- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO vs. FAKO – Share your FAKO stories

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO vs. FAKO – Share your FAKO stories

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

- Where did you get your FAKO score?

- Which FAKO score did you receive and from which bureau?

- Where did you get your genuine FICO® Score?

- Which FICO® Score did you receive and from which bureau?

- What type of loan/credit were you applying for? (type, rate, terms, etc. are all helpful)

- Share your FAKO story (What was your first impression when you received your FAKO score? How did you figure out that it was not a FICO® Score or that it was different than a FICO® Score? How did the FAKO score impact your loan/credit experience? )

1 & 2- Vantage Score 3 FAKO's from Credit Karma (TU-751, EQ-749), Credit Sesame (TU-732), Quizzle (TU-750), Credit.com (EX-746), USAA (EX-728), CapOne (TU-751)

3 & 4- FICO Score 8's from Amazon Store Card (TU-782), AMEX (EX-764), Barclay (TU-769), Citi (EQ-787), Discover (TU-785)

FICO Score 5? from DCU (EQ-738)

5- Only credit cards (CapOne QS, USAA Amex, CIti Simplicity). No loan plans for house (free and clear) or car (last payment next week!) anytime soon.

6- My only impression is that it seems the FAKOs used by the credit monitoring services are intended to make you think your credit score is lower than it actually is, perhaps to encourage you to use those services to improve your scores. I've never applied for a mortgage loan and it's been five years since my last auto loan application. All I recall from that experience was that I had seen my FAKO from one of those monitoring sites and thought I had a 660-670 score, but the salesman came back and said my score was somewhere in the 740s, getting me a decent rate.

* DCU Platinum $10K * USAA Rewards Sig Visa $18k * Chase Amazon Rewards Visa $7k * Kohls $3k * Amazon Store $10k * Citi DC $5.8k * Discover IT $5.8k * AmEx EveryDay $4.1k * Chase Freedom $3k * CapOne WEMC $10k * Barclay Cashforward $6.9k * Citi Premier $3.6k * USAA AmEx Cashback Rewards $18k * BoA Platinum Plus $15k * USBank Kroger 1-2-3 $10.5k * Amex Hilton Honors $8.7k * PenFed Platinum Rewards $10k * PayPal Credit $5.3k * NFCU GoRewards $18.6k * Walmart MC $10k * AMEX BCP $5K * 5/3 Bank Truly Simple $4.5k * AMEX Gold* CapOne Venture $10K* Chase Southwest RR $7.9k* Citi Costco $7k* Sam's Club MC $10k*

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I know that I have an old medical collections that was paid that is still on my credit report. It is two years old and was for only $217. Other than that, there should be absolutely no negatives on my credit report other than four hard pulls.

Here's where I am confused. On the Amex intro papers it said that I could get a free report from Experian. When I got it, it showed my score was only 688. Is it normal for a fako Report to be 130 points off?

Also, the experian report showed dozens of credit checks from different credit card companies that I have not even applied to. Discover has been checking it three times a month, every month. Please tell me that these are not hard pulls..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:

I am so confused. I just got my new AmEx Blue cash preferred card. They only gave me a $2000 credit limit. On credit karma, it shows that my transUnion score is 812 add my equifax score is 819. I make around $150,000 a year and have two Chase cards with a total of around $25,000 credit limit. I have a Kohl's card with a $2000 credit limit (I think). My utilization is 0%. I use them fairly heavily but pay off before they even post.

I know that I have an old medical collections that was paid that is still on my credit report. It is two years old and was for only $217. Other than that, there should be absolutely no negatives on my credit report other than four hard pulls.

Here's where I am confused. On the Amex intro papers it said that I could get a free report from Experian. When I got it, it showed my score was only 688. Is it normal for a fako Report to be 130 points off? Not sure how normal it is, but it happens. Up until recently, my TU Vantage 3 was that much lower than my FICO8.

Also, the experian report showed dozens of credit checks from different credit card companies that I have not even applied to. Discover has been checking it three times a month, every month. Please tell me that these are not hard pulls.. Those are soft pulls.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

How did you go about getting the EQ score up?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

Experian:

FICO: 686

USAA Vantage: 715

Equifax:

FICO: 694

CK: 717

TU:

FICO: 689

CK: 713

I guess it's not a huge difference, but I really like seeing the 700 range on my FAKOs. Oh well, hopefully I'll get there soon. Another intersting thing: my AAoA on FICO reports ranges between 7-9 years. On CK, it shows 1 year only. I don't think they're taking the old baddie into account as much as FICO is. So maybe this is a snapshot of what my FICO scores will be when it falls off in May?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

So I always thought the Fico score my credit card provided was a real Fico. I've read on here that some of the ones the credit card gives are actually FAKO. I'm not even sure what it is.

My Amex cards give me a Fico 8 via Experian @ 812

My Citi cards give me a Fico Bankcard 8 via Equifax @ 846

Is that my actual Fico or Fako from my credit cards? Thanks!

Credit Karma I know isn't the real one. They have me at.

Transunion @ 785

Equifax @ 803

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:

I am so confused. I just got my new AmEx Blue cash preferred card. They only gave me a $2000 credit limit. On credit karma, it shows that my transUnion score is 812 add my equifax score is 819. I make around $150,000 a year and have two Chase cards with a total of around $25,000 credit limit. I have a Kohl's card with a $2000 credit limit (I think). My utilization is 0%. I use them fairly heavily but pay off before they even post.

I know that I have an old medical collections that was paid that is still on my credit report. It is two years old and was for only $217. Other than that, there should be absolutely no negatives on my credit report other than four hard pulls.

Here's where I am confused. On the Amex intro papers it said that I could get a free report from Experian. When I got it, it showed my score was only 688. Is it normal for a fako Report to be 130 points off?

Also, the experian report showed dozens of credit checks from different credit card companies that I have not even applied to. Discover has been checking it three times a month, every month. Please tell me that these are not hard pulls..

Credit Karma scores are Vantage scores which are not used by lenders. Unless and until lenders use the CK scores, it is a waste of time to review those scores. Look at CK to see your inq's and the items on those two credit reports, but don't consider their scores at all.

The Amex score you received of 688 is your actual FICO score (at that time). Ignore Credit Karma scores as they use a totally different algorithm than FICO scores.

It is common for CK scores to be vastly different from your FICO scores as they measure different attributes in your credit report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:

I am so confused. I just got my new AmEx Blue cash preferred card. They only gave me a $2000 credit limit. On credit karma, it shows that my transUnion score is 812 add my equifax score is 819. I make around $150,000 a year and have two Chase cards with a total of around $25,000 credit limit. I have a Kohl's card with a $2000 credit limit (I think). My utilization is 0%. I use them fairly heavily but pay off before they even post.

I know that I have an old medical collections that was paid that is still on my credit report. It is two years old and was for only $217. Other than that, there should be absolutely no negatives on my credit report other than four hard pulls.

Here's where I am confused. On the Amex intro papers it said that I could get a free report from Experian. When I got it, it showed my score was only 688. Is it normal for a fako Report to be 130 points off?

Also, the experian report showed dozens of credit checks from different credit card companies that I have not even applied to. Discover has been checking it three times a month, every month. Please tell me that these are not hard pulls..

That amount of score difference is not surprising for your situation. The collection is over $100 and will count against Fico 08 score even though paid. Impact of the collection alone could be a 100 point deduct.

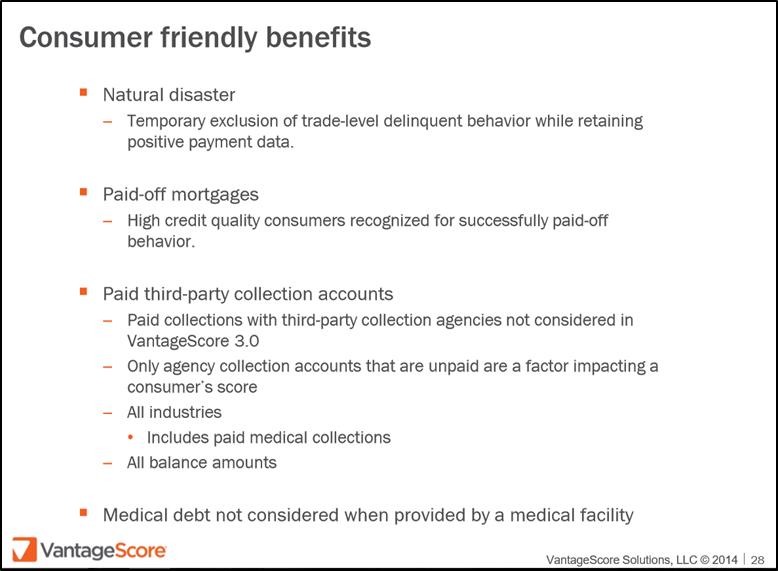

I don't believe the paid medical collection is being factored into your VantageScore 3.0.

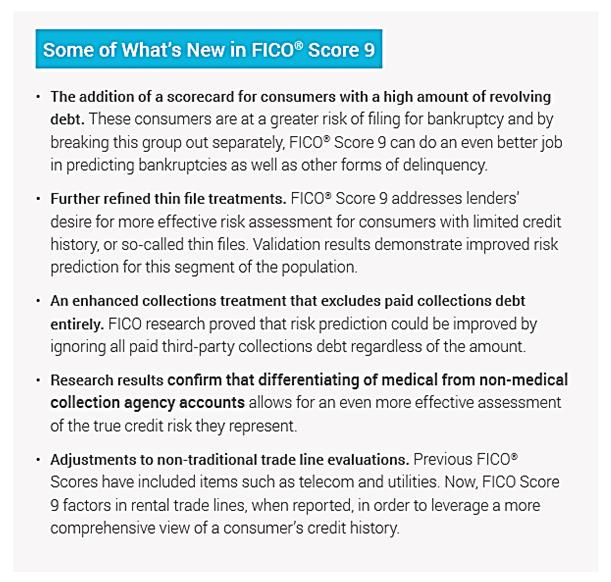

As an FYI, the paid collection probably is not hurting your Fico 09 score either as Fico 09 excludes paid collections.

If you purchased a 3B report, you may see Fico 09 scores 80 to 100 points higher than corresponding Fico 08 scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

I'm curious why we are comparing apples to oranges in some cases. If sites like CK and Cap 1 CW are using V3 then why would we compare it to Fico scores? They use different scoring models.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs. FAKO – Share your FAKO stories

@Anonymous wrote:I'm curious why we are comparing apples to oranges in some cases. If sites like CK and Cap 1 CW are using V3 then why would we compare it to Fico scores? They use different scoring models.

I agree! There can be similarly large variations in FICO 8 vs the 04 versions for example. I think the thread was more FICO marketing than anything else. Though, to be fair, credit card lenders are generally more likely to be looking at some version of FICO than at Vantage. But you still need to knw WHICH model for some of the issuers