- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Fico dropped suddenly, need help.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Fico dropped suddenly, need help.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

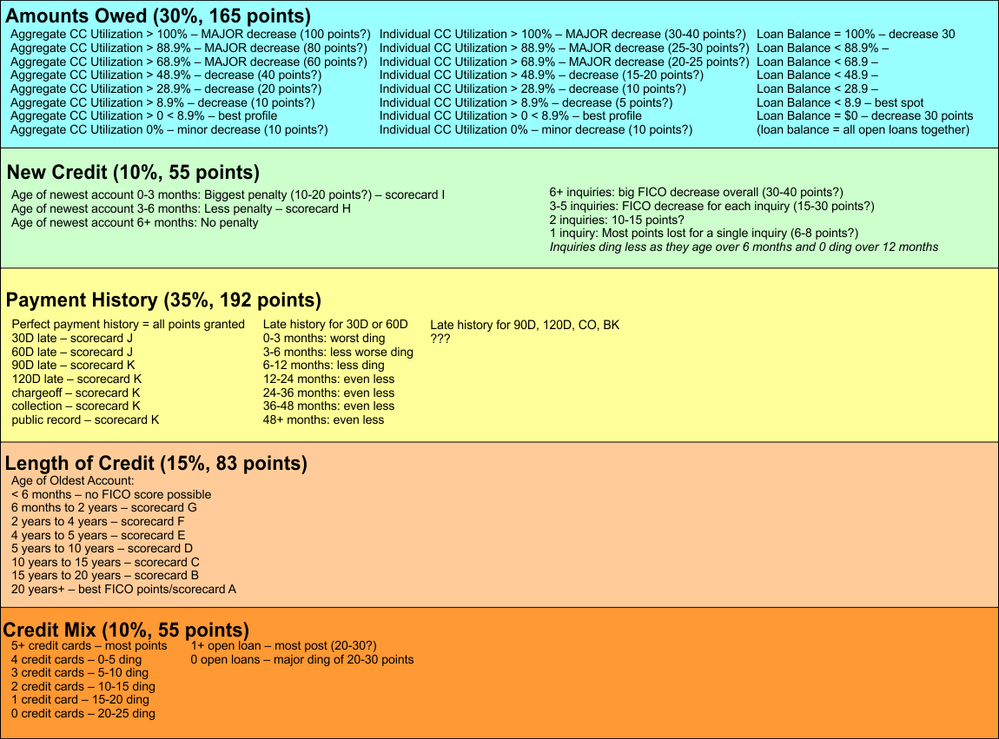

@Anonymous wrote:You're right there on the edge of "very good" and "good" so you may see a bit more of a punch than someone in the 600s. Would you mind sharing what your alert score changes are when the account finally shows up? I'm working on this JPG of FICO scoring and every data point I get helps to tune it a little bit more!

I will definitely. The new AMEX card statement cuts on the 10th of this month, Experian reports quicker than the other two so I will update this thread with the before and after FICO score once this new account gets reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

That would be awesome! I believe Amex typically doesn't report the first statement but does report the second one so hopefully your profile doesn't change too much elsewhere (like accidental utilization posting).

I really screwed up my plans for September due to Irma making me go from $5 utilization (1%) reporting to maxed out on 3 cards for that entire month. Had really good data to pull, oops.

The "new account penalty" is one of the least researched portions in my digging around -- few people actually hold off on apping for 6 months to clear out their old "new account penalty" so it's really tough to find data points!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:That would be awesome! I believe Amex typically doesn't report the first statement but does report the second one so hopefully your profile doesn't change too much elsewhere (like accidental utilization posting).

I really screwed up my plans for September due to Irma making me go from $5 utilization (1%) reporting to maxed out on 3 cards for that entire month. Had really good data to pull, oops.

The "new account penalty" is one of the least researched portions in my digging around -- few people actually hold off on apping for 6 months to clear out their old "new account penalty" so it's really tough to find data points!

It's really informative, so thank you ABC for sharing that table, it defintely helps most of us to decide whether it would be wise to apply soon or wait and garden before adding new credit cards. I was lucky that the AMEX approval for the Delta was a SP so I was able to get approved for the account without any additional dings for the HP. It was exactly 6 mos. from when I was originally approved for the BCE and Discover (March 2017). I remember back in April, my scores dipped quite a bit, but it somehow stayed within the 700's for both TU and EQ, it was EX that went down as low as 692 between April - May, and I guess it was because I got dinged for the HP as well as the penalty for the AAoA. Would you know if Charge cards are factored the same way in the FICO scoring model? Because when I look at my reports, it seems to look at the total number of revolvers, excluding the Charge card, eventhough on the overall report, it shows 4 accounts total, when I look at, say my Discover FICO score card, it is only counting my 3 current revolvers. Cap1, Discover and AMEX BCE but not the Green Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

There are other data points but I don't have those threads bookmarked on my phone unfortunately.

I will be getting a Platinum next year to do my own testing tho!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:

FICO Score 8 ignores charge cards towards utilization scoring per this awesome thread: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/All-revolvers-zero-testing-HELOC-Amex-charge-PLOC/td-p/4913590

There are other data points but I don't have those threads bookmarked on my phone unfortunately.

I will be getting a Platinum next year to do my own testing tho!

Thank you ABC for the informative read. Amex has become my favorite account, and have spread my expenses on all three cards. They are constantly sending invitations now for the PRG and the Gold Delta but I think I have enough AMEX accounts for my type of spend. The last on my wish list would be a competative Visa Network card which I plan to app for next year. Either BofA or Chase. My goal is to get a second CLI on the BCE to bring it up to at least 5K and the same with the Discover card. So that I would get a more competative SL.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

A great Visa card is on my list as well! I'm already in love with my BCP because every time I hit $25 at the grocery store I can smell $1.50 banking for the future. And where I live, sales tax is 10.25% on non-grocery items so that 6% is basically reducing my sales tax rate there, too. The Platinum in the future will be helpful, but not sure HOW helpful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

@Anonymous wrote:A great Visa card is on my list as well! I'm already in love with my BCP because every time I hit $25 at the grocery store I can smell $1.50 banking for the future. And where I live, sales tax is 10.25% on non-grocery items so that 6% is basically reducing my sales tax rate there, too. The Platinum in the future will be helpful, but not sure HOW helpful.

I do love the AMEX BCE, but i'm sure no cards can currently compete with the 6% cashback on the AMEX BCP. As for rewards points, I would sometimes check when I log into my AMEX account for existing offers that would let me earn more MR points, they currently have AMAZON Prime membership offering additional 5,000points and 2,000 points if you order anything above $50, which is currently competing with Discover's quarterly spend category. So if you want to save up for some future travel plans, I'd say the Platinum would be a great addition for your profile. I don't think I'll ever travel that much to justify that annual fee so I'll stick to the Delta and the Green. I may come back to CapOne for the Venture once my profile supports it, if they are still considered a Visa Signature card. Otherwise, I may just go for the BofA Cashback rewards in Spring next year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

I think I figured my problem out, an old account dropped of my report which dropped my AAOA.

This only happened on EX

Experian Today

Oldest Account

5.2 year(s)

Average Account Age

1.7 year(s)

October 24,2017

Oldest Account

23.2 year(s)

Average Account Age

2.8 year(s)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

Wow that's painful!

You went from the best age scorecard (20+ years) to the 4th age scorecard (5-10 years) -- not surprised you lost so many FICO points!

I don't have much math or data points on it but it seems each age scorecard gives you 10 points more in ceiling/max score. So going from #1 to #4...30 point drop?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Fico dropped suddenly, need help.

ABCD, are those AoOA ranges that you provide in your chart concrete (actual) values, or are you just sort of shooting from the hip and estimating? Same thing with AoYA, are those ranges estimates? My AoYA crossing the 6 month mark had zero impact on any of my FICO 08 scores.

Perhaps something should be included about AAoA? While it isn't used in score card assignment, it's a big factor and one that maxes out I believe at 7 years and 8 months (max points).