- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Is there a minimum revolving utilization FICO ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is there a minimum revolving utilization FICO 8 likes?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a minimum revolving utilization FICO 8 likes?

I just had a devilish thought.

I have been casting about looking for reasons why, in these dark days, where my revolving utilization has been creeping up

from its usual 0 to 1% numbers to 5%, my FICO 8 scores seem to be strengthening instead of weakening.

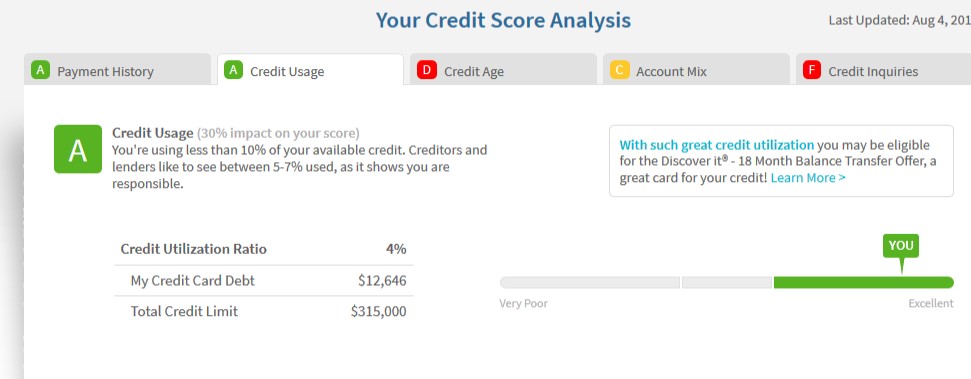

And then I came upon this statement on Credit Karma Sesame:

"Creditors and lenders like to see between 5-7% used, as it shows you are responsible."

Can it be that getting utilization up to 5% is a good thing?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

@SouthJamaica wrote:I just had a devilish thought.

I have been casting about looking for reasons why, in these dark days, where my revolving utilization has been creeping up

from its usual 0 to 1% numbers to 5%, my FICO 8 scores seem to be strengthening instead of weakening.

And then I came upon this statement on Credit Karma:

"Creditors and lenders like to see between 5-7% used, as it shows you are responsible."

Can it be that getting utilization up to 5% is a good thing?

SJ -

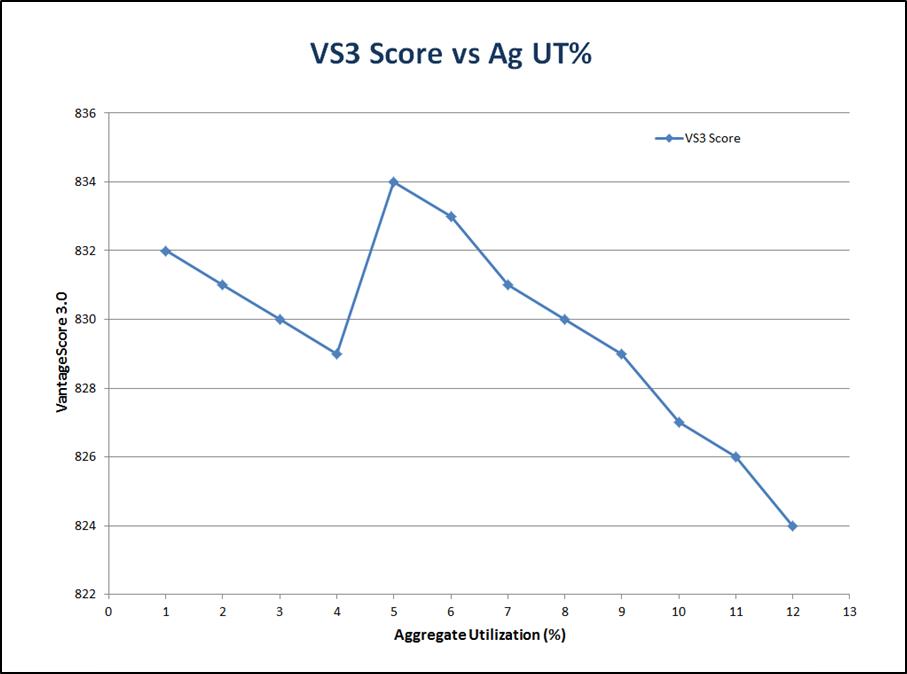

I have seen this with my VS3 scores and reported on it last year. For me somewhere between 4% and 5% aggregate utilization was optimal. I also ran a series of simulations using the one on CK and presented results in a graph. Graph pasted below.

P.S. For my thin but aged profile my actual VS3 scores top out at 835 - same top score with all three CRAs. EQ used to lag by 2 or 3 points but, I had one INQ on it and 0 on the other CRAs. Yes - EQ did NOT reach parity with TU and EX until the lone INQ aged TWO years. VS3 does count INQs for a full 2 years.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

@Thomas_Thumb wrote:SJ -

I have seen this with my VS3 scores and reported on it last year. For me somewhere between 3.5% and 5% aggregate utilization was optimal. I also ran a series of simulations using the one on CK and presented results in a graph. Graph pasted below.

P.S. For my thin but aged profile my actual VS3 scores top out at 835 - same top score with all three CRAs. EQ used to lag by 2 or 3 points but, I had one INQ on it and 0 on the other CRAs. Yes - EQ did NOT reach parity with TU and EX until the lone INQ aged TWO years. VS3 does count INQs for a full 2 years.

Fascinating. So it's a more or less true statement for Vantage 3.0?

But how about FICO? It's my FICO scores that have been showing strength despite (or perhaps because of) increase in revolving utilization from 1% to 5%. Can it be that they too reward 5% utilization?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

Hi TT. It's curious that the simulator predicts that going from 1% to 4% should result in a steady decline in the score -- then going from 4 to 5% should cause an increase -- then 5 to 12 should result in a steady decrease again. That seems improbable. One can imagine that the developers would conceive that 4-5% is optimal, but then there would be an increase from 1 to 4 rather than a decrease.

Did you also see that in your real world data? Your V3 got worse going from 1 to 4%, then it went up, then from 6 onward it went down again?

Have you ever noticed any significant changes in FICO 8 between 0,1% to 8.99%?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

@SouthJamaica wrote:I just had a devilish thought.

I have been casting about looking for reasons why, in these dark days, where my revolving utilization has been creeping up

from its usual 0 to 1% numbers to 5%, my FICO 8 scores seem to be strengthening instead of weakening.

And then I came upon this statement on Credit Karma:

"Creditors and lenders like to see between 5-7% used, as it shows you are responsible."

Can it be that getting utilization up to 5% is a good thing?

Do you know where it is on Karma's web site that you found that statement? I am really curious to read more about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

My Fico 8 scores have stayed flatlined at 850 regardless of utilization in the 1% to 9% range - never been over 9%. Thus, I have no personal data to offer on this. I do get a monthly EQ Fico 8 bankcard score. In the space I operate (0.5% to 6% aggregate UT), # cards reporting appears to be the only factor influencing my EQ Fico 8 BC score,

Regarding Fico (or VS), if pressed I advise keeping AG UT above zero but under 6% for best results - However, I have no robust Fico score data showing score drops if AG UT is in the 7% to 9% range or 0.5% to 4% range. Although VS3 may have a narrow sweet spot, no need to be overly prescriptive.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

@Anonymous wrote:

@SouthJamaica wrote:I just had a devilish thought.

I have been casting about looking for reasons why, in these dark days, where my revolving utilization has been creeping up

from its usual 0 to 1% numbers to 5%, my FICO 8 scores seem to be strengthening instead of weakening.

And then I came upon this statement on Credit Karma:

"Creditors and lenders like to see between 5-7% used, as it shows you are responsible."

Can it be that getting utilization up to 5% is a good thing?

Do you know where it is on Karma's web site that you found that statement? I am really curious to read more about it.

Oops. I misspoke. It was on Credit Sesame, not Credit Karma.

It was in the Credit Usage section of my Credit Score Analysis.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a minimum revolving utilization FICO 8 likes?

@Anonymous wrote:Hi TT. It's curious that the simulator predicts that going from 1% to 4% should result in a steady decline in the score -- then going from 4 to 5% should cause an increase -- then 5 to 12 should result in a steady decrease again. That seems improbable. One can imagine that the developers would conceive that 4-5% is optimal, but then there would be an increase from 1 to 4 rather than a decrease.

Did you also see that in your real world data? Your V3 got worse going from 1 to 4%, then it went up, then from 6 onward it went down again?

Have you ever noticed any significant changes in FICO 8 between 0,1% to 8.99%?

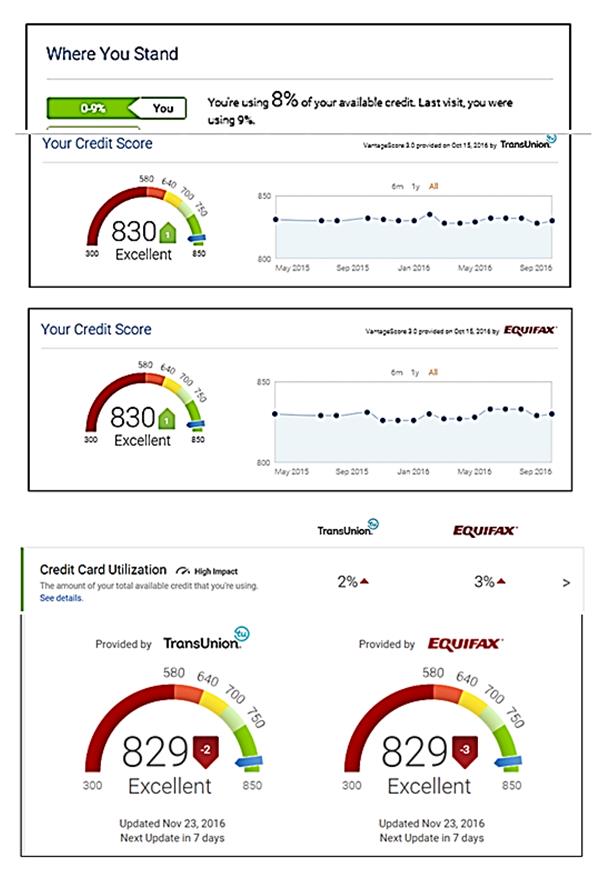

With CK you used to be able to tease out monthly graphs for utilization as well as score for 6 month, one year and "all" time frames. It appears that I can no longer generate utilization graphs and time scale for score graphs is fixed. In any event, I had the opportunity to experience an 8% and a 9% aggregate utilization with VS3 due to a spike in reported spending on DW's card that I am AU on. Scores did drop to 829 at 9% AG UT and rebounded to 830 at 8% AG UT. More interestingly my lowest scorees seem to be occuring when UT was in the 3% to 4% range. Yes, my scores typically climbed when UT drops to the 0.5% to 1.5% from 2% to 3.5% range as predicted by the TransUnion VS3 simulator offered on CK's web site. My CK and Credit.com VS3 scores peaked at 835 when utilization was in the 4% to 5% range with 5 of 6 cards reporting balances back on 2/8/2016.

By comparison my Fico 04 and Fico 98 scores (3B report) all dropped substantially as shown on a 2/14/2016 report with 6 of 6 cards reporting. Fico 8 Enhanced scored dropped also - just not as much as "mortgage" scores. Again, for my profile, Fico scores are primarily reacting to # cards reporting balances - NOT to minor changes in aggregate utilization.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950