- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How do you get that elusive 850 x 3?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do you get that elusive 850 x 3?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you get that elusive 850 x 3?

I've decided to take the summer and continue my gardening in the hopes of achieving the elusive 850 FICO 8's across the board. When I think I'm close I'll need to sign up for monitoring to see, but for now I'll be going off Barclay and AmEx's reported EX and EQ scores. Looking at the pattern of my Barclay pulls, they should post a new score next month so I can check then and see where I'm at.

So, from what I've gleaned from reading the forums, the best way to accomplish the 850's would be to have one card only showing utilization, and keeping that to 1-9%. Is there any other magic involved that I'm missing? My AAoA is fairly lengthy, and I've currently got a mortgage and auto loan reporting so credit mix is good, so I've gotten close before (prior to my app spree in early 2015), but one of my scores always lags behind the others - and sadly, I think it's TU, which I don't have access to without paying. There WILL be a screengrab if I am ever able to accomplish this, as I know it will be fleeting.

For the moment, though, I'm willing to micromanage my accounts to be sure what they report, and I'll be shooting for what I described above. If there is anything else I should be paying attention to, I'd love to learn! And if this doesn't work with one of the bureau's, what do I look for in my reports that would be different enough to keep all the scores from being the same?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

Utilization on your mortgage and car loan will also be a factor.

I think there is also useful info in this thread about scorecards: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/td-p/4359411

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

@manyquestions wrote:Utilization on your mortgage and car loan will also be a factor.

I think there is also useful info in this thread about scorecards: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/td-p/4359411

The loan balances might be a factor, but the mortgage was a refi three years ago and yet they left the original loan amount in, rather than the refi amount. Thus, it already shows as significantly paid down. The car is only 1.5 years old, so only about 30% paid down which might affect the score.

Thank you for the link to the scorecard info - it was an interesting read! I'm thinking I'm going to spring for monitoring and take a peek at where I am and what the differences are between my reports so that I can try to figure out how to get them all to 850.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

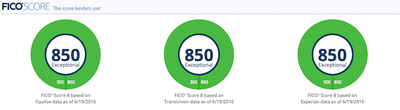

So I caved and purchased the monitoring again, and lo and behold, apparently being 1.5 years out on the car loan and more than a year since an inquiry or new account did it. Huh!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

Congrats!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

@disdreamin wrote:

@manyquestions wrote:Utilization on your mortgage and car loan will also be a factor.

I think there is also useful info in this thread about scorecards: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/td-p/4359411

The loan balances might be a factor, but the mortgage was a refi three years ago and yet they left the original loan amount in, rather than the refi amount. Thus, it already shows as significantly paid down. The car is only 1.5 years old, so only about 30% paid down which might affect the score.

Thank you for the link to the scorecard info - it was an interesting read! I'm thinking I'm going to spring for monitoring and take a peek at where I am and what the differences are between my reports so that I can try to figure out how to get them all to 850.

What's you current aggregate balance to loan ratio on your installment loans? If you have an open mortgage (which you do), you can certainly have an 850 score with a 65% aggregate B/L ratio as shown by inverse. I suspect you are below that ratio. If, on the otherhand, your B/L is above 70% it will be a paradigm shift.

Also, what's your AAOA (FYI - as a heads up, I asked this on another thread where you posted as well)

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

@Thomas_Thumb wrote:

@disdreamin wrote:

@manyquestions wrote:Utilization on your mortgage and car loan will also be a factor.

I think there is also useful info in this thread about scorecards: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/SCORECARDS/td-p/4359411

The loan balances might be a factor, but the mortgage was a refi three years ago and yet they left the original loan amount in, rather than the refi amount. Thus, it already shows as significantly paid down. The car is only 1.5 years old, so only about 30% paid down which might affect the score.

Thank you for the link to the scorecard info - it was an interesting read! I'm thinking I'm going to spring for monitoring and take a peek at where I am and what the differences are between my reports so that I can try to figure out how to get them all to 850.

What's you current aggregate balance to loan ratio on your installment loans? If you have an open mortgage (which you do), you can certainly have an 850 score with a 65% aggregate B/L ratio as shown by inverse. I suspect you are below that ratio. If, on the otherhand, your B/L is above 70% it will be a paradigm shift.

Also, what's your AAOA (FYI - as a heads up, I asked this on another thread where you posted as well)

Current balance to loan ratio on mortgage is 55.5%, current auto loan is at 72.6%. AAoA is 121 months on EX and EQ, 111 months on TU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

The scoring factor is aggregate B/L. Given your mortgage, I suspect your aggregate will be under 60%. Certainly it is under 70%.

Also your AAOA is over 8 years which I peg as a likely minimum for a Fico 08 850. So, no paradigm shift based on your data.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

For aggregate, you are correct - it's under 70%. It comes out around 58% overall.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do you get that elusive 850 x 3?

@disdreamin wrote:So I caved and purchased the monitoring again, and lo and behold, apparently being 1.5 years out on the car loan and more than a year since an inquiry or new account did it. Huh!

Congrats! Very well done!!!

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k