- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Mortgage/Fico Score/Previous Collections

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Mortgage/Fico Score/Previous Collections

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

No. Thom Thumb is not suggesting that you close cards.

He's talking about reducing the number of cards that are showing a positive balance. He means the same thing as I told you: having all cards at $0 except for one card which will have a comparatively small balance. You are working on doing this, based on your posts today. You will end up having two of your three cards at $0 with the remaining card reporting at $230. That's great.

And yes, both the very old models and the new models care a whole lot about credit card balances. So paying off your debt will give you a big help on your mortgage scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

You don't want to close any cards - just reduce the # of cards reporting a non zero balance to the CRAs each month.

Example, if you have 6 cards and normally 4 or 5 show a non zero balance on statements each month, then Fico 04 will ding your score. By reducing the # cards reporting a non zero balance from 4/5 to 1/2, you would pick up quite a few points (perhaps 20). Key take aways:

1) The CRAs only look at balance which is reported to them - that is the amount shown on each credit card statement when it cuts. If you use a card and put $300 of charges on it and then pay the charges BEFORE statement cuts reported balance will be zero.

2) You need to allow at least 1 card to report a non zero balance each month to avoid a score penalty - but it can be a small balance.

3) Keep any balance that does report on a card under 30% of the available credit line.

4) keep total reported balance (all cards combined) relative to aggregate credit line (all cards combined) under 9% utilization for best results.

Note: For best results with Fico 04 model (used for EQ and TU mortgage scores) - only report a balance on one credit card and keep aggregate utilization under 9%.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

Good for you. And remember: it will take some time for your cards to report their new (much lower) balances, as many as 30-40 days possibly.

You are a member of Credit Karma, so you can and should be using it to pull your credit reports (ignore the scores, but the reports will be a big help to you). You can pull them for free as often as once a week.

Monitor your reports through Karma and you will be able to see when all your CC balances are reporting the way you want them. When you see that this is the case (for both TU and EQ), wait 2-3 more business days and then you can if you like pull your mortgage scores again through myFICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

Wow I cannot thank OP & all you great folks enough for this info!! I have lost so much sleep trying to determine how to raise MORTGAGE scores & the info just isn't out there ![]() I've been watching my dream home in a great neighborhood go from $430,000 to the low $200,000 since last July while I've been trying to raise my score from the low 400s...got so excited t see Fico scores in low 600s only to find out those weren't my MORTGAGE scores. Depressing. Fico 8s move fast, but those darn mortgage scores are stubborn!!

I've been watching my dream home in a great neighborhood go from $430,000 to the low $200,000 since last July while I've been trying to raise my score from the low 400s...got so excited t see Fico scores in low 600s only to find out those weren't my MORTGAGE scores. Depressing. Fico 8s move fast, but those darn mortgage scores are stubborn!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

You get a new 3B report along with all the FICO scores (including the mortgage scores) once every 90 days. Outside that, the mortgage scores do not update.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

I have been struggling with getting my mrtgage scores up for months and it's tough. I rarely carry more than 10% balance on any CC and have never paid them late. I have some medical collections from a while ago that I have worked on getting removed but, all in all, only a few negative items and 3 CCs that I pay off almost completely each month. I have been doing this for several months now and my scores keep going up. Even if I have to put $4000 on a card one month, I do whatever I can to pay every cent.

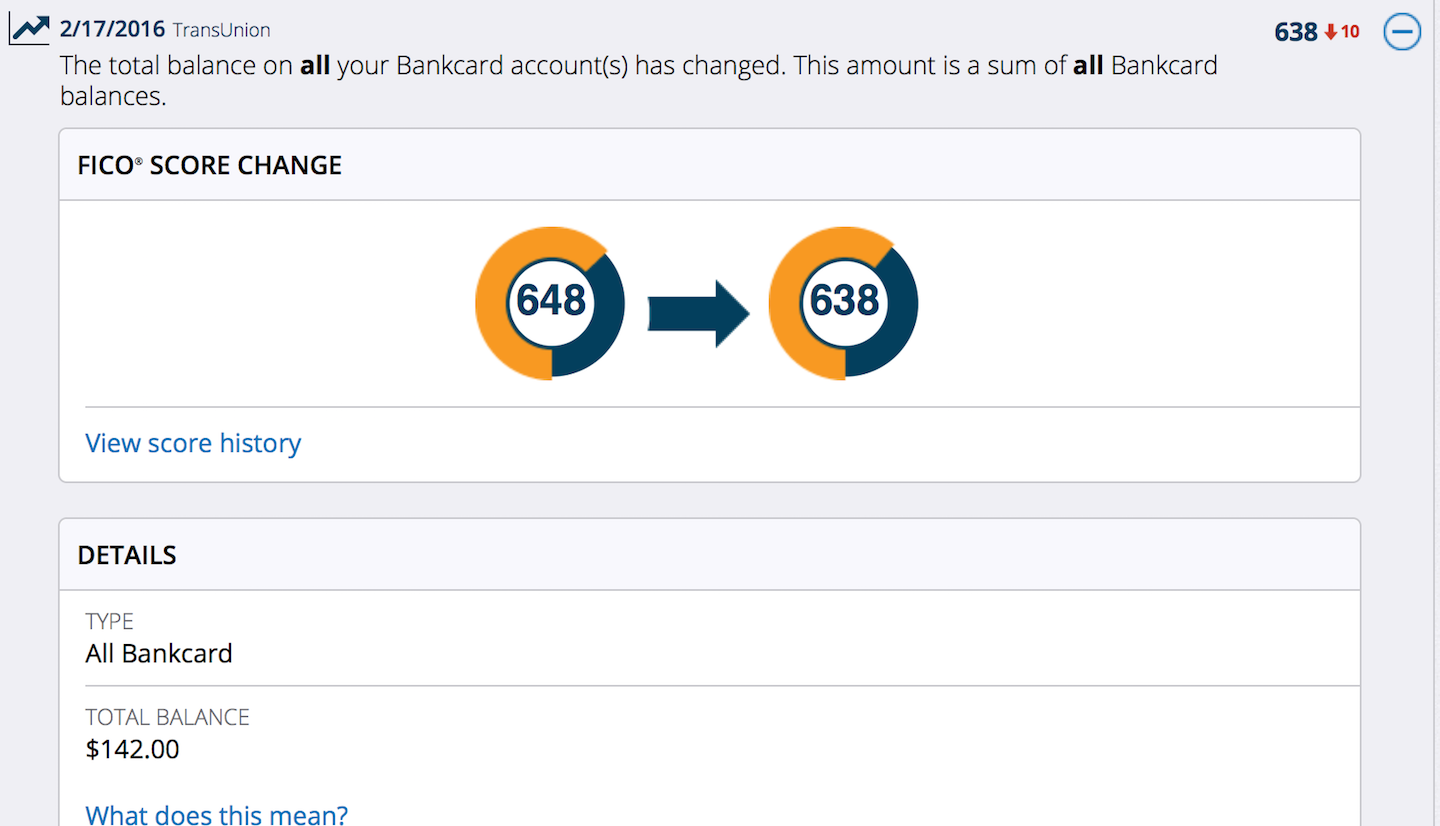

I can't stress this enough: Based on my experience, uour util rate is going to be what moves your score the quickest. Pay off everything asap!! I mean, pay off all but a few dollars. Really.. It took me a while to realize how sensative FICO scores are for people that have less than perfect histories. Maybe for those out there with $50,000 in CC availability, 20 years of perfect mtg history, various installment loans that have been pain down to 10%, etc. -- having a 20% to 50% util on theic CCs doesn't hurt so much. But for those us w/o such lengthy histories, it truly does. I have had my old mortgages age off my histiry and it has really hurt me. I went to a mostly cash system for about 10 years and I lost a lot of ground. Everything is magnified when there's less to work with. Below is a screen shot from a few days ago when I had a hotel charge come through between my statement end date on the 15th (where I had a $0 bal) and the reporting date on the 17th!! Huge drop for $142! The limit is $2000 so this is a very small util and the drop was still this big. I also have big jumps when I, for examle, go from a $150 bal on a $3500 limit card down to a $60 balance. It can be a 15 point jump. It's crazy. Any I'm talking about FICO 8 scores here b/c that's what I see every day. I only pull my full score versions once a months and I have no idea why they're all so different. My mortgage scores are all over the place. From the same as my 8s to 50 pts lower. I'm at a loss on that one.

My point is this: make sure you do whatever you can to pay off all but 1-3% on each card and keep it off until the card has reported a few days after the statement date. You will see big jumps. Aside from that, try GW deletes from old late pays and try to get PFDs on existing collections. However, these don't happen as fast. With your CCs, you will see a jump within a couple of days of your CC statement reporting date.

Hope that helps and good luck. I totally understand your pain but really watch what you are spending if you can't pay it off in full.....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Mortgage/Fico Score/Previous Collections

I was able to get a 60 day late from 2 years ago deleted and it seemed to help my 8s and my mtg versions both go up. I do think that getting lates removed helps the mtg versions. That's just based on my experience over the last year of so. Even getting a 60 changed to a 30 can help. I had Cap One auto refuse but Care Credit/Synchrony did agree to a GW delete. Even tho hey're old, it seemed to help.