- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Is this rebucketing? Strange Discover TU - Updated

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is this rebucketing? Strange Discover TU - Updated

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is this rebucketing? Strange Discover TU - Updated

First off, some background in this thread: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/New-installment-loan-effect-updated-3-201...

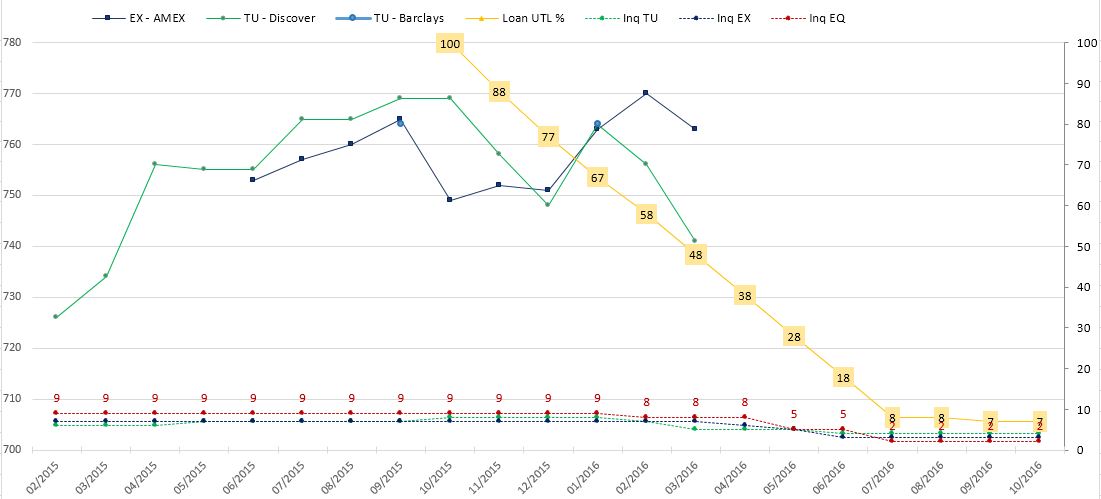

I've been paying down a small savings secured loan in approx. 10% decrements, in order to gather some data points on the effect of utilization. But after what I thought was a recovery trend, TU has taken a downward path, losing 20+ points in 2 months. CK reports are accurate, no negatives, no new or unrecognized information, no sudden changes...

Not really worried since I know my info is accurate and positive, but intrigued by this strange behaviour. Is this rebucketing? Any ideas what's going on? Thanks!

Edit: graph updated with March's EX from Amex.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

/subscribed.

Couple comments, but not answers to your question:

1) Hard to tell from the graph, your TU scores are identical right? Are Barclays and Discover true FICO08s?

2) Just looking ahead, since you will have INQs drop near the sweet spot of your loan pay off test, bear in mind their effect as well.

3) You mention no new accounts based on CK. I would bite the bullet and get a 3B report. Is it possible your oldest account aged off (of TU) or something similar you did not pick up on?

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

@BallBounces wrote:/subscribed.

Couple comments, but not answers to your question:

1) Hard to tell from the graph, your TU scores are identical right? Are Barclays and Discover true FICO08s?

2) Just looking ahead, since you will have INQs drop near the sweet spot of your loan pay off test, bear in mind their effect as well.

3) You mention no new accounts based on CK. I would bite the bullet and get a 3B report. Is it possible your oldest account aged off (of TU) or something similar you did not pick up on?

Thanks for commenting!

1) Yes, both Barclays and Discover reported about the same scores, and yes, both are FICO8 to the best of my knowledge. But Barclays just update my scores sparingly, one in September last year, other in Jan this year.

2) Correct, I'm hoping for some sweet increase there

3) I would rather not pay for it, at least not yet! Like I said, not really worried at this point. My file is pretty new, no closed accounts except one AU sometime last year and I took a very good look at CK, so far all looks good.

On the other hand, I was just reading this other thread, maybe a Discover/TU glitch?

Edit: difference in AAoOA between both bureaus in CK is because the TU reports shows my closed AU account as open but Responsibility terminated, in EQ is just closed. So my guess is they are using that account for age calculations in TU.

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

All right, you are in this for the knowledge and game of it, so you gotta pay to play! If you don't want to do a full 3B pull (understandable) perhaps a $1 trial at CCT is a possibility? ![]() I would love to know what your scores really are. I am guessing if Barclays did not give you a TU score, then maybe Discover is being glitchy.

I would love to know what your scores really are. I am guessing if Barclays did not give you a TU score, then maybe Discover is being glitchy.

EDIT TO ADD:

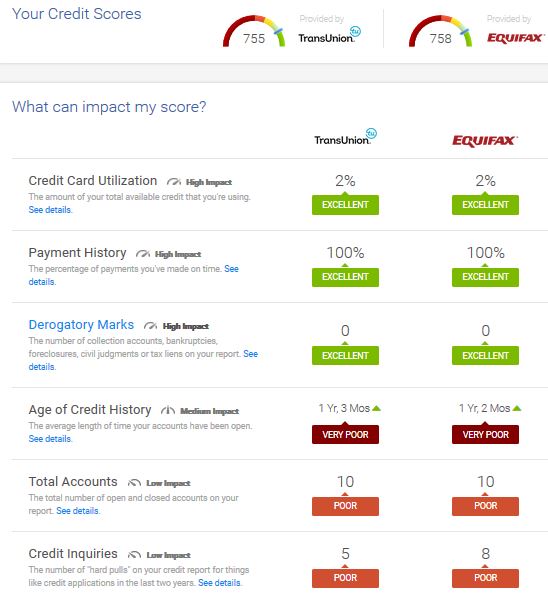

Back to the original bucket question, that's not my area of knowledge and I have forgottent what I once knew about what we thought some of the buckets are, but looking at your CK profile maybe AAoA at 1+ year plays in to one...

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

Lol, I was hoping to save some money, guess you could tell I'm THAT cheap ![]()

I did try to get my TU from annualcreditreport.com, but for some reason they always refuse to give it to me online, unlike EQ and EX. And I loathe those call-to-cancel type of services, had a hard time once cancelling with one of them, and my English does not help while arguing on the phone ![]()

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

Not sure it's rebucketing, that tends to get thrown around whenever we get something unexplained but I don't think you have much to change buckets on? Presumably it would've affected your Amex EX too similarly, I don't think buckets are different between the bureaus honestly, the scorecard count is the scorecard count and I don't think that's modifyable for the bureau datasets.

If you are updating your CK regularly, do some sanity checking of the report from call it 2 datapoints ago to now. From what I recall your file is pretty darned new and clean, there's really nothing to bucket on and inquiries falling off aren't a bad thing.

I have to trigger a pretty big change to get Barclays to update their scores unfortunately. It's hard to pull out sophisticated data analysis from free scores TBH unless it's a big swing... this is kind of a big swing but the change is likely to be found in the report data, I know your balances aren't flatlined so there is some variation there.

What I would sanity check though, oldest account and AAOA. First one does play into buckets, AAOA maybe kinda sorta does not really sure on that one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

@Revelate wrote:Not sure it's rebucketing, that tends to get thrown around whenever we get something unexplained but I don't think you have much to change buckets on? Presumably it would've affected your Amex EX too similarly, I don't think buckets are different between the bureaus honestly, the scorecard count is the scorecard count and I don't think that's modifyable for the bureau datasets.

If you are updating your CK regularly, do some sanity checking of the report from call it 2 datapoints ago to now. From what I recall your file is pretty darned new and clean, there's really nothing to bucket on and inquiries falling off aren't a bad thing.

I have to trigger a pretty big change to get Barclays to update their scores unfortunately. It's hard to pull out sophisticated data analysis from free scores TBH unless it's a big swing... this is kind of a big swing but the change is likely to be found in the report data, I know your balances aren't flatlined so there is some variation there.

What I would sanity check though, oldest account and AAOA. First one does play into buckets, AAOA maybe kinda sorta does not really sure on that one.

Thanks Rev! I combed thru my weekly reports in CK back to January: nothing out of the ordinary there. Biggest individual utilization on any revolving line was 9%, overall between 2-3%. I did let one card report at 51% back in December (wanted to see if I could trigger BoA to offer a SP CLI) but that seems too far in time to be the cause of this, right?

Also I thought about rebucketing because of the model somehow picking up the new loan just now, it was a credit-cards-only profile before, not sure if that has anything to do with FICO buckets or not.

I'm leaning more towards some kind of glitch, will wait for Amex score around next week and see if EX replicates TU behaviour or not. Also credit.com should refresh in next 3-4 days.

Edit: no glitch, Barclays' TU came at 741 also

Last update: NOV 2022

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

@axlm wrote:

@Revelate wrote:Not sure it's rebucketing, that tends to get thrown around whenever we get something unexplained but I don't think you have much to change buckets on? Presumably it would've affected your Amex EX too similarly, I don't think buckets are different between the bureaus honestly, the scorecard count is the scorecard count and I don't think that's modifyable for the bureau datasets.

If you are updating your CK regularly, do some sanity checking of the report from call it 2 datapoints ago to now. From what I recall your file is pretty darned new and clean, there's really nothing to bucket on and inquiries falling off aren't a bad thing.

I have to trigger a pretty big change to get Barclays to update their scores unfortunately. It's hard to pull out sophisticated data analysis from free scores TBH unless it's a big swing... this is kind of a big swing but the change is likely to be found in the report data, I know your balances aren't flatlined so there is some variation there.

What I would sanity check though, oldest account and AAOA. First one does play into buckets, AAOA maybe kinda sorta does not really sure on that one.

Thanks Rev! I combed thru my weekly reports in CK back to January: nothing out of the ordinary there. Biggest individual utilization on any revolving line was 9%, overall between 2-3%. I did let one card report at 51% back in December (wanted to see if I could trigger BoA to offer a SP CLI) but that seems too far in time to be the cause of this, right?

I'm leaning more towards some kind of glitch, will wait for Amex score around next week and see if EX replicates TU behaviour or not.

Could be; hard to say and unfortunately as I just found out - the bureaus don't real-time update everything. It's really hard to see what was on a report at a given pull unless you pulled it literally same time, as I had DCU report the new balance on 2/29 and neither MF at 3/2 nor CK on 3/3 got it in their pulls, and I checked the soft inquiries are there on the dates as recorded on the credit reports by the bureau.

Nowhere to run on that one, damn you bureaus, damn you!

That unfortunately skews precise data when trying to chase glitchy behavior, I don't know how common it is but without other scores to compare it to it's hard to say whether it's a glitch or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

@axlm wrote:Lol, I was hoping to save some money, guess you could tell I'm THAT cheap

I did try to get my TU from annualcreditreport.com, but for some reason they always refuse to give it to me online, unlike EQ and EX. And I loathe those call-to-cancel type of services, had a hard time once cancelling with one of them, and my English does not help while arguing on the phone

I hear that. CCT is really the only one of these I would recommend doing the $1 trial for. When you call to cancel, do it late and it is automated... no speaking to a rep, no hard sale, just an offer to continue at half price.

That being said, I can appreciate the disdain for signing up and cancelling. I don't like to do it in general either.

021924:

FICO 08 scores listed and are stagnated until multiple derogatory items expire over the next two years.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is this rebucketing? Strange TU

@BallBounces wrote:

@axlm wrote:Lol, I was hoping to save some money, guess you could tell I'm THAT cheap

I did try to get my TU from annualcreditreport.com, but for some reason they always refuse to give it to me online, unlike EQ and EX. And I loathe those call-to-cancel type of services, had a hard time once cancelling with one of them, and my English does not help while arguing on the phone

I hear that. CCT is really the only one of these I would recommend doing the $1 trial for. When you call to cancel, do it late and it is automated... no speaking to a rep, no hard sale, just an offer to continue at half price.

That being said, I can appreciate the disdain for signing up and cancelling. I don't like to do it in general either.

Didn't know about the automated thing. I might actually sign for it in the near future and let it run at half-price for a couple of months. Thanks for the tip!

Last update: NOV 2022