- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Fico Score Wells Fargo

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico Score Wells Fargo

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Fico Score Wells Fargo

So Wells Fargo has a new online site and now I can see my Fico Score and it show me with a 756 Score which is good and there system. However on everyon of my other accounts I am showing a Score of much Higher Such as Bank America 826 Chase 823 Amex 829 Discover 819. How can Welss Fargo be so different ???? I have never been late on a payment and have overall good credit utilization.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

@Anonymous wrote:So Wells Fargo has a new online site and now I can see my Fico Score and it show me with a 756 Score which is good and there system. However on everyon of my other accounts I am showing a Score of much Higher Such as Bank America 826 Chase 823 Amex 829 Discover 819. How can Welss Fargo be so different ???? I have never been late on a payment and have overall good credit utilization.

my WF score is WAY lower than everything else too. I ignore their scoring model. We all know WF is a special case ![]()

"Use your Credit wisely, don't let it use you!"~Me ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

Guess it 's time to find a new Bank

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

@Anonymous wrote:Guess it 's time to find a new Bank

That's what I did! I sold my house and moved all my money to Capital One, Chase, and PenFed. WF has some shady practices.

"Use your Credit wisely, don't let it use you!"~Me ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

The FICO score you are getting through Wells Fargo is the FICO Bankcard Score 2 drawn on Experian data.

http://www.doctorofcredit.com/wells-fargo-now-offers-credit-cardholders-free-fico-score/

This is a much older scoring model than what you are seeing from your other sites, which are likely all FICO 8 scores. The good news is that most CC issuers tend to use FICO 8, which are your better scores.

One of the things you should do with every free FICO score you get (e.g. via credit cards, etc.) is read the fine print to find out what model it is and what credit bureau it uses for its data source.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

Yep - it's critical to clarify what model the various credit cards or credit unions are reporting. The Wells Fargo scores are undoubtedly accurate for the model.

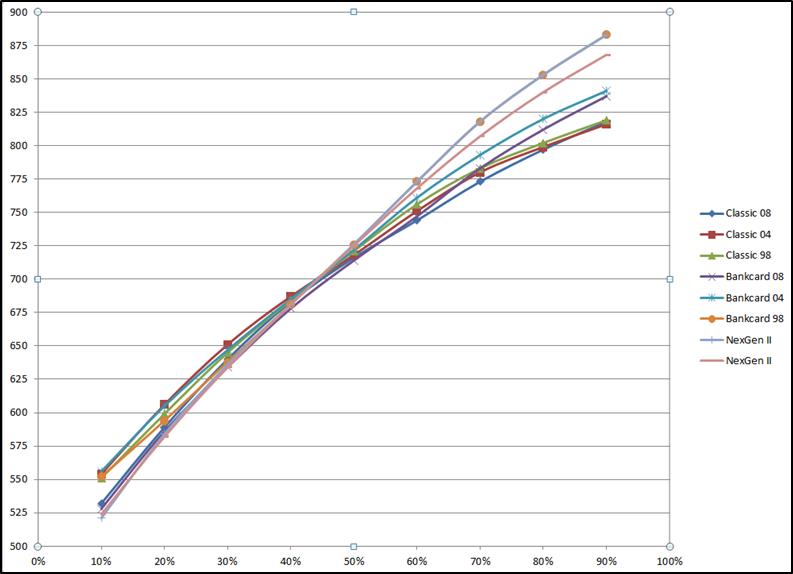

Pasted below for illustration is a chart of EX Fico scores by model [Note Fico score 3 = Fico 04 and Fico score 2 = Fico 98]

The X axis is % of population at or below the Y axis score (percentile).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

I have some inquiries regarding the new wells fargo score as well.

I am on the other side of the fence where my wells fargo score is much higher than my experian/transunion scores. I recently financed a car from the dealership at a very high interest rate because of my lack of current credit history (20%). Since wells fargo had their new score system up on their site, I figured Id give refinancing a shot. I was just now approved for a refi with a new 6.5% rate!

But I'm wondering on the different scores they use. My wells fargo is 782. Experian 726. Trans/Equifrax 620.

I notice that for Trans/Equifax, I have some old emergency medical bills from 4 years ago that I never took care of. If I were to open a line of credit like citibank or Chase, which score will they use? Is one score more important than the other?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

7/2020: EQ - 842; TU - 832; EX - 848

10/2017: EQ - 823; TU - 835; EX - 824

05/2016: EQ - 712; TU - 706; EX - 710

11/2015: EQ - 694; TU - 651; EX - 653

5/2015: EQ - 670

5/2014: EQ - 653

11/2013: EQ - 645

05/2013: EQ - 656

11/2012: EQ - 646

Eight CCs ($179,500 CL, 0%-1% UTIL)

AoOA = 18.6 years, AAoA = 60 mos., AoYA = 18 mos.

One mortgage, one HELOC, no car loans.

Derogs from 2009 and 2010 now gone after 7 years. I started paying attention to credit scores in about 2014. It's taken a few years but credit scores are now good after starting in the high 500s back in 2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

Welcome to the forums! My coments below in blue.

@Anonymous wrote:I have some inquiries regarding the new wells fargo score as well....

....My wells fargo is 782. Experian 726. Trans/Equifrax 620.

You refer to your "Wells Fargo" vs. your "Experian." Actually, both scores are drawn on Experian data.

Is it 100% clear what the difference is between, on the one hand, credit bureaus like EX, TU, and EQ -- and scoring algorithms, like FICO 8, FICO 4, FICO 98, FICO 8 Bankcard Enhanced, etc? Credit Bureaus are places where data sit. Like a big silo or a warehouse. Then somebody comes along and uses a credit scoring program to turn all that data into a single number.

When you hear people talk about their scores on the forum, therefore, they will typically tell you two things: (1) the scoring model or algorithm that was used and (2) the credit bureau that supplied the data. For example, somebody might say, "My FICO 8 scores are TU 755, EQ 734, EX 759." When that person said "FICO 8" she was specifying the exact model that was used to create the score.

I notice that for Trans/Equifax, I have some old emergency medical bills from 4 years ago that I never took care of. If I were to open a line of credit like citibank or Chase, which score will they use?

By Line of credit" do you mean a credit card? Do you have any credit cards? If so, how many?

There are many different scores that a CC issuer might use in dtermining where to grant you a card. As I mentioned above, they might use any one of the three bureaus for your data, and they might use a number of different scoring models. Making a guess as to what they will use is possible. If you go to the CC forum and ask them, they may be able to help. You should be prepared to tell them what state you live in. Probably the real question you want to ask is, "Give that I live in state _____, is there a CC issuer that is very likely to pull Experian? My EX score is much better than EQ or TU, since I have unpaid medical bills on those two bureaus."

Is one score more important than the other?

Yes. The score that is most important at any moment is the score that a partoicular creditor will be using. See above.

Final thoughts. Something that would be very much in your interest is to get your bad medical debt resolved. I would go to the Rebuilding forum and explain exactly what you see on your EQ and TU reports and ask if there is anything that can be done about it.

The other thing you need to do is become very familiar with how credit reports and scores work.

Finally, on your list of things to do should be to make sure you have two credit cards. Eventually three.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score Wells Fargo

@Anonymous wrote:Guess it 's time to find a new Bank

Just because a bank provides you with a credit score that's not a FICO 08 doesn't mean that they're providing you with an "incorrect" or "wrong" score and it certainly isn't a valid reason to switch banks.