- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Fico Score simulator and Fico mortgage score r...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico Score simulator and Fico mortgage score rebuild

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

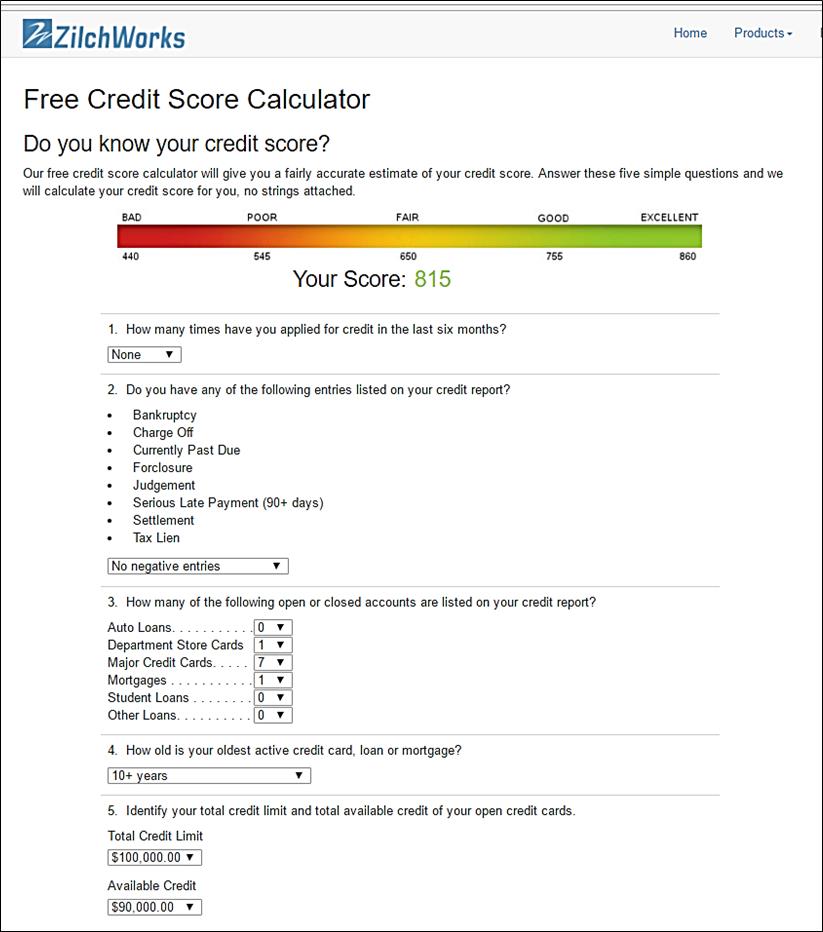

BBS - thanks for trying it and giving some feedback. If you have time, try a few what ifs and look at how your profile's score shifts.

This estimator is best used to look at how changes in profile shift score. It is not accurate in absolute terms but, offers some utility in looking at shifts in score from "state A" to "state B". In your case, if you have closed accounts over 10 years old but, your oldest open account is 5 years - I would plug in 10 years for account age.

Again, I would primarily use this calculator as a means to estimate score how score might shift between profile conditions. [All calculators under estimate my Fico 8 scores]

P.S. It estimates my score at 815 given inputs representing my current profile [it calculates my score at 832 without the store card] - So again, this estimator has flaws but also does offer some insight into score shifts - just don't get wrapped up in a particular absolute score.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

Gotcha. I will play with it some more. I think I get caught up on the lingo where it says up top that it will give you a fairly accurate estimate of "your credit score" as if a person only has one credit score or that only one scoring model exists. The language is just a bit misleading I suppose and while you and I can see through that sort of thing I worry about the average Joe that comes along and reads into it more than he should.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

Did you receive a MyFico alert when the $416 showed paid? That paid it down to $0? I think you'll get the points you need based off of what you have done. Is the remaining $99 balance going to be 9% of one card?

EQ 778 EXP 782 TU 729

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

How many total cards do you have? I don't think you got a score increase on just the one because you haven't crossed the next threshold for utilization yet.

EQ 778 EXP 782 TU 729

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

EQ 778 EXP 782 TU 729

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico Score simulator and Fico mortgage score rebuild

Are you able to pay your aggregate utilization down to a single-digit amount? If so, no doubt your scores will improve quite a bit. When applying for a mortgage, the last thing you want is to have any significant revolving CC debt.