- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Installment "monthly payment" a factor?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Installment "monthly payment" a factor?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Installment "monthly payment" a factor?

I noticed that my Equifax report lists the "monthly payment" on an installment loan.

This particular loan was prematurely paid down so that I could pay a nominal amount for the next 58 months to pay it off, but of course the report lists the original monthly amount.

Questions:

1. Is this "monthly payment" a factor in FICO scoring?

2. If so, in which scoring models?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

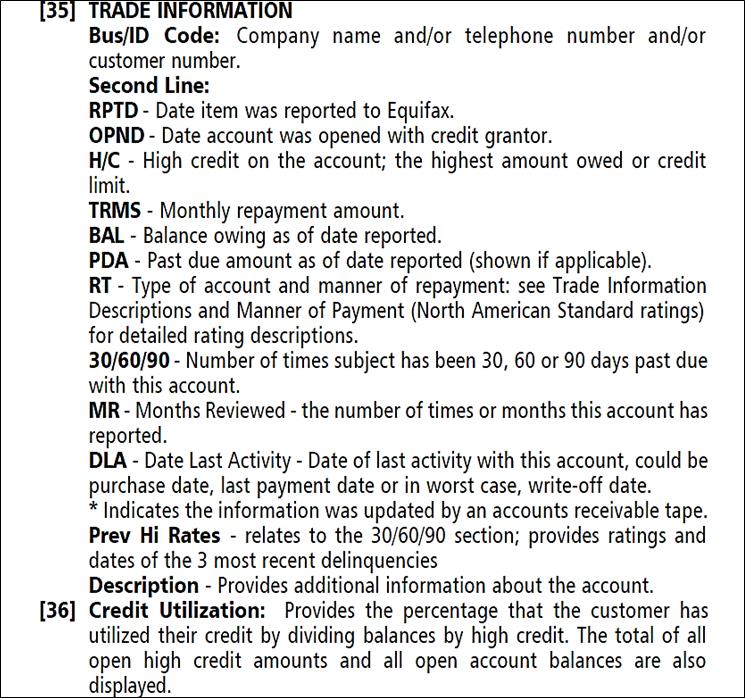

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

A related (but slightly different) question:

SouthJ's situation is fairly common around here:

* An installment loan that has been paid down to a small balance early on

* With the due date for the next payment being pushed back several years

* And therefore possibly there may be $0 in actual payments for years

That means the DOLA (Date of Last Activity) could be a long time ago at some point.

Questions:

* Is it possible that some scoring models regard a loan for which there's been no payments for a long time differently than one for which there is?

* Does it therefore make sense (just as a CYA) to make a small quarterly payment ($1.01 say) on any loan?

My guess is that when trended data become more widely used then this will definitely be a smart thing to do. But in principle even old models could measure this with the DOLA.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

Good topic here. Does DOLA take into account any interest added to the outstanding loan balance though? Perhaps one hasn't made a payment in many months or even years, but if interest is causing the account balance to grow, thus causing a new balance to be reported to the bureaus, does that constitute "activity?"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

I found a definition of DOLA on Equifax a while back that clearly stated that, for an open account in good standing, the DOLA was the date of the last payment made to it. It looks like EQ has moved the article since then and I can't find it.

Thus, a change in the balance (of the sort you describe) would not in itself trigger the DOLA to update. (Assuming that article was correct.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

Of course, this article says something else!

https://www.creditrepaircloud.com/blog/understanding-the-date-of-last-activity

Here it explicitly says that your scenario of the balance slowly increasing by a few pennies each month does indeed cause the DOLA to update:

The Date of Last Activity listed on a client’s credit report is updated when one of three things happens on any active account: the consumer makes a payment, misses a payment, or the balance of the account increases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

The other good vehicle to pay ahead and then keep it open forever is a federal student loan. I paid my 43k SL down to $50 and have kept it open for years. Eventually they do force you pay it off, but when mine does close it will be 20 years old. (And when it falls off my report it will be 30 years old.)

I opened a Share Secure loan at Alliant solely so I could capture all the steps involved for the writeup, but my installment utilization was already very low. So I never got to see what kind of benefit I might get.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

Gotcha. Way to "take one for the team" to get some hands on experience with it before writing about the technique!

That student loan surely will have a nice impact on your AAoA once it's at the 30 year mark. No doubt by that time though your AAoA will already be in the maximum FICO scoring zone though. A little buffer is always a good thing, no doubt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

This from Equifax:

http://www.equifax.com/pdfs/corp/CIS-105-E_Consumer_User_Guide.PDF

http://www.equifax.com/assets/canada/english/consumer_credit_report_user_guide.pdf

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Installment "monthly payment" a factor?

So DLA by TTs linked definition above doesn't include a new balance being reported due to some interest growing the balance. Seems we've got some inconsistency here between source data!