- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- How much do inquiries affect the mortgage fico sco...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How much do inquiries affect the mortgage fico scores?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How much do inquiries affect the mortgage fico scores?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

All of those inquiries made on the same day should only impact your scores as if they were one inquiry. That said, 1 inquiry that's about a year old likely has zero impact at this point, other than the fact that the inquiry can still be seen by other prospective lenders.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

Even though my mortgage FICO (yes, I just get it pulled by a lender but decided to try to get a bit more cleanup in and have it pulled at the 45 day mark)) specifically says the number of inquiiries is affecting two of my scores? Of course it could be more recent pulls. After I got a Walmart card in January, I tried unsuccessfully to get two more Comenity cards. In the last 6 months though, I just have two Credco inquiries on each CRA (I thought I was going to take the plunge in June but realized I needed to wait), an Amex in May and Chase last month - both apprroved (woot!) It is unlikely that all the inquiries 9-12 months old are impacting me? Do they have less score impact as the first year since inquiry passes or (as I had assumed) same impact for 12 months and then no impact after 12 months?

Sigh. I have to get those last few points in. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

The experience of the veterans here, if I have understood them right, is that inquiries have 100% full impact up to 1 year, and then they have zero FICO impact after that.

Do you have any open installment loans? (E.g. an auto loan, student loan, personal loan, mortgage?) If not, we can suggest an easy way to get some points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

No mortgage yet. I have4 student loans (absolutely ancient but rehabbed and current) and an auto payment. I have some black marks on my credit including two collections on Transunion and one on Equifax. A few other black marks but luckily it's a sight better than it was when I began with up to 25-26 collections on each CRA!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

Depending on the thickness of your file and your number of inquiries, they may only impact your score for a short time but could have an impact for up to 1 year.

I scooped up a couple of inquiries back in June when I applied for 4 credit cards. I received 1 inquiry on TU and EQ and 2 inquiries on EX. I had 1 inquiry already on both TU and EQ from about a year prior, and 10 inquiries on EX... but those 10 were "seen" as only 2 because like you a large portion of them (9 in my case) were at the same time when I got my auto loan.

My scores from the bureaus that I received 1 inquiry on dropped slightly, but were back to the same scores the following month and higher scores the month after that. On EX where I took 2 inquiries, it took another month to get the points back. So, for my profile, it seems that the number of inquiries I get impacts my score for about that number of months. Now, I'm sure if I went on a serious spree that hit the same bureau like 6 inquiries to TU for example it could take a little longer than 6 months for my scores to recover, but who knows, maybe not. My file has a 7 year AAoA and over 20 accounts on it, so it's moderately aged and I think can absorb inquiries better than a thinner file.

Bottom line is that inquiries will not impact score for 1 full year on some profiles, and may only impact score for a couple of months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How much do inquiries affect the mortgage fico scores?

@Anonymous wrote:

Last year my credit was still pretty poor and when I bought a car, the dealer had to try about 6 places to get a half decent interest rate for me. So I have 6 inquiries that should no longer affect my credit score, I'm assuming, by 11/1 - they were all run maybe 10/21. Do they really count as the same damage as one inquiry? Or should it help raise my scores when we are past that year point? I'm guessing two (I had a another that month) inquires won't make a huge difference but 6-7 would depending on how impact was calculated. I am trying to claw up to a mid score of 680. I'm up about 170 points since beginning credit clean up 5/2015 but am afraid these few points are going to be tough to get. Sigh. I should never have let my credit become such a mess.

Good question.

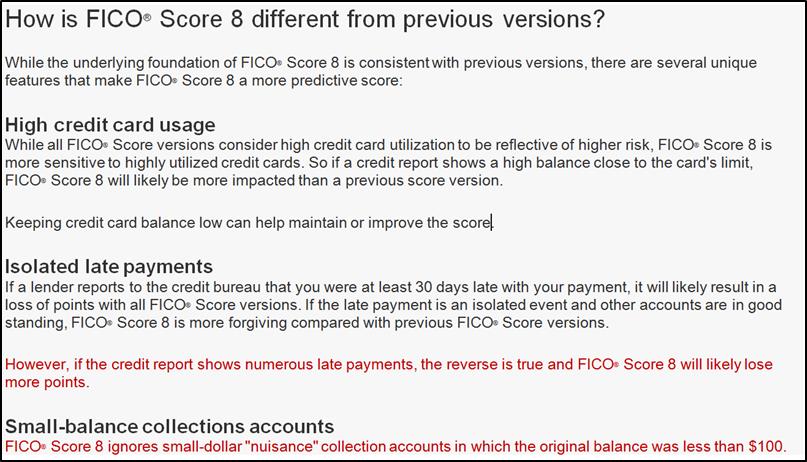

Fico mortgage algorithms (Fico 04 and Fico 98) do treat inquiries, # (%) cards reporting balances and installment loans differently than Fico 08.

1) A single inquiry on EQ cost me 13 points on EQ Fico 04 mortgage. I lost no points in EQ Fico 08. The impact on mortgage score was for a full year - inquiry gone, score up. So, don't assume a minor or no point change on Fico 08 means you will see the same result on Fico 04. Fico mortgage algorithms punish score more severly point wise than does Fico 08 for the 1st few inquiries.

2) Fico mortgage scores are much more sensitive to # of open accounts(cards) reporting balances than is Fico 08. Posters have reported balances on 1/2 or more cards without a point ding on Fico 08. Fico 04 will not tolerate such behavior and your score can take a major hit if too cards report balances. The "report a balance on one card only rule" should be followed when trying to optimize Fico mortgage scores. In fact, that guideline was derived from data associated with Fico mortgage scores.

3) EQ and TU Fico 04 mortgage algorithms don't require an open installment loan - a closed loan on file is fine. The older EX Fico 98 mortgage does like to see an open installment loan as do all Fico 08 algorithms.

4) EX Fico 98 mortgage does look at charge card balance to high balance as a scoring factor (B/HB). Neither Fico 04 mortgage or Fico 08 look at this factor. If you have an AMEX charge card, make sure your B/HB on any charge cards you have is below 30% in the 2 months prior to getting a mortgage. I tested this a couple times.

- Lost 20 points [837 => 817] on EX Fico score 2 (EX Fico 98 mortgage model) when I allowed B/HB ($1997/$1997) to report at 100%.

- On a previous test I lost 5 points [837 => 832] on EX Fico score 2 when B/HB ($628/$1278) was at 49%

Thus, the below 30% recommendation to avoid any point loss associated with B/HB on NPSL charge cards.

5) The Fico mortgage algorithms do not differentiate between type or dollar amount of collection on file. If there is a collection, there is a demerit. Fico 08 does not treat all collections equally - some small dollar amount are ignored in Fico 08. So, if you have some they will be hurting your mortgage scores.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950