- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Inquiry Research and Datapoint Tracking Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Inquiry Research and Datapoint Tracking Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry Research and Datapoint Tracking Thread

@Revelate wrote:

I'm going to catch the EQ 1->0 inquiry bit in Februrary next year... decided not to bother with the EX ones as appeared to be plenty of EQ datapoints around those inquiry counts from before and I'm skeptical of inquiries being different between differing scorecards anyway... likewise somewhat doubtful of their being handled differently between bureaus too.

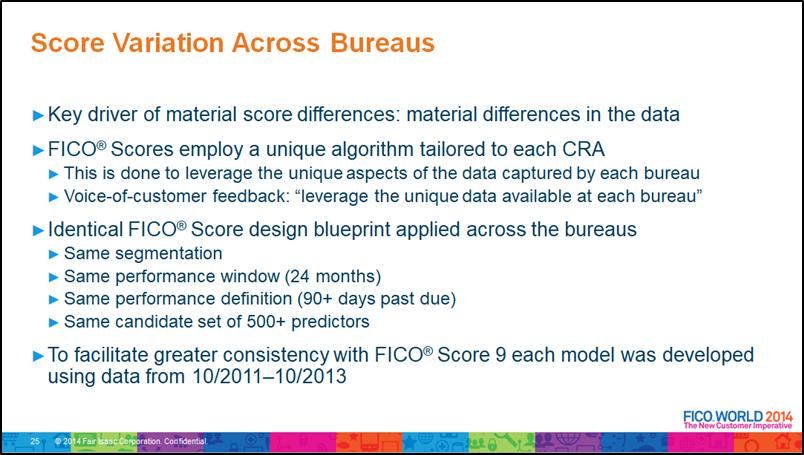

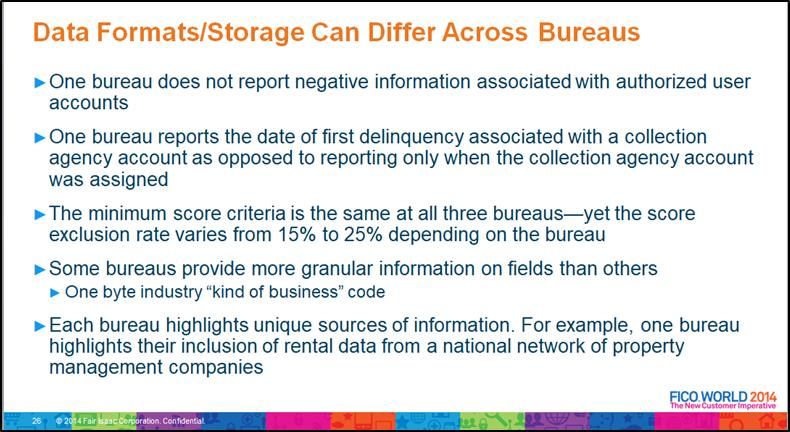

Agreed, I don't think inquiries are handled differently between CRAs on Non-Derog (clean) scorecards from a threshold perspective but, impact on score may differ slightly.

Conversely, my observations are #/% of open cards/accounts is tweaked by CRAs. EQ responding negatively at a lower threshold with a greater impact on Fico 04 but, TU appears to react more strongly on Fico 8. I may even have a statement from Fico on such tweaking. [I'll paste it if I find it]. Undoubetedly, relative behavior among CRAs is likely profile dependent so - YMMV.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry Research and Datapoint Tracking Thread

I'll have some data points to add on 5/2/18 when I change from:

EX: 2 --> 0

TU: 1 --> 0

EQ: 2 --> 1

I would think that when it comes to my TU and EQ scores that one will change and the other won't (depending on possible bins) where no doubt my EX will go up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry Research and Datapoint Tracking Thread

Subexistence, be careful with the distinction between inquiries and how long it's been since you opened a new account. While there is some similarity, they are not the same. Inquiries, as Revelate stated, have a score impact for 12 months; however, certain parts of your new credit component have an impact lasting from 6 to 12 months.

“Within its new credit category, FICO considers the following factors:

- How many accounts have been opened in the past six to 12 months, as well as the proportion of accounts that are new, by account type?

- How many credit inquiries have been made recently?

- How long it's been since the opening of any new accounts, by account type.

- How long it's been since any credit inquiries.

- The re-appearance on a credit report of positive credit information for an account that had earlier payment problems.”

Inquiries are hard pulls, but new accounts could be hard, soft, or no pull accounts. I speak from experience. A little over a year ago I was flooded with junk mail from my bank to take a very low interest rate line of credit with an extremely long draw period. I didn’t need it so it went with the rest of my unsolicited mail – File 13. Finally, in January 2017 I received a call from the bank and had a very good conversation with the lender. I informed her that the hit I would take from the inquiry was worse than the benefit I would get with the available credit. She said that since I had such a long relation with the bank (and as long as I agreed to have any debits during the repayment period auto deducted) it would be a soft pull. I agreed! Big mistake!

A few months later when it reported I saw the problem. There was no inquiry and since I did not take any funds at that time, my utilization actually went down with the increase amount of available credit; however, my AAoA took a slight hit. More importantly, I saw this new account hit that I did not expect. The only good thing is that I did get a big chunk of that back this past August and hope to regain the majority of the loss early next year (2018). So while you may have heard about the 6-month benefit time, that applies to this monster “how long it's been since you opened a new account.”

Y

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry Research and Datapoint Tracking Thread

Small datapoint:

EX FICO 8:

Inquiries: 3->2

788 -> 795

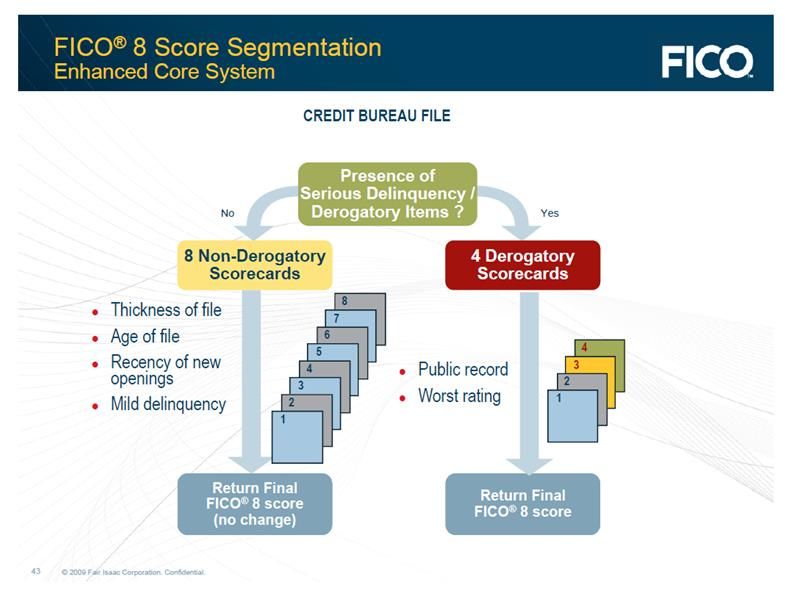

Talk about prettier file scaling compared to the older EQ one where I was still sorted into a derogatory scorecard.

AAOA: 46 months

AOYA: 11 months

CFA only blemish, trivial revolving utilization and number of revolvers with balances.

Might actually make 800 this year, that'd be neat.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Inquiry Research and Datapoint Tracking Thread

I had a 726 TU FICO 8 score that dropped to 722 after SoFi pulled my credit. I think the hit was due to it being the 4th inquiry for the last 12 mos.