- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Going to let 10/10 cards report a balance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Going to let 10/10 cards report a balance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

@oilcan12 wrote:Thank you masscredit for your data points and experiment.

Would you mind providing more information about your credit profile such as:

How many new accounts do you have in the last 6 months, 12 months and 24 months?

What is your AAoA and oldest card?

Is your credit clean or do you have derogatories?

Do you have an installment loan?

Thank you for any additional information you can provide.

I have 3 new cards in the last 6 months. No others in the last 2 years.

EQ AAoA - 3 years 8 months - Oldest is Feb '97

TU AAoA - 2 years 8 months - Oldest is May '05

There is a BK from 2009 and 3 tax liens on each

One installment (auto) loan from Sept '14. That's at 72%.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

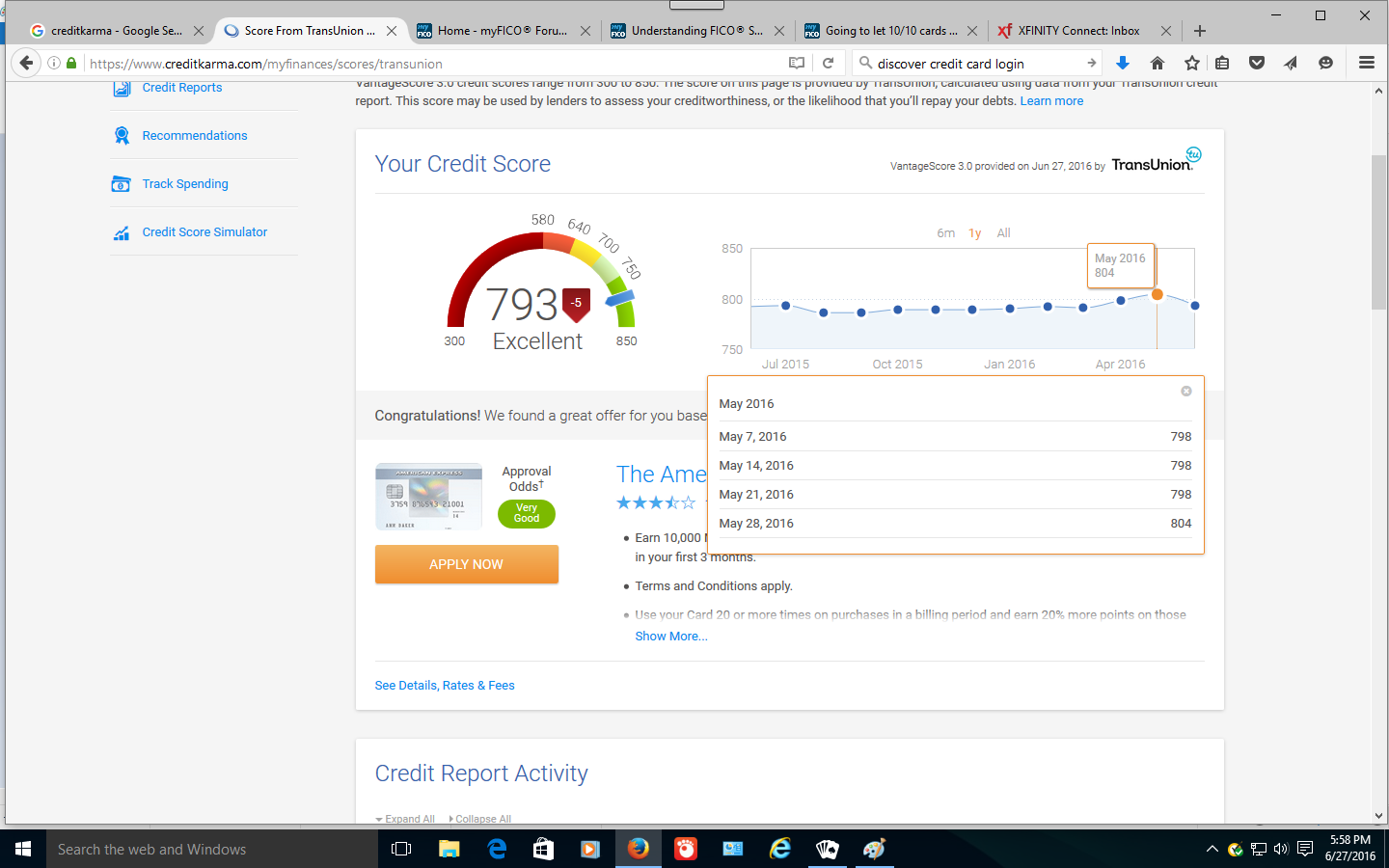

@masscredit wrote:I use CK to monitor balances that have reported but don't watch the scores to much. I'm looking at their website now. They only show the scores on their site by month and not by date.

EQ

April - 728

May - 720

June 11th - 713

TU

April - 717

May - 711

June 11th - 707

So there has definately been more movement with the 3.0 scores than the 08. I'll watch these closer as the rest of my accounts post over the next couple of weeks and also as I pay the cards off.

You can see each update per month just click on the score dots or the blue lines in between.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

Thanks! I didn't know that. Now I can see all of the scores on there! ![]()

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

Thank you masscredit.

I've been following your thread from the beginning and really appreciate your experiment.

I'm not a micro-manager. I let balances report and just PIF by the due date. However, I have always been careful not to have too many cards reporting at once. I don't think I'm going to worry about how many cards report anymore. I feel liberated!

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k

NFCU Flagship $32K | NFCU Cashrewards $42K | Discover IT $39K | SECU Visa $20K | Chase SW $24k | CSR $15K | Chase Bonvoy $11.5K | Chase Freedom $11.5K | Chase Amazon Visa 8.5K | AMEX Bonvoy $18.1K | AMEX Hilton Surpass $15K | AMEX Hilton Aspire $24.4K | AMEX Gold | Aviator Red $16K | Uber Visa 10k | Citi TY Premier $24.6K | BoA Premium Rewards 35k | BoA Cash Rewards Visa $31.5k | BoA Cash Rewards MC $23k | US Bank Cash+ $10k | USAA AMEX $6K | Cap1QS $11K | BJs MC $27.6K | Walmart MC $5.1K | Loft MC $25,000 | Macy’s Store/Amex $20K/$1K | BR Visa $10K | JCP $1K | VS $3.2K | Home Depot $5K | Lowes $8.5K | Target $14.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

@sunkissed wrote:Thank you masscredit.

I've been following your thread from the beginning and really appreciate your experiment.

I'm not a micro-manager. I let balances report and just PIF by the due date. However, I have always been careful not to have too many cards reporting at once. I don't think I'm going to worry about how many cards report anymore. I feel liberated!

Bravo!

I always let balances report naturally on all cards I use and then PIF statements. Key is having adequate aggregate CLs (say 0.8x annual income or higher) to maintain revolving CC utilization in single digit territory.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

This is very intersting to me, as I had something weird happen last night. I have the Experian credit monitor and my score went from 693 last month.... to 683 Mid June.... to now 669 ![]() So at 4 am this morning I was looking and looking and nothing new was added ( accounts, INQ., Collections) nothing new.

So at 4 am this morning I was looking and looking and nothing new was added ( accounts, INQ., Collections) nothing new.

What happen was this:

Chase Freedom Balance reported May 1900.00 Mid June 1400.00 June 24th 0.00

Barclay May 643.00 June 0.00

Discover May 7900.00 June 0.00

Cap1 May 419.00 June 0.00

Cap1 card 2 May 9800.00 June 9000.00

Amex1 May 1000.00 June 0.00

Amex2 May 95.00 June 0.00

Amex3 Premiere Rew Gold May 303.00 June 303.00 They have not reported paid off yet but balance is 0 as of June 8th

Wamart May 357.00 June 357.00 ( 0 balance just won't update til 3rd of July)

Others with no balance:

Barclay

Vicky Sec.

Cap1

Amex4

I noticed on my experian earlier this month under factors it had in the positive column "You have been making USE of your revolving credit" ...as a positive I was like oookkkkaaayyyy.

But I think for me it is better if I have small balnces report on at least 4-5 cards.

My Experian updates everday I login it. Begining of June I gained 18 points in overthe first week..

Bk13 Still reporting turned 6 years this month...AAoA 4 years ish Utilization abont 9% until Mid this month.

I wil see what happens whenI pay off Cap1 9k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

Ignore anything that isn't an actual reason code; all third party interpretations should be zealously discounted honestly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Going to let 10/10 cards report a balance

Something that I'm not used to is payment due dates. I usually PIF before the statements close so I just know those dates. After this round of letting balances post, I had to go though all of my accounts to make sure most were paid before the due date so nothing is late. I bought a TV at Walmart so I'm going to take advantage of their zero percent interest offer. Other than that I'll go back to my normal routine but know that I can let other accounts report balances without hurting my scores.

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500