- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How many Credit cards with balances is optimal whe...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many Credit cards with balances is optimal when you have more than 3 cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

@Anonymous wrote:The FICO scoring method for EQ, EX and TU vary in this case. I believe it's EQ that penalizes the worst for having more than 1 card reporting a balance, whereas the other ones appear to penalize if you carry a balance on half your cards or more, rounded up.

Hello ABCD! I think you meant to use report instead of carry above. The thing that the OP is confused about is this distinction between reporting and carrying, which the folks here have been trying to clear up for him in the last several posts.

Thomas Thumb has done some interesting research that seems to indicate that the mortgage models are much more sensitive to this issue of having almost all your cards at $0 except one. FICO 8 cares, but not so much and perhaps as you say the FICO 8 impact is bureau dependent.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

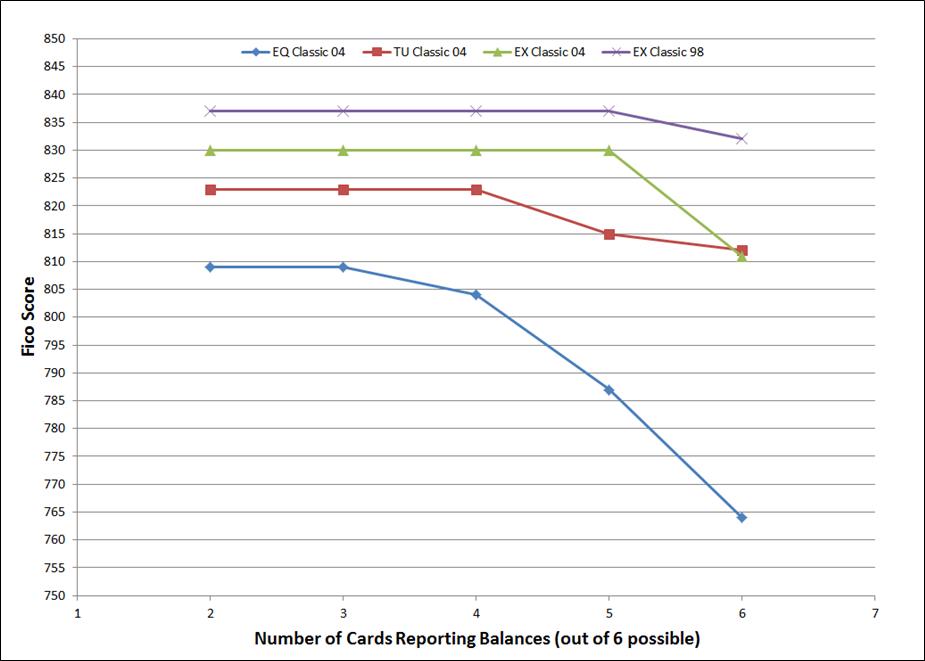

Pasted below is what I experience with my File on Fico 04 and Fico 98. With all Fico models up through Fico 8 the CRAs can and do tweak how factors are weighed. One of the factors tweaked is cards reporting balances. [I will add a Fico 8 Bankcard graph on cards vs score later for comparison]

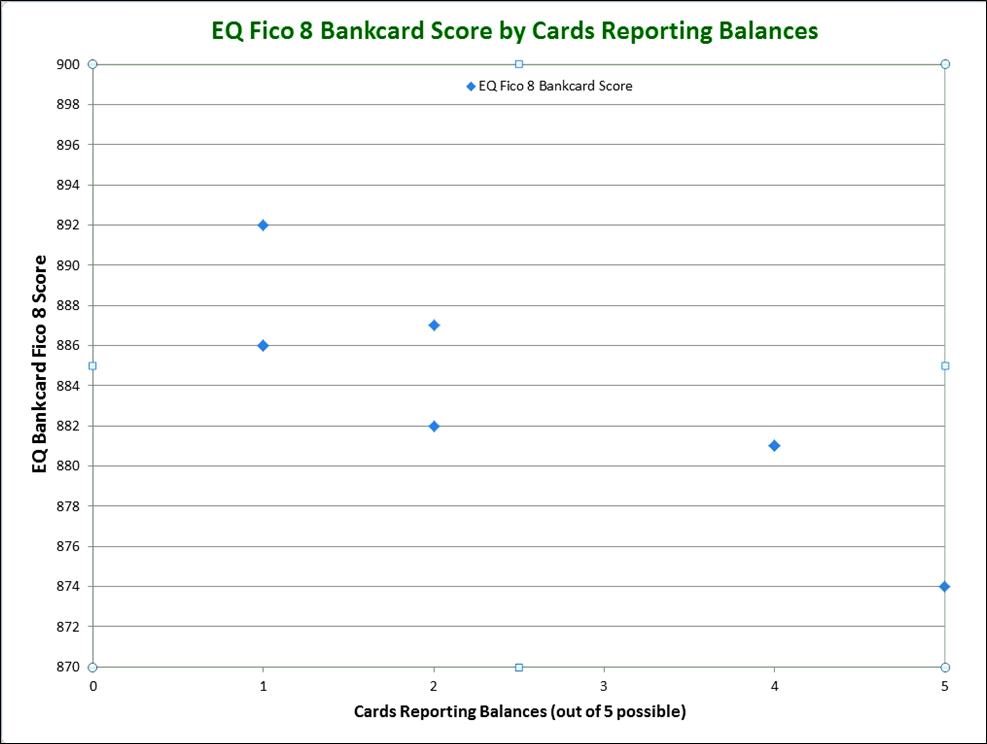

Pasted below are EQ Fico 8 Bankcard scores by # cards reporting balances. Some card counts have more than one data point. The slight difference in scores for the same card count is to be expected as noise factors have a minor influence. Note: my single AU card is not included in count because it is ignored in Fico 8. That card reports a balance every month and is included in the above because Fico 04 and Fico 98 models do consider the AU card

| Cards Reporting (out of 5) | EQ Fico 8 Bankcard Score |

| 1 | 892 |

| 1 | 886 |

| 1 | 886 |

| 2 | 887 |

| 2 | 882 |

| 4 | 881 |

| 4 | 881 |

| 5 | 874 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

@Anonymous wrote:I know it's "optimal" for scoring if one of three cards carries a 9% or less balance...

If I have 4 CC's, should only 1 still have a balance?

If I have 5 CC's, can 2 then carry a balance (Again, less than 9% total)?

If I have 6 CC's, can 2 carry a balance?

If I have 7 CC's, can 3 carry a balance?

And so on?

so that it's always LESS THAN half with a balance, does optimal scoring still occur?

Sometimes you want to carry a balance on, say Lows for the 24 months financing.... and have a 0% BT on another.... But if you have 5 cards, three with 0 balance... and your under 9% total....

save the money on financing.

The games that can be played with number of cards reporting are small differences in FICO scoring. If you want to optimize for a mortgage, then look closely at reducing the number of cards reporting. Otherwise, a reasonably activey set of cards is going to report balances, and the rewards set on each card can mean the entire range of cards is busy in any given month. Number of cards can be a change in score, bur interest savings or good rewards is actual money you earn in the near term. No one pays you for a good FICO score, except at the time you apply for a new loan or mortgage, then the interest rate makes a difference.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

To our OP:

As a postscript on the issue of taking advantage of "special financing" offers, it is crucial to make sure that any such offer is not going to be classified as a Consumer Finance Account. A 0% credit card (e.g. a 0% promotion on that Lowe's card) will almost certainly not be classified as such, but unless it is being purchased on a true credit card, then the risk of it being classified as a CFA is quite high. Classic examples of things that can be classified as a CFA:

* A washer/dryer at Lowes

* A sofa at Rooms To Go

* A big screen TV at Best Buy

CFAs harm your score for the entire time they appear on your report, which is typically ten years after they are closed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

@Anonymous wrote:To our OP:

As a postscript on the issue of taking advantage of "special financing" offers, it is crucial to make sure that any such offer is not going to be classified as a Consumer Finance Account. A 0% credit card (e.g. a 0% promotion on that Lowe's card) will almost certainly not be classified as such, but unless it is being purchased on a true credit card, then the risk of it being classified as a CFA is quite high. Classic examples of things that can be classified as a CFA:

* A washer/dryer at Lowes

* A sofa at Rooms To Go

* A big screen TV at Best Buy

CFAs harm your score for the entire time they appear on your report, which is typically ten years after they are closed.

CGID -

If one has a Lowes card, just say it's a 10K limit...

And you buy that washer/dryer on special 0%/24m terms, on that card that you already have, it would NOT be a CFA.

If I walk into best buy, apply for a card, get a 5K limit, buy a 2K tv, this should also not be a CFA

A CFA is when you get an account to pay for the item, that ha a set time frame, and is closed when it's paid off, like buying a mattress with 0% for 60 months etc...?

does this sound correct?

Not to further side track my original question, but why are these looked at so bad, why do they do harm?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many Credit cards with balances is optimal when you have more than 3 cards?

@Anonymous wrote:

@Anonymous wrote:To our OP:

As a postscript on the issue of taking advantage of "special financing" offers, it is crucial to make sure that any such offer is not going to be classified as a Consumer Finance Account. A 0% credit card (e.g. a 0% promotion on that Lowe's card) will almost certainly not be classified as such, but unless it is being purchased on a true credit card, then the risk of it being classified as a CFA is quite high. Classic examples of things that can be classified as a CFA:

* A washer/dryer at Lowes

* A sofa at Rooms To Go

* A big screen TV at Best Buy

CFAs harm your score for the entire time they appear on your report, which is typically ten years after they are closed.

CGID -

If one has a Lowes card, just say it's a 10K limit...

And you buy that washer/dryer on special 0%/24m terms, on that card that you already have, it would NOT be a CFA.

If I walk into best buy, apply for a card, get a 5K limit, buy a 2K tv, this should also not be a CFA

A CFA is when you get an account to pay for the item, that ha a set time frame, and is closed when it's paid off, like buying a mattress with 0% for 60 months etc...?

does this sound correct?

Not to further side track my original question, but why are these looked at so bad, why do they do harm?

That sounds right on target.

In answer to your question about why FICO historically has viewed these as bad, the simple answer must be: because the statistical data at FICO's disposal indicates these as a risk factor (and FICO has datasets on millions of consumers that it uses to build its models). People with CFAs on their files must be, considered together as a big group, substantially more risky than people who do not.

If that is the case, all we can do is speculate as to why that might be the case. My guess is that people who buy a mattress on a CFA are almost certainly doing so because they are wanting to buy things that they do not have money for -- any money. From which it almost certainly follows that they have no savings and are living hand to mouth. Such people are (I would expect) at much higher risk of defaulting on debts -- all it takes is for it to rain tomorrow and they won't have the funds to make payments. Of course there might be individual exceptions to this, but we are now speculating on why as a group they'd be more likely to default on debts (which is what the FICO score measures).