- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Fastest way to exit the 800 club....

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fastest way to exit the 800 club....

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fastest way to exit the 800 club....

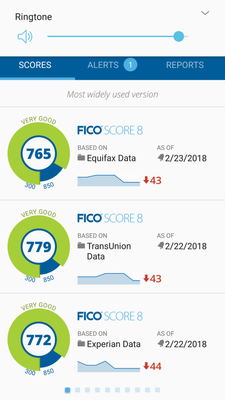

Do what I did and balance transfer to 99% credit utilization on the new card.

Guess I should have researched it here first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

Thank's for sharing the data. It would be helpful to know a little more about your profile.

- How many credit cards do you have and what's your aggregate utilization?

- Do you have any open installment loans and if so what's the balance to loan ratio?

- What's your AAoA, AoOA and AoYA?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

It's dumb, I dropped 80 points by maxing a $500 card (that I PIF), and my scores were so slow to recover that I will probably never reach where I started unless I garden for life

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

That's a pretty steep drop. What's your aggregate utilization and how many cards do you have?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

Good luck. People say it will come back but it usually takes a long time. In other words, it goes down a lot faster than it goes up, imo.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

Thanks for the response and congrats on the 850's.

My post was really to show folks what can happen and probably should have been added to one further down the list re: strange things happening recently.

As far as the calculus, I am not into that(though perhaps I should).

63 years old, priced out of the socal real estate market, just bought a car with a good rate(luckily I was 800+ at the time, no need for any big credit purchases- I'll just let it ride. It'll go back up and down and up.....

My goal is to payoff the car and the 5k that I balance transferred(no other debt) and one way to do it is to just use myAmex green which will force me to stay within my means.

Glta with your Fico's!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

Hey Fuzzle & Morongobill:

Don’t worry and you’re not that old and what you did is not that bad. I just wrote about an experiment I conducted last month on the topic of AZEO utilization. http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/AZ-Verses-AZEO/td-p/5178215

First thing to remember is that while utilization is a very big part of your CS, it is the easiest to rectify. You can’t fix lates or other derogs without time (7 or 10 years to get the full benefit without GW letters). Inquiries take at least 6 months to 2 years to really help you. Age is age and you can only gain one month per month. But UTILIZATION you can fix literally in a few days or weeks.

Fuzzle you said; “I dropped 80 points by maxing a $500 card (that I PIF), and my scores were so slow to recover that I will probably never reach where I started unless I garden for life.” This is not factual if all you did was max out your card. Search the forum, you will find that you can PIF that card and get all or most of those points back within a couple cycles (meaning months) at most. There must have been other things if you see no increase; but if all you did was max out a card, then clear it (making sure you have at least something showing as revolving) and you will get it back.

Morongobill, it is laudable that you presented your data to the Community. Like Fuzzle you too can gain those points back quickly. You did mention you made other purchases (car and possibly the new hit on the CC with the transfer) but that won’t take as long to help you as you think. Sure you will have the inquiry for the car (and possibly the CC if it were new), but that will go away in a few months/years depending on your total inquiries. Also you may take a hit on some models (mortgage or auto) with a high debt to balance until you get the loan down; but alas that is also in your control. I fully agree that maxing out a card (even if it increases your overall CL) will hurt you initially; but you are in control. As quick as you pay it down (into the next lower bracket), the quicker your score will rise.

The irony of FICO scoring is that there are areas a person can control and those they cannot (after the fact of the event). The frustrating part is those which you cannot control. The poor person who several years ago had a problem and got behind (had a few lates) cannot truly (easily) control that parameter. They simply must wait the time. On the other hand, if you run up a card in a particular month (for whatever reason) you can fix that at your will. Pay it down to the next bracket, score goes up. Pay it way down, score goes way up. YOU HAVE CONTROL!

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fastest way to exit the 800 club....

Guys above that are citing large score drops due to an increase in utilization. Please understand that utilization is a single moment in time snapshot with respect to scoring. Your score will go back to what it was as soon as you return your utilization to what it was. It doesn't take longer for a score to go up than it takes for it to go down when it comes to utilization.

If you went from 1% utilization on a $500 limit card to 100% utilization and the card reported 100% utilization and you lost 80 points, if you take the card back down to 1% utilization and next month 1% utilization reports, you'd gain back exactly those 80 points. This is assuming that nothing else changed with your profile.