- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO's confusing explaination

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO's confusing explaination

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO's confusing explaination

Hello All

Maybe you can help me make heads or tails out of FICO's explanation of one of the things affecting my score.

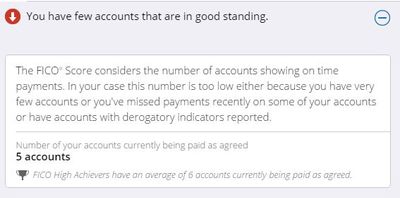

I have a FICO 08 EX score of 718. I know there is a paid medical collection on it and 2 - 30 day lates from closed CC. But one of their explanations is the screen shot below.

I have the following open accounts

home mtg - never late/ or miss

Home eq ln - never late/or miss

Car loan - never late/ormiss

masterC - never late/ or miss

Amex - never late/or miss

Student ln - never late/ or miss

That's 7 active good accounts, correct ???? One more than the average high achievers.

What gives to this explanation?

Thoughts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO's confusing explaination

Don't sweat the reason codes. They often aren't indicative of what is really going on. I've had the same reason code you've described above at times (and at times not) and I've got 20-21 positive accounts on my credit reports depending on the bureau, half of which are current/open and only 1 account with a late payment from ~4 years ago. It is what it is with reason codes at times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO's confusing explaination

Quick question.... for all the open accounts you list that are in good standing, was at least the minimum payment made each month, including the credit cards? (Please don't assume I am trying to get you to always use each credit card and make payments each month -- leaving some of your cards unused should be fine -- just trying to help make sense out of that reason code.)

The most straightforward thing to do when you get a baffling reason code is to carefully parse all the clauses and see if any apply to you. I agree that the first clause is untrue (very few accounts) and the second clause is unlikely to be true (though "missed payment" could simply be failing to make a payment -- not necessarily a late).

But the last clause is clearly true. You do have some accounts with derogs. So "look no further."

FICO has been around a long time, so its reason codes can be a mess, a slew of stuff being inherited from previous models and possibly combined in ugly ways. This strikes me as a good example. Much more helpful would be to receive a clear reason code for whichever of those three are true.

Because Vantage is a more recent entry into the market, its V3 reason codes are sharper and easier to make sense out of, in my opinion, much of the time.

Anyway, I'd just ignore this reason code and keep doing the stuff you know is good. You know it is good to have several accounts in good standing, some of which are CCs and some of which are installment loans. Check! You know its good to be always paying all your bills on time. Check! You know that its not good to have past derogs on your report -- so see if there is a way to get those removed. (People here can help you.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO's confusing explaination

@nupey10 wrote:Hello All

Maybe you can help me make heads or tails out of FICO's explanation of one of the things affecting my score.

I have a FICO 08 EX score of 718. I know there is a paid medical collection on it and 2 - 30 day lates from closed CC. But one of their explanations is the screen shot below.

I have the following open accounts

home mtg - never late/ or miss

Home eq ln - never late/or miss

Car loan - never late/ormiss

masterC - never late/ or miss

Amex - never late/or miss

Student ln - never late/ or miss

That's 7 active good accounts, correct ???? One more than the average high achievers.

What gives to this explanation?

Thoughts?

I agree with the other posters, that you shouldn't sweat it; it's not meaningful.

Personally I'm guessing it's saying you should have another credit card or something so that you can be even more profitable for banks.

I've received that reason code when I had a goodly number of accounts, so I'm pretty sure it's meaningless.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO's confusing explaination

@nupey10 wrote:Hello All

Maybe you can help me make heads or tails out of FICO's explanation of one of the things affecting my score.

I have a FICO 08 EX score of 718. I know there is a paid medical collection on it and 2 - 30 day lates from closed CC. But one of their explanations is the screen shot below.

I have the following open accounts

home mtg - never late/ or miss

Home eq ln - never late/or miss

Car loan - never late/ormiss

masterC - never late/ or miss

Amex - never late/or miss

Student ln - never late/ or miss

That's 7 active good accounts, correct ???? One more than the average high achievers.

What gives to this explanation?

Thoughts?

The detail explanation indicates this reason could be displayed due to:

1) You have very few accounts. I doubt this comes into play from your good standing accounts list above.

2) You've missed payments recently- this could come into play if we knew what exactly they mean by recently, since you have 2 late payments on your report

3) You have accounts with derogatory indicators. Definitely comes into play since you have a medical collection.

I suspect #2 and #3 is why this reason code is showing up. But as others have said, don't sweat it. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO's confusing explaination

Thanks again All.

Wish I would have listened to my Dad yrs ago when he told me to not do anthing to mess up my credit. Repair is hard work!

With all my good accounts at least minimum payments made on 2 of them ( student ln and Mtg ln).

Car ln gets $50 xtra, Home eq $100 xtra.

The closed CC which has the 2 lates ( dec'12 jan'13) dumping money into that( 2014 owed 8.1k, today 3.8k, end of this month will be down to 2.2k and done no later than Oct)

For the 2 CC I try to have one at $0 before posting and the other less than $100 before posting. I use those pretty much as ATMs, paying them weekly as if I was using ATM cash never really accruing any interest fees. I read this was a strategy to get them to raise CL without asking..... so far hasn't worked.......

Thanks again