- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Less obvious reason for a VS 3.0 +16?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Less obvious reason for a VS 3.0 +16?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

Hi TT. I doubt that the Infograph is entirely reliable. It claims that closing an account harms your score (when in fact there's no actual impact to age) and also claims that if you default on a loan your score will recover in 1.5 years -- both dubious claims. It also seems to imply that if you max out a credit card you will receive a 90-day penalty, when in fact the penalty vanishes instantly as soon as the debt is paid down (and remains as long as the debt remains high). And as you seem to be aware the claims of severity of score impact made by the chart are almost worthless.

One of the difficulties posed by claims of recovery (often made here on the Forum about FICO as well) is that there's a tendency to infer that the absence of penalty from the point at which the score has recovered -- but that's not a valid inference. The passage of time might well have caused certain other factors to increase one's score. I have similarly heard many people here claim that people "recover" from the FICO score damage done by an inquiry (say) in three months -- but the more likely estimates of score impact are that an inquiry does whatever damage its going to do via a step function and then it remains in full for 365 days without any period of gradually being mitigated.

My guess is that these kinds of charts are things that people in a scoring company's customer relations dept create and they have a tenuous relationship at best to the way the actual algorithm works.

The link you posted a while back of all Vantage 3.0 reason codes was IMMENSELY helpful and much appreciated. It's the sort of thing that would be right up BBS's alley, I think.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

@Anonymous wrote:

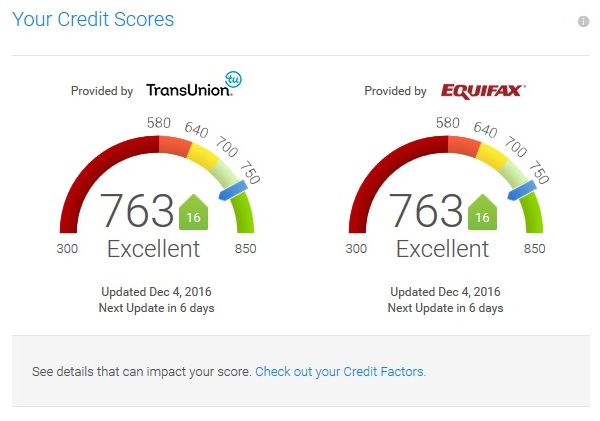

This is what I see when logging in. Odd that you see "what's changed" - I don't recall ever seeing that there.

That's pretty strange. Maybe it's a feature they're rolling out over time or something I don't know. Try their iOS app is you have an iPhone. Not sure about android. Even though is still only a VS3.0 it shows what caused it to change since the last update which I like.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

@Anonymous wrote:

@JLK93 wrote:

@Anonymous wrote:

my AAoA from the VS 3.0 viewpoint is 2.2 years,

I know very little about VS. What did you mean by the VS 3.0 viewpoint?

I just mean that I know VS 3.0 only looks at open accounts, not all accounts (open and closed) in the last 10 years when determining AAoA. So, while my AAoA is 7 years in terms of what FICO looks at, from the viewpoint of VS 3.0 my AAoA is only 2 (2.2) years.

Nope. Vantage uses the same AAoA that FICO does, not the AAoOA that CK's "interpretive graphs" incorrectly display.

Didn't we have this conversation before....?

Searching... yup, we did: http://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/AAoA-in-Vantage-3-0-vs-FICO-8/m-p/4537669#M107568

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

Understood, it's just the CK summary software that only computes AAoA using open accounts where the scoring model uses all accounts on the report the way FICO does. Sort of bogus that their summary software provides data that goes against what their model actually scores.

Is this the same for late payments? Their summary software indicates that late payments only impact score for 2 years. Do they impact score for the full 7 years under VS 3.0 like they do under FICO scoring models?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

@Anonymous wrote:Understood, it's just the CK summary software that only computes AAoA using open accounts where the scoring model uses all accounts on the report the way FICO does. Sort of bogus that their summary software provides data that goes against what their model actually scores.

Is this the same for late payments? Their summary software indicates that late payments only impact score for 2 years. Do they impact score for the full 7 years under VS 3.0 like they do under FICO scoring models?

Curious to hear what others say about this. My guess (emphasis on guess) is that Vantage 3.0 is probably like FICO 8 in how it handles late payments.

In other words, 30 Day lates are treated in a fairly friendly/benign way, as long as you have demonstrated a solid year of perfect payment history after them, and even more benignly after two years. This is a shift from how previous FICO models handled them, which was to cut someone much less slack if he had become a good scout, and to continue the punishment for the full seven years.

60 and 90 day lates FICO 8 may also be more flexible with for good scouts, but probably less so. The reason is that a couple 30-day lates can arguably happen by accident, whereas a 60-day late almost surely shows substantial financial hardship and risk.

My guess is that Vantage 3 is probably a lot like FICO 8 in all of the above.

As you can imagine, I view all of Karma's advice and claims about its algorithms with skepticism. Karma was a terrible offender at one time in that it gave horrible almost fraudulent advice about the total number of accounts you needed in order to have a good score. (It would claim, for example, that you'd have a very bad score with only 9 accounts.) This was because they made a good portion of their money by inducing worried users to open new cards via their portal. (Take a look at the top of this screen at all the APPLY NOW! buttons and you'll see that they aren't exactly alone here.)

Nonetheless I am a big advocate of Karma, as long as it is used judiciously. Great tool for getting free reports and free Vanatge scores and a free Auto Insurance score.

PS. You'll see if you read a bit earlier in this thread that I am skeptical about almost every "general overview" of advice that any scoring company gives about its algorithm. (Including power point presentations given by FICO.) The only exception is when a company describes its scoring groups with percentages and gives factors within a group. These have typically been scrutinized repeatedly by the company and in all likelihood by algorithm developers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

@JLK93 wrote:Do you have FICO scores from December?

JLK93, I pulled my 3 FICO 08's today and wanted to report back on that. My TU score remains unchanged (7 weeks now) where my EX and EQ scores are both +2. I sort of view the +2 as insignificant and don't think it's because anything really changed. I feel like if it was because my 90 day late passed a threshold (2 years) that I would have seen more like 5-7 points. I could be wrong about that, just a feeling. And, if those +2 points WERE because of the 90 day late hitting 2 years that would mean that TU doesn't give back any points for a 90 day late hitting 2 years.

I guess what I'm saying is that I don't think my 90 day late aging is what caused my VS 3.0 +16.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

To see what's changed on CK. CLick the actual score from the main page that will take you to what's changed breakdown, you can do that for each score, once you're in that page it has the other score at the top to move to that what's changed page.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

@Anonymous wrote:To see what's changed on CK. CLick the actual score from the main page that will take you to what's changed breakdown, you can do that for each score, once you're in that page it has the other score at the top to move to that what's changed page.

When I click either score on the main page I get taken to the "credit score details" page which just has a graph tracking what my score has been with them each month for the last year. No where do I see "what's changed" mentioned anywhere. I also don't see my other score at the top of that page as you indicated should be the case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

On the Android app CK displays different information on the home screen every time. The link right below your scores wii take you there. It says "credit factors". Sometimes it says "credit factors", and sometimes it says "what changed". Most likely a natural part of the bs you can expect from anything free. Honestly I don't think these people even know exactly what these algorithms do once they're turned loose.

But I keep getting scolded because I think everything Is a FAKO score ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Less obvious reason for a VS 3.0 +16?

Yeah, I see the "credit factors" section but no where under it do I see a "what's changed" or any place where it indicates what may have caused a score to go up or down.