemed obvious that the very nature of an auto flavor would involve this. A number of forum veterans came down on that idea like a ton of bricks, which baffled me at the time, but I didn't care that much so I let it go.

In the last year it seems like people are much more receptive to this idea, which is encouraging.

Assuming it to be true, I remain unclear about the details. For example, I wouldn't be certain that the auto loan has to be open. You need an open loan of some type to benefit from having a 1-9% installment utilization, but it's not clear to me that the auto loan needs to be open. Maybe the Auto flavor gives scoring benefit for closed auto loans that had a perfect payment history.

The practical risk in speculating about this is that it could induce a person to specific actions: e.g. Bob doesn't have an auto loan so he decides to get one to help improve his auto score. Buying a car is expensive! Nobody should ever make an expensive purchuse based on a hypothetical scoring benefit.