- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How Accurate is Capital One's Credit Tracker?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How Accurate is Capital One's Credit Tracker?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

Capital One is my lowest at 659. Credit Karma has me at 720 and 711. My FICO has me between 680 and 699 on all three.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

Does anyone know what model Cap One credit tracker uses? I would guess that it is provided by one of the CRAs. For example, I know Wells Fargo credit monitoring was affiliated with EX and reports the EX plus score.

Reason I am asking is a young co-worker has Cap One credit tracker. He has only a single CC (from Cap One) that is now 7 months old. Once his card reached 6 months they gave him a 9x increase in CL ($500 => $4500). His credit tracker score is 760 which I found astounding given he is new to credit with a freshly minted credit report.

From earlier posters, it appears they all have lower Cap One tracker scores than their corresponding Fico 8 score. Can it therefore be possible that someone new to credit, with only one account, to start out with a Fico 8 of 760? Has the model that Cap One uses changed in the last 6 months? New to credit with a razor thin file potentially having a top tier Fico 8 credit score is a paradigm shifter for me.

Any data on Fico 8 scores for someone new to credit (under 12 months history) with just one or two open accounts would be appreciated.

I came across a few posts pasted below which are close but more would be helpful.

I want to preface this thread by saying thanks to everyone in the community here. Much of my beginning success has been to reading countless threads by the wonderful and knowledgable people here.

Profile

Income: ~$37000

Oldest Account: 7 months

AAoA (according to myfico): 6 months

Cards: US Bank HD Secured ($500, 5/15); Cap1 Platinum ($1500, 8/15); Discover It ($1000, 12/15)* [I have no other credit history besides these]

Scores: 716 EX, 707 EQ, 712 TU [pulled recently]

*I’ve just (as of an hour ago) apped for the Discover It and got approved for $1000.

Hey friends!

I've been gunning for a CSP and the last couple of times have not been successful. It's been a couple of months since I last tried and am wondering if it's worth trying again.

I first opened a CitiForward with a $500 CL in January this year (2014) and have paid all my bills on time.

I then opened a BOA Cash Reward Platinum Plus Visa with a $4000 CL in July this year (2014) and this has been my active card ever since.

So the age since my oldest card is 10-11 months, while the AAoA is around 7 months.

My credit score with Equifax is 720

Re: Looking for 2nd Card. CSP/Venture chances??

CONGRATS! Very awesome getting the Venture as they say you need at least 3 years history! this gives me hope  Also thanks for taking one for the team on that CSP app kidding!

Also thanks for taking one for the team on that CSP app kidding!

I too have a thin file with less than 1 year CC history, high 700s Fico. I was on the fence about applying...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

I "think" they use TU Vantage 3 score but only update it like once a month. I say think because I am not 100% positive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

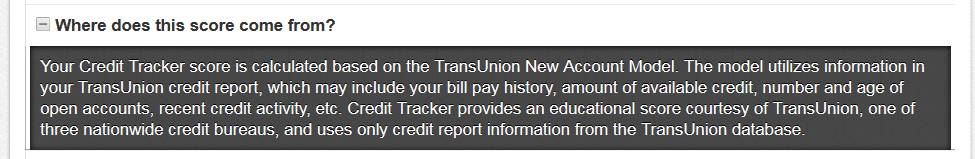

@Thomas_Thumb wrote:Does anyone know what model Cap One credit tracker uses? I would guess that it is provided by one of the CRAs.

They use the TU New Account Model 3.0

The TransUnion New Account Model, designed with advanced characteristic evaluation and scorecard segmentation, assesses new prospects’ and applicants’ risk level. This model enables institutions to better identify new or prospective applicants who are most likely to become 90 or more days delinquent within a 24-month timeframe.

-Source: https://www.transunion.com/docs/rev/business/financialservices/TransUnion_Models-Jan2011.pdf

EDIT to add screengrab-

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

@Thomas_Thumb wrote:

Any data on Fico 8 scores for someone new to credit (under 12 months history) with just one or two open accounts would be appreciated.

Not exactly what you were asking for, but it's the best I've got....

In February 2015 pulled a 3B report w/ scores for my 19year old daughter.

Revolving 1 - Joint BofA BBR - $9k limit, $97 balance, opened Dec '14 (3 months)

Revolving 2 - AU on CapOne - $4k limit, $0 balance, opened Nov '10 (52 months)

Nothing else on reports

FICO 08 - EQ 752 - TU 768 - EX 733

FICO 05 - EQ 782

FICO 02 - EX 784

FICO Auto Score 8 - EQ 750 - EX 730

FICO Auto Score 5 - EQ 781

FICO Auto Score 2 - EX 756

FICO Bankcard Score 8 - EQ 751 - EX 732

FICO Bankcard Score 5 - EQ 784

FICO Bankcard Score 2 - EX 798

Reason codes on all scores are "short history" & "no/few accounts" related.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

@Aahz wrote:

@Thomas_Thumb wrote:Does anyone know what model Cap One credit tracker uses? I would guess that it is provided by one of the CRAs.

They use the TU New Account Model 3.0

The TransUnion New Account Model, designed with advanced characteristic evaluation and scorecard segmentation, assesses new prospects’ and applicants’ risk level. This model enables institutions to better identify new or prospective applicants who are most likely to become 90 or more days delinquent within a 24-month timeframe.-Source: https://www.transunion.com/docs/rev/business/financialservices/TransUnion_Models-Jan2011.pdf

EDIT to add screengrab-

Thanks Aahz, Score range 150 to 950 per the below table - yes?

MODEL NAME | TYPE OF MODEL | SCORE RANGES | EXCLUSION CRITERIA | DEVELOPMENT DATES | OTHER INFORMATION |

TransUnion New Account Score 3.0 | Delinquency (90+ days) on new accounts within 24 months | 150–950 High score = low risk | Must have: 1 undisputed tradeline with ECOA not equal to ‘A’ No deceased indicator

| April 2003 April 2005 |

14-day inquiry dedupe of all auto-and mortgage-related inquiries Same-day dedupe of all inquiries 12 scorecards Scaled to TransUnion Account Management Model

|

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

my CP 1 credit tracker score is 730, but my Fico score is 781.

why such a steep drop between the two??

Thanks for any help in advance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

@Anonymous wrote:my CP 1 credit tracker score is 730, but my Fico score is 781.

why such a steep drop between the two??

Thanks for any help in advance.

The Capital One Credit Tracker has changed. It is now based on Vantage 3.0 model using TransUnion data, and is updated once a week.

I think it's pretty accurate.

If you mean, by accurate, how close is it to FICO 8, sometimes it varies substantially, but sometimes it doesn't. At the moment my FICO 8 and my Vantage 3.0, both based on TransUnion data, are identical.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Accurate is Capital One's Credit Tracker?

@Anonymous wrote:my CP 1 credit tracker score is 730, but my Fico score is 781.

why such a steep drop between the two??

Thanks for any help in advance.

If you have a new or thin file, the Vantage 3.0 score (used by Capital One Credit Wise, Credit Karma, Credit Sesame, other free sites, and many credit unions) will react agressively to changes that have little impact on actual FICO scores. Example for me today (and I have MANY such examples, as I've been tracking this closely for the last seven months): large credit limit increase on one bank card gave me a 15 point boost on Vantage 3.0. FICO8 change-zero. TU Vantage 3.0 score still 60 points below FICO8 score.

Bottom line, don't use Vantage 3.0 scores as a basis for real world credit decisions. They are used by the free services because they can be obtained for a very low cost.