- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Further Proof FICOs & FAKOs Have ZERO correlation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Further Proof FICOs & FAKOs Have ZERO correlation

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Further Proof FICOs & FAKOs Have ZERO correlation

In this past week I paid off two cards with 0% Balance Transfers down to zero. Paying off $11,000+ of my $30,000 in debt I was carrying and dropping utlity from 12% to 7%

EQ FICO8 742 -> 761

TU FICO8 752 -> 772

EQ Vantage (CK) 732 -> 703

TU Vantage (CK) 726 -> 703

Yes, my Credit Karma FAKOs took massive hits for paying off more than a third of my credit card debt.

No, there were no other changes. I track my reportsactivity obsessively.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@Aahz wrote:In this past week I paid off two cards with 0% Balance Transfers down to zero. Paying off $11,000+ of my $30,000 in debt I was carrying and dropping utlity from 12% to 7%

EQ FICO8 742 -> 761

TU FICO8 752 -> 772

EQ Vantage (CK) 732 -> 703

TU Vantage (CK) 726 -> 703

Yes, my Credit Karma FAKOs took massive hits for paying off more than a third of my credit card debt.

No, there were no other changes. I track my reportsactivity obsessively.

I had a similar issue with CK a few weeks ago.

I paid balances down to less than $300 on one card, they were previously 1800 total spread over 5 out of 8 cards.

FaKos dropped TU 40 pts and EQ 30. AND I had a paid judgement removed from Equifax.

I think they penalize for paying cards completely off or down. They must. There is no other explanation

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

Yep same problem for me too dactyl why I don't pay any attention to it.Its only good for keeping track of accounts only no scores.Kills me how many people swear by these scores and will argue it's accurate.When I go into debt My fico scores will go down well CK goes up and when I pay it off or down Fico up and CK down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@silkysean wrote:Yep same problem for me too dactyl why I don't pay any attention to it.Its only good for keeping track of accounts only no scores.Kills me how many people swear by these scores and will argue it's accurate.When I go into debt My fico scores will go down well CK goes up and when I pay it off or down Fico up and CK down.

Agrred, those FAKO's are only good for tracking changes to credit reports, during credit rebuilding.

AmEx Hilton Honors Surpass//AmEx Platinum Card//Ann Taylor Rewards Mastercard//Capital One Platinum Card//Credit One AmEx//Credit One Platinum VISA//Fingerhut//Navy More Rewards AmEx//TruWest Platinum VISA//Aspire VISA//Costco Anywhere VISA//Lowes Advantage//Apple Card

Loans:

1 Mortgage/////Navy FCU Auto Loan (2020 Jaguar I-Pace)//Capital One Auto (2016 BMW i3)

Next Cards (4th QTR 2022):

Navy Flagship Rewards VISA//Chase Sapphire Preferred

Stats:

Scores: 700's // Inq's: 1 for mortgage // Util: 1% // AoOA: 21 yrs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@surferchris wrote:

@silkysean wrote:Yep same problem for me too dactyl why I don't pay any attention to it.Its only good for keeping track of accounts only no scores.Kills me how many people swear by these scores and will argue it's accurate.When I go into debt My fico scores will go down well CK goes up and when I pay it off or down Fico up and CK down.

Agrred, those FAKO's are only good for tracking changes to credit reports, during credit rebuilding.

They're good for the reports, worthless for the scores.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@Aahz wrote:In this past week I paid off two cards with 0% Balance Transfers down to zero. Paying off $11,000+ of my $30,000 in debt I was carrying and dropping utlity from 12% to 7%

EQ FICO8 742 -> 761

TU FICO8 752 -> 772

EQ Vantage (CK) 732 -> 703

TU Vantage (CK) 726 -> 703

Yes, my Credit Karma FAKOs took massive hits for paying off more than a third of my credit card debt.

No, there were no other changes. I track my reportsactivity obsessively.

Weird, interesting data point though regarding Vantage, I never had much in the way of balances to really test anything regarding that. I have a very very early working theory that VS aggregates some data elements for a more complex calculation instead of FICO which appears to compute revolving utilization and some other metrics individually... like my TU with a recent 30 day late took a large drop when I added an inquiry, but my EQ/EX VS which didn't have the late lost substantially less.

Not sure how that correlates here though, but maybe their data showed wide swings in debt either positive or negative show some sort of propensity to default? That's kind of a stretch to be sure, I do wonder how the scores will be after a given period of time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

Agree with the OP.

My FICO 8's TU is 729, FICO EX 720, FICO EQ is 714 (Sept 26, 2016). I am still debt-heavy from my daughter's wedding two weeks ago, but I am paying down the debt.

My Vantage 3.0 scores (CK) are hugely different. Much, much lower than FICO: CK TU 613 and CK EQ 596 (Oct 2, 2016)

Even though I know that Vantage scores are not reflective of my ability to repay, it certainly hurts to look at the score difference of more than 100 points! By the way, these scores are all effective as of the dates shown. Not on the same dates, but close and no changes between Sept 26 and Oct 2.

EDIT: For clarification, I do have some new accounts in the past 2 years and I know that Vantage 3.0 dings heavily for new accounts in addition to dinging for heavy utilization (my current utilization overall is 35%). So the new accounts have dropped my AAoA and affect my Vantage score more than the FICO scores (thank goodness).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@Aahz wrote:In this past week I paid off two cards with 0% Balance Transfers down to zero. Paying off $11,000+ of my $30,000 in debt I was carrying and dropping utlity from 12% to 7%

EQ FICO8 742 -> 761

TU FICO8 752 -> 772

EQ Vantage (CK) 732 -> 703

TU Vantage (CK) 726 -> 703

Yes, my Credit Karma FAKOs took massive hits for paying off more than a third of my credit card debt.

No, there were no other changes. I track my reportsactivity obsessively.

There is definitely something seriously wrong with the FAKO scoring model. Before I disputed 6 student loan baddies on my CR, my credit score on the TU site was 701 (Vantage I believe) - some 38 points higher than my TU Fico 8 score.

When TU removed the disputed student loans, my credit score on their site dropped some 91 points! My first thought was that the removal of those account seriously decreased my AAoA (previously 15yr 11 m). But that only changed to 13 yrs. So go figure. From that point, I decided not to use anything that reported a non-Fico score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Further Proof FICOs & FAKOs Have ZERO correlation

@Anonymous wrote:

@Aahz wrote:In this past week I paid off two cards with 0% Balance Transfers down to zero. Paying off $11,000+ of my $30,000 in debt I was carrying and dropping utlity from 12% to 7%

EQ FICO8 742 -> 761

TU FICO8 752 -> 772

EQ Vantage (CK) 732 -> 703

TU Vantage (CK) 726 -> 703

Yes, my Credit Karma FAKOs took massive hits for paying off more than a third of my credit card debt.

No, there were no other changes. I track my reportsactivity obsessively.

There is definitely something seriously wrong with the FAKO scoring model. Before I disputed 6 student loan baddies on my CR, my credit score on the TU site was 701 (Vantage I believe) - some 38 points higher than my TU Fico 8 score.

When TU removed the disputed student loans, my credit score on their site dropped some 91 points! My first thought was that the removal of those account seriously decreased my AAoA (previously 15yr 11 m). But that only changed to 13 yrs. So go figure. From that point, I decided not to use anything that reported a non-Fico score.

There is nothing "wrong" with Vantagescore 3.0. The 3 CRAs who developed the model clearly state its purpose is to IMPROVE upon (not mimic) Fico scoring models. The intent is for their scores to be a better indicator of borrower risk. Is Vantagescore a better predictor? - don't know, don't care.

My Fico 04 and Fico 98 scores are quite different from my Fico 08 and Fico 09 scores. Does that mean they are wrong? Of course not! Different model, different score - to be expected as they factors evaluated in scoring and the relative weight of those factors differs by model.

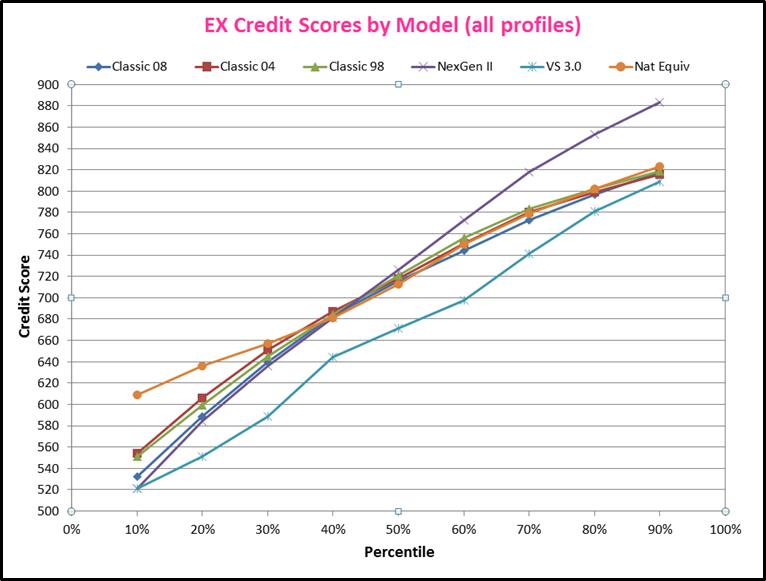

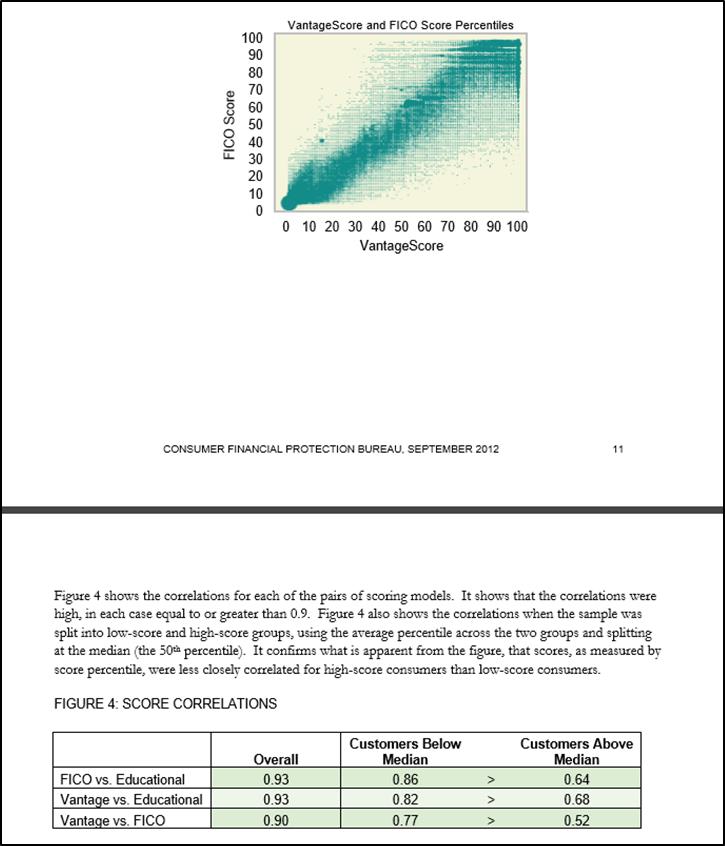

Interestingly, all Fico models (except NextGen) have the same general curvature. VantageScore is quite different.

Below is a copy paste from a 2012 study on correlation between models. Correlation is stronger at lower scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content