- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: From 800+ to Foreclosure - How Negatives Effec...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

From 800+ to Foreclosure - How Negatives Affect Your Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@JagerBombs89 wrote:

If you are referring to the house/foreclosure, she probably isn't too concerned, especially since her name isn't on any of the paperwork so it will not affect her credit at all. As far as her personal credit, I'd say she has more collections than I can count on two hands and probably some lates as well. My best guess is her score is probably in the mid 500s so she should be happy she isn't getting hit with a foreclosure as well! When we were together, she was an AU on a couple of my cards but I contacted the creditors and removed her as an AU and had them delete the account from her credit report. Why should she benefit off of my good standing with creditors?!?!

It is just incredible what the judicial system let's women get away with! You can bet that if the shoe was on the other foot and you left town she would be allowed to sell the house!

Several months before I divorced my ex-wife she used my 800 credit scores to fraudulently apply for 7 credit cards in my name and hid them from me. She maxxed them all out and never made a payment. First I heard about them was several months after the divorce when the lenders started calling me. I couldn't get anybody to do anything about it! The police or judge wouldn't do anything!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@JagerBombs89 wrote:The only thing I'm not looking forward to is the slow-crawl of time that it is going to take for everything to drop. 7 years is such a long time for stuff to remain on the credit report!

I absolutely understand (as you know, I am in a very similar boat). It is frustrating that no matter what you do, you are in "that bucket" for such a long period of time. The good news is that it really appears that the worst is already behind you score wise! It looks like you will rebound pretty quickly with all of the other accounts being positive. It will be interesting to see how high you will be able to get your scores after a couple of years of positive history. I seem to be stuck in the 730-ish range at the moment, however I am hoping that after another year or two of all positive history that I will be able to scrape a few more points up from off the side of the road. I would not be at all surprised if you get up to the 740-750 range in a decent period of time.

While I am thinking about it, not sure if you saw what I mentioned in another thread a few weeks ago, but somehow our foreclosure is not even showing on my wife's credit reports at all. The TL is not even there. Her scores are all in the 810 to 820 range! This appears to mean that I am being held down by about 100 points or so nearly three years after the foreclosure. I have a credit card settlement in there as well, so I would think you would be held down less than that.

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@EW800 wrote:

@JagerBombs89 wrote:The only thing I'm not looking forward to is the slow-crawl of time that it is going to take for everything to drop. 7 years is such a long time for stuff to remain on the credit report!

I absolutely understand (as you know, I am in a very similar boat). It is frustrating that no matter what you do, you are in "that bucket" for such a long period of time. The good news is that it really appears that the worst is already behind you score wise! It looks like you will rebound pretty quickly with all of the other accounts being positive. It will be interesting to see how high you will be able to get your scores after a couple of years of positive history. I seem to be stuck in the 730-ish range at the moment, however I am hoping that after another year or two of all positive history that I will be able to scrape a few more points up from off the side of the road. I would not be at all surprised if you get up to the 740-750 range in a decent period of time.

While I am thinking about it, not sure if you saw what I mentioned in another thread a few weeks ago, but somehow our foreclosure is not even showing on my wife's credit reports at all. The TL is not even there. Her scores are all in the 810 to 820 range! This appears to mean that I am being held down by about 100 points or so nearly three years after the foreclosure. I have a credit card settlement in there as well, so I would think you would be held down less than that.

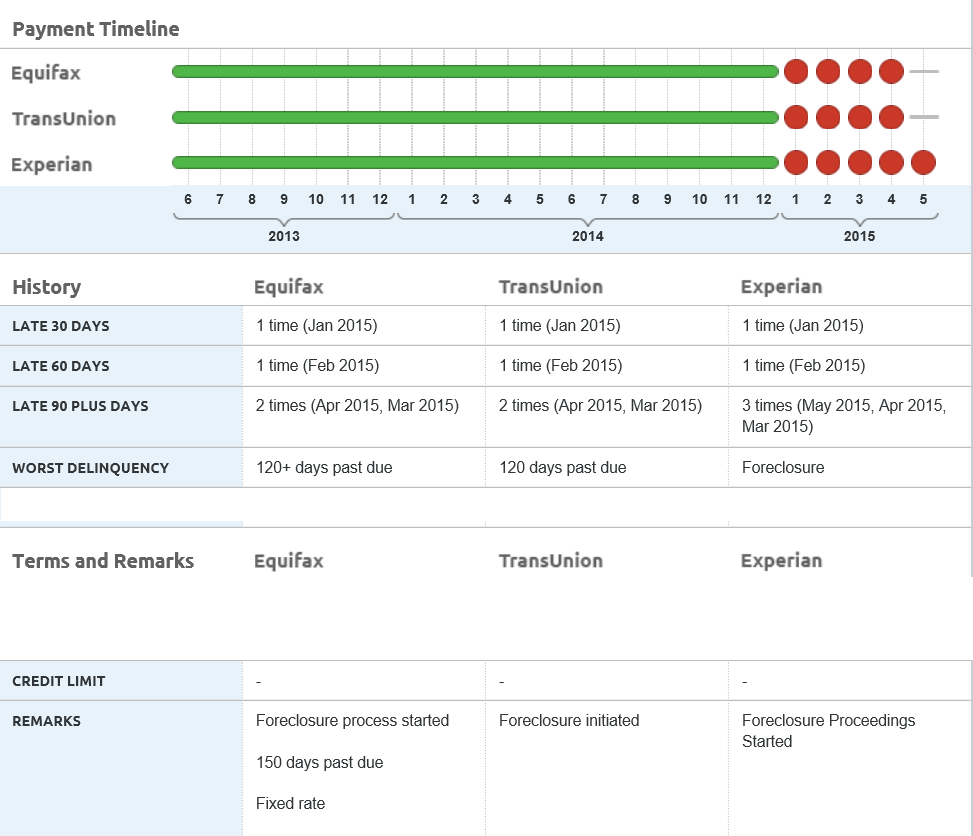

So do you (or anyone) know how foreclosures work as far as scoring purposes? All reports have been updated as of May 2015 to reflect current status. Both EQ & TU are listed as 120+ days past due while EX is listed as "Foreclosure." However, both EQ & TU have "Foreclosure process started" & "Foreclosure initiated," respectively. Is it safe to assume that FICO is scoring me on EQ, TU, & EX with a Foreclosure on file or must my status be officially changed? EQ & TU are only reporting it in the comments section...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

And here comes another round of updates! Based on the results, the overall results appear that 08 scores are going up, while older (auto&bank) scoring models are less forgiving and continue to drop. As expected, my Mortgage scoring dropping the most, of course except for Experian which has gone up! Weird! ![]()

FICO Scores as of 04/2015 - 120 Days Late Reporting (all scoring models):

Equifax 04 - 625

Equifax 08 - 637 Experian8- 629 Trans 08 - 648

EQ Home - 625 EX Home - 638 TU Home - 636

EQ Auto 8 - 645 EX Auto 8 - 640 TU Auto8 - 654

EQ Auto 5 - 657 EX Auto 2 - 670 TU Auto4 - 650

EQ Bank8 - 656 EX Bank8 - 652 TU Bank8 - 670

EQ Bank5 - 652 EX Bank2 - 669 TU Bank4 - 653

FICO Scores as of 05/2015 - 150 Days Late Reporting/Foreclosure (all scoring models):

Equifax 04 - XXX

Equifax 08 - 636 Experian8- 636 Trans 08 - 657

EQ Home - 612 EX Home - 644 TU Home - 622

EQ Auto 8 - 644 EX Auto 8 - 647 TU Auto8 - 663

EQ Auto 5 - 646 EX Auto 2 - 675 TU Auto4 - 637

EQ Bank8 - 655 EX Bank8 - 659 TU Bank8 - 679

EQ Bank5 - 641 EX Bank2 - 622 TU Bank4 - 641

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

Hello!

Thanks once again for sharing your scores through this process. It really does look like you have already hit bottom, and as you mentioned, even seeing gains in some areas! I know it sucks to have a foreclosure on the report, however score-wise, I actually don't think you are doing too bad at all! As we discussed, I think all the other positive accounts must be working in your favor.

Sadly, I cannot answer the question in regard to how scoring works through each of these different steps. When I went through it, I was monitoring my Equifax score, but ashamed to say that I did not do a good job of going through my reports line by line as closely as I should have. Hopefully others here can chime in in regard to how FICO looks at the started comments and such.

Please see my next message in regard to how the foreclosure is current listed on each of my reports.

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

And wouldn't you know it, my account on Experian just updated 20 minutes ago! Now it's being reported as "Account is in a bank adjustment, deed in lieu, or a bank liquidation status." If anyone is familiar with this reporting term, I made a thread in Rebuilding Your Credit for replies!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

It is interesting to me how my foreclosure is now listed on my reports. I had a LOT of dialog with knowledgeable members of this forum when trying to figure it out, as there are differences between the three CRA's. While there were differences in opinion as to which CRA was reporting the foreclosure correctly, everyone seemed to agree that with being about half way through the seven year clock at this point, I should just leave everything alone and not chance poking a bear.

Equifax

Status: 120+ Days Past Due

Balance: $0

Comments: Foreclosure

In the 81-month history area, it is showing "180" on Sept 2012. From Oct 2012 ro Nov of 2013, it is all green. No reporting at all since November 2013.

81-Month Payment History

| Year | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| 2013 | * | * | * | * | * | * | * | * | * | * | * | |

| 2012 | 60 | 90 | 120 | 150 | 180 | 180 | 180 | 180 | 180 | * | * | * |

| 2011 | * | * |

Experian

Status: Foreclosed

Balance: $0

Comments: (No comments listed)

In the account history area, "F" on May, June, July and Dec of 2013. "ND" on Aug-Nov of 2013. No reporting at all since Dec 2013.

TU

Status: Account 120 Days Past Due Date

Balance: $0

Remarks: Foreclosure Collateral Sold

In the account history area, I show "120" for April through Sept of 2012. No updates since.

As you can see, each of the CRA's are reporting my status differently, however as mentioned above, numerous forum contributors suggest that I just leave it alone and just let the TL's take their course toward falling off in the summer of 2018. Several people mentioned that as long as the balance is $0 and all updating stopped, that I am fine.

If anyone has any comments in regard to how my status shows differently among the CRA's, please let me know your thoughts.

It will be interesting to see what your reports show when all said and done, as compared to what I am seeing.

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@JagerBombs89 wrote:And wouldn't you know it, my account on Experian just updated 20 minutes ago! Now it's being reported as "Account is in a bank adjustment, deed in lieu, or a bank liquidation status." If anyone is familiar with this reporting term, I made a thread in Rebuilding Your Credit for replies!

That is interesting. It will be interesting to see what some of our experrts make of that update!

April 2024: EX8: 840; EQ8: 832; TU8: 842 -- Middle Mortgage Score: 822

In My Wallet: Discover $73.7K; Cap1 Venture $51.7K; Amex ED $38K; Amex Optima $2.5K; Amex Delta Gold $18K; Citi Costco $24.5K; Cap1 Plat $8.4K; Barclay $7K; Chase Amazon $6K; BoA Plat $21.6K; Citi TY Pref $22K; US Bank $4K; Dell $5K; Care Credit $6.5K. Total Revolving CL: $300K+

My UTIL: Less than 1% - Only allow about $20 a month to report, on one account. .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@JagerBombs89 wrote:With the start of the new year, I made many life altering decision: attending more classes to get my bachelors, leaving the military service, and yes - leaving the 800 club for a foreclosure. Before I missed my first payment, I paid off my auto loan, maitained 1% utilization on my credit cards, and set up an emergency fund for unexpected expenses. But let me give you some quick background notes so it makes more sense.

It has been over 18 months, every month, of making $1,200+ mortgage payments for a house that no one lived in. My wife at the time decided to cause over $20,000 in damage when she moved out and left me with the cleanup. Insurance wouldn't cover "intentional damage" and I didn't have the money to make the repairs. Over the months I wanted to make sure I became financially secure no matter what. My ex decided to leave the state mid-divorce (she represented herself) and since I am in a community property state, I would need her signature to sell the house. Prior to not making my payment, I tried for months to see what "other" options were available through my bank, but alas, community property stipulations wouldn't allow me to do ANY sort of sale on my own - even though I am the sole owner on the deed and mortgage. So as of January 2015, I went from full time job to full time student, and now 30 days past due on my mortgage. And instead of getting depressed about it, I decided I would turn my experience into a score update thread. This way, the community can see how much damage each late does from 30 to 60 all the way to foreclosure. I will update this thread every time I get my monthly FICO score updated.

FICO Score Contemplation: I wonder if FICO starts ignoring subsequent lates on a single account versus single 30/60/etc days late across multiple accounts

Account Age:

Oldest: 7 years

AAoA: 4 years (rough estimate)

Newest: 1 Month (approved for Chase Freedom with best APR with 30 day late reporting

)

FICO Scores as of 12/2014 - Absolutely no derogatories:

EQ04 - 790 / / EX08 - 814 / / TU08 - 829

FICO Scores as of 01/2015 - 30 Days Late Reporting:

EQ04 - 697 / / EX08 - 702 / / TU08 - 705

FICO Scores as of 02/2015 - 60 Days Late Reporting (all scoring models):

Equifax 08 - 633 Experian8 - 629 TU08 - 640

EQ Home - 626 EX Home- 651

EQ Auto 8 - 641 EX Auto 8 - 640

EQ Auto 5 - 658 EX Auto 2 - 682

EQ Bank8 - 652 EX Bank8 - 652

EQ Bank5 - 653 EX Bank2 - 691

FICO Scores as of 03/2015 - 90 Days Late Reporting (all scoring models):

Equifax 08 - 636 Experian8- 630 Trans 08 - 640

EQ Home - 622 EX Home - 638 TU Home - 648

EQ Auto 8 - 644 EX Auto 8 - 641 TU Auto8 - 646

EQ Auto 5 - 654 EX Auto 2 - 670 TU Auto4 - 661

EQ Bank8 - 653 EX Bank8 - 653 TU Bank8 - 662

EQ Bank5 - 649 EX Bank2 - 669 TU Bank4 - 662

FICO Scores as of 04/2015 - 120 Days Late Reporting (all scoring models):

Equifax 08 - 637 Experian8- 629 Trans 08 - 648

EQ Home - 625 EX Home - 638 TU Home - 636

EQ Auto 8 - 645 EX Auto 8 - 640 TU Auto8 - 654

EQ Auto 5 - 657 EX Auto 2 - 670 TU Auto4 - 650

EQ Bank8 - 656 EX Bank8 - 652 TU Bank8 - 670

EQ Bank5 - 652 EX Bank2 - 669 TU Bank4 - 653

FICO Scores as of 05/2015 - 150 Days Late Reporting/Foreclosure (all scoring models):

Equifax 08 - 636 Experian8- 636 Trans 08 - 657

EQ Home - 612 EX Home - 644 TU Home - 622

EQ Auto 8 - 644 EX Auto 8 - 647 TU Auto8 - 663

EQ Auto 5 - 646 EX Auto 2 - 675 TU Auto4 - 637

EQ Bank8 - 655 EX Bank8 - 659 TU Bank8 - 679

EQ Bank5 - 641 EX Bank2 - 622 TU Bank4 - 641

Hi,

I just read your post and i just wanted to say that is great you put your situation to good. I am going through a divorce myself and my husband left and no where to be found and i have 2 young kids without any support. I wish you the best of luck and youre gonna be just fine. ![]() I was in an abusive relationship and i am a living testimony.

I was in an abusive relationship and i am a living testimony.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: From 800+ to Foreclosure - How Negatives Effect Your Score

@jamie123 wrote:

@JagerBombs89 wrote:

If you are referring to the house/foreclosure, she probably isn't too concerned, especially since her name isn't on any of the paperwork so it will not affect her credit at all. As far as her personal credit, I'd say she has more collections than I can count on two hands and probably some lates as well. My best guess is her score is probably in the mid 500s so she should be happy she isn't getting hit with a foreclosure as well! When we were together, she was an AU on a couple of my cards but I contacted the creditors and removed her as an AU and had them delete the account from her credit report. Why should she benefit off of my good standing with creditors?!?!

It is just incredible what the judicial system let's women get away with! You can bet that if the shoe was on the other foot and you left town she would be allowed to sell the house!

Several months before I divorced my ex-wife she used my 800 credit scores to fraudulently apply for 7 credit cards in my name and hid them from me. She maxxed them all out and never made a payment. First I heard about them was several months after the divorce when the lenders started calling me. I couldn't get anybody to do anything about it! The police or judge wouldn't do anything!

I could tell you all some stories of house my husband who is bipolor pawned, took money out of accounts etc. when the time came i had to leave my apartment for weeks to get him to leave because its illegal to change locks. I had to do it for my safety. Basically cannot take him of health insurance and have to pay 300 or more a month and no support for the 1700 day care bill for our kid. So truly its not fair for anyone. All i can say if I ever get married again PRENUP! you leave with what you came with and always seperate accounts. Its sounds mean and heartless but thats my story. My present is 120% better than my past and grateful to be alive and safe